Understanding Cryptocurrency: Bitcoin and Central Bank Digital Currency

Explore the evolution of Bitcoin, from its prehistory to mining processes and security measures against double-spending. Delve into the advantages of decentralized systems and the potential impact on traditional financial institutions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Leipzig University Faculty of Economics and Business Administration Institute for Economic Policy Development of Financial Markets and Institutions Dr. Kristoffer J. M. Hansen XIV. Cryptocurrency and Central Bank Digital Currency

XIV. Cryptocurrency and Central Bank Digital Currency 1. Bitcoin 2. Beyond Bitcoin 3. Central Bank Digital Currency (CBDC) 4. Literature

1. Bitcoin Prehistory Growing need for a native currency or payment protocol as internet took off. Earlier attempts: E-gold Hashcash

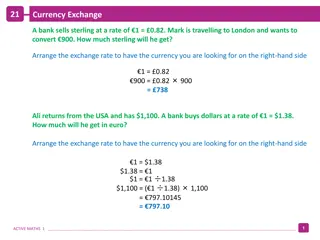

The Problem Peer-to-peer transactions not possible in the digital world. Trusted third parties needed to verify transactions, prevent double-spending. Double-spending: the same coin is spent twice. Central authorities: creditcard companies, paypal, banks. Problem: whole system depends on trusted third parties, all transactions must go through them. Single point of failure. Potential privacy concerns. Inflation possible.

The Solution: Bitcoin A Peer-to-Peer Electronic Cash System Proposed by Satoshi Nakamoto in 2008. Pseudonym, no-one knows who despite many claimants. A decentralized system validates transactions by proof-of-work. New transactions broadcast to network and collected in blocks. Each node in the network works on finding a difficult proof- of-work for its block. First to finish broadcasts block to network, acceptance by starting work on next block. The blockchain is the result: a cryptographically secured record of all transactions with bitcoin.

Bitcoin Mining The producing node receives the first transaction in a new block new bitcoin created this way. Supply capped at 21 million thereafter fixed for all eternity. Transaction fees also a source of funding, difference between input transactions and output transactions. Difficulty of proof-of-work varies over time, programmed to secure stable output of new blocks. One-CPU-one-vote: the longest chain considered the correct one, nodes only add blocks to the longest chain. If two new blocks broadcast to network simultaneously, different nodes work on different blocks. Once the next block found and broadcast, this becomes the longest chain and the other discarded.

Double-Spend and 51-Percent Attack When a majority of nodes honest, this guards effectively against double-spend problem. A dishonest node will have to control 51 percent of CPU power to subvert the blockchain. But what can he achieve? He can only falsify his own transaction in the previous block i.e., recall an amount he has spent and then spend it again. Given the costs of mining, financial rewards from new blocks would probably make it not worthwhile: better to focus on producing honest blocks and reap the reward from that.

Mining Boom From CPU to GPU: production of dedicated mining hardware. From laptops and workstations to mining pools. Inputs: hardware rigs and electricity. Mines located where electricity is cheap. Iceland. China (until recently). USA. Russia.

Mining Boom Image source

Privacy and Bitcoin Old system: third party kept data on partners and transactions on file, secure from the public but potentially accessible to anyone (leaks, hackers, confiscation). Bitcoin: transactions are public, but transactions cannot be tied to individual persons. The public can see the transaction, but there is no information on the blockchain linking specific transactions to specific persons. However, linking is still possible if the owner of a key is revealed. Bitcoin detectives can then track down ownership and spending of coins (e.g., in case of crime, fraud).

2. Beyond Bitcoin Other uses of the blockchain: Secure records (sales, land titles, marriages ) Smart contracts. DeFi. ICOs. Decentralized lending platforms. Original blockchain limited in these applications.

New Cryptocurrencies Joke coins like dogecoin (2013) to make fun of wild speculation in cryptocurrencies. Since then championed (?) by Musk Dog money by Remy Ethereum announced 2013, public 2015. Smart contracts, scripting, tokens Privacy coins with enhanced privacy features.

Proof-of-Work or Proof-of-Stake PoW criticized for being too costly, using too much electricity. 2021: Bitcoin mining uses more power than country of Finland. 0.5 percent of all electricity globally. About 91 TWhs annually (New York Times). But note the extreme uncertainty of these estimates! PoS is an alternative way to mine new blocks. Ownership of coins determines one s power . Energy needs minimized. Criticized for fostering centralization. Proposed for ether for end 2021, implementation moved to mid 2022.

Which Bitcoin? Blocksize Wars There have been several hard forks of bitcoin, leading to several versions. BTC, BCH, BSV Each is an independent, separate coin and blockchain. Hard fork: miners disagree on new update to software. One group adopts update, other group refuses/adopts different update. One core issue: the blocksize. Should there be a limit on how big blocks should be and therefore on how many transactions can be collected in each block?

Blocksize No blocksize in original version. Added in 2010 by Satoshi: max size 1MB. Reason: avoid spamming that would take bitcoin down. Transactions free at this point, therefore potential risk. However, only meant as temporary security measure: once bitcoin adoption spread, it could be raised (or removed altogether). With 1MB, number of transactions limited to about 3 per second. Plenty for the time, but nothing next to paypal, visa etc. Impossible to scale with this limit. Transactions become very costly, as people bid for artificially scarce space on the blockchain.

Blocksize Debates (Wars) Big block arguments: Impossible to scale with small blocks. Blocksize increases can be programmed into bitcoin. Extra data storage needed not a problem, reasonable to expect continuing improvement here as well as in computing power (Moore s law). Small block arguments: Bigger blocks compromise the network, risks centralization as costs of running a node increases. Not necessary: the blockchain can provide ultimate settlement, people s transactions can take place on secondary layer, side chains built on top of bitcoin.

Resolution: BTC Core developer group proposed keeping block size, segregated witness would effectively raise limit to 2MB. Side chains promised: Blockstream and the Lightning Network. Most (Chinese) miners convinced by Core team 2015. Transaction costs fluctuate on BTC, frequently as high as $50 (much less more recently). Day-to-day purchases effectively priced off of BTC. Widespread adoption of bitcoin hampered. Bitcoin as digital gold : store of value and settlement asset, not cash.

Resolution: BCH Alternative proposal to raise blocksize to 8MB rejected. Hard fork from BTC in 2017. Technically, both are bitcoin (same for all other forks) but most hashing power remained with BTC, market value of BTC higher, original developer team with BTC. Some popularity in the first years, but has since declined. Retail use of bitcoin, cryptocurrencies generally has declined. High fees on BTC discouraged it. Confusion over forks. Innovation in traditional financial system caused costs to plummet. In Europe: hidden subsidy to credit card use.

3. Central Bank Digital Currency Central banks have discussed central bank digital currencies (CBDC) in recent years, expressly in response to the rise of digital currency. Academic discussion began around 2014-5. Papers by BIS (2020), ECB (2020), Federal Reserve (2022). Pilot projects in China. Core idea: a digital form of the currently used currency, exchangeable at par with other forms (physical cash, bank money).

Designing CBDC Blockchain or central issuer? Tokens. Accounts with central bank. Wholesale or retail? Wholesale: CBDC only available to banks and financial institutions. Retail: private persons have access to CBDC. Immediate or mediated access? Immediate: private persons have immediate access to CBDC. Mediated: CBDC are administrated in accounts by banks.

Purposes of CBDC Central bank wants to remain relevant to financial developments. Claims that bitcoin show demand for a CBDC. Necessary to have CBDC to combat money laundering, terrorism. Central banks recognize desire for financial privacy, respects it but only conditionally (i.e., authorities will potentially have access to complete record of transactions (ECB 2020)). Rogoff (2016). A necessary tool for monetary policy.

CBDC and Monetary Policy How can CBDC help monetary policy? Overcome zero lower bound on interest rates (Goodfriend 2000; Bordo & Levin 2017). Interest rate manipulation difficult when rates are already low what to do when central bank rates already negative? With CBDC, it becomes possible to impose negative rates on digital money. Encourage spending by penalizing hoarding. In recession, avoid leakage into hoards by penalizing holding cash (CBDC). Program it to lose value after a short while. Shades of Gesell?

CBDC, Monetary Policy, and Physical Cash However, one problem: none of this works if physical cash is still available. Negative rates can be avoided by shifting from CBDC to cash. Same with programmed devaluation. Also true of money-laundering concerns. Surveillance of CBDC can be avoided through cash, other payment systems. Transparency really means complete government oversight/control not possible with cash, private cryptocurrencies, possible with CBDC. Central bank intentions contradictory: they want to respect privacy, they don t want to abolish cash but their stated goals for CBDC can only be achieved by destroying financial privacy and abolishing cash.

4. Literature Bank for International Settlement, 2020. CBDC: Central Bank Digital Currencies: Foundational Principles and Core Features. Available online. Board of Governors of the Federal Reserve System, 2022. Money and Payments: The U.S. Dollar in the Age of Digital Transformation, Washington, D. C. Available online. Bordo, M. and A. Levin, 2017. Central Bank Digital Currency and the Future of Monetary Policy, NBER Working Paper no. 23711. European Central Bank, 2020. Report on A Digital Euro, Frankfurt am Main. Available online. Goodfriend, M., 2000. Overcoming the Zero Bound on Interest Rate Policy, Journal of Money, Credit and Banking 32, no. 4, pp. 1007-35. New York Times, Sept. 3, 2021. Bitcoin Uses More Electricity Than Many Countries. Available online (but paywall). Rogoff, K., 2016. The Curse of Cash, Princeton, N. J.: Princeton University Press. Satoshi Nakamoto, 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online.