Winding Up of a Bank Company in Bangladesh: Legal Process and Circumstances

The winding up of a bank company in Bangladesh involves terminating its legal existence by ceasing its operations, realizing assets, and distributing them among creditors and shareholders. Section 65(I) of the law empowers the High Court Division to order winding up based on inability to pay debts or application by the Bangladesh Bank. Circumstances for application by the Bangladesh Bank include failure to comply with legal requirements, disentitlement to conduct banking business, or contravention of the law even after notices are served. The process is crucial for maintaining financial stability and regulatory compliance in the banking sector.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

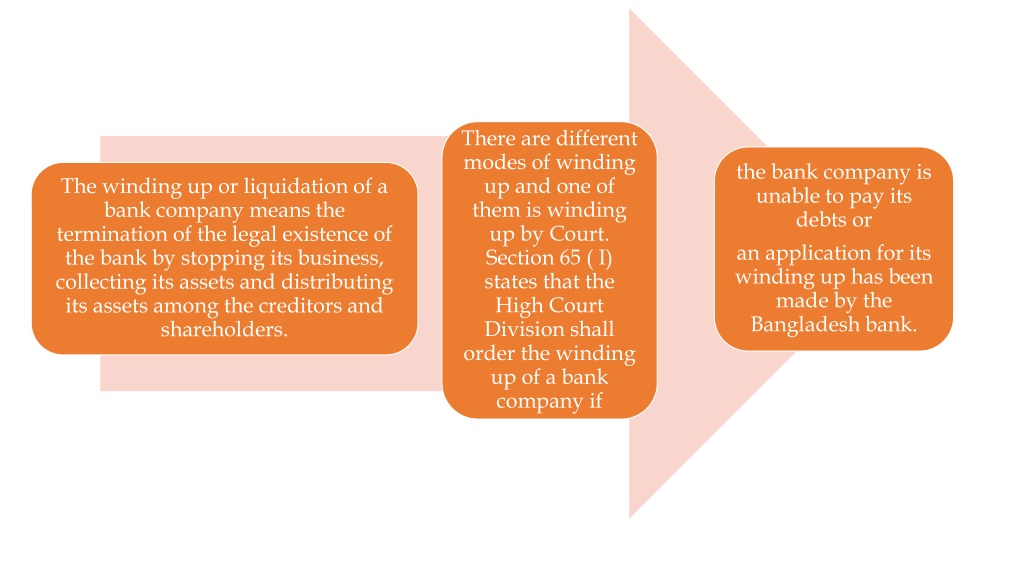

There are different modes of winding up and one of them is winding up by Court. Section 65 ( I) states that the High Court Division shall order the winding up of a bank company if the bank company is unable to pay its debts or an application for its winding up has been made by the Bangladesh bank. The winding up or liquidation of a bank company means the termination of the legal existence of the bank by stopping its business, collecting its assets and distributing its assets among the creditors and shareholders.

There are different modes of winding up and one of them is winding up by Court. Section 65 ( I) states that the High Court Division shall order the winding up of a bank company if the bank company is unable to pay its debts or an application for its winding up has been made by the Bangladesh bank.

CIRCUMSTANCES FOR APPLICATION MADE BY THE BANGLADESH BANK FOR WINDING UP OF A BANK Sub- section [(3) (a)] of section 65 sates that The Bangladesh Bank may make an application under this section for the winding up of a bank company if the banl company: has failed to comply with the requirements under section 13, or

has by reason of the provisions of section 3I, become disentitled to carry on banking business in Bangladesh, or has by reason of the provisions of section 3 I, become disentitled to carry on banking business in Bangladesh, or has been prohibited from receiving fresh deposits by an order under clause (a) of sub-section (5) of section 44 or under sub-clause (b) of clause (S) of Article 36 of the Bangladesh Bank Order. 1972 (P.O. No. 127 of 1972), or

having requirement of this Act, other than the requirement laid down in section 13, has continued such failure, after notice in writing of such failure has been conveyed to it; or failed to comply with any contravened any provision of this Act and continue such contravention after the Bangladesh Bank conveys the bank company about the contravention by notice in this behalf. Sub- section [(3) (b)] of section 6S further sates that The Bangladesh Bank may make an application under this section for the winding up of a bank company if in the opinion of the Bangladesh Bank:

a the returns, statements or information furnished to it under disclose that the bank company is unable to pay its debts, or,

Bank Company Deemed to be unable to pay According to [65(4)] of the Bank Companies Act, without prejudice to the provisions contained in [section 42] of the Companies Act. 1994, a bank company shall be deemed to be unable to pay its debts; it has refused to meet any lawful demand made at any of the company s offices or branches within two working days, or such demand is made else where and if Bangladesh Bank certifies that the bank company is unable to pay its debts, or Bangladesh Bank certifies in writing that the bank company is unable to pay its debts.

RESTRICTION ON YOLUNTARY WIND UP According to section 75 of the Bank Companies Act 199 I, notwithstanding anything to the contrary contained in [section 286] of the Companies Act 1994, no bank company which holds a licence granted under section 3I may voluntarily wound up unless the Bangladesh Bank certifies in writing that the company is able to pay in full all its debts to its creditors as they accrue, and without prejudice to the provisions contained in [section 314 and 3I5 of that Act the High Court Division shall, on application of the Bangladesh Bank, order the winding up of the company by the High Court Division if at any stage during the voluntary winding up proceedings, the company is not able to meet such debts as they accrue.