Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to help grasp these fundamental principles in the field of engineering economics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Engineering Cost and Estimation Sayantan Sarkar

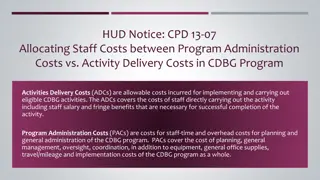

Engineering Costs Fixed Cost:These constant or unchanging regardless of the level of output or activity . Example: In production environment, costs for factory floor space and equipment remains the same regardless of production quantity, rent, insurance premiums, or loan payments. Variable Costs: These are not constant and depends in level of out or activity. Example: Piece rate labor, Commissions, incentives. Semi Variable cost: A cost contains both fixed and variable component and which is thus partly affected by fluctuations in the level of activity. Semi-variable costs is that cost of which some part remains fixed at the given level of production and other part varies with the change in the volume of production but not in the same proportion of change in production. For example, Telephone expenses of which rent portion is fixed and call charges are variable Variable cost per unit = change in cost/change in output

Example: If the cost of production of 2000 units is Rs.26,000 and 25000 units is Rs.30,000. Variable cost per unit = (30000 26000)/(2500 2000) = 4000/500 = Rs.8 per unit. Variable cost of 2000 units = 2000 8 = Rs. 16,000 Fixed cost = Total cost- variable cost = Rs.26,000-Rs. 16,000 = Rs.10,000

Total cost: It is the summation of the total fixed cost and total variable cost. Average cost: It is total cost divided by number of units Marginal cost : MC is the change in total cost associated a change in output.

Engineering Costs Let s take example of two student enrolled in engineering one is full time while other is a part time. student A full time student can enroll in 12-18 credit hours for afixedfeeof$1800. Overload creditsarechargedat $120/credit Full-time student: It is the case of fixed cost, regardless of number of credit hours he has to pay tuition fee. Fixed cost: $1800 per semester for 12-18credits Avg. cost 1 if student chooses 12 credits: 1800/12=$150/credit Avg. cost 2 if student chooses 18 credits: 1800/18= $ 100/credit Variable cost: cost of addition credit beyond 18 Variable cost for addition credit beyond18:$120 5

Example Total Cost=Total Fixed cost +TotalVariable cost

Engineering Costs Profit-loss breakeven chart. It is plot of revenue against costs for various level of outputs (activity). It allows to understand breakpoint and region of profit and loss. Profit loss breakeven chart figure here Terminologies: Break-even point: the level of activity at which total cost of product/goods/services equals to revenue Profit region: values of variable x greater than break point where total revenue is greater than total cost Loss region:Values of variable x less than breakpoint where total revenue is less than total cost

Engineering Costs (Example continued) So here: Breakeven point: 15students Profit region: for more than 15, FSSe will be in profit Loss region: For less than 15,FSSe will be in loss

Engineering Costs Sunk Cost: A sunk cost is money already spent as a result of past decision. e.g., (i) If 5 students signed up for the engineering course than, the advertising cost would be sunk cost (ii). Price of two years old pc purchase at $2000 is sunk cost which has no influence on current market value of $400 of pc 10

Engineering Costs Opportunity cost: An opportunity cost is associated with using a resource in one activity instead of another. Opportunity cost refers to the value forgone in order to make one particular investment instead of another. For example, let's assume you have Rs. 5 lakh that you could either invest in Company A stock or put toward a graduate degree. You choose the stock. The opportunity cost in this situation is the increased lifetime earnings that may have resulted from getting the graduate degree -- that is, you choose to forgo the increase in earnings when you use the money to buy stock instead. 11

Opportunity cost: example- Suppose a man has invested a sum of s. 50,000 in shares. Let the expected annual return by this alternative be Rs. 4500. If the same amount is invested in real estate, a return of 10% is expected. Then the corresponding total return per year for the investment in real estate is Rs 5000. This return is greater than the return from shares. The foregone excess return of Rs. (5000-4500) = Rs. 500 by way of not investing in real estate is the opportunity cost of investing in shares.

Recurring and Nonrecurring costs Recurring costs refersto any expense that is know and anticipated and that occurs at regular interval. Eg: monthly rent, bills Non recurring costs areone-time expenses that occur at irregular intervals and thus are sometimes difficult to plan for or anticipate from a budgeting perspective. Eg: initial outlay of a company, cost of renovation of a building In engineering economics analysis, recurring costs are modeled as cash flow that occur at regular interval. Nonrecurring costs can also be handled if we are able to anticipate their timing and size. 13

Engineering Costs A cash cost is a cash transaction, or cash flow. If a company purchases an asset, it realizes a cash cost. A book cost is not a cash flow, but it is an accounting entry that represents some change in value. When a company records a depreciation charge of $4 million in a tax year, no money changes hands. However, the company is saying in effect that the market value of its physical, depreciable assets has decreased by $4 million during the year. Life-cycle costs refer to costs that occur over the various phases of a product or service life cycle, from needs assessment through design, production, and operation to decline and retirement.

Cost Estimating Engineering economic analysis focuses on future consequences of present decisions and therefore one must estimate all cost related variables Estimates for engineering economic analysis include purchase costs, annual revenue, yearly maintenance, interest rates for investments, annual labor and insurance costs and tax rates etc Types of Estimates 1. Rough Estimate 2. Semi-detailed estimate 3. Detailed estimate 15

Types of Estimates 1. Rough Estimates: These are order of magnitude estimate used for high level planning for determining project feasibility and in a project initial planning and evaluation phase. These estimates require minimum resources to develop and their accuracy is -30 to 60%. 2. Semi-detailed estimates: These are used for budgeting purpose at a project s conceptual or preliminary design stage. These are more detailed than rough but still require time and resources. Their accuracy is generally -15 to 20% 3. Detailed estimates: These are used during project detailed design and contract bidding phases. These involve most time and resources and thus are much more accurate than rough estimates. The accuracy is general -3 to 5% 16

Difficulties in Estimation One of a kind estimates: The first time something is done, it is difficult to estimate costs required to design, produce, and maintain a product over its life cycle. E.g., NASA first space mission, promotional cost of a new product. Time and effort available: Our ability to develop engineering estimates is constrained by the time and man-power availability Estimator Expertise: The more experienced and knowledgeable the estimator is, the more accurate the estimate will be. 17

Estimating Models 1. Per unit model 2. Segmenting model 3. Cost indexes 4. Power-sizing model 5. Improvement and learning curve 18

Estimating Models 1. Per-unit model: It is a simple but useful model in which a cost estimate is made for a single unit, then the total cost estimate results from multiplying the estimated cost per unit times the number of units. It is commonly used in construction industry. Example: Cost of Rs.65 per square meter Service cost per customer Gasoline cost per km 19

Estimating Models 2. Segmenting model: It can be described as Divide and Conquer . It partitions the total estimation task into segments. Each segment is estimated, then the segment estimates are combined for the total cost estimate. An estimate is decomposed into its individual components, estimates are made at those lower levels, and then the estimates are aggregated (added) back together. It is much easier to estimate at the lower levels because they are more readily understood. 20

Estimating Models 3. Cost indexes: It can be used to account for historical changes in costs. The widely reported Consumer Price Index (CPI) is an example. Cost index data are available from a variety of sources. Suppose A is a time point in the past and B is the current time. Let IVA denote the index value at time A and IVB denote the current index value for the cost estimate of interest. To estimate the current cost based on the cost at time A, use the equation: (Cost at time B)/ (Cost at time A) = (IVB / IVA) => Cost at time B = (Cost at time A) (IVB / IVA) 21

Example Miriam is interested in estimating the annual labour and material costs for a new production facility. She was able to obtain the following labour and material cost data: Labour costs: Labour cost index value 10 years ago was at 124 and is 188 today Annual labour cost for a similar facility 10 years ago was Rs. 575,500 Material Costs: Material cost index value was at 544 three years ago and is 715 today Annual material cost for a similar facility was Rs. 2,455,000 three year ago Find out the present annual labour and material cost. 22

Example - Solution Miriam will use cost index equation for estimating the present annual labor and material cost. Annualcost today Index valuetoday Annual Labor Cost = Annualcost10 yearsago Index value10 yearsago Index valuetoday Annualcost today =Annualcost10 yearsago Index value10 yearsago Annualcost today = 575500188= Rs. 871800 124 Annual Material Cost Annualcost today Index valuetoday = Annualcost 3yearsago Annualcost today = 2455000 715 = Rs.3227000 Index value3yearsago 544 23

Estimating Models 4. Power-sizing model: It accounts explicitly for economies of scale. For example, the cost of constructing a six-story building will typically be less than double the construction cost of a comparable three-story building. To estimate the cost of B based on the cost of comparable item A, use the equation: Cost of B / (Cost of A) = [ ("Size" of B) / ("Size" of A) ] x where 'x is the appropriate power-sizing exponent, available from a variety of sources. An economy of scale is indicated by an exponent less than 1.0. An exponent of 1.0 indicates no economy of scale, and an exponent greater than 1.0 indicates a diseconomy of scale. "Size" is used here in a general sense to indicate physical size, capacity, or some other appropriate comparison unit. 24

Example Miriam has been asked to estimate the today s cost of a 2500 sq. ft heat exchange system for the new plant being analysed. She has the following data: Her company paid Rs.50000 for a 1000 sq. ft heat exchanger 5 years ago. Heat exchangers within this range of capacity has a power sizing exponent (x) of 0.55. Five years ago the Heat Exchanger Cost Index (HECI) was 1306; it is 1487 today Solution: Miriam will use the following equation of power sizing model; Cost of 2500 sq. ft = (Cost of 1000ft2) [ ("Size" of 2500ft2) / ("Size" of 1000ft2) ] ^x where x =0.55 Cost of 2500 sq. ft equipment = (50000) [ (2500) / (1000) ]^ 0.55 Cost of 2500 sq. ft equipment =Rs. 82,800 25

continue: Example Miriam knows that the Rs. 82,800 reflects only the scaling up of the cost of the 1000 ft2 model to 2500 ft2 model. Now she will use following equation of cost index model to determine the today s cost of equipment Equipment cost today Equipment cost 5yearsago Index valuetoday Index value5yearsago = Annualcost today =828001487= Rs. 94,300 1306 26

Problem Paresh works for a trade magazine that publishes lists of Power-Sizing Exponent (PSE) that reflects economies of scale for developing engineering estimates of various types of equipment. Paresh has been unable to find any published data on the VMIC machine and wants to list its PSE value in his next issue. Given the following data, calculate the PSE that Paresh should publish w.r.t. 50 KW generator machine. Cost of 100 KW m/c today= $100,000 Cost of 50 KW m/c 10 years ago=$45,000 Generator index today= 856 Generator index 10 years ago=604 27

..Problem: Solution Using Cost Index Model Cost of 50 KW m/c today = 45,000 (856/604) = $63,775 Using Power Sizing Model: (63,775/100,000) log (0.63775) = x log(0.50) = (50/100)x x = 0.65 28

Estimating Models 5. Improvement and the learning curve One common phenomenon observed, regardless of the task being performed, is that as the number of repetitions increases, performance becomes faster and more accurate. This is the concept of learning and improvement in the activities that people perform. The learning curve captures the relationship between task performance and task repetition. The learning curve shows that if a task is performed over and over than less time will be required at each iteration. 29

Learning curve cost estimating is based on the assumption that as a particular task is repeated, the operator systematically becomes quicker at performing the task. The learning curve slope indicates "how fast" learning occurs. The following expression can be used for time estimating in repetitive tasks Example: A learning curve rate is 70%, the operator s time for the first t unit is 65 seconds. What is the operator s time for the 50thunit? Sol: b = log (0.70) / log 2.0 = -0.5145 T50= T1* (50) ^ b = 65 * (50) ^ -0.5145 = 8.68 mins.

Solved Example Calculate the time to required to produce the hundredth unit of a production run if the first unit took 32 minute to produce and the learning curve rate for production is 80%.

Problem: If 200 labour hours were required to produce the 1st unit in a production run and 60 labour hours were required to produce the 7th unit, what was the learning curve rate during production. ==> T(7) 60 0.300 log 0.30= b log (7) b =T(1) x 7b = (200) x7b = 7b TN =T1* (N) ^ b = log (0.30)/log(7) = -0.62 b = [log (learning curve rate)/lob 2.0] = -0.62 log (learning curve rate) learning curve rate = -0.187 = 10(-0.187) = .650 = 65%

When thousands or even millions of units are being produced, the learning curve effect is ignored/vanished at a time/stage called steady state. Steady state is the time at which the physical constraints of performing the task prevent the achievement of any more learning or improvement. time Steadystate Number ofunits