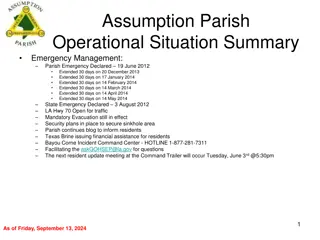

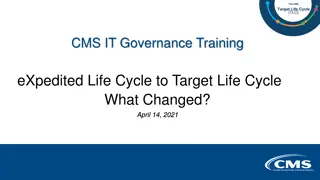

Assumption Governance and Review Proposal for Financial Studies

Implementing a robust system for assumption governance and review based on experience and studies. Includes making proposals for each assumption set, independent reviews, centralized documentation, and documenting impact. Testing investment returns, expenses allocation, mortality rates, and more with professional judgment and recent experience. Ensuring accurate financial calculations and informed decision-making.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

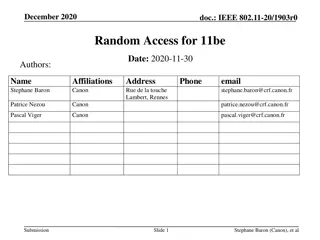

Assumption Governance Assumptions based on experience studies Controls around studies calculations accurate Make proposal for how each assumption set Independent review of the proposal Centralized location for all documentation Documenting impact of any assumption change

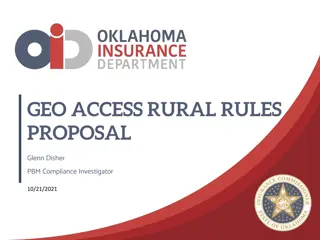

Assumption SetttingIllus Act Testing Investment Returns based on recent experience Allocate investment income as done in practice Mortality & persistency based on recent experience when credible Professional judgment when not Direct sales expenses Agent commissions, overrides, other direct compensation

Assumption SetttingIllus Act Testing All Other Expenses Exclude direct sales expenses no double counting Choices fully allocated, marginally allocated, GRET Fully allocated expenses based on recent expense study Direct and indirect expenses. Direct obvious way to allocate Indirect not as obvious Marginally allocated Fully allocated without Indirect

Assumption SetttingIllus Act Testing GRET Generally Recognized Expense Table NAIC Rules If no GRET exists, must use fully allocated If GRET exists, any of three methods Marginally allocated only if expenses as large as GRET Taxes FIT and other taxes

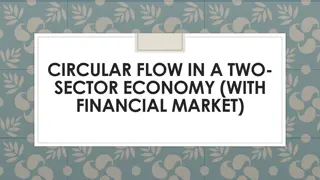

Testing New Sales Test DCS Self-Support and Lapse-Support DCS and Assumptions come together Compare Asset Shares to Cash Surrender Values (CSV) Test until all policies gone Accumulated Cash Flow > CSV after duration 15