The House System at Queen Mary's High School - Fostering Collaboration and Leadership Through Engaging Activities

The House system at Queen Mary's High School promotes collaboration, leadership, and community engagement through a variety of activities, competitions, and charitable initiatives. Named after influential female authors, the Houses instill values of sportsmanship, respect, and integrity. Students fr

6 views • 5 slides

Citizenship in the Community Merit Badge Requirements

Explore the Citizenship in the Community Merit Badge requirements focusing on understanding the rights, duties, and obligations of being a good citizen in your community. From discussing what citizenship means to volunteering at charitable organizations, this badge encourages active participation in

0 views • 45 slides

Explore the Generosity of "Your Rotary Foundation

Delve into the impactful initiatives and charitable work carried out by "Your Rotary Foundation." Learn about their mission, projects, and opportunities to contribute to positive change in communities worldwide.

0 views • 17 slides

Transforming Governance Programme by Cause4

Cause4 is a social business specializing in advice, fundraising, training, and programme development. Led by Michelle Wright, they offer expertise in governance and ACE's National Portfolio requirements. The Transforming Governance Programme, delivered in partnership with Arts Council England, focus

0 views • 41 slides

NOT-FOR- PROFIT MAKING CONCERN

Not-for-profit organizations, such as educational institutions, public hospitals, and charitable trusts, operate with the main objective of providing services rather than making profits. These organizations rely on various sources of funding like contributions, donations, and grants. Accounting for

4 views • 4 slides

Sponsorship Dossier for Club Rise Up: Embracing Kindness

Club Rise Up, a charitable organization focusing on community well-being and personal development, presents a sponsorship dossier to seek support for their Ramadan initiative. The dossier highlights the club's mission, the upcoming Ramadan project, reasons for sponsoring, and benefits for corporate

0 views • 15 slides

New Audit Report Requirements for Charitable Institutions

CBDT has issued a new audit report form, 10B and 10BB, for charitable institutions, demanding extensive requirements from the assesses. The notification applies from April 1, 2023, emphasizing the need for improved accounting practices. The applicability of Form 10B and 10BB differs based on the ins

3 views • 84 slides

WMO Scale of Assessment of Members' Contributions for 2024-2027 Period

The WMO scale of assessment for members' contributions is based on the latest United Nations scales approved by the General Assembly. The scales for the 2024-2027 period will be determined considering the UN scales from the 2021 and 2024 sessions. Adjustments for membership differences will be made,

4 views • 6 slides

MOOSE LEGION UPDATES

Moose Legion provides insights into its 2023-2024 membership statistics, awards earned, charity contributions, and excellence recognition. Updates include active membership, retention rates, achieved goals, membership awards, charitable giving, and recognition levels for Moose Legions.

1 views • 13 slides

Understanding the 40% Retention Rule for Charitable Organizations in Kentucky

The 40% Retention Rule in Kentucky mandates that a charitable organization must retain at least 40% of the adjusted gross receipts from charitable gaming for its charitable purposes. This rule ensures that funds generated from gaming activities are primarily used for the organization's intended char

0 views • 16 slides

Understanding Charitable Giving: Strategies and Tools

Explore different ways to give effectively, beyond cash donations. Learn about appreciated asset donations, donor-advised funds, and qualified charitable distributions to maximize your impact while optimizing tax benefits for charitable giving.

0 views • 23 slides

Development of Settlement Geography: Contributions from Germany, France, and Others

Development of Settlement Geography has been influenced by major contributions from countries like Germany, France, and other European nations. German scholars like Carl Ritter and August Meitzen focused on house types and urban centers, while French geographers like Vidal de La Blache emphasized ru

0 views • 9 slides

Understanding Taxation and Assessment of Charitable Trusts

Explore the complexities and nuances of taxation and assessment for charitable trusts and institutions. Learn about key issues such as tax rates, income computation, tax audits, capital gains, registration surrender, and more. Discover the basic rules to follow, including exemptions, income categori

0 views • 46 slides

Recent Amendments in Charitable Trusts: A Comprehensive Overview

Recent amendments to charitable trusts, as outlined by CA Sudhir Baheti, cover important aspects such as registration sections, creating new trusts, and changes in Section 10(23C) of the Income Tax Act, 1961. The amendments impact income exemptions for educational institutions, application procedure

0 views • 40 slides

Prescription and Arrear Contributions in Pension Law

Contributions are crucial for pension funds, with arrear contributions arising when payments are not made on time. Late payment interest applies to arrear contributions, prompting legal steps if ignored. Sanctions vary from termination to legal action, highlighting the importance of timely contribut

5 views • 12 slides

Tikun Olam Fund Allocations 2018 - Jewish Charitable Contributions

This data outlines the allocations made by the Tikun Olam Fund in 2018 to various Jewish institutions and organizations, covering areas like the Conservative movement, Jewish medical institutions, community development, and counseling services. Funds were distributed to support a range of causes, in

0 views • 15 slides

Understanding Charitable Giving Trends in the U.S.

Explore the trends and statistics of charitable giving in the U.S., covering topics such as individual giving, foundation contributions, bequest giving, corporate donations, and where the money flows. Delve into historical and current statistics to understand the factors influencing philanthropy in

1 views • 40 slides

JCFGM Executive Committee Meeting Summary and Reports April 25, 2022

The JCFGM Executive Committee meeting on April 25, 2022, covered various aspects including the mission statement, agenda items, funds and assets report, Life & Legacy Plus program details, Treasurer's report, and resolution related to Life & Legacy program participation. The meeting highlighted the

0 views • 11 slides

Public-Private Partnership in Water Conservation by Rhino Ark Charitable Trust

Established in 1989, Rhino Ark Charitable Trust focuses on sustainable solutions for mountain forest ecosystems and biodiversity conservation through public-private partnerships. With a key emphasis on water towers like Aberdare Range and Mt. Kenya, they aim to mitigate human-wildlife conflicts and

0 views • 11 slides

Jewish Community Foundation of Greater Mercer Board of Trustees Meeting Highlights

The Jewish Community Foundation of Greater Mercer held a board of trustees meeting discussing key topics such as financial reports, new board members, and charitable initiatives. The president's report highlighted contributions to the COVID-19 Emergency Response Fund and expressed gratitude for the

1 views • 22 slides

Residence Returning Scheme Points Allocation Guidelines

This document outlines the points allocation guidelines for the Residence Returning Scheme, covering categories such as Academic Excellence, University Contributions, Hall-Based Contributions, and Discipline Deduction. It provides detailed criteria for scoring in each category, including GPA points

0 views • 21 slides

Unveiling the Significance of Gifts in Wills and Pursuit of Immortality

Explore the profound impact of charitable gifts in wills on global legacies and the quest for eternal remembrance. Delve into the underlying motivations, the essence of legacy, and the critical need for greater awareness and action to encourage more people to leave charitable bequests in their wills

0 views • 24 slides

Rotary International - History, Achievements, and Service

Rotary International is the world's largest service organization with over 1.2 million members globally. Founded in 1905, it has a rich history of community service, including efforts to eradicate polio. Learn about its grassroots beginnings, charitable contributions, and affiliate clubs like Intera

0 views • 22 slides

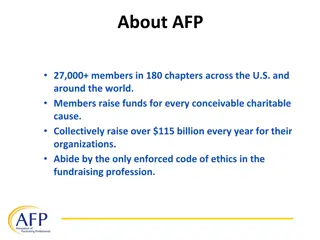

Overview of Association of Fundraising Professionals (AFP) and Charitable Act Impact

AFP comprises 27,000+ members across 180 chapters globally who raise over $115 billion annually for charitable causes. Members must adhere strictly to the AFP Code of Ethics, promoting honesty, integrity, and transparency in fundraising efforts. The Charitable Act (S.566/H.R.3435) aims to renew the

0 views • 5 slides

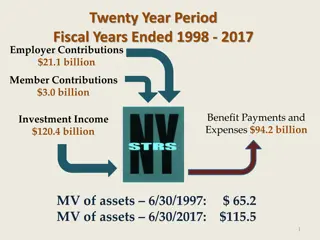

NYSTRS Financial Performance Overview 1998-2017

NYSTRS experienced significant growth over a twenty-year period, with employer contributions totaling $21.1 billion, member contributions at $3.0 billion, benefit payments and expenses reaching $94.2 billion, and investment income amounting to $120.4 billion. The breakdown of income sources reveals

0 views • 5 slides

The Inspiring Life of St. Elizabeth Ann Seton

St. Elizabeth Ann Seton, a widowed New York socialite who embraced the Catholic faith, founded a community of women in 1809. Despite facing personal tragedies and challenges, she established the first Catholic parochial school system in the United States. Her legacy continued through the Daughters o

0 views • 23 slides

Returning Scheme and Criteria for Residence Recommendations

The Returning Scheme and Criteria for Residence Recommendations outline the key attributes, points allocation, and evaluation process for residents seeking to return to their hall. Points are awarded based on academic excellence, university contributions, hall-based activities, and discipline. The s

0 views • 20 slides

Strategies for Combatting Charity Fraud: Insights and Enforcement Approaches

Explore key enforcement issues in combating charity fraud, including areas of authority, common enforcement focuses, fundraising methods regulated, enforcement approaches, and inter-office cooperation. Gain insights into regulatory efforts to protect consumers and charitable contributions.

0 views • 33 slides

The Impact of Donor Advised Funds on American Philanthropy

The rise of Donor Advised Funds (DAFs) has reshaped charitable giving in America, with organizations like Fidelity Charitable dominating the landscape. DAFs play a significant role in charitable donations, accounting for over 10% of all giving. This growth has sparked discussions on the effectivenes

0 views • 57 slides

JCFGM Board of Trustees Meeting Summary - September 19, 2022

The JCFGM Board of Trustees Meeting on September 19, 2022, focused on promoting philanthropy and addressing charitable needs in the Jewish community and other charitable institutions. The agenda included reports from various committees, updates on funds and assets, a new Mitzvah Match Fund, contribu

0 views • 18 slides

World War II Home Front Contributions and Impact

The chapter highlights the significant roles played by various groups during World War II on the home front. It covers topics such as the Selective Service Act, War Productions Board, women in the workforce, African Americans' contributions, Native American code talkers, Mexican-American involvement

0 views • 11 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Woodland Rotary Endowment - A Pillar of Service in Community

The Woodland Rotary Endowment is a charitable organization closely affiliated with the Rotary Club of Woodland, operating as a pillar of service within the community. Governed by a board of directors, it offers scholarships and charitable contributions while upholding the values of the Rotary Club.

0 views • 12 slides

Understanding Taxes, Charitable Giving, and Legislative Impacts

Explore the intersection of taxes, charitable giving, and pivotal legislative acts such as the Tax Cuts and Jobs Act of 2017. Learn about key considerations, planning tools, and changes in federal income taxes under the Biden Tax Plan. Discover how estate taxes, donor-advised funds, and retirement a

0 views • 59 slides

The Case for Progressive Taxation: Ensuring Equality Through Fair Contributions

Progressive taxation involves higher tax rates for individuals with higher incomes or greater wealth, aiming to bridge economic and gender inequalities. This system can be achieved through well-designed tax scales, exemptions, and thresholds, ultimately contributing to fair distribution of contribut

0 views • 8 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

JAGA Charitable Trust Inc. Financial Overview

JAGA Charitable Trust, Inc. has seen an increase in member contributions in 2023 YTD compared to 2022. The trust's income sources include community foundations, PGA Tour contributions, and various events. Investment strategy focuses on earning returns above 0.37% with low risk and liquidity. To incr

0 views • 5 slides

FPUA Charitable Contributions Overview

FPUA's Charitable Contributions Utility Advisory Committee focuses on supporting various organizations and initiatives that benefit the community. The process involves receiving sponsorship requests, evaluating impact potential, and providing financial support to organizations like Boys & Girls Club

0 views • 9 slides

Lodge Lurgan 2014-2015 Valedictory Report Summary

The Valedictory Report of Lodge Lurgan for the 2014-2015 term, under the leadership of WM Kiran Fakir, highlights the lodge's vision, goals, achievements in administrative governance, growth, development, communications, projects, activities, charitable works, and financial contributions. The report

0 views • 15 slides

Overview of Colleges of Education: Challenges and Contributions

This report explores the role of colleges of education in American education, highlighting their significant contributions through teaching, research, and service. It addresses issues such as diversity among educator candidates, enrollment declines, and faculty retirements, emphasizing the evolving

0 views • 30 slides