Principles of Accounting Accounting

Discover the language of business with accounting principles, functions, and history. Learn the importance of accounting in various economic activities. Explore the role of accounting in tracking finances and making informed decisions for business sustainability.

2 views • 140 slides

Lecture 7-Exercises and Concept for Analysis (Conceptual Frmework)

Explore qualitative characteristics in accounting with exercises on verifiability, comparability, understandability, and timeliness. Recognize accounting assumptions used by Marks and Spencer, such as accrual basis and full disclosure.

0 views • 9 slides

Promoting Accounting

Leaving Certificate Accounting is a vital business studies option that equips students with financial analysis skills. Covering topics like Financial Statements, Budgeting, and Management Accounting, this course offers a foundation for a successful career in accounting. With a breakdown of grades an

7 views • 9 slides

Understanding Income and Expenditure Account in Accounting

Income and Expenditure Account, similar to the Profit and Loss Account, records revenue items on the credit side and expenses on the debit side. It follows the accrual concept and reflects only the current period's incomes and expenses. Surplus or deficit is shown based on the excess of income over

0 views • 4 slides

Overview of Behavioral Accounting in Business Decision Making

Behavioral accounting is a system aimed at providing financial information for decision-making in business operations. It focuses on the behavior and motivations of individuals involved in accounting systems, catering to both internal and external users for performance evaluation and investment deci

8 views • 104 slides

Understanding Personal Investment Accounting Standards (AS-13)

Introduction to Accounting Standard -13 (AS-13) for personal investment accounting, covering types of investments, factors to consider while holding investments, formats for investment accounting, handling face value and interest columns, as well as cum-interest and ex-interest calculations.

0 views • 11 slides

OVERVIEW OF BASICS OF ACCOUNTING

Explore the evolution of accounting practices from ancient times to modern standards, including the role of Luca Pacioli, industrial revolution impacts, and the establishment of accounting standards by ICAI in India. Discover the basic principles of Generally Accepted Accounting Principles (GAAP) an

1 views • 29 slides

Understanding Cost and Management Accounting

Accounting encompasses recording, classifying, and summarizing business transactions, while financial accounting focuses on interpreting financial data for determining profits. Cost accounting involves tracking expenses for product cost determination, and management accounting provides data for deci

7 views • 16 slides

Navigating the Accounting Talent Market with a Recruitment Agency

Navigating the accounting talent market can be challenging, but partnering with an accounting recruitment agency simplifies the process. These agencies offer access to a broad talent pool, expert screening, and industry insights, ensuring you find the best candidates. Their specialized services save

0 views • 8 slides

StartupFino expert Accounting Services in India

Discover streamlined financial management with StartupFino expert Accounting Services in India. From Online Accounting to Bookkeeping, we offer tailored solutions for your needs. Trust us for Best Online Accounting Services and Bookkeeping Services in India, ensuring hassle-free financial management

1 views • 1 slides

Understanding California Community Colleges Attendance Accounting Basics

Explore the importance of discussing attendance accounting basics for California Community Colleges, especially in transitioning to a new academic calendar structure. Discover how scheduling guidelines are influenced by attendance accounting principles and regulations provided by the state. Uncover

7 views • 46 slides

Understanding Basic Accounting Concepts and Budget Management at USF

This content provides valuable insights into basic accounting concepts such as budgeting, journal entries, accrual accounting, and budget management processes at USF. It covers essential topics like budget checking initiation, expense incurring methods, and budget impact on different financial trans

2 views • 45 slides

Introduction to Accounting Information and Economic Events in Business Firms

This e-learning programme covers the use of accounting information in profit and not-for-profit trading organizations. It explains the meaning of business, types of business firms, economic events, and the definition of accounting. The content also discusses the American Accounting Association's def

6 views • 14 slides

Understanding Cost Accounting Essentials

This overview delves into topics such as financial accounting, classification of accounts, cost ascertainment, and management accounting. It covers the meaning of cost, methods and techniques of costing, advantages and limitations of cost accounting systems, and essentials for a robust cost accounti

4 views • 27 slides

Understanding Book-keeping and Accounting in Business

Book-keeping is the systematic recording of business transactions while accounting involves analysis, interpretation, and communication of financial information. Book-keeping is clerical and routine, done by bookkeepers, while accounting is analytical and requires specialized knowledge, handled by a

4 views • 7 slides

Understanding Debit and Credit in Accounting

Debit and credit are fundamental concepts in accounting that help record business transactions accurately. Debits increase assets or expenses and decrease liabilities or equity, while credits do the opposite. The rules of debit and credit ensure that accounting entries are balanced, with each transa

1 views • 8 slides

Accounting Entries for Hire Purchase Transactions

Different hire purchase transactions are recorded in the books of both the hire vendor/seller and hire purchaser through various accounting methods like the Asset Accrual Method. This method involves gradual capitalization and recording installment payments towards the cash price of the asset. Depre

0 views • 11 slides

Financial Accounting IFRS Learning Objectives

This educational material covers Chapter 3 of the Financial Accounting IFRS 3rd Edition by Weygandt, Kimmel, and Kieso. It delves into topics such as adjusting the accounts, time period assumption, accrual basis of accounting, fiscal and calendar years, accrual versus cash-basis accounting, and more

0 views • 20 slides

Understanding Deferred Taxation in Accounting

Deferred taxation in accounting arises due to differences in financial statement preparation and tax regulations, leading to provisions for future tax obligations. It involves estimating tax liabilities based on future tax legislation and accounting treatments. Provisions, such as for doubtful debts

0 views • 24 slides

Understanding Management Accounting and Cost Accounting

Management accounting involves planning, organizing, and controlling human efforts to achieve organizational goals, while cost accounting focuses on determining the cost of products and services. The objective of cost accounting includes cost analysis, reduction, and decision-making support.

0 views • 33 slides

Accounting Basis Diagnostic Tool for NPOs and Funders

This diagnostic tool focuses on cash, modified cash, and accrual basis accounting for Non-Profit Organizations (NPOs) and funders. It explains the impact of accounting basis decisions and how to utilize the tool effectively. Designed for NPOs and funders, it helps in understanding, negotiating, and

0 views • 39 slides

Tips and Tricks for Doing a Literature Review Successfully

Explore valuable insights and strategies shared by Khaled Hussainey, a Professor of Accounting & Financial Management, University of Portsmouth, UK. Gain knowledge on structuring literature reviews, identifying research gaps, developing hypotheses, and conducting systematic literature reviews. Disco

0 views • 66 slides

Understanding Financial Accounting Principles in IFRS

Explore key concepts in financial accounting such as time period assumption, accrual basis, adjusting entries, and types of accounting methods. Learn about fiscal vs. calendar years and accrual versus cash-basis accounting in the context of International Financial Reporting Standards (IFRS).

1 views • 20 slides

Understanding Cost Accounting: Techniques and Processes

Cost accounting is a specialized branch of accounting that involves the accumulation, assignment, and control of costs. It encompasses techniques like ascertainment of costs, estimation of costs, and cost control to aid in decision-making. Cost accounting plays a crucial role in budgeting, standard

2 views • 11 slides

Understanding Intermediate University Accounting Basics

Explore the fundamental concepts of accounting in an intermediate university course, including the general ledger, journal entries, double-entry system, GL accounts, T-accounts, and accrual accounting. Gain insights into creating financial statements and recording transactions accurately.

0 views • 40 slides

Introduction to Computer-Based Accounting Systems in Business

Information systems play a crucial role in modern business operations, particularly in accounting. This course covers topics such as setting up accounts, using software like Sage, and analyzing financial data. Computer-based accounting offers advantages such as accuracy and speed, but also comes wit

1 views • 31 slides

Structuration Analysis of Central Government Accounting Practices and Reforms in Emerging Economies: A Study from Nepal

Delve into the nuances of central government accounting practices and reforms in emerging economies, focusing on Nepal. The study explores why key stakeholders resist externally-driven changes, investigates the unintended consequences of reforms, and highlights the role of organizational actors in s

0 views • 21 slides

Introduction to Industrial Costing: Understanding Cost Types and Accounting Systems

Explore the fundamentals of industrial costing, including different cost types and accounting systems such as actual cost accounting, normal cost accounting, and standard cost accounting. Learn about cost data control, tasks of cost accounting, and the integration of cost type accounting in cost and

1 views • 24 slides

Year-End Journal Entry Accrual Process Overview

Gain insights into the year-end journal entry accrual process in Workday. Understand the submission and approval processes, find journals, review checklists, and learn how to create reversing accrual entries for the upcoming fiscal year.

0 views • 13 slides

Evolution of Accounting Practices in Social Housing Properties

Historic accounting practices for housing properties in the social housing sector underwent significant changes prior to and after the accounting period ending 1997/1998. Initially, all property assets were capitalized including major repair expenditure. However, a shift occurred leading to the remo

0 views • 44 slides

Airline Industry Work Regulations and Benefits Overview

This data provides insights into various aspects of the airline industry, including flight attendant pay increments, duty day restrictions, days off, duty period credits, vacation accrual, and sick leave accrual. Details cover different carriers such as Southwest, Alaska, US Airways, Virgin, America

0 views • 9 slides

Financial Accounting Concepts and Standards Explained

This content provides detailed explanations of key financial accounting concepts such as accrual accounting, matching concept, FASB standards, and revenue recognition guide. It also presents questions related to income per crocodile, revenue timing rules, and methods of revenue recognition based on

0 views • 11 slides

Tracing Intellectual Origins in Accounting: A Journey of Thought Evolution

Tracing the intellectual origins in accounting reveals the roots and influences behind current theories and practices. This process involves connecting the dots across decades to understand the intellectual baggage inherited from the past. Different streams of thought in US accounting literature, st

0 views • 41 slides

Accounting Standards for Non-Corporate Entities Overview

Introduction to accounting standards for non-corporate entities such as partnerships, LLPs, trusts, and nonprofits. Explanation of the applicability of accounting standards based on business size and the classification of Level I, II, III, and IV entities by ICAI. Details of the ICAI announcement da

0 views • 14 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

European Developments in Public Sector Accounting: Lessons Learned

This presentation delves into the sovereign debt crisis in Europe, highlighting its causes and lessons learned. It discusses the role of the public sector in relation to the private sector's performance, the impact of political systems on public sector accounting reforms, and the need for a harmoniz

0 views • 18 slides

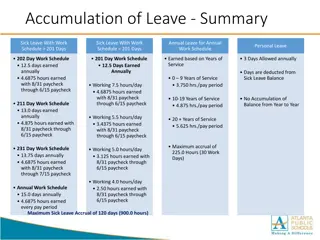

Leave Accumulation Summary for Employees

Detailed information on the accumulation of various types of leave (sick, annual, personal) based on different work schedules and years of service. The summary covers accrual rates, maximum accrual limits, days earned annually, and deductions from leave balances.

0 views • 6 slides

System of Environmental-Economic Accounting and Experimental Ecosystem Accounting Overview

The System of Environmental-Economic Accounting (SEEA) and Experimental Ecosystem Accounting aim to integrate biophysical data, monitor ecosystem changes, and link them to economic activities. They provide a framework for accounting for ecosystem assets and services, playing a crucial role in the po

0 views • 34 slides

Understanding Accruals and Prepayments in Accounting

Accruals and prepayments are essential concepts in accounting that ensure accurate financial reporting. Accrual basis of accounting requires recognizing income and expenses when earned or incurred, regardless of cash flow timing. Accrued expenditure represents unpaid expenses at year-end, impacting

0 views • 13 slides

Importance of Cost Accounting in Business Management

Cost accounting plays a crucial role in modern business environments where cost effectiveness and quality consciousness are vital for success. This branch of accounting helps in planning, controlling, and determining the costs of products or services, providing essential data for efficient managemen

0 views • 6 slides