Scheme of Arrangement under the Companies Act, 1956

The changes introduced in the existing procedures for stock exchanges and listed companies regarding the scheme of arrangement under the Companies Act, 1956. It covers the submission of draft schemes, display on websites, changes in internal procedures, court process, approval of shareholders, and i

4 views • 16 slides

Important Provisions of Companies Act Regarding Audit

The Companies Act mandates specific provisions related to audit, including the appointment of auditors, consent, certificates, and rotation requirements. Companies need to appoint auditors timely, obtain consent and eligibility certificates before appointment, and adhere to mandatory auditor rotatio

2 views • 22 slides

Buyback of Shares in India under Companies Act & Tax Consideration

Explore the intricacies of share buybacks in India, from regulatory compliance under the Companies Act to tax considerations under the Income-tax Act. Discover how companies navigate legal frameworks to optimize surplus cash, enhance shareholder value, and strengthen promoter holdings through strate

6 views • 4 slides

Blog 2- Unveiling the Top RPO Companies in the USA_ Elevate Your Recruitment Strategy

In the competitive landscape of talent acquisition, companies are increasingly turning to Recruitment Process Outsourcing (RPO) providers to streamline their hiring processes and gain access to top talent. With a myriad of RPO companies in the USA, it can be challenging to identify the best partners

6 views • 2 slides

Recent Amendments in Companies Act, 2013: An Overview

The Companies Act, 2013, a significant legislation in India, underwent amendments to enhance corporate governance and compliance. Passed in 2012, the Act regulates aspects of corporate entities, fostering transparency and accountability. The amendments aim to adapt to evolving business landscapes an

0 views • 123 slides

Significant Amendments in Schedule III of the Companies Act, 2013

Schedule III of the Companies Act, 2013 has been amended to include instructions for the preparation of financial statements for different categories of companies. Key changes relate to rounding off figures based on total income, definition of turnover, and disclosure requirements for shareholding o

0 views • 29 slides

Understanding Redemption of Preference Shares in Companies

Preference shares in companies offer preferential rights in dividend payments and capital repayment during liquidation. Redemption of preference shares involves returning the preference share capital to the shareholders. This process requires adherence to specific provisions under the Companies Act,

0 views • 25 slides

Understanding Implications of IG Empowerment Act and Paperwork Reduction Act

The IG Empowerment Act provides beneficial provisions for Inspector Generals (IGs) such as exemptions from certain acts, including the Computer Matching Act and Paperwork Reduction Act. The Paperwork Reduction Act requires federal agencies, including IGs, to obtain OMB clearance before conducting su

1 views • 25 slides

Banking Regulations in Bangladesh: A Comprehensive Overview

The Bangladesh Bank Order of 1972 established the central bank, Bangladesh Bank, which regulates banking activities under the Bank Companies Act of 1991. This legislation, along with the Financial Institutions Act of 1993, sets the framework for overseeing bank companies and non-banking financial in

2 views • 27 slides

Understanding Different Types of Companies in Business

Explore the various kinds of companies in the business world, including statutory companies, registered companies, private companies, public companies, and more. Learn about the differences between private and public companies, statutory company examples like LIC and RBI, and the characteristics of

0 views • 25 slides

Overview of Finance Act 2019 and Its Business Implications

The Finance Act 2019, signed into law in January 2020, aims to promote fiscal equity, align tax laws with global practices, introduce tax incentives, support small businesses, and raise revenue. It made significant changes to tax laws affecting companies, VAT, personal income tax, capital gains tax,

0 views • 22 slides

Understanding the Role of a Board of Directors and Company Secretary in Corporate Governance

Strong corporate governance is crucial for business performance, as it involves the system of rules, practices, and processes that direct and control a company. In Uganda, the Companies Act of 2012 governs corporate governance, with a voluntary code for private companies and mandatory for new public

1 views • 21 slides

Understanding Economic Substance Presentation in International Business Units

The presentation focuses on the Economic Substance Act (ESA), outlining the scope of resident companies under ESA, relevant activities requiring annual declaration, the Economic Substance (ES) test criteria, outsourcing possibilities, and the Reduced ES test for specific holding companies in Barbado

4 views • 13 slides

Enhancing Corporate Transparency and Compliance through Beneficial Ownership Regulations

The Companies (Amendment) Act, 2019 in Trinidad and Tobago has introduced regulations to enhance corporate transparency and compliance with CFATF recommendations by focusing on beneficial ownership. These regulations aim to combat money laundering and terrorist financing through requirements for com

0 views • 31 slides

Implementation Guide on Reporting under Rule 11(g) of Companies (Audit and Auditors) Rules, 2014

This comprehensive guide covers the provisions, objective, and important terms related to reporting under Rule 11(g) of Companies (Audit and Auditors) Rules, 2014. It discusses the importance of maintaining proper books of accounts, introduces the concept of audit trail, explains crucial terms like

2 views • 49 slides

Insights into the Biotech Industry: Companies, Key Players, and Career Pathways

Keith Ho's career journey from a scientist to a digital health expert at Biogen is highlighted. The overview covers the definition of biotech, the concentration of biotech companies in the US, and the global distribution of such companies. Additionally, key insights into the top biopharma companies

0 views • 9 slides

Proposed Changes in Company Regulations under The Companies Act

The proposed changes under The Companies Act include redefining terms like "significant influence" and "joint venture," aligning accounting years for associate companies, modifying the definition of net worth, and more. These revisions aim to enhance clarity and efficiency in corporate regulations.

0 views • 50 slides

An Overview of Different Types of Companies and Their Characteristics

Explore the various kinds of companies based on mode of incorporation, number of members, liability of members, and more. Learn about statutory companies, registered companies, private companies, and the distinctions between different types of companies in the business world.

0 views • 25 slides

Understanding Charges and Registration according to Companies Act, 2013

This comprehensive content covers the concepts of charges, registration of charges, fee structures, and penal provisions as per the Companies Act, 2013. It explains the duty of companies, fee structures for charges created before and after specific dates, and the importance of timely registration to

0 views • 12 slides

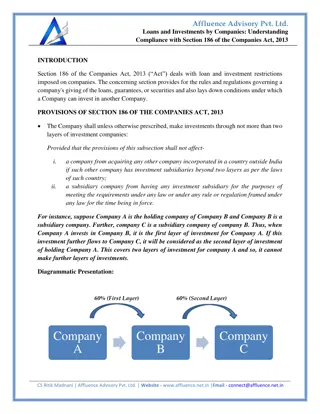

Loans and Investments by Companies -Understanding Compliance with Section 186

Section 186 of the Companies Act, 2013, outlines strict rules for company loans and investments. This section ensures companies adhere to legal limits, obtain necessary approvals, and maintain transparency in financial dealings. Understanding these c

0 views • 5 slides

Understanding Charges and Mortgages in Property Transactions

According to the Transfer of Property Act and Companies Act, charges and mortgages play significant roles in property transactions. This content explains the definitions of charges and mortgages, their distinctions, registration requirements, and the duty of companies to register charges. It covers

0 views • 22 slides

Disqualification and Vacation of Office of Directors in Companies Act, 2013

Directors play a crucial role in companies per the Companies Act, 2013. They must adhere to specific qualifications and can face disqualification under Section 164, such as being of unsound mind, insolvent, convicted of offenses, or failing to comply with court orders. Understanding these regulation

0 views • 42 slides

Characteristics of Companies in the Care Sector

Companies operating in the care sector exhibit distinct characteristics, such as financial prioritization, control by financial experts, and reliance on technology. Large care chains engage in takeovers and have offshore accounts, while smaller companies face asset stripping and profit maximization

0 views • 5 slides

Understanding Section 185: Prohibition on Loans to Directors in Companies Act 2013

Section 185 of the Companies Act 2013 prohibits companies from directly or indirectly providing loans, guarantees, or securities to their directors or related persons. The rationale behind this regulation is to prevent misuse of public funds, siphoning off money, and securing personal gains. This se

0 views • 22 slides

Practical Aspects of Strike Off and Restoration of Companies by CS Ashish O. Lalpuria

This presentation discusses the practical aspects of striking off and restoring companies based on analysis of case laws from NCLT and NCLAT. It covers types of strike off, companies that cannot be struck off by ROC, and the process of strike off by the Registrar of Companies. Various scenarios and

0 views • 44 slides

Overview of Limited Liability Companies under Polish Company Law

Explore the legal aspects of limited liability companies under the Polish Commercial Companies Code, detailing formation, share capital requirements, shareholder liabilities, and powers granted to these entities. Learn about the two main types of companies in Polish law, their characteristics, and k

0 views • 13 slides

The Foundations of the Separation of Powers in Companies

The separation of powers in companies is based on the dualism of organs: the Board and General Meeting. The actual situation in companies diverges between large public companies with autonomous management and smaller private companies with owner-operators. The search for the foundations of the separ

0 views • 15 slides

Types of Companies in Corporate Administration

This article discusses the various kinds of companies in corporate administration, including incorporated, chartered, statutory, and registered companies. It covers the definition of a company, different types of legal entities, and examples of each type. The classification of companies based on inc

0 views • 17 slides

Efic: Specialist Financing Solutions for Australian Companies

Efic is a specialist financier owned by the Australian Government, providing creative financing solutions to help Australian companies succeed globally. They offer various financial instruments like bonds, guarantees, and loans to assist companies in winning contracts and expanding internationally.

0 views • 11 slides

Corporate Transparency Act (CTA) Beneficial Ownership Reporting Requirements

The Corporate Transparency Act (CTA) mandates companies to report information about their beneficial owners to FinCEN starting January 1, 2024, to combat illicit activities. Reporting companies include U.S.-based corporations, LLCs, and foreign companies registered to do business in the U.S. Exempt

0 views • 10 slides

Impact of Corporate Transparency Act on Businesses

The Corporate Transparency Act (CTA), part of the Anti-Money Laundering Act of 2020, aims to prevent money laundering and other illegal activities by disclosing beneficial owners of US entities. The act mandates reporting companies to provide ownership information to the US Treasury's FinCEN. Exempt

0 views • 37 slides

Understanding Borrowing Powers of Companies under Companies Act, 2013

The term "Borrowing" in the Companies Act, 2013, pertains to the power granted in Section 180(1)(c) for companies to borrow money with the consent of the company by a special resolution. This includes provisions on limits, definitions of temporary loans, necessary board resolutions, and validity of

1 views • 8 slides

Challenges and Opportunities for Chartered Accountants under Companies Act, 2013

Explore the various penalties and punishments for defaults under the Companies Act, 2013 as discussed in a workshop held on 26th October 2013 in Ahmedabad. The session covered offenses such as misleading statements in prospectuses, fraudulent inducements, and fictitious applications for securities,

0 views • 33 slides

Companies (Cost Records and Audit) Amendment Rules 2014 Overview

The Companies (Cost Records and Audit) Amendment Rules 2014, presented by CMA Harshad S. Deshpande, cover the applicability of cost records and cost audit for companies in regulated and non-regulated sectors. The rules specify the class of companies engaged in production or services that must mainta

1 views • 41 slides

Transitioning to The Companies Act 2014: Key Provisions and Changes

The Companies Act 2015, enacted on June 1, 2015, consolidates existing company laws from 1908 to 2013 into a single unified body of legislation. This comprehensive act aims to simplify company law, modernize corporate governance, and reduce administrative burdens. Companies need to decide on suitabl

0 views • 29 slides

Recent Case Laws in Corporate Laws - Economy Hotels India Services Pvt. Ltd. v. Registrar of Companies & ANR. (NCLAT)

In this case, Economy Hotels India Services Pvt. Ltd. filed a petition under Section 66 of the Companies Act for confirming the reduction of share capital. The National Company Law Tribunal (NCLT) rejected the application, but the National Company Law Appellate Tribunal (NCLAT) allowed the reduction

0 views • 21 slides

The Civil Rights Act of 1964 and the Supreme Court

In the 1960s, Congress passed the Civil Rights Act of 1964, a pivotal legislation that prohibited discrimination in public accommodations. This act represented a significant shift in focus towards minority rights. The Supreme Court's past rulings on the Civil Rights Act of 1875 influenced Congress t

0 views • 24 slides

Understanding Growth Companies and Growth Stocks

Differentiating between good companies and good investments, this content delves into the intrinsic value versus market value of stocks, the characteristics of growth companies and growth stocks, and how stock prices can be undervalued or overvalued in the market due to incomplete information. It em

0 views • 38 slides

Companies (Winding Up) Rules, 2020: An Overview

The Companies (Winding Up) Rules, 2020 provide guidelines for winding up a company by the Tribunal under the Companies Act, 2013. The rules cover various aspects such as modes of winding up, circumstances under which a company may be wound up by the Tribunal, definitions, forms, and more. It specifi

1 views • 110 slides

Overview of Oppression and Mismanagement Provisions under Companies Act, 2013

This content provides detailed information about the provisions related to oppression and mismanagement as per the Companies Act, 2013. It outlines the eligibility criteria for members of shareholders to raise concerns, the power of the tribunal to intervene, and the possible orders that can be pass

0 views • 6 slides