Boxes For Cigarettes

Custom Boxes For Cigarette reflect the continuous conflict between individual choice and public health and provide a platform for regulatory initiatives and persuasive communications.\n\/\/custompackagingpro.com\/product\/custom-cigarette-packaging-boxes-wholesale

0 views • 1 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Printed Labels Manufacturer from Kolkata India

PB Holotech is one of the leading label manufacturers and suppliers to the Bidi and tobacco industry. Primary raw material of bidi labels is paper. The bidi labels are customized with hot stamping according to size and specification. Chromo and poster papers are required for making of Bidi labels of

0 views • 4 slides

Shaping The Future The Applications Of Metal Stamping Parts

If you are looking for Metal Stamping Parts, then look no further than YuYao QiDi Plastic Mold. For more information, visit YuYao QiDi Plastic Mold or email at info@cn-molds.com or whatsapp on 13605741887.

0 views • 4 slides

Surplus Line Association of California: Stamping Fee Payment Guide

An introductory guide to the Surplus Line Information Portal 2.0 (SLIP) and California's Electronic Filing System, focusing on Stamping Fee Payment methods, online payment terms, and setting up automatic payments. The guide includes step-by-step instructions and images for easy understanding.

3 views • 9 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

7 views • 11 slides

Winnerslabels - License plate stamping foil manufacturer in Asia, India

A hot stamping foil process involves the application of heat and pressure on metallic foil surfaces or holograms onto other materials such as carton board, laminated board, plastics and other corrugated board products.\n\nA hot stamping foil process comprises embossing, holographic application, comb

4 views • 3 slides

Winners Labels- Use Custom Hot Foil Stamping for Glass Containers

What Is Hot Foil Stamping?\nHot foil stamping is the process of using pressure & heat to apply metallic foil to various kinds of containers for decoration and product labeling. It works on cardboard, paper, corrugated board, glass, plastic sheets, and many other types of materials. Hot foil stamping

3 views • 3 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Why hot Stamping Foil for car number plate and other surfaces is versatile

Hot stamping foil is a versatile and reliable method for decorating car number plates and a multitude of other surfaces. Its durability, aesthetic appeal, and wide range of applications make it an invaluable tool in various industries. Whether for automotive use, packaging, electronics, or fashion,

0 views • 3 slides

Revolutionize Your Mailing with Pitney Bowes E Stamping Solutions

Pitney Bowes E Stamping solutions provide a modern approach to Mailing Solutions, enhancing efficiency and compliance. Our advanced Digital Stamping Solutions, including the B700 Tax Meter, ensure accurate and reliable stamp duty processing. Integrat

0 views • 7 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

1 views • 21 slides

Understanding the Stamp Act of 1899: A Comprehensive Overview

The Stamp Act of 1899 is a fiscal statute aimed at revenue collection for the state through stamp duty on various transactions. This law ensures the rights of contracting parties, regulates stamp duty rates, and defines the proper procedure for stamping instruments. Adhesive and impressed stamps are

1 views • 53 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

3 views • 32 slides

Cigarette Bin Hire for Events

Rent our portable cigarette bins for efficient event cigarette disposal. Ideal for providing a designated smoking area. Book now!

1 views • 7 slides

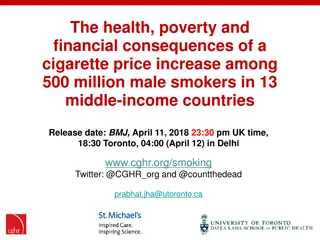

Impact of Cigarette Price Increase on Health and Poverty among Male Smokers in Middle-Income Countries

Study reveals a potential 50% cigarette price increase could save 450 million years of life across 13 countries, with the poorest 20% benefiting the most. Financially, USD $157 billion could be saved in treatment costs, mostly by the poorest. Tobacco control through taxation is crucial to prevent mi

0 views • 18 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

The Impact of Cigarette Taxes and Indoor Air Laws on Prenatal Smoking and Infant Death

This study examines the effects of cigarette taxes and indoor air laws on prenatal smoking and infant death. It discusses how cigarette taxes can increase smoking cessation during pregnancy and reduce the probability of smoking, while comprehensive smoking bans can decrease the likelihood of smoking

1 views • 27 slides

Supporting Staff to Quit Smoking: E-Cigarette Intervention Program Overview

Overview of a program in North East and North Cumbria offering support to staff to quit smoking using e-cigarettes, led by healthcare professionals. The initiative aims to remove barriers to quitting and promote behavior change, providing easy access, non-judgmental support, and free NRT/e-cigarette

0 views • 10 slides

Understanding the Links Between Cigarette Smoke and Disease

Epidemiological and experimental evidence clearly show the devastating impact of smoking on health, leading to diseases like lung cancer and Chronic Obstructive Pulmonary Disease. Statistics reveal the alarming risks associated with smoking, emphasizing the urgent need for smoking cessation. Researc

0 views • 17 slides

Canadian Task Force Recommendations on Behavioural Interventions for Cigarette Smoking Prevention in Youth

The Canadian Task Force on Preventive Health Care (CTFPHC) provides recommendations on behavioural interventions for preventing and treating cigarette smoking in school-aged children and youth. The guidelines focus on evidence-based strategies to address tobacco smoking in adolescents, emphasizing p

0 views • 35 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

1 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

5 Noted Advantages of Hot Stamping Foil

Hot foil stamping is nothing but an innovative process of using heat & pressure to apply metallic foil or holograms in materials like carton boards & holograms. It can also be applied in laminated boards, plastics and corrugated sheets. Hot stamping

0 views • 4 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Key Findings from 2020 National Survey on Drug Use and Health

Results from the 2020 National Survey on Drug Use and Health provide insights into past month general substance use, tobacco use, nicotine vaping, and cigarette use among individuals aged 12 or older. The data shows trends from 2002 to 2020, highlighting changes in substance and tobacco consumption

0 views • 62 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

1 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

1 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Boost Quality with Advanced Cigarette Stamping & Labelling Machines

Budhan Engineering's Tax Stamper is engineered to efficiently apply tax stamps on cigarette packages, ensuring compliance with tax regulations. Our advanced system uses precise technology to deliver consistent and accurate results, adapting to variou

0 views • 2 slides

Understanding the Types of Stamping Foil and How They’re Used in Printing

Uses of stamping foils\nHot stamping foil is widely used in the finishing of packaging of products such as food, medicine, beverages, and luxury products.\nFoil stamping is also used on currency notes, artwork as well as for designing invitation card

0 views • 7 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

Why Custom Hot Foil Stamping is Ideal for Glass Container Branding

What Is Hot Foil Stamping?\nHot foil stamping is the process of using pressure & heat to apply metallic foil to various kinds of containers for decoration and product labeling. It works on cardboard, paper, corrugated board, glass, plastic sheets, an

0 views • 5 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)