Understanding Financial Markets in India

Financial markets play a crucial role in connecting lenders and borrowers, providing avenues for investment and capital generation. In India, the financial system includes money markets and capital markets, offering diverse financial products and opportunities for investors. Money markets deal with

2 views • 106 slides

Insights into the Asset Management Industry and Registered Fund Landscape

Explore the world of asset management and registered funds through an in-depth look at the industry's key players, legal and compliance aspects, career opportunities, and economic contributions. Learn about the mission of the Investment Company Institute (ICI), the vital role of asset managers, and

2 views • 13 slides

Strategic Infrastructure Asset Management Plan (SIAMP) Overview

Strategic Infrastructure Asset Management Plan (SIAMP) Module 6 focuses on portfolio management principles for effective infrastructure asset management. Portfolio managers are guided on planning, managing work portfolios, and collaborating with other delivery management modules. The SIAMP outlines

6 views • 32 slides

Understanding Markets and Economic Structures

Markets play a crucial role in bringing buyers and sellers together for transactions. This article discusses the concept of markets, different types of markets in a capitalist economy, focusing on perfect competition. It outlines the features and conditions of perfect competition, emphasizing the im

2 views • 42 slides

Distribution of Income and Expense Document Overview

This document provides detailed information on the Distribution of Income and Expense (DI) process within Kuali Capital Asset Management (CAM). It explains the purpose of DI documents, their use in capitalizing Work-In-Progress (WIP) assets, and the various scenarios in which DI documents are utiliz

2 views • 29 slides

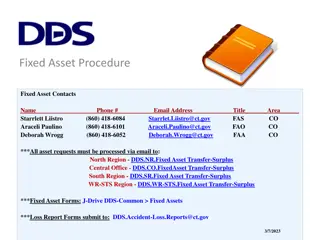

Fixed Asset Management Procedures and Contacts Overview

Comprehensive overview of fixed asset management procedures, contact information, asset categories, receiving new assets guidelines, inventory audits, responsibilities, and related forms. Includes details on controllable and capital equipment, asset definitions, categories, and the roles involved in

1 views • 15 slides

Understanding Asset Recovery: Importance, Processes, Tools, and Global Impact

Asset recovery involves the retrieval of assets wrongfully taken through theft, fraud, or criminal acts. This process is crucial in combating financial crimes, such as money laundering and corruption. The content discusses the significance of asset recovery, various processes involved, tools used, a

0 views • 34 slides

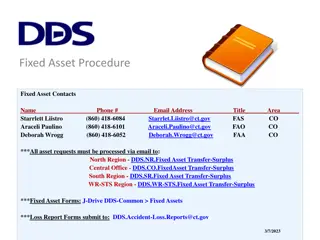

Fixed Asset Management Procedures and Contacts Overview

This document provides an overview of fixed asset management procedures, contacts, categories, and responsibilities within the State of Connecticut. It covers the definition of fixed assets, capital vs. controllable equipment, receiving new assets, inventory audits, asset management responsibilities

0 views • 15 slides

Understanding Asset Shares and Estate Management in Insurance: Insights from the 35th India Fellowship Webinar

Delve into the complexities of asset shares and estate management in the insurance industry through the lens of the insightful 35th India Fellowship Webinar. Learn about historical paradigms, regulatory shifts, and available alternatives for insurers in managing asset shares and estate growth. Explo

3 views • 30 slides

Legal Infrastructure for Asset Finance in Civil Law Jurisdictions

The Civil Code outlines obligations and guarantees in asset finance, with specific qualifications like lawful causes of preference and security trusts. Privileges and hypotecas play key roles in the legal system. Title transfer by way of security fosters integrated asset finance systems. The aviatio

0 views • 106 slides

Understanding the Importance of Money Markets and Bond Markets

Money markets play a crucial role in the financial system by providing short-term, low-risk, and liquid investment options. Participants include institutional investors and dealers who engage in large transactions. Money market securities have specific characteristics, such as large denominations, l

0 views • 23 slides

Global Framework for Efficient Asset Recovery Guidelines

The Global Framework for Asset Recovery, guided by the UNCAC, emphasizes returning stolen assets to combat corruption effectively. The UNCAC obligates signatory countries to return funds under specific conditions, promoting transparency and accountability in the asset return process. Stakeholders ad

3 views • 9 slides

Understanding International Financial Markets: Key Insights and Considerations

International Financial Markets play a crucial role for Multinational Corporations (MNCs) in accessing foreign exchange, money, credit, bond, and stock markets. MNCs leverage the international money market for various purposes like borrowing short-term funds in foreign currencies and investing for h

0 views • 25 slides

Factors Affecting the Amount of Depreciation in Asset Valuation

Depreciation in asset valuation depends on the cost, estimated useful life, and probable salvage value. The cost of an asset includes various expenses incurred to put it in working condition. Estimated net residual value is the expected sale value of the asset at the end of its useful life after ded

2 views • 5 slides

University Asset Management Procedures and Responsibilities

This presentation outlines the processes and responsibilities related to maintaining and controlling the university's capital assets. It covers tasks such as updating asset records, conducting audits, and serving as a liaison between units and the Fixed Assets Accountant. The slides detail the Fixed

2 views • 67 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

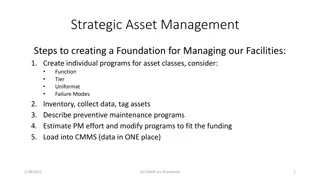

Strategic Asset Management for Facilities Optimization

Establish a solid foundation for managing facilities by creating individual asset programs, conducting inventory and data collection, implementing preventive maintenance strategies, estimating effort, and loading data into a centralized CMMS. Asset management is crucial for project managers as it im

1 views • 7 slides

The Importance of Asset Stock Accumulation for Sustainable Competitive Advantage

Strategy literature often overlooks the crucial role of building and accumulating non-tradeable asset stocks for achieving and safeguarding competitive advantage. The concept of asset stock accumulation provides a complementary framework to evaluate the sustainability of a firm's competitive edge, e

1 views • 7 slides

Livestock Economics and Marketing: Understanding Markets and Classification

Livestock markets are essential for the buying and selling of livestock and related products. Markets can be classified based on various factors such as location, nature of commodities, time span, and more. Understanding the essentials of markets, livestock market components, and classification help

0 views • 18 slides

Understanding Digital Asset Management (DAM) on AEM Platform

Digital Asset Management (DAM) is an essential application on the AEM Platform that enables users to effectively organize and manage various digital assets like images, videos, documents, and audio files. It offers features such as metadata support, renditions, asset finder, and administration UI. L

0 views • 20 slides

Asset Recovery Practices in England and Wales: Criminal vs. Civil Proceedings

Asset recovery in England and Wales involves a combination of criminal and civil proceedings to secure justice and return funds to victims of crime. The CPS's Proceeds of Crime Division plays a crucial role in obtaining Restraint Orders and Confiscation Orders. Civil recovery, focusing on illicit fi

0 views • 11 slides

Understanding Foreign Exchange Markets and Risks

Financial managers need to grasp the operations of foreign exchange markets for global business success. These markets allow participants to trade currencies, raise capital, transfer risk, and speculate on currency values. Transactions expose businesses to foreign exchange risk, where fluctuations i

0 views • 40 slides

Understanding PeopleSoft Asset Management at Georgia University System Summit

Explore key questions surrounding PeopleSoft Asset Management at Georgia University System Summit, including processes for adding and capitalizing assets, handling open transactions, and differentiating between open and pending transactions. Gain insights into updating tables, managing asset details

0 views • 33 slides

Understanding Asset Allocation and Portfolio Management

Explore the process of asset allocation, which involves distributing wealth among different countries and asset classes for investment purposes. Learn about asset classes, the components of structured portfolio management processes, and the individual investor life cycle stages. Dive into strategies

0 views • 46 slides

Advancements in Electricity Markets and Regulation: Focus on Integration of Distributed Energy Resources

This article highlights the ongoing activities and discussions within the C5 Committee on Electricity Markets and Regulation, emphasizing the impacts of market approaches, regulatory roles, and emerging technologies in the electric power sector. Key areas of attention include market structures, regu

0 views • 14 slides

Implementing Voluntary Residual Capacity Markets for Clean Energy Policies

Explore the concept of voluntary residual capacity markets to support the implementation of state clean energy policies. Learn how these markets allow load-serving entities to meet capacity obligations outside traditional markets, respecting state goals and methods. Discover the workings and design

0 views • 9 slides

Understanding the Significance of Financial Markets and Institutions

Studying financial markets and institutions is crucial as it facilitates the efficient transfer of funds, promotes economic growth, impacts personal wealth, influences business decisions, and plays a significant role in determining interest rates. Debt markets, including bond markets, enable borrowi

0 views • 15 slides

Understanding Money Markets and Their Role in the Economy

Money markets are financial markets where short-term, low-risk securities are traded. Unlike banks, they offer distinct advantages such as liquidity, active secondary markets, and cost efficiency in providing short-term funds due to lower regulations. Despite the presence of banks, money markets pla

0 views • 33 slides

Leveraging Arrow-Debreu Exchange Mechanisms for On-Chain Asset Exchanges

Utilizing Arrow-Debreu exchange markets, this study explores scalable solutions for on-chain asset exchanges, focusing on replicability, market models, and parallelizing transaction processing. Key considerations include agent endowments, utility functions, and maximizing trade efficiency within mar

0 views • 19 slides

Understanding Dynamics of Perfect Markets in Microeconomics

Explore the dynamics of perfect markets in microeconomics through this presentation by Mrs. L. Booi. Learn about the short and long run production, cost and revenue curves, and the concepts of perfect markets and imperfect markets. Gain insights into how things behave and affect other markets in the

0 views • 23 slides

Understanding Power Markets in Nordic Countries: Insights into Day-ahead and Intraday Markets

Delve into the intricate workings of power markets in Nordic countries, exploring key terms, market pricing strategies, vRES impact, and the significance of day-ahead and intraday markets. Discover how the merit order and bidding zones influence pricing and system operations, ensuring efficient elec

0 views • 11 slides

Evolution of Markets and Peddlers in New York City

Early markets in New York City date back to the 17th century, with the establishment of public markets and the emergence of peddlers playing a significant role in the city's history. The evolution of markets, corruption issues, the importance of peddlers to immigrants, and the challenges they faced,

0 views • 17 slides

Understanding Financial Markets: Mechanisms and Efficiency

Financial markets play a crucial role in connecting borrowers and lenders, facilitating the flow of funds for optimal allocation. Different financial phases involve borrowing, saving, and investing. Transfers of funds occur directly or through intermediaries. Efficiency in financial markets ensures

0 views • 15 slides

Understanding Stable Matching Markets in Unbalanced Random Matching Scenarios

In the realm of two-sided matching markets where individuals possess private preferences, stable matchings are pivotal equilibrium outcomes. This study delves into characterizing stable matchings, offering insights into typical outcomes in centralized markets like medical residency matches and decen

0 views • 49 slides

Understanding International Finance: Scope, Importance, and Challenges

International finance explores interactions between countries, including currency exchange rates, foreign direct investment, and risk management. The scope includes foreign exchange markets, MNC financial systems, and international accounting. It raises questions on liberalizing financial markets, I

0 views • 52 slides

Facility Asset Management and Building Life Cycle: A Comprehensive Guide

Explore the framework of Facility Asset Management and Building Life Cycle, focusing on proactive asset management strategies, total cost of ownership, asset lifecycle management, and asset management system components. Understand the importance of defining assets, setting objectives, creating plans

0 views • 23 slides

Update and Review of FY23 Physical Inventory Process

This production by Stan Alderson provides essential information on updating the physical inventory process for capital assets. It includes details on new or updated forms, such as the Capital Asset Manual Addition Request and Capital Asset Reinstatement Request. The importance of conducting a physic

0 views • 14 slides

Transportation Asset Management Strategic Action Plan

Transportation Asset Management (TAM) is crucial for state transportation departments to operate, maintain, and improve physical assets efficiently. The TAM Strategic Action Plan aims to enhance TAM practices by emphasizing sustained asset condition, accountability, efficiency, and effectiveness. Th

0 views • 4 slides

Understanding Asset Management and its Importance in Community Development

Asset management is crucial for organizations to track what they own, determine their value, monitor their condition, and plan for their maintenance or replacement. This process allows for informed decision-making, ultimately aiming for sustainable service delivery. Practicing asset management invol

0 views • 15 slides

Effective Asset Allocation Strategies for Investment Success

Investment professionals emphasize the critical importance of the asset allocation decision in shaping investor outcomes. Strategic Asset Allocation (SAA) focuses on long-term goals, while Tactical Asset Allocation (TAA) addresses short-term objectives. Proper navigation through economic cycles invo

0 views • 18 slides