The Case for Central Bank Digital Currency (CBDC) by G. Venkatesh

Central Bank Digital Currency (CBDC) offers numerous advantages such as scalability, safety, and potential for financial inclusion. India introduced its CBDC a year ago with goals of digitizing the economy and simplifying cross-border trade settlement. However, CBDC penetration is currently low, and

0 views • 22 slides

Managing Interest Rate and Currency Risks: Strategies and Considerations

Interest rate and currency swaps are powerful tools for managing interest rate and foreign exchange risks. Firms face interest rate risk due to debt service obligations and holding interest-sensitive securities. Treasury management is key in balancing risk and return, with strategies based on expect

3 views • 21 slides

The Ultimate Guide to Currency Exchange in Everything You Need to Know

The Ultimate Guide to Currency Exchange: equips readers with the knowledge and tools needed to navigate the complex world of currency exchange confidently and effectively. To know more in details, visit our website today: \/\/unipayforex.com

2 views • 7 slides

Expert Strategies for Currency Exchange in 2024

In 2024, expert currency traders are employing advanced strategies like algorithmic trading, sentiment analysis, cross-currency arbitrage, carry trades, and macroeconomic forecasting. By leveraging technology and market insights, these strategies aim to capitalize on opportunities and mitigate risks

1 views • 7 slides

How To Identify Counterfeit Money - undetectablecounterfeitbills.com

How To Identify Counterfeit Money is crucial not only for protecting your finances but also for maintaining the integrity of the economy. With counterfeiters becoming more sophisticated, it's essential to stay informed about the various methods and tools available to distinguish genuine currency fro

7 views • 1 slides

Exchange Travel Money Made Easy

Understand the importance of exchanging currency before traveling.\nAvoid inconvenience and extra charges by having local currency on hand.

4 views • 7 slides

Importance of Currency of Sources in Research: Enhancing Your Academic Pursuit

Recognizing the significance of currency in sources furthers academic research by ensuring relevance, quality, and credibility. Seminal works hold crucial importance in shaping understandings and methodologies. Sources include primary and secondary texts, data, and scholarly articles, each serving u

0 views • 5 slides

Counterfeit Detection Techniques in Currency to Combat Financial Fraud

Currency counterfeiting poses a significant challenge to the financial systems of countries worldwide, impacting economic growth. This study explores various counterfeit detection techniques, emphasizing machine learning and image processing, to enhance accuracy rates in identifying counterfeit curr

0 views • 15 slides

Understanding Futures and Swaps in FX Markets

Exploring the world of FX derivatives such as futures, options, and swaps, with insights into how futures contracts differ from forward contracts, the concept of long squeezes in the oil market, and the risks associated with specific investment products like Crude Oil Treasure. Discover the intricac

0 views • 47 slides

Currency Risk Management Strategies for Impact Investment Funds in Frontier Markets

Small Foundation (SF) commissioned ISF Advisors to analyze foreign currency risk management strategies for impact investment funds in African early-stage MSMEs. The report highlights the challenges faced and provides recommendations for effective currency risk management strategies to achieve commer

0 views • 14 slides

Accounting for Foreign Branches: Converting Trial Balances and Exchange Rates

A foreign branch maintains its accounts in a foreign currency, requiring the head office to convert the trial balance into its own currency before finalizing accounts. Fixed and fluctuating exchange rates impact the conversion process, with specific rules for fixed assets, liabilities, and current a

0 views • 7 slides

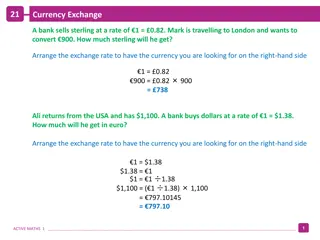

Currency Exchange Calculations and Comparison

Learn about currency exchange rates through various scenarios involving the conversion of different currencies like sterling, dollars, Australian dollars, Japanese yen, pounds, and euros. Explore how much currency you can get for a certain amount in each scenario and compare the values to determine

1 views • 4 slides

Understanding Foreign Exchange Rate Systems and Their Impact on Economies

Foreign exchange plays a crucial role in the global economy, representing all currencies other than a country's domestic currency. Different exchange rate systems like fixed, flexible, and managed floating rates have distinct features and implications for trade, capital flows, and macroeconomic stab

1 views • 49 slides

Saudi Arabian Monetary Agency (SAMA) Overview

The Saudi Arabian Monetary Agency (SAMA) serves as the central bank of Saudi Arabia with a focus on managing the country's monetary policy, maintaining price stability, and supervising financial institutions. Established in 1952, SAMA's functions include managing the national currency, foreign excha

0 views • 24 slides

Exploring the Ethical Dilemmas of NGOs Using Suffering as Currency

NGOs often face complex ethical dilemmas when addressing human suffering, where the hardships of individuals become the currency for their work. This leads to questions of integrity, dignity, and duty, raising concerns about honesty and fairness. The ethical considerations of using suffering as a co

0 views • 11 slides

Understanding Banking Concepts and Monetary Policies

Explore key banking concepts such as Currency Deposit Ratio, Reserve Deposit Ratio, Statutory Liquidity Ratio, High-Powered Money, and their significance in regulating the money supply and liquidity in an economy. These concepts shed light on the relationship between currency, deposits, reserves, an

0 views • 14 slides

Practical Guide to Interest Rate Swap Valuation by Alan White

Understand the concept of interest rate swaps, their practical applications, valuation methods, and real-world examples. Learn about swaplets, fixed and floating legs, and how swaps can be used to manage interest rate exposure.

3 views • 11 slides

Arithmetic Practice Questions and Currency Conversions

Practice questions involving currency conversions and arithmetic calculations are provided in the content. Various scenarios are presented, such as determining costs in different currencies, finding exchange rates, and comparing prices in different countries based on exchange rates. The questions re

1 views • 25 slides

Best Foreign Currency Exchange in Tanglin

If you\u2019re looking for a Foreign Currency Exchange in Tanglin, contact Classic Exchange. Their foreign currency exchange company provides reliable, efficient, and competitive foreign exchange services tailored to meet the diverse needs of travele

0 views • 6 slides

Explanations of Icelandic Financial Collapse in 2008: Neoliberalism or Government Intervention?

The Icelandic financial collapse of 2008 was not solely attributed to neoliberal policies or government intervention but rather a combination of factors including vulnerable economic conditions and critical decision-making. Contrary to popular belief, Iceland was not more reckless or oversized in it

0 views • 18 slides

Exploring Digital Currency and Blockchain Technology

Delve into the world of digital currency and blockchain technology, from the inception of DigiCash to the concept of digital work measured through hashing. Discover the potential of all-digital currency and the importance of work verification in the blockchain ecosystem.

0 views • 43 slides

Benefits of Invoice Currency in International Trade: Analysis and Implications

Explore the benefits of using invoice currency in international trade, focusing on the implications for importers. The study presents a model of endogenous choice of import frequency and invoice currency, revealing how Home Currency Invoicing (HCI) can help mitigate exchange-rate risks and reduce im

0 views • 35 slides

Understanding Forwards, Futures, and Swaps in Investment Finance

Dive into the world of investments with a detailed analysis of forwards, futures, and swaps. Discover how these derivatives work, their key characteristics, and practical examples of how they are utilized for hedging and risk management in the financial markets.

1 views • 36 slides

Exploring Concepts in Commerce and Finance at Annamalai University

Join Annamalai University's Department of Commerce for a presentation on currency, including general vs. digital/crypto currency, virtual currency, demonetization, and remonetization. Delve into the impact of artificial intelligence in banks, and learn about essential financial networks like SWIFT,

0 views • 67 slides

Understanding Endogenous Optimum Currency Areas

Mundell's Optimum Currency Area Criteria and the concept of setting the endogeneity stage are discussed in relation to business cycles and trade integration. Approaches to empirically test business cycle synchronization and the theoretical ambiguity with empirical clarity are examined in the context

0 views • 35 slides

The Resurgence of the US Dollar in Cuba: Implications and Challenges

The return of the US dollar to Cuba after 15 years has significant implications on the economy and the Cuban Peso. This resurgence, exacerbated by the COVID-19 crisis, has highlighted the weaknesses of the Cuban monetary system and the challenges it faces in unifying its currency. The distrust in lo

0 views • 21 slides

Insights into Long-Term Local Currency Hedging in Latin America

Explore the regional share of total TCX hedging, trends in LATAM local currency hedges over time, country-wise LATAM hedges, sector shares in LATAM production, and a case study on renewable energy in Costa Rica. Gain valuable information on managing currency risks and enhancing financial stability i

0 views • 8 slides

Introduction to Bubble Sort Algorithm

Bubble sort is a simple comparison-based sorting algorithm that repeatedly compares adjacent elements and swaps them if they are in the wrong order. It is easy to implement but inefficient for large datasets. The algorithm iterates through the list multiple times until no more swaps are needed, ensu

0 views • 16 slides

Debt-for-Nature Swaps: A Solution for Small States' Debt Challenges

Debt-for-Nature Swaps offer an innovative approach to addressing debt challenges in small states by converting debt into funding for conservation activities. While these swaps have potential benefits, their contribution to debt reduction has been limited. Despite generating significant funds for nat

0 views • 12 slides

Understanding Derivatives and Swaps: A Comprehensive Overview

Explore the concepts of derivatives and swaps, including their types, features, and the swap market. Delve into the details of how derivatives are used as contracts based on underlying financial assets, while swaps involve the exchange of financial instruments between parties. Learn about different

0 views • 20 slides

Understanding the Use of Interest Rate Swaps in Insurance Industry

This presentation delves into the world of interest rate swaps (IRS), their types, regulations, and market overview in the insurance sector. It explores why the IRS market is not growing despite its potential benefits. The content covers IRS basics, variations in types, regulatory guidelines, and ke

0 views • 21 slides

Use of Credit Default Swaps (CDS) by Investment Funds

Presentation at the ESMA workshop discussed the potential benefits and costs of using Credit Default Swaps (CDS) by investment funds. It highlighted the various uses of CDS, including risk management, alternative liquidity, and investment strategies. Evidence shows that a small percentage of UCITS f

0 views • 6 slides

Understanding Financial Derivatives: An Overview of Forward Contracts, Futures, Options, Swaps, and Credit Derivatives

Financial derivatives play a crucial role in managing risk and speculation in financial markets. This overview covers the definitions and characteristics of forward contracts, futures contracts, options (calls and puts), swaps, and credit derivatives. Swaps involve exchanging payments over time, whi

1 views • 23 slides

Understanding Funding Grid and Commitment Accounting in ConnectCarolina

Learn about lump sum payments, funding swaps, and essential processes in ConnectCarolina. Explore how to use the funding grid, enter payments, swaps, and chartfield rules. Discover the role of Commitment Accounting in managing employee funding effectively. Enhance your ConnectCarolina knowledge and

0 views • 64 slides

Retroactive Funding Swaps: Addressing Financial Issues in ConnectCarolina

ConnectCarolina faced challenges with inaccurate distribution of labor expenses, leading to complications in encumbrances and suspense accounts. A new tool for retroactive funding swaps is introduced to rectify these issues with a focus on improving compliance and accurate financial tracking, especi

0 views • 41 slides

Understanding Credit Derivatives and Managing Credit Risk

This chapter delves into credit derivatives, exploring their purpose, types such as credit default swaps and total return swaps, and the development of the market over the years. It discusses credit risk, problems associated with it, methods for estimating credit risk, and the role of credit derivat

0 views • 35 slides

Understanding Interest Rate and Currency Swaps

Introduction to interest rate swaps (IR) and currency swaps, covering definitions, examples, reasons for use, valuation, payoffs, credit risk, and other swap types. Details include the concept of swaps, calculation of cash flows, and a focus on interest rate swaps with examples and cash flow illustr

0 views • 63 slides

Understanding Currency Derivatives and Exchange Rate Movements

Explore the history and significance of currency derivatives in global and Indian markets. Learn about currency appreciation, depreciation, and the impact on foreign exchange rates. Discover how to interpret changes in currency values and their implications for trading. Gain insights into the functi

0 views • 85 slides

Introduction of Currency Board in Bulgaria: Historical Insights and Policy Implications

The introduction of the currency board in Bulgaria in the late 1990s marked a significant departure from past economic policies. The move aimed to restore economic stability by implementing measures to curb inflation, reduce debt burden, and enhance the attractiveness of the national currency. Despi

0 views • 27 slides

Understanding Currency Evolution: From Physical to Electronic

Explore the evolution of currency from physical to electronic forms, covering the history of currency, the role of trust, advantages and disadvantages of physical currency, and insights into electronic currency systems like credit cards and PayPal. Discover how centralized and decentralized systems

0 views • 50 slides