Understanding the Stamp Act of 1899: A Comprehensive Overview

The Stamp Act of 1899 is a fiscal statute aimed at revenue collection for the state through stamp duty on various transactions. This law ensures the rights of contracting parties, regulates stamp duty rates, and defines the proper procedure for stamping instruments. Adhesive and impressed stamps are used, with a focus on conveyance and instruments' significance. Learn about the key provisions and importance of proper stamping under this act.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

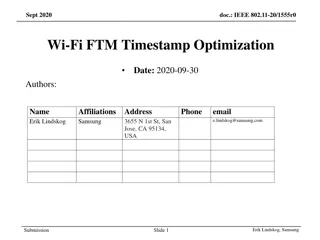

INTRODUCTION TO Stamp Act, 1899 Presented by: Noreen Farooq Civil Judge/Judge Family Court, Mansehra 2

Stamp Act, 1899 Introduction: Stamp Act is a fiscal statute, its object is to collect revenue for the state. Its object is just like the Court Fee Act and income tax ordinance. The revenue that is collected and imposed by the Stamp Act 1899 is called stamp duty. The stamp duty under the stamp Act is imposed on Transactions which is effected or executed by/through an Instrument . Stamp Act 1899, prescribes that, 3

Stamp Act, 1899 (CONT) I) What transaction and instruments shall be liable to stamp duty, and II) At what rate such stamp duty shall be imposed. Explanation: beside of its being a fiscal/tax statute, its object is also to secure the rights of the contracting parties from rival claimants and other subsequent illegal transaction. An instrument which is duly stamped, after that it is legally become capable for registration under 4

Stamp Act, 1899 (CONT) the registration Act, 1908. The proper time for stamping an instrument is, when it is duly executed by the parties and signed by the parties so, the proper time for stamping an instrument is, after its execution and before its registration. An instrument which is stamped in the manner above is called Duly stamped Instrument 5

Stamp Act, 1899 (CONT) What is stamp: The stamp/duty that are applied/provided for instruments are in the shape of a document which are in the nature of Adhesivestamp or Impressedstamp . Adhesive Stamps: Adhesive stamps are pasted on the instrument, which is in the nature of 1x1 inches or 1 x 2 or 1 x 3 inches. 6

Stamp Act, 1899 (CONT) The example of such stamp is a stamp which is applied/pasted on registry envelope and AD cards, and stamps/ tickets used in the post office. Impressed Stamp Impressed stamps are provided in the nature of stamp papers . 7

Stamp Act, 1899 (CONT) From the above discussion, it has been clear that stamp duty under the Stamp Act 1899, is imposed on Conveyance of property etc effected through an instrument, so here it is note worthy to explain these two terms, i.e, conveyance and instrument . 8

Stamp Act, 1899 (CONT) Conveyance: According to section 2(10) of Stamp Act, conveyance includes a conveyance on sale and every instrument by which property, whether movable or immovable, is transferred inter-vivos and which is not otherwise specifically provided for by schedule-I. 9

Stamp Act, 1899 (CONT) Instrument: According to section 2(14) of Stamp Act, instrument includes every document by which any right or liability is, or purports to be created, transferred, limited, extended, extinguished or recorded 10

Stamp Act, 1899 (CONT) Explanation/comments on Conveyance & Instrument with relevant illustrations: Sale Transaction: Illustration: A being owner of the property, B Sold that property in favor of C in consideration of 2-lac Rs sale deed is executed by A in favor of C . This sale deed is an instrument, as it transfers the right of A in the property in favor of C , so this instrument is liable to stamp duty. 11

Stamp Act, 1899 (CONT) Gift deed: When a person transfers property in favor of another person by gift and executes gift deed in favor of that person, so such gift deed is also an instrument as defined in the Stamp Act, 1899 because by this deed/instrument the right in the property is transferred in favor of donee. So, such deed /instrument shall be 12

Stamp Act, 1899 (CONT) stamped. Such stamp duty on such gift deed/instrument shall be paid according to the amount/ratio as specified in serial/item No.33 of the schedule No.1 of the Stamp Act. Exchange of property: If owners of properties exchange said properties with each other, and executes exchange deeds in favor of each other. Such 13

Stamp Act, 1899 (CONT) exchange deeds are instruments also as each person extinguishes his rights in favor of another and at the same time each one also require rights in exchange, therefore exchange deed/instruments are liable to stamp duty. Such stamp duty is to be imposed at the rate as specified in item/serial No.31 of the schedule-I of Stamp Act. 14

Stamp Act, 1899 (CONT) Lease deed: Lease transactions are if effected through deed, whereby one person transfers his rights in the property for a specified period in favor of another person, so the leaser extinguishes his rights such leaser deed also fulfills the definition of an instrument as defines in the Stamp Act is an instrument of lease which is liable to stamp duty. Such stamp duty on lease deed/instruments shall be imposed according to serial/ 15

Stamp Act, 1899 (CONT) item No.35 of schedule No.1 of Stamp Act. Partition deed: Partition or family settlement is the distribution or settlement of the joint property between co-sharers, whereby some co-sharers acquires certain property and at the same time extinguishes his rights in same joint property in favor of another 16

Stamp Act, 1899 (CONT) co-sharers. Such private partition or settlement if reduced into writing is also an instrument, because each party in consideration of the acquisition of property in private partition also extinguishes his rights in the remaining joint property. An instrument of partition is liable to be stamp duty which is payable according to ratio/amount specified in item/serial No.45 of the schedule-I of the Stamp Act. 17

Stamp Act, 1899 (CONT) Mortgage deed: Mortgage of the property has been defined in the Transfer of Property Act, that mortgage is the transfer of property for the security of loan/amount advanced, with the condition that after the repayment of said loan, such property shall be delivered back to the owner. If mortgage deed is executed. Such deed limits 18

Stamp Act, 1899 (CONT) the rights of the real owner/mortgagor in his property, which fulfills the definition of instrument as defined in the stamp Act i.e An instrument includes every document by which any right is created, transferred and limited etc . Therefore, mortgage deeds are also liable to stamp duty such stamp duty is payable at the rate specified in serial No.40 of the schedule No.-I of the Stamp Act. 19

Stamp Act, 1899 (CONT) Bill of exchange: Bill of exchange is a document by which one person accepts his liability for the payment of an amount, which creates the right to receive the payment from the debtor, in favor of creditor. Therefore, bill of exchange is an instrument as per Stamp Act, as such is liable to stamp duty. Stamp duty upon bill of exchange is 20

Stamp Act, 1899 (CONT) payable according to the amount specified in serial No.13 of schedule-I of Stamp Act. Promissory note: Promissory note is also an instrument under the Stamp Act, as the debtor undertakes his liability of payment to the creditor, as such is liable to stamp duty. Stamp duty on promissory note is payable as per ratio specified in serial No.49 of the Stamp Act. 21

Stamp Act, 1899 (CONT) Power of attorney: Power of attorney is a document whereby one person/principal transfers certain rights with respect to his property is an instrument and is chargable to stamp duty as per item No.48 of schedule-I of the Stamp Act. 22

Stamp Act, 1899 (CONT) Partnership deed: Partnership has been defined in Partnership Act, 1932 which means the partnership is the relation between persons who have agreed to share the profits of the business carried on by all or any of them for all. The deed between the partners is, if executed is termed as partnership deed, which is an instrument and chargable with stamp duty as per item No.46 of schedule-I of the Stamp Act. 23

Stamp Act, 1899 (CONT) Pre-requisite conditions for imposition of Stamp Duty: Though the above mentioned instruments/deeds are liable to stamp duty, but there are some basic conditions which must be satisfied before imposition of stamp duty. These conditions are mentioned in section-3 of the Stamp Act, which are as under. 24

Stamp Act, 1899 (CONT) a) The instrument shall be executed in Pakistan. b) If the instrument is executed out of Pakistan it shall relate to the property or matter within Pakistan. c) There is no stamp duty on instruments by or on behalf of or in favor of the Government. 25

Stamp Act, 1899 (CONT) d) There is no stamp duty on the transfer or disposition by mortgage of any ship or vessel registered under the Merchant Shipping Act, 1894 or registered under registration of Ships Act 1841. 26

Stamp Act, 1899 (CONT) Stamp duty on several instruments used in single transaction: According to section-4 of the Stamp Act when there is a single transaction of sale etc between the parties, but for such single transaction several instruments are executed, in such a case the principal or main instrument shall be chargeable with the full 27

Stamp Act, 1899 (CONT) duty prescribed in schedule-I of the Stamp Act whereas the other instruments shall be chargable with a duty of Four rupees instead of full duty prescribed in the first schedule. For example: When the property is sold by A in favor of B and A executes and instrument of sale in favor of B , but at the same 28

Stamp Act, 1899 (CONT) time B also executes a deed in favor of A for giving some time to A for the use of possession of that property till full payment of sale consideration, so the deed executed by A is the principal instrument chargable with full duty of stamp whereas the deed executed by B is not principal instrument is chargable with 29

Stamp Act, 1899 (CONT) stamp duty of Fourrupees . Stamp duty on single instrument containing several distinct matters: According to section-5 of the Stamp Act when a single instrument contains several distinct matters. In such a case the stamp duty shall be paid with aggregate of such matters. It means that whatever stamp duty is provided for each matters in the 30

Stamp Act, 1899 (CONT) schedule-I of the Stamp Act, total amount of such stamp duty shall be chargable on such instrument. Power of Provincial Government to reduce remit or compound duty: The provisional government u/s 9 & 9-A is empowered to reduce or remit the whole or any part of the stamp duty. 31

Stamp Act, 1899 (CONT) Use of Adhesive stamps & its cancellation: According to section-11 of the Stamp Act Adhesive stamp shall be used upon the bill of exchange, promissory notes, entry as an advocate on the rule of High Court, Notorial Acts and transfers by endorsement of shares in any incorporated company or other body corporate. But it is note worthy that an adhesive stamp when has been executed/affixed by any person on any instrument, shall cancel the same so, that it cannot be used again. For example 32

Stamp Act, 1899 (CONT) For example adhesive stamp is cancelled by crossing it, or signing the same or writing executants name on it. Legally adhesive stamp if not cancelled, the same instrument shall be deemed as unstamped and not legally admissible. Use of impressed stamps: According to section-13 of the Stamp Act, every instrument written upon paper stamped with an impressed stamp shall be written in such manner. That the stamp may appear on the face of 33

Stamp Act, 1899 (CONT) the instrument and cannot be used for any other instrument. Time of stamping instruments: a) According to section-17 of the Stamp Act, all instruments chargable with stamp duty, when it is executed by any person in Pakistan, shall be stamped before or at the time of execution. 34

Stamp Act, 1899 (CONT) b) According to section-18, every instrument executed out of Pakistan may be stamped within three months after it has been first received in Pakistan. Valuation of duty (Stamp duty): a) Situation may arise that an instrument contains money/value or consideration in foreign currency. In such case, the foreign currency shall be converted/calculated to Pakistan currency at the current rate of exchange on the day of instrument and the duty 35

Stamp Act, 1899 (CONT) shall be charged on such money according to section-20 of Stamp Act. b) When an instrument is chargeable with duty in respect of stock or any marketable or other security such stamp duty shall be calculated on the value of such stock or security according to the average price or value thereof on the day of the date of the instrument. 36

Stamp Act, 1899 (CONT) c) If principal amount and interest is mentioned is an instrument the stamp duty shall be charged only on principal amount and the interest shall not be chargeable with stamp duty as per section 23 of the Stamp Act. d) Where the property is subject to mortgage is transferred/sold in favor of the mortgagee, the mortgagee shall be entitled to deduct from the stamp duty payable, the 37

Stamp Act, 1899 (CONT) amount of any duty already paid in respect of the mortgagee (Section 24 of the Stamp Act). Stamp duty by whom payable (Section-29): a) In absence of any agreement to the contrary, in case of instruments of bill of exchange, indemnity band, mortgage deed, promissory note, transfer of shares in incorporated company, the expenses of providing the proper stamp 38

Stamp Act, 1899 (CONT) duty shall be borne by the person, drawing, making or executing the instrument. b) In case of exchange of property, the stamp duty shall be paid by the parties in equal shares. c) In case of partition instrument, stamp duty shall be paid by the parties in proportion to their respective shares. 39

Stamp Act, 1899 (CONT) d) In case of sale, the stamp duty shall be paid by the purchaser. In case of lease of the property the stamp shall be paid by the lease. e) Evidentiary value of un-stamped instrument: According to section-35 of the Stamp Act when an instrument required by law to be stamped, is not so stamped, such instrument is inadmissible in evidence, shall not be registered or authenticated by any person or public officer. 40

Stamp Act, 1899 (CONT) Examination and impounding of instruments: Every person having by law or by the consent of authority receive evidence and person incharge of public office except an officer of police before whom any instrument, is chargable in his opinion with duty is produced or come in performance of his functions shall if appear to him that such instrument is not duly stamped impound the same. For the purpose of this section in case of doubt, 41

Stamp Act, 1899 (CONT) the Provisional Government may determine what officers shall be deemed to being public office and who shall be deemed as person incharge of public office in this regard. Special provision as to unstamped receipts: According to section-34 of Stamp Act deals that when any receipt chargable with duty is tendered or produce before any 42

Stamp Act, 1899 (CONT) officer unstamped in the course of the audit of any public account, such officer may in his discretion, instead of impounding the instrument, require a duly stamped receipt to be substituted therefore. Agreement which is unstamped or is not properly stamped. Subject only to disabilities specified in S.35. 43

Stamp Act, 1899 (CONT) disabilities can be removed in manner prescribed in Ss.35 and 36. It is wrong to contend that an instrument becomes invalid if it falls within mischief of S. 35. and object of Legislature in enacting Stamp Act was to protect public revenues and not to interfere with commercial life by invalidating instrument vital to smooth flow of trade and commerce. Merely because an instrument cannot be admitted in evidence for any purpose or because it 44

Stamp Act, 1899 (CONT) cannot be acted upon by persons specified in S.35, does not mean that such an instrument is invalid. Decree passed by Trial Court in favor of plaintiff on insufficiently stamped document. Decree challenged by defendant with contention that decree was not legally sustainable as it was based on insufficiently stamped document in violation of S.35. High Court upholding the decree directing plaintiff/respondent 45

Stamp Act, 1899 (CONT) to make up the deficiency of stamp duty on insufficiently stamped document which was basis of decree. Sections 35 and 36 come into play only when document is required by law to be stamped but it is not duly stamped. Hence, provisions of Ss. 35 and 36 would not apply to documents not required by law to be stamped. 46

Stamp Act, 1899 (CONT) Section 36 admission of instrument, where not be questioned. Where an instrument has been admitted in evidence Such admission shall not be called in question at any stage of the same suit or proceeding on the ground that the instrument has not been duly stamped except as provided in section 61 of the Act. Meaning thereby appellate Court was bound to hold that admission of document was proper as nothing could be done at appellate stage. All the documents whether stamped or under stamped or unstamped when once admitted would preclude any controversy 47

Stamp Act, 1899 (CONT) on this point except the extent committed under section 61 of the Stamp Act 1899. Most relevant sections related to Court proceedings Sections 33, 34, 35, 36, 37, 59, 60 & 61. 48

Stamp Act, 1899 (CONT) Revision of certain decisions of Courts regarding the sufficiency of stamps: 1. When any Court in the exercise of its civil or revenue jurisdiction or any Criminal Court in any proceeding under Chapter XII or Chapter XXXVI of Code of Criminal Procedure, 1898, makes any order admitting any instrument in evidence as duly stamped or as not requiring a stamp or upon payment of duty and a penalty under section 35, the Court to 49

Stamp Act, 1899 (CONT) to which appeal lies from or references are made by such first mentioned Court may, of its own motion or on application of the Collector, take such order into consideration. 2. If such Court, after such consideration, is of opinion that such instrument should not have been admitted in evidence without the payment of duty and penalty under section 35 50