Global Palm Oil Market Outlook and Trends by David Hightower

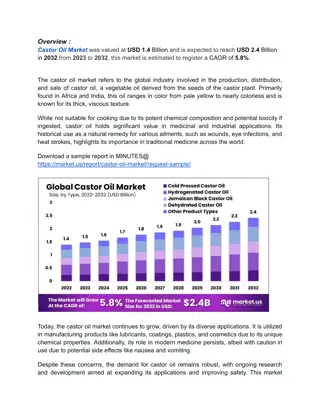

This presentation explores the global palm oil market outlook, discussing key factors like world reserve currency, commodity bull market, vegetable oil production, ending stocks, and the rise in soy crush demand, with visual representations of data trends over the years.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Global Palm Oil Market Outlook David Hightower

World Reserve Currency Safe Haven Growth Leader Global Citizen Tide

Cash: Weekly Vegetable Oils - 10 Years / Rotterdam 1600 Sun 1500 1400 Rapeseed 1300 Soybean 1200 Palm 1100 1000 900 800 700 600 500 400 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Jun-20 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20

World Vegetable Oil Ending Stocks vs. Stocks/Usage Ratio 30 16% 27 15% 24 14% Ending Stocks (million tonnes) 21 13% Stocks / Usage Ratio 18 12% 15 11% 12 10% 9 9% 6 8% 3 7% 0 6% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Ending Stocks Stocks / Usage

World Palm Oil Ending Stocks vs. Stocks/Usage Ratio 12 21% 11 20% 10 19% Ending Stocks (million tonnes) 9 18% 8 17% Stocks / Usage Ratio 7 16% 6 15% 5 14% 4 13% 3 12% 2 11% 1 10% 0 9% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Ending Stocks Stocks / Usage

Most Needs Will Come From Record Soy Crush China Vegetable - Production vs Usage Million Metric Tonnes 45 Production Usage 40 35 30 25 20 15 10 5 0 2004 2013 1997 1998 1999 2000 2001 2002 2003 2005 2006 2007 2008 2009 2010 2011 2012 2014 2015 2016 2017 2018 2019 2020

Big Recovery 2021 if Virus Under Control India Vegetable - Production vs Usage Million Metric Tonnes 24 22 Production Usage 20 18 16 14 12 10 8 6 4 2 0 2004 2013 1997 1998 1999 2000 2001 2002 2003 2005 2006 2007 2008 2009 2010 2011 2012 2014 2015 2016 2017 2018 2019 2020

Long-Term Demand Issues Bullish Vegetable Oil - Per Capita Consumption Kilograms 60 United States India China 50 49.7 40 30 28.9 20 16.5 10 0 1990 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020

Vegetable Oil - Major Consumers Million Metric Tonnes 45 United States India China 41.1 40 35 30 25 22.5 20 16.4 15 10 5 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2001 2002 2003 2004 2005 2006 2019 2020

Malaysia Palm Oil Production Million Metric Tonnes 22 20 18 16 14 12 10 8 6 4 2 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Short-term forces Declining palm production, recovery in energy and tightening stocks supported recent run-up World palm prod expected to reach record in 2020/21, but stocks are expected to fall to 4-yr low, stocks/usage ratio to 13%, 33-yr low Indonesia prod record high 5th year in a row 2021 Record soyoil prod could help the market put in a significant peak in early 2021.

More forces China may not as much palm oil this year Huge feed requirements in China, building crush capacity and boosting soybean imports. An expanded crush means they will be producing more soybean oil, reduce vegoil import needs. India s veg oil imports year ending Oct were est at 13.5-13.6 mmt, down from 15.55 mmt previous yr Another issue 2021 biodiesel consumption; took big hit first half of 2020. La Ni a, expected to bring favorable growing weather to SE Asia but too much rain/ virus employee issues short-term.