National Public Private Partnership Policy 2011

An arrangement between the government and private sector for the creation of public assets or delivery of public services. This partnership focuses on harnessing private sector efficiencies, innovation, and technological improvements to provide affordable and improved services. Investments are made

5 views • 25 slides

Risk Analysis for GST Enforcement

Delve into the cutting-edge approach of ANVESHAN for risk analysis in GST enforcement, focusing on early identification of risky taxpayers, anomalies in digital information, and actionable intelligence to combat fraud. This presentation highlights the utilization of registration documents, E-way bil

0 views • 9 slides

National Conference of Enforcement Chiefs: Enhancing Tax Compliance and Enforcement Practices

The National Conference of Enforcement Chiefs held by the Commercial Taxes Department, Government of Andhra Pradesh, focused on nurturing tax compliance, targeting evasion cases, preventing harassment, and overseeing tax administration to curb high-pitch demands. The enforcement wing emphasized data

0 views • 16 slides

Understanding CONFIA: The Brazilian Cooperative Compliance Program

Cooperative Compliance is a relationship between taxpayers and Tax Administration based on principles like good faith, collaboration, and transparency. CONFIA aims to provide legal certainty, prevent disputes, reduce compliance costs, and improve tax compliance through voluntary and cooperative deve

1 views • 14 slides

Understanding Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Joint Meeting Public Hearing: Annexations in Orchard Park

The Joint Meeting Public Hearing in Orchard Park discusses the annexation of 130 parcels, aiming to charge all residents for services uniformly. The process addresses boundary issues between the Town and Village, with a focus on streamlining services like garbage collection, water systems, and road

2 views • 6 slides

Campaign Finance Enforcement

Explore the detailed process of handling delinquent and defective campaign finance reports, audits, enforcement proceedings, and penalties as presented at the Indiana Election Administrators Conference. Learn about the actions required for late reports, defective filings, and the steps involved in e

0 views • 19 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Property Tax Relief Programs in New Jersey

New Jersey offers several property tax relief programs including Legacy Program - ANCHOR, Senior Freeze PTR, and the new program Stay NJ (P.L. 2023, CH. 75). These programs provide benefits to qualified taxpayers, seniors, and homeowners based on income thresholds and residency requirements. Stay NJ

6 views • 14 slides

Understanding Tax Tables, Worksheets, and Schedules for Federal Income Taxes

Explore the concept of tax tables, worksheets, and schedules for calculating federal income taxes. Learn how to express tax schedules algebraically and compute taxes using IRS resources. Examples featuring single and married taxpayers provide practical insights into determining taxable income and ca

0 views • 11 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

Juvenile Court Judges Commission: Enhancing Pennsylvania's Juvenile Justice System

The Juvenile Court Judges Commission in Pennsylvania, comprising nine judges appointed by the Governor, plays a crucial role in providing leadership, advice, and support to improve the state's juvenile justice system. Their mission is focused on community protection, offender accountability, victim

3 views • 18 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

Enhancing Taxpayer Education for Voluntary Compliance

Liberian taxes operate on a self-assessment system, where taxpayers must assess, submit returns, and pay taxes. Taxpayer education is crucial in promoting voluntary compliance. The Liberia Revenue Authority's Taxpayer Service Division conducts extensive educational programs covering tax types, respo

0 views • 21 slides

WHO Prescriptions for a Healthy Recovery from COVID-19: Building a Sustainable Future

The World Health Organization (WHO) presents key prescriptions for a healthy recovery from COVID-19, emphasizing a green and sustainable approach. These include protecting nature, investing in essential services, ensuring healthy energy transitions, promoting sustainable food systems, building livea

0 views • 8 slides

Afghanistan Revenue Department Implements Value Added Tax

The Afghanistan Revenue Department has introduced Value Added Tax (VAT) as a step towards self-reliance and economic stability. The program aims to inform taxpayers about VAT, its purpose, implementation process, and impact on domestic revenues. By adopting VAT, Afghanistan aims to decrease reliance

0 views • 35 slides

Legal Case Analysis: Akwa Ibom State Internal Revenue Service v. Jumanwin Nigeria Limited

This legal case analysis delves into a notable state revenue case involving Akwa Ibom State Internal Revenue Service and Jumanwin Nigeria Limited. The case revolved around tax assessments, best judgment practices, and enforcement of tax liabilities. Key arguments, lessons learned, and judgments are

0 views • 9 slides

Understanding 1099 Reporting Guidelines and Systems

The article provides insights into the 1099 reporting process, including details about the Miscellaneous Income System (MINC), Form 1099 issuance, criteria for 1099 reporting, the Statement of Earnings System (EARN), and the Special Payroll Processing system (SPPS). It explains the responsibilities

2 views • 15 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

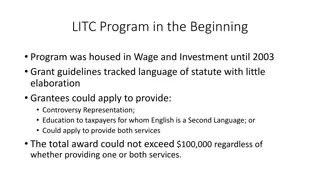

Evolution of Low Income Taxpayer Clinics (LITC) Program

The Low Income Taxpayer Clinics (LITC) Program has evolved over the years to ensure fairness and integrity in the tax system for low-income taxpayers and those who speak English as a second language. Initially housed in Wage and Investment, the program now reports to the National Taxpayer Advocate.

0 views • 10 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

Overview of 1099 Reporting Systems

The 1099 Reporting Systems consist of MINC, EARN, and SPPS, which are used for IRS 1099 reporting purposes. These systems handle transactions and generate Form 1099 for recipients based on predefined criteria. Taxpayers are responsible for accurate reporting to the IRS, with reporting thresholds set

0 views • 15 slides

Understanding National Debt and its Implications

National debt refers to the total money owed by the government to financial institutions and individuals. Managing national debt, measured through the Debt/GDP ratio, is crucial as it impacts future taxpayers and national wealth. Borrowed money comes with the burden of interest repayment, posing cha

0 views • 49 slides

Juvenile Justice Diversion Programs: Principles and Importance

Explore the concept of diversion in juvenile justice, which involves redirecting young offenders away from formal legal proceedings towards community support. Learn about the guiding principles, importance, and various diversion programs at regional and international levels. Understand how diversion

0 views • 15 slides

Understanding the Labeling Theory in Criminology

The Labeling Theory explores how individuals, particularly juveniles, are labeled by society and authorities, leading to self-fulfilling prophecies of delinquent behavior. It discusses the impact of societal perceptions on criminal identity, highlighting the consequences of being labeled as "bad kid

0 views • 9 slides

Discontinuance of Utility Service and Wastewater Lien Process in Cities and Towns (June School 2013)

The process of discontinuing utility services, particularly water and wastewater services, due to nonpayment of charges is outlined in statutes such as IC 8-1.5-3-4 and IC 36-9-23-6. The statutes provide guidelines for discontinuing water service to consumers or properties after a specified period o

0 views • 20 slides

Motor Fuel Single Point Filing System Update

Motor Fuel Single Point Filing System has been in operation for almost a year, allowing taxpayers to electronically file and pay county or municipal motor fuel taxes. This voluntary system, established under Act 2018-469, provides a centralized platform for tax compliance and reporting. Local requir

0 views • 12 slides

Overview of State Debts and the Treasury Offset Program (TOP)

Explore the role of Debt Management Services (DMS) in assisting states with debt collection, including child support obligations and income tax debts. Learn about the Treasury Offset Program (TOP) that intercepts federal and state payments to payees with delinquent debts. Discover how states can add

0 views • 13 slides

Understanding the Juvenile Justice System

Dive into the complexities of the juvenile justice system, exploring topics such as peaceful solutions, juvenile rights compared to adults, delinquent and unruly behaviors, probable cause for custody, and the detailed steps in the juvenile justice process from intake to appeal.

0 views • 35 slides

Understanding Income Taxes and Contributions in Quebec

This resource provides comprehensive information on income taxes and contributions in Quebec, covering topics such as taxable income, tax deductions, rights and responsibilities of taxpayers, and ways to reduce tax payments through investment plans like TFSAs and RRSPs. It also emphasizes the import

0 views • 43 slides

Madison County Revenue Compliance Procedures

The procedures followed by Amy Beard, a Revenue Compliance Officer II in Madison County, towards delinquent taxpayers include contacting, sending certified letters, filing warrants, and conducting hearings and trials. Repeat attempts are made to contact taxpayers and ensure compliance. Failure to co

0 views • 11 slides

Understanding the Impact of Audits on Post-Audit Tax Compliance

Audits have direct and indirect effects on taxpayers, influencing compliance behaviors. While more audits generally lead to increased compliance, outcomes can be ambiguous, with some studies showing a decline in post-audit compliance. Behavioral responses to tax audits are driven by perceived risks

0 views • 15 slides

Club Treasurer 2020-2021 Duties and Responsibilities

The Club Treasurer for 2020-2021 has specific responsibilities including receiving and depositing monies, paying club obligations approved by the board of directors, keeping financial records, and maintaining general records of club receipts and disbursements. It is important for the treasurer to in

0 views • 12 slides

Understanding Capitalization Regulations in Taxation

This document delves into the intricate world of capitalization regulations in taxation, covering topics such as safe harbors, routine maintenance, small taxpayers, partial disposition elections, and more. It discusses the evolution of the 263 regulations, changes in methods of accounting, and the c

0 views • 64 slides

October Caseload Data Collection Webinar by Oregon Department of Education

Oregon Department of Education is hosting a webinar on the October Caseload Data Collection, which determines funding allocations for districts with Neglected and Delinquent Facilities. This collection window opens on October 26 and closes on December 1, 2023. The webinar covers important topics suc

0 views • 31 slides

Title I-D, Subpart 2 Fall Webinar Overview

The Title I-D, Subpart 2 Fall Webinar held on September 15, 2022, discussed the purpose of improving educational services for neglected or delinquent students, eligibility criteria for receiving funds, requirements for preparing students for post-school opportunities, and the importance of accurate

0 views • 13 slides

Understanding Income Taxes and Contributions in Canada

This content provides an overview of income taxes and contributions in Canada, covering topics such as tax facts, tax basics, taxpayer rights and responsibilities, types of taxes, government revenues, and key messages for Canadian taxpayers. It emphasizes the importance of filing tax returns accurat

0 views • 43 slides

Legislative and Form Updates for Taxpayers in Virginia

Reporting and paying consumer use tax, conformity to IRC, electronic income tax payments, historic rehabilitation tax credit limitations, land preservation tax credit, and neighborhood assistance tax credit changes are among the legislative and form highlights affecting taxpayers in Virginia. These

1 views • 7 slides

Enhancing Educational Services for Neglected and Delinquent Youth

This document explores Title I-D, Subpart 2, focusing on improving educational services for neglected, delinquent, and at-risk youth in locally operated facilities. The Oregon Department of Education collaborates with various partners to ensure equitable access to quality education for over 580,000

0 views • 13 slides