Current Outlook for World Vegetable Oils Market - Insights by Dorab E. Mistry

The outlook for world vegetable oils market provided by Dorab E. Mistry discusses various factors affecting prices, including palm production, soybean crops, and financial stability. Analysis on futures exchanges, production forecasts, and demand for bio diesel are included to give a comprehensive overview of the market trends.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

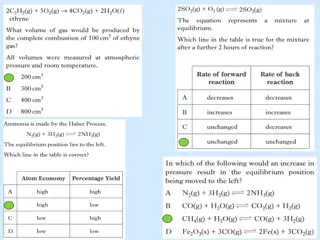

2014-15 Price Outlook for World Veg Oils By Dorab E Mistry Godrej International Limited http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Congratulations Congratulations to Dalian Commodity Exchange World s biggest futures exchange for soya and palm complex. I have spoken at every CIOC since the first one DCE is the most liquid exchange for veg oils in the world http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Background BMD futures hit a low of 1914 Ringgits on 2 September. Then rallied 300 Ringgits Can CPO futures re-visit this bottom? Only if Brazil and Argentina produce massive soybean crops OR Palm oil production rises against the normal cycle in Nov to March OR if we have a financial CRASH

Have Prices Bottomed Out YES. Palm production peaked in August Palm exports are very strong Most bio diesel demand is under Mandates All bearish estimates on soybeans have been thrown at the market. Yet prices recovered by 15 % http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Have Prices Bottomed out US soybean acres as certified by FSA are much lower than USDA. This can reduce the carry-over from 500 to 350 mln bu DCE futures are too low and do not reflect this risk Brazilian plantings are late Brazilian Real is not weakening further http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Palm Production Dry patch of Feb-March 2014 will cost? Malaysia will produce 19.6 to 19.8 mln mt Indonesia will not exceed 30 mln mt Stocks will peak end October and then decline up to June 2015 Will new Indonesian government increase usage of palm bio diesel? http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Soya Prospects Brazilian plantings of soya have not begun well. Prices of soybeans, soya oil and meal have bottomed out for the present Fund managers who started buying beans around $ 9 appear very determined and strong

Other Oilseeds Sun seed production is down 2.2 mln mt Sun oil demand is very strong Rapeseed production is unchanged Groundnut production is down 1.5 mln mt CPKO production is up in line with palm CNO production in 14-15 will be higher

INDIA Soya Meal is soft so crush will be slow India will store local oilseeds and suck in larger imports of cheaper oils Consumption is strong. Feel Good Factor ushered by new Modi government Palm will benefit most from record high imports in 14-15 http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Indian imports POC Est Actual 13-14 14-15 Palm 7,880 7,712 8,750 Soya 1,550 1,952 1,800 Sun 1,330 1,502 1,300 Others 300 450 450 TOTAL 11,060 11,616 12,300 http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

CHINA Palm stocks too low. Dalian futures need to rise to facilitate more imports Crush margins will gradually improve this year Reserve stock of 5 million tonnes of Rape oil. Unlikely to be released this year http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

US Mandate Africa demand World consumes 29 mln mt Oils & Fats for Biodiesel. Of this 80 to 90 % is mandated What will be US mandate ? Higher ? Africa demand will grow strongly due to low prices http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

World Demand Food Demand rising at 3.5 to 4 mln mt Bio fuel demand will rise by 1 mln mt only Palm Oil Gas Oil spreads are now too narrow Brazilian mandate is Up Bio fuel demand can grow if US Mandate is raised http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Incremental Supply 000 tonnes 14-15 13-14 Soya oil + 2,700 + 1,800 Sun oil - Palm oil + 2,000 + 3,400 Others - Total Supply + 3,950 + 7,500 Total Demand + 4,500 + 5,200 600 + 1,600 150 + 700

Looking Back and Front Oil Year 13-14 was full of pain due to Letters of Credit and poor crush margins Malaysia has exempted CPO from Export Tax up to December 2014 Indonesia may revert to Export Tax in Dec Malaysia will export CPO Indonesia will export Refined Palm http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Price Outlook BMD futures on 3rdmonth are around 2300 Ringgits. May rise if Ringgit weakens BMD will rise gradually after 10 December to reach 2500 by POC on 4 March 2015 Dalian futures will rise faster Around June 2015, palm prices will rise further http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Price Outlook Soya oil FOB Argentina will rise to trade $ 750 to 800 FOB Dec/Jan Sun oil will move to a premium over soya oil of $ 50 at least Laurics Bearish. CPKO must go down to level with CPO cif Rotterdam. CNO can trade a $ 150 over CPKO http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Will excellent weather continue We have enjoyed 12 months of excellent weather all over the world Will this excellent weather continue for another 12 months? We are only one major weather problem away from tight markets ! http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg

Conclusion The worst is over. Dalian futures need to rise to remove disparity between futures and cash Congratulations & Well Done to DCE and BMD Good Luck and God Bless http://t3.gstatic.com/images?q=tbn:tYG3ORvhHGYEPM:http://springfest.in/javascript_2/development-bundle/Web%2520Logos-Spons/sf2008/Godrej-logo.jpg