Challenges Faced by Insolvency Resolution Professionals during Corporate Insolvency Resolution Process

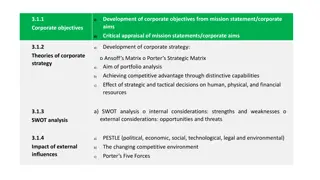

Insolvency Resolution Professionals encounter various challenges during the Corporate Insolvency Resolution Process, such as the need for prompt public announcements, appointing valuers, handling difficult transactions like preferential deals and related party transactions, assessing fraudulent activities, and evaluating resolution applicants' eligibility. These challenges demand rigorous investigation, documentation, and timely actions to navigate the insolvency proceedings effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Challenges for IRP/Resolution professional during CIRP CMA IP Manoj Kulshrestha M.Com, FCMA, IP PGDFM, MIMA, PractsingCost Accountant and Insolvency Professional

After admission of the case, IRP has to do public announcement within 3 days from the date of admission or after commencement of CIRP and also propose 3 names of IPs for appointing authorised representative/s for a class of creditors Public Announcement and Appointment of Authorised Representative/ s He should obtain consent from proposed IPs to show willingness for appointment of authorised Representative/s for a class of financial creditors. Knowing the CD and its creditors normally a challenging task within 3 days from the date of admission of the case.

RP has to appoint the two valuersfor each class of assets. Viz, land and building, plant and machinery and financial assets. In many cases It is observed that CD has not updated balancesheet and also not filed the annual return for last few years. Appointment of valuers However the scope of valuation can not be defined to proposed valuersand also the fee quotation can not be submitted by them in time. This exercise is supposed to be done for at least for six valuersor otherwise more valuersneed to be contacted. Such appointment can not be done within time till the assets are traced by IRP/RP during CIRP.

Difficult to determine such transactions Information not available in many cases Preferential transactions, undervalued transactions, diversion and related party transactions Difficult to challenge before AA and determine with evidences Undervaluation is based on valuer sreports. Preferential transactions can not be determined unless there is substantial information and evidences are there. Related party due diligence not easy Reporting of such transactions to IBBI and filing an application with AA. Reporting by any creditor or Liquidation shall also make RP responsible for avoidance of transactions and make him responsible.

How to make an assessment of such fraud Forensic Audit report Transactions for Defrauding creditors Intention of CD., promoters and management of the CD. RP to collect evidences and file application before AA Report such transactions to IBBI.

RP should evaluate the eligibility of resolution applicant Provide him the information as required by him. Resolution Applicant and Resolution Plan Take resolution plan/s and place them before the CoC. RA can question RP that RP does not provide appropriate information for filing Resolution plan. Voting and approval RP should follow the process only as all stakeholders will participate in the process.

MCA Handling Other Stakeholders Income Tax Department Careful in assessing damages during CIRP due to going concern, supply chain, tax issues, legal issues Concerned regulator/licencing Authority SEBI

Thanking You CMA IP Manoj KUlshrestha