MRES Transmission Update: Projects, Rates, and Regulatory Changes - August 25, 2023

Explore the latest updates on MRES transmission projects, rate adjustments, and regulatory developments discussed during the meeting on August 25, 2023. Details include MRES member rate information, specific rate adjustments for MMU and WMU, transmission project energization, true-up information, an

1 views • 15 slides

Briefing to the Standing Committee on Appropriations on Adjustments Appropriation Bill

The presentation by Ms. Funani Matlatsi, DDG: CFO District Development Model, covers the adjustments in the national expenditure outcome, rationale for unallocated funds, impact on LGES, financial performance of the Municipal Infrastructure Grant, measures to mitigate fund stopping, steps to settle

3 views • 37 slides

SBRP SUPPLEMENTAL RETIREMENT BENEFIT

Supplementation retirement benefit (SBRP) is a defined benefit providing lifetime income separately managed by SBCTC. Eligibility requirements include age, years of service, and disability retirement provisions. Calculations are complex and based on retirement age, years of service, goal income, and

0 views • 26 slides

Antibiotic Adaptation in Renal Insufficiency - Dosage Adjustments and Risks

Understanding the importance of adapting antibiotic therapy in patients with renal insufficiency is crucial to ensure efficacy and minimize risks. This content covers various factors influencing antibiotic selection, dosing adjustments based on patient parameters, and the risks associated with inapp

0 views • 52 slides

Understanding Neurodiversity in the Workplace: Challenges and Adjustments

Neurodiversity encompasses various neurological differences such as ADHD, ASD, dyslexia, and more. This diversity also includes mental health conditions. Neurodiverse individuals may face memory challenges at work, requiring specific adjustments for support. Providing extra time for note-taking, sim

2 views • 23 slides

Delete Inventory Adjustments in QuickBooks Online and Desktop

Delete Inventory Adjustments in QuickBooks Online and Desktop\nDeleting inventory adjustments in QuickBooks is easy. To delete an inventory adjustment in QuickBooks Online, go to \"Inventory\" > \"Inventory Adjustments\", find the adjustment, click it, and choose \"Delete\". For QuickBooks Desktop,

1 views • 4 slides

Workplace Adjustments and Employee Lifecycle Overview

This content discusses the key stages in the employee lifecycle where workplace adjustments may be necessary to support employees effectively. It emphasizes the importance of providing reasonable adjustments as required under the Equality Act 2010, especially during recruitment, induction, performan

3 views • 4 slides

Proposed FY 2022 Highway Program Amendment Summary

The Federal Infrastructure Bill, Infrastructure Investment and Jobs Act (IIJA) was passed, providing $550 billion in funding for transportation. The bill includes reauthorization of surface transportation programs from FY 2022 to FY 2026. Changes to projected funds for FY 2021 projects and adjustmen

0 views • 8 slides

Resource Adequacy Load Forecast Adjustments 2023

The document outlines the process of adjusting load forecasts for resource adequacy in 2023, focusing on factors such as IOU service areas, coincidence factors, peak demand estimates, LSE-specific adjustments, demand-side programs, and pro-rata adjustments. It includes detailed data and forecasts fo

1 views • 15 slides

Capacity Building Webinar on Retirement Benefits: Module 2 - Defined Benefit Pension

Chitra Jayasimha and speakers like Kishore Singh and Jayesh D. Pandit will lead a webinar on Defined Benefit Pension focusing on government sector pensions, actuarial aspects, and calculations. Chitra, with vast experience in actuaries and benefit consulting, brings knowledge from various countries.

0 views • 22 slides

Understanding the Nagoya Protocol on Access and Benefit Sharing in the Pacific

The Nagoya Protocol aims to drive conservation and sustainable use of biological resources in the Pacific by ensuring fair access and benefit sharing. It outlines core components such as access, benefit sharing, compliance, and traditional knowledge. Stakeholders include providers, users, national f

0 views • 11 slides

Overview of Retirement of a Partner and its Effects

Understanding the process of retirement of a partner in a business entity is essential as it involves various adjustments and implications on the firm's financial structure. When a partner retires, it can lead to changes in profit-sharing ratios, adjustments in assets and liabilities, and the treatm

0 views • 15 slides

Understanding Composite Benefit Rates in Budget Planning

Composite Benefit Rates (CBR) aggregate individual benefit components and costs to simplify budgeting in organizations. CBR represents benefits as a percentage of payroll, charging a single rate based on employee groupings. This approach maintains the overall cost of benefits but can shift expenses

0 views • 13 slides

Understanding Periodic Safety Update Reports (PSURs) in Pharmacovigilance

Periodic Safety Update Reports (PSURs) are essential pharmacovigilance documents that evaluate the benefit-risk balance of medicinal products post-authorization. These reports are submitted by Market Authorization Holders (MAH) at specified intervals to ensure the ongoing safety and efficacy of medi

3 views • 5 slides

Understanding Grant Award Adjustments and Budget Modifications

Grant award adjustments involve modifications to federal awards, such as reallocating funds or changing project scope. Recipients must initiate a Grant Adjustment Notice (GAN) for budget modifications and follow specific guidelines to ensure timely processing and approval. Different criteria apply f

8 views • 6 slides

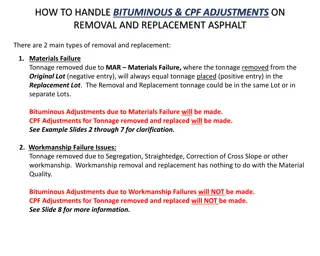

Handling Bituminous & CPF Adjustments on Removal and Replacement of Asphalt

Learn how to manage bituminous and CPF adjustments when removing and replacing asphalt due to materials failure or workmanship issues. Understand the process for adjustments within the same lot or different lots, including entering tonnage, dates, and certifications. Follow step-by-step instructions

0 views • 8 slides

Introduction to the new Student Support Framework

The new student support framework, introduced in September 2022, aims to provide inclusive support for various student groups by streamlining procedures and enhancing accessibility to support services. It covers areas such as extenuating circumstances policy, reasonable adjustments, support to study

0 views • 36 slides

Public Perceptions of Housing Benefit Tax in Papua New Guinea

The research conducted at the University of Papua New Guinea in 2018 focused on the public perceptions surrounding housing benefit tax in the country. The study highlighted changes in taxable values of employer-provided housing, justifying tax adjustments, tax measures introduced in budget documents

0 views • 16 slides

Empowering Employers with Discovery Primary Care Solutions

A comprehensive overview of Discovery Primary Care, a unique healthcare product designed to provide employers with affordable quality private healthcare for their employees and families. The product offers two benefit options, Primary Care Activate and Primary Care Advanced, along with the option to

0 views • 7 slides

Changes in Housing Benefits and Support Programs for 2016

Reductions in Housing Benefit backdating period, Benefit Cap, and changes to temporary absence rules were implemented in 2016. Working age claimants faced limitations in benefits, and Universal Credit started replacing Housing Benefit. These changes impacted claimants' eligibility and payment levels

0 views • 19 slides

Travel Pay Guidance and Work Schedule Adjustments for Payroll Services

Explore scenarios related to travel pay, holidays, dual employment, and work schedule adjustments in the context of payroll services. Understand how to calculate hours worked, handle holidays, manage overtime, and make scheduling adjustments to avoid overtime. Access additional resources for trainin

0 views • 15 slides

Overview of Indian Oil Corporation Limited Employee Benefits Scheme

Indian Oil Corporation Limited provides various employee benefits schemes including the Superannuation Benefit Fund Scheme and Post-Retirement Medical Benefit Facility. The scheme, introduced in 1987, offers benefits to both officers and non-officers. Over the years, it has evolved from a Defined Be

0 views • 18 slides

Protecting Your Business with Key Person Cover from Fidelity Life

Key Person Cover from Fidelity Life provides financial protection for businesses by helping replace key staff members unable to work due to sickness or injury. Established businesses and newly self-employed individuals can benefit from this cover, with options for benefit amounts, waiting periods, a

0 views • 12 slides

Effective Communication and Decision Making in Clinical Trials

Explore the challenges faced by Data Monitoring Committees (DMCs) in communicating emerging benefit-risk assessments to sponsors without revealing study results. Learn about the importance of conveying key trial data to sponsors for informed decision-making while maintaining study blinding. Discover

0 views • 18 slides

Benefit Only/Shell Agency Benefit Coordinator Overview

This overview provides insights into the Benefit Only/Shell Agency benefit coordination process, covering topics such as new employee notifications, benefit enrollment processes, open enrollment, troubleshooting, and more. It also highlights the project timeline and scope for implementing Workday HC

0 views • 24 slides

Understanding Marginal Analysis in Economic Decision-Making

Marginal analysis involves comparing Marginal Benefit with Marginal Cost to determine the optimal quantity for an activity. If Marginal Benefit is greater than Marginal Cost, there is a Net Marginal Benefit; if it's less, there's a Net Marginal Cost. The principle helps weigh costs and benefits befo

0 views • 14 slides

Overview of Benefit-Cost Analysis in Policy Decision Making

This chapter delves into benefit-cost analysis as an essential tool in policy evaluation. It outlines the steps involved in conducting a benefit-cost analysis, emphasizes the significance of defining and quantifying policy problems, and highlights the importance of identifying the seriousness of soc

0 views • 40 slides

Update on International Treaty on Plant Genetic Resources for Food and Agriculture

The International Treaty on Plant Genetic Resources for Food and Agriculture aims to establish a system compatible with CBD, conserve and sustainably use genetic resources, and ensure fair benefit-sharing. However, there are challenges with the current Standard Material Transfer Agreement (SMTA) and

0 views • 15 slides

Protection and Support with REAL.Life.Cover

REAL.Life.Cover provides financial support for your loved ones in the event of your death or terminal illness. With two types of cover options, it offers flexibility and long-term affordability. Main benefits include terminal illness benefit, financial planning assistance, and parents' grieving bene

0 views • 13 slides

Comprehensive Post-Retirement Information and Benefit Details

Detailed information on post-retirement benefits and regulations for SCRS and PORS members, including benefit adjustments, incidental death benefits, returning to covered employment rules, and service retirement earnings limitations. Learn about eligibility criteria, benefit adjustments, service cre

0 views • 7 slides

Reliance Nippon Life Fixed Savings Plan - Key Benefits and Coverage Details

The Reliance Nippon Life Fixed Savings Plan is a non-linked, non-participating individual savings life insurance plan offering survival benefits, maturity benefits, and death benefits. Policyholders can benefit from fixed regular additions, guaranteed sum assured on maturity, and protection for thei

0 views • 14 slides

Understanding Budget Adjustments vs. Budget Amendments in AEL WIOA Summer Institute

Explore the differences between budget adjustments and budget amendments in the context of AEL WIOA Summer Institute's financial processes. Budget adjustments allow for moving a sum less than 20% without an amendment, while budget amendments involve larger changes and require specific approvals. Lea

0 views • 24 slides

Update on Modeling and Coordination Discussions

Weekly coordination calls with Ramboll and discussions with EPA OAQPS leads focused on Regional Haze and modeling adjustments. Final draft of procedures document with visibility projections and glide slope adjustments. Upcoming RTOWG meetings covering methodology, projections, and modeling evaluatio

0 views • 5 slides

2024: A Time of Change - The Future of Housing Benefit in Windsor & Maidenhead

In 2024, significant changes are expected in the housing benefit landscape, with an emphasis on welfare reform, Universal Credit expansion, and large-scale benefit changes. The Department for Work and Pensions (DWP) is implementing initiatives to support low-income families and individuals, offering

0 views • 20 slides

Adjustments to SmartConnect and Popdock Pricing in AUD, NZD, and CAD Currencies Effective January 4, 2021

Starting January 4, 2021, there will be adjustments to SmartConnect and Popdock pricing in AUD, NZD, and CAD currencies. The pricing changes include SmartConnect monthly subscription plans and 8-year site license models, with different tiers offering various features and support options. Certain ser

0 views • 10 slides

Understanding Federal Partnership Audits and Their Impact on State Revenue Departments

The presentation discusses the impact of federal partnership audits on state revenue departments, emphasizing how states benefit from federal audit efforts. It covers topics such as reporting federal audit adjustments, the background of federal audit adjustments, and the final determination process.

0 views • 51 slides

Understanding District Characteristic Adjustments in Education Funding

Various types of formula adjustments are used to address the diverse costs of education among schools and districts, including district size adjustments, necessarily small schools adjustments, density adjustments, regional cost adjustments, and transportation funding approaches. These adjustments ai

0 views • 11 slides

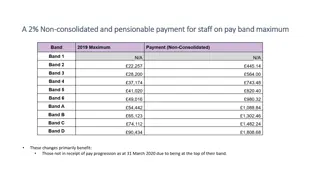

Pay Band Adjustments and Scales Update

Changes in pay band structures and scales have been implemented to benefit staff members at the top of their pay bands, those ineligible for pay progression, new starters, and recently promoted employees. Details include adjustments for staff on pay band maximums, removal of minimum points in pay ba

0 views • 4 slides

How Automatic Adjustments in Microwave Ovens Simplify Cooking

Discover how automatic adjustments in microwave ovens make cooking easier by optimizing time, power, and precision for perfectly cooked meals every time. \/\/lahorecentre.hashnode.dev\/how-automatic-adjustments-in-microwave-ovens-simplify-cooking

7 views • 1 slides

Evaluation of Clinical Prediction Models Using Net Benefit versus ROC Curves

Performance evaluation of clinical prediction models involves comparing predicted outcomes with ground truth data using ROC curves. The area under the ROC curve (AUC) is commonly used to assess model performance. A novel method for comparing different models is proposed. Decision-making on treatment

0 views • 22 slides