Estimating Market and Disposable Top Income Shares with National Accounts Data

This contribution addresses the challenge of accurately estimating income inequality by bridging gaps between National Accounts figures and household surveys. The proposed adjustment method reallocates discrepancies to higher income quantiles based on economic rationale. Questions arise regarding the fixed allocation percentages, impact of tax legislation on distribution, and the potential increase in inequality. The use of official System of National Accounts (SNA) data is highlighted for its reliability, though variations in data compilation across countries pose challenges. Overall, the paper offers valuable insights into improving income inequality analysis.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Estimating market and disposable top income shares with national accounts data By Thomas Goda and Santiago Sanchez LIS conference 27th 28th April 2017 Charles-Henri DiMaria - ANEC 04-27-2017

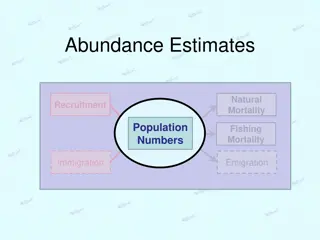

What is the main goal of the contribution? Mis or under reporting in households surveys especially in higher quartiles affect accuracy of figures and may assess wrongly the extent of income inequality. But this is true for other topics such as wealth But fills another important gap in analyses how to bridge gaps between National Accounts figures and households surveys? National Accounts provides totals that are coherent in the full sequence of accounts: income consumption savings - But cannot say a word about inequalities and distribution. Households surveys provide information on distribution but is generally not consistent with the sequence of accounts and total National official figures. 2

What is the proposed adjustment? IF NA accounts report higher totals then discrepancies are allocated to higher quantiles (this is an assumption) Pareto distribution and 95% of capital income discrepancies go to S10 and 5% to S20- S10. 75% of labour income discrepancies go to S10 and 25% to S20- S10. 80% of disposable income discrepancies go to S10 and 20% to S20-S10. Mixed income: 70% labour income 30% capital income 3

Questioning shares All computation are based on fixed allocation per-strata: 95%, 5%, 70%, 30%. Where the values are coming from? Economic and/or statistical rationale. Can they be fixed across countries? Why not assuming that there is no entrepreneurs in some countries in the S10? Does tax legislation may impact distribution in some countries and or percentiles it might be more interesting to declare income as capital income rather than labour income and conversely? Does the methodology automatically increases inequality? (especially when discrepancies are large) 4

Of the quality of National Accounts we choose to use official SNA data for the adjustment because they record all money flows within an economy in a systematic way well (is it rhetorical?) NA are based on the idea of reliability of sources balancing counterpart information. E.g. in LUX mixed income is a residual computed as a difference of Value Added minus income of employees. Then all adjustments of VA impact mixed income (illegal activities ) Even income of employees might differ e.g. tips, income in kind (meals, uniforms, ) Capital income is often sourced from banking data flows are estimated and the distinction between self-employed and firms is not clear. NA are revised! Then Gini coefficients should be revised too! NA are compiled differently from one country to another! 5

In a nutshell This paper is important and interesting at least to bridge information on distribution with NA totals but: Using fixed shares across time and countries should be discussed, Impacting only top percentile is not that obvious, NA are not the divine Word and different practices may impact countries in different ways. 6