Insights into Long-Term Local Currency Hedging in Latin America

Explore the regional share of total TCX hedging, trends in LATAM local currency hedges over time, country-wise LATAM hedges, sector shares in LATAM production, and a case study on renewable energy in Costa Rica. Gain valuable information on managing currency risks and enhancing financial stability in the Latin American market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Long-Term Local Currency Hedging in Latin America Overview

Regional Share Total TCX hedging Asia 15% Total production: USD 6.4 bn Sub-Saharan Africa 22% Middle East North Africa 3% LATAM production: USD1.5 bn Europe / Central Asia 37% Latin America 23% ALIDE - LCY Workshop 9/25/2024 1

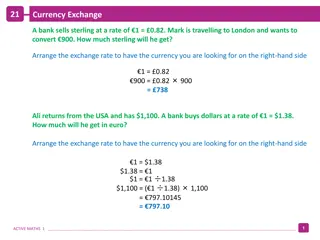

LATAM local currency hedges over time 350 120 300 100 250 80 200 60 150 40 100 20 50 0 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Sum of Production, USD million (LHS) # of Transactions (RHS) ALIDE - LCY Workshop 9/25/2024 2

LATAM hedges, by Country (USD million) 400 300 200 100 0 -100 -200 ALIDE - LCY Workshop 9/25/2024 3

LATAM Sector Shares (Production) Other non-FI Manufacturing Other sectors Infrastructure Renewable Energy SME finance Other FI Microfinance ALIDE - LCY Workshop 9/25/2024 4

ALIDE - LCY Workshop 9/25/2024 5

Renewable Energy in Costa Rica Case Study The Costa Rican Institute of Electricity (ICE, produces 80% of national energy production) has long- term USD debt liabilities ICE issued two USD 500 million bonds with maturity 2021, and 2043 USD debt and local currency revenues -> currency mismatch TCX provided a 5 and 7 year USD-CRC swap on coupon payments (via commercial bank) Improved ICE s forecasting and budgeting abilities & reduced debt vulnerability to exchange rate depreciation! ALIDE - LCY Workshop 9/25/2024 6

TCX regional exposure in LATAM (Total Production) ALIDE - LCY Workshop 9/25/2024 7