Understanding Fiscal Policy to Combat Recessions

Explore the role of fiscal policy in fighting recessions through stimulating aggregate demand, using government spending and tax cuts. Learn about the Keynesian multiplier effect, MPC, and different policy responses to economic fluctuations. Discover how government interventions can help stabilize the economy amid recessionary pressures.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

BUSINESS 115 Economics, Markets and Law Week 10: Economic Fluctuations & Stabilization Policy Workshop Part II: Using Fiscal Policy to Fight Recession

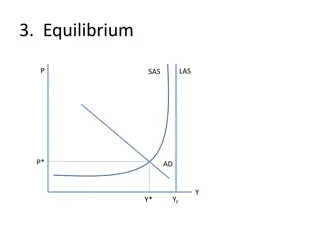

Todays Plan Learning Activity A: Using Fiscal Policy to Fight Recession 1. Stimulate aggregate demand via fiscal policy 2. The MPC and Keynesian Multiplier 3. Government Spending and Tax Cut 4. Expansionary Fiscal Policy & Inflation Workshop Quiz 2

5. Policy Responses to Recession Decreases in both AD and AS (Covid-19) An adverse shift in the short-run aggregate- supply curve Price Level Long-run aggregate supply AS2 Short-run aggregate supply, AS1 Stimulate demand via fiscal and monetary policy A P1 And an adverse shift in demand Aggregate demand 0 Y1 Quantity of Output Leads to a large fall in output 3

A.1 Stimulate Aggregate Demand via Fiscal Policy Directly via government purchases Aggregate Demand (Y) = C + I + G + NX Indirectly via subsidies or personal income tax cut, COVID-19 Income Relief Indirectly via corporate income tax cut, investment tax credit 4

A.2 MPC and the Keynesian Multiplier Y = C + I + G + NX + ? + $100 Million Suppose the NZ government spends $100 million on infrastructure upgrading. How much does it affect aggregate demand (Y)? Government spending becomes the revenue of the construction sector. Then, construction firms pay their workers, managers, shareholders in the form of wage, salary, bonus, dividends, etc. What do their workers, managers, shareholders do with their incomes? 5

A.2 MPC and the Keynesian Multiplier Y = C + I + G + NX + ? + $100 Million Suppose that they spend of their income and save the rest of . The marginal propensity to consume (MPC) =0.75, while the marginal propensity to save (MPS) = 1 MPC = 0.25. How much does aggregate demand (Y) change? Direct effect $100 + $100*0.75 G Indirect effect Is this the end of the story? How does their spending affect the income of other people? C 6

A.2 MPC and the Keynesian Multiplier The process goes on and on $100 + $100*0.75 + $100*0.75*0.75 + $100*0.75*0.75*0.75 + = ? This is called a geometric series with each preceding number getting multiplied by 0.75 to generate the succeeding number $??? (? ?.??)=$??? ?.??= $??? The sum of this series is = The $100m government spending raises aggregate demand by $400m! 4 times of the initial spending ? ? ? ??%= ??%= ? The Keynesian Multiplier: MPC MPS 7

A.2 MPC and the Keynesian Multiplier 2. but the Keynesian multiplier effect amplifies the shift in aggregate demand. Price Level $100 million AD2 AD3 1. An $100 million increase in G initially raises aggregate demand by $100 million Aggregate demand, AD1 0 Aggregate Output 8

A.2 MPC and the Keynesian Multiplier John Maynard Keynes The Keynesian Multiplier: ? ? ? ???= ??? How much would the Keynesian Multiplier be if MPC => 1 or MPS => 0 ? How much would the Keynesian Multiplier be if MPC => 0 or MPS => 1 ? Do people have the same MPC in the real world? Who tend to have a higher MPC? Who tend to have a lower MPC? 9

A.3 Government Spending versus Tax Cut Directly via government purchases ($100m/MPS) Y = C + I + G + NX Richer people typically tend to save more and have a lower MPC. Households with High MPC Households with Low MPC A tax cut aimed primarily at the wealthier does not have a pronounced stimulatory effect if most of tax cut is saved rather than spent. The rise in aggregate demand is smaller than in the case of direct government spending. Indirectly via tax cut ($100m) Source: Election 2020 - Spending v tax cuts - the questions that really need answering by Ananish Chaudhuri 10

A.4 Expansionary Fiscal Policy and Inflation Suppose that the COVID-related economic uncertainty has substantially reduced the SRAS in NZ. The SRAS curve will also stay put for the foreseeable future. (The Case Study in workshop 10 Part I) Price Level LRAS SRAS1 P1 If the Treasury raises the government spending, how does the aggregate demand (AD) curve move? How do the equilibrium output and the price level change? AD1 0 Quantity of Output Y1 Y* 11

A.4 Expansionary Fiscal Policy and Inflation Suppose that the COVID-related economic uncertainty has substantially reduced the SRAS in NZ. The SRAS curve will also stay put for the foreseeable future. (The Case Study in workshop 10 Part I) Price Level LRAS SRAS1 AD2 P2 P1 If the Treasury raises the government spending, the AD curve shifts rightwards, leading to the higher output and the higher price level. AD1 Higher output comes at the cost of inflation, similar as in the case of monetary policy.) 0 Quantity of Output Y1 Y* Y2 12

Question #1 Which of the following will have the most expansionary impact in the midst of a recession? An increase in government spending of $4 billion with a marginal propensity to consume of 0.5. If MPC is 0.5 then Consumption Multiplier = [1/(1-MPC)]=2; so $4 billion adds $8 billion worth of stimulus. Decrease in government spending cannot be right. If MPC is 0.1 or 0.2 then CM= [1/(1-0.1)] =1.11 or [1/(1- 0.8)]=1.25, both less than 2. 13

Question #2 If the marginal propensity to consume approaches the value of one (1), the value of the consumption multiplier approaches: Infinity. Consumption Multiplier = [1/(1-MPC)] IF MPC = 0 then CM = 1 (no multiplier effect) IF MPC = 1, then CM approaches infinity (1/0) 14

Question #3 Following the Covid-19 pandemic, the New Zealand government will be running large budget deficits. In the absence of any other intervention such as quantitative easing, which of the following will most likely happen as a result of this budget deficit. New Zealand's exports will fall and imports will rise. Budget deficits tend to reduce supply of loanable funds and therefore raise interest rates. This will attract new financial investments in NZ thereby driving up the demand for dollar and the exchange rate (value) of NZD. If and when the NZD appreciates exports become more expensive (and fall) while imports become cheaper (and rise). 15

Question #4 Suppose the marginal propensity to consume is 0.5. If government expenditure goes up by $50 billion primarily via deficit financing then you can expect with some certainty that: Aggregate demand in the economy will increase by $100 billion. If MPC = 0.5 then consumption multiplier = 2. So $50 billion increase in government spending should increase aggregate demand by $100 billion. 16

Question #5 In the midst of a recession, an increase in government spending has a direct impact on the economy while a cut in taxes will affect the economy in a more indirect way. This is because: An increase in government spending directly adds to the economic stimulus via the consumption multiplier while the stimulating effect of tax cuts depends on how much of those tax cuts households and individuals actually end up spending (as opposed to saving). 17

Question #6 If a government does decide to stimulate economic activity via a tax cut, then such a tax cut will have a greater expansionary impact if it is aimed primarily at those with a MPC of ___ as opposed to those with MPC of ___. This is because: 0.8; 0.2; this is because the higher is the MPC the higher is the value of the consumption multiplier; so the expansionary impact will be higher with a higher MPC than with a lower MPC. 18

Learning Outcomes Upon successful completion of this week s module, you should be able to: use the MPC (marginal propensity to consume) and the MPS (marginal propensity to save) to calculate the Keynesian multiplier, use the Keynesian multiplier to calculate the overall impacts of government spending on aggregate demand, explain the different impacts of tax cuts on households with different MPC, use the AD-AS model to show that both monetary and fiscal policy can raise output at the cost of inflation. 19

42. Minimum Wage and Unemployment (Price Floor and Elasticity) On 1 April 2021, adult minimum wage increased from $18.90 to $20.00 per hour, while starting-out and training minimum wage increased from $15.12 to $16.00 per hour. (a)Explain with diagrams when the minimum wage leads to unemployment.(b)When the minimum wage leads to unemployment, explain with diagrams that the elasticity of labor demand and supply matters for the unemployment size. 22

Supply of labour Minimum wage Demand for labour Minimum wage below equilibrium wage has no impact Drop in employment 23

Supply of labour Minimum wage Demand for labour Small drop in employment 24

43. Effectiveness of Monetary Policy (Elasticity) Governments often rely on monetary policy in order to combat recessions. Consider a closed economy with a highly inelastic demand for loanable funds. Why might monetary policy be of limited use in this case? Your answer should be accompanied by a suitable diagram of the market for loanable funds. 25

Monetary policy tries to lower interest rates to stimulate borrowing and investment Here a relatively small drop in the interest rate leads to a large increase in the magnitude of loanable funds demanded. r1 r2 Demand for funds (Investment) Q1 Q2 26

Interest rate Here even a relatively large drop in the interest rate leads to only a small increase in the magnitude of loanable funds demanded. Demand for funds 27

44. Currency Manipulation and Trade: Suppose the Reserve Bank of New Zealand intervenes in the currency market to keep the NZ dollar undervalued, i.e., holding the value of NZD to a level below the equilibrium. (a) Use the diagram of the currency market to explain under-valuation. (b) Undervaluation usually aims to help exporters. Explain how it works. (c) Why might this strategy of undervaluing the currency run into trouble if the Government was running large government budget deficits? Your answer should be accompanied by two suitable sketch diagrams one for the market for loanable funds and a second for the currency market. 28

e= Pounds/NZ $ Supply Undervaluation Demand for dollars exceeds supply; shortage of dollars 1/2 1/3 Demand Quantity of dollars 29

Discussion: What if the government runs budget deficit? Discussion: What if the government runs budget deficit? Real Interest Rate Suppose the government runs budget deficits. Supply (Saving=Y-C-G) Interest rate goes up. This makes NZ assets more attractive to foreigners. INFLOW of money into NZ. Demand for dollars increases. 5% Demand (Investment) Loanable Funds ($ billions) 0 $1,200 30

e= Pounds/NZ $ Supply As demand for dollars increases the magnitude of shortage of dollars goes up and it becomes more and more difficult to keep the dollar under-valued 1/2 1/3 Demand Quantity of dollars 31

45. Relation between Interest Rate and Exchange Rate (a) Use the National Income-Expenditure Identity to explain that trade imbalance reflects the gap between domestic saving and investment. Use the Balance of Payments to explain that net capital flows offset trade imbalances.(b) Suppose that the interest rate in NZ has been around 5% for quite a while, the same as the interest rate in London. Besides, NZ has a balanced trade account so far, NX=0. Today, the Newshub reported that, due to excellent economic prospects in UK, the interest rate in London rises to 8%. With other things held constant, how does this news affect the relative attractiveness of NZD-denominated assets, NZ NFI, the exchange rate of NZD, NZ exports and imports, and net exports? Use the diagrams of the loanable funds market and the currency market to explain the mechanism. 32

S = I + NFI If S > I, then NFI > 0 net outflow If S < 1, then NFI < 0, net inflow If interest rates higher overseas then net outflow; sell dollars to buy foreign currency. Supply of dollar increases; currency depreciates. 33

e= Pounds/NZ $ Supply With an increase in the supply of dollars, the dollar depreciates 1/2 1/3 Demand Quantity of dollars 34

46. Monetary Policy Instruments and Its Applications (a) What is the required reserve ratio (RRR)? What is the money multiplier? Provide a numerical example to explain how the fractional-reserve banking system operates via the money multiplier. Explain how a central bank can manipulate the money supply by (i) increasing or (ii) decreasing RRR. (b)What is the official cash rate (OCR)? Explain how RBNZ affects the market interest rate & the quantity of loanable funds by decreasing the OCR. (c)The RBNZ implements expansionary monetary policy to mitigate the Covid-19 recession. Explain its impacts on aggregate output and the price level, the exchange rate of the NZ dollar, NZ exports and imports. Use the AD-AS diagram and the diagram of the currency market to explain your findings. 35

3. Fractional Reserve Banking System Kiwibank now holds on to only $9 and lends out the remaining $81. And the process goes on $100+$90+$81+$72 This is called a geometric series with each preceding number getting multiplied by 0.9 to generate the succeeding number 100 $ $ 100 = = 1000 $ The sum of this series is = 9 . 0 1 ( ) 1 . 0 So the initial $100 deposit has essentially created $1000 worth of money claims! 36

3. Fractional Reserve Banking System Money multiplier The money multiplier is essentially the inverse of the reserve requirement. If the reserve requirement is 10% (0.1) then the money multiplier is 10. If the reserve requirement is 5% (0.05) then the money multiplier is 20. If the reserve requirement is 20% (0.2) then the money multiplier is 5. Simple rule: larger the reserve requirement the smaller the money multiplier! 100 $ $ 100 = = 1000 $ 9 . 0 1 ( ) 1 . 0 37

3. Fractional Reserve Banking System Money multiplier Simple rule: larger the reserve requirement the smaller the money multiplier! This in turn provides an easy way of controlling the money supply Want to increase money supply and lower interest rates? Reduce the reserve requirement and thereby increase the money multiplier. Want to decrease money supply and raise interest rates? Increase the reserve requirement and thereby decrease the money multiplier. 38

3. Fractional Reserve Banking System Money multiplier Reduce the reserve requirement and thereby increase the money multiplier. This creates more money floating around the economy; some of this gets deposited in banks thereby increasing the supply of funds and lowering the interest rate. Increase the reserve requirement and thereby decrease the money multiplier. This creates less money floating around the economy; some gets taken out of banks thereby reducing the supply of funds and raising interest rate. 39

B.2 Fractional Reserve Banking System Now, suppose that the reserve requirement ratio is 10% (0.1) For every $100 deposit, the ASB bank physically holds on to 10%*100=$10 and is now free to lend out the remaining 100 10=$90. Suppose the person who gets the $90 loan puts the money into his/her account at the Kiwibank. Kiwibank holds on to 10%*90 =$9 and lends out the remaining 90 9=$81. What if the process continues? How much money can be created in the banking system? 40

B.3 OCR and the Market Interest Rate Banks in NZ hold settlement accounts at the RBNZ, which are used to settle obligations with each other at the end of the day. Official cash rate (OCR) OCR: the interest rate that banks get for their deposits with RBNZ as well as the interest banks pay to borrow overnight cash from RBNZ. Market interest rates are generally held around the Reserve Bank's OCR level. Why? Source: What is the Official Cash Rate? By RBNZ 41

Expansionary monetary policy reduces Interest rates causing outflow of financial assets e= Pounds/NZ $ Supply Supply of dollars increases; Currency depreciates; Exports rise Imports Fall 1/2 1/3 Demand Quantity of dollars 42

47. Expansionary Fiscal Policy and Its Implications (a)Discuss at least one potential tool that the government can use as part of an expansionary fiscal policy. Explain how this tool would work by making explicit reference to the consumption multiplier (Keynesian multiplier). (b) Explain the impacts of expansionary fiscal policy on the loanable funds market and the currency market. (c) Businesses and exporters are typically opposed to the government running large budget deficits. Explain why that is the case separately for (i) businesses and (ii) for exporters. In each case your answer should be accompanied by a relevant sketch diagram of the primary market of interest.(d) Compare the impacts of expansionary monetary and fiscal policy on the interest rate, the exchange rate, exports and imports, net exports, aggregate output and the price level. 43

Discussion: What if the government runs budget deficit? Discussion: What if the government runs budget deficit? Real Interest Rate Suppose the government runs budget deficits. Supply (Saving=Y-C-G) Interest rate goes up. This makes NZ assets more attractive to foreigners. INFLOW of money into NZ. Demand for dollars increases. 5% Demand (Investment) Loanable Funds ($ billions) 0 $1,200 44

A.2 MPC and the Keynesian Multiplier Y = C + I + G + NX + ? + $100 Million Suppose that they spend of their income and save the rest of . The marginal propensity to consume (MPC) =0.75, while the marginal propensity to save (MPS) = 1 MPC = 0.25. How much does aggregate demand (Y) change? Direct effect $100 + $100*0.75 G Indirect effect Is this the end of the story? How does their spending affect the income of other people? C 45

A.2 MPC and the Keynesian Multiplier The process goes on and on $100 + $100*0.75 + $100*0.75*0.75 + $100*0.75*0.75*0.75 + = ? This is called a geometric series with each preceding number getting multiplied by 0.75 to generate the succeeding number $??? (? ?.??)=$??? ?.??= $??? The sum of this series is = The $100m government spending raises aggregate demand by $400m! 4 times of the initial spending ? ? ? ??%= ??%= ? The Keynesian Multiplier: MPC MPS 46

e= Pounds/NZ $ Supply As demand for dollars increases Currency appreciates; Exports fall; imports rise 1/2 Demand Quantity of dollars 47