Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments, and expenditures are made to compute the gross total income. Total income includes all income earned or received in India for residents, with specific exemptions and deductions outlined in the Income Tax Act. Understanding the distinction between gross and total income is crucial for accurate tax calculation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

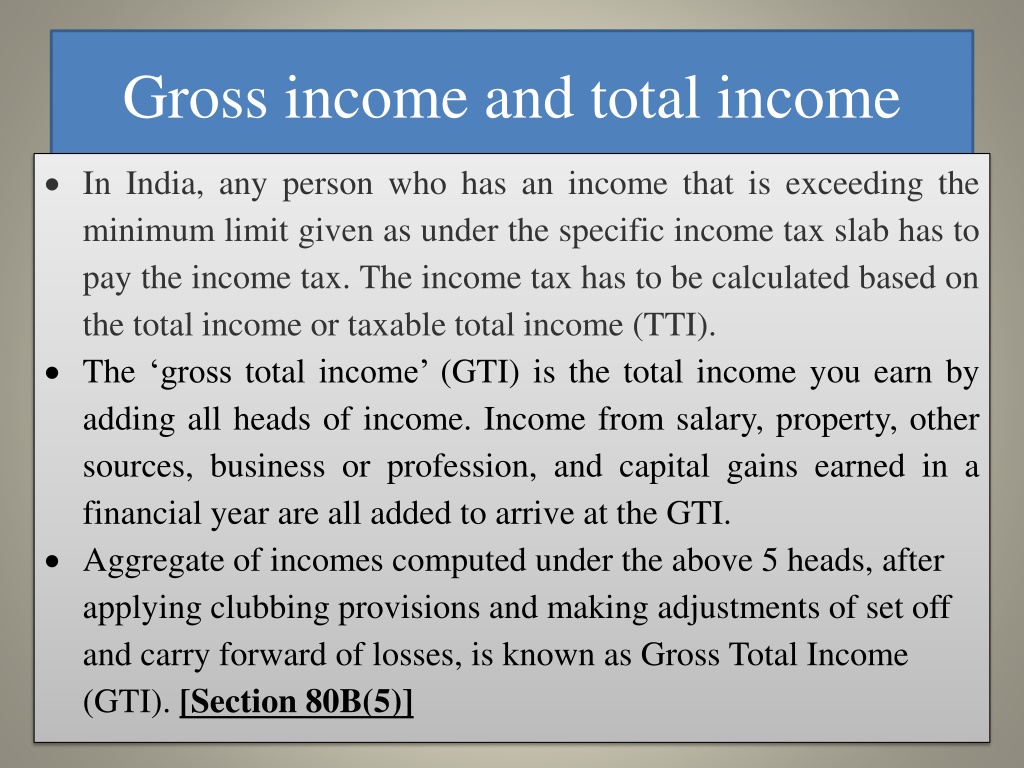

Gross income and total income In India, any person who has an income that is exceeding the minimum limit given as under the specific income tax slab has to pay the income tax. The income tax has to be calculated based on the total income or taxable total income (TTI). The gross total income (GTI) is the total income you earn by adding all heads of income. Income from salary, property, other sources, business or profession, and capital gains earned in a financial year are all added to arrive at the GTI. Aggregate of incomes computed under the above 5 heads, after applying clubbing provisions and making adjustments of set off and carry forward of losses, is known as Gross Total Income (GTI). [Section 80B(5)]

The various additions required to be made in Gross Total Income Apart from adding earnings from all five heads of income following shall also be added to calculate your gross total income. Income to be added as per the clubbing provisions under the Income Tax Act Adjustments for set off and carry forward of losses Unexplained Tax Credit under section 68 of the Income Tax Act 1961, received whether in cash or credit. Unexplained Investments as per the purview of section 69 of the Income. Although we have obtained an understanding on the above income and assets or expenditures which are added to the gross total income. But, these additions or nature of additions are not generally witnessed in routine

Continue Assets and other money under Section 69A, valuables like money, jewellery etc for which no proper explanation is available with the assessee Undisclosed or lower disclosed income is added to the Gross Total Income as per the provisions of Section 69B of the Income Tax Act 1961. This relates to all those income and assets which you have not reported or made a lower disclosure then the actual funds. Unexplained expenditures under section 69C. Hundi amount borrowed or repaid. In case you have borrowed or repaid some amount on Hundi then it shall be added to your Gross Total income or GI as per the provisions of section 69D of the income tax act.

Total income Section 5 determines the scope of total income for a resident or a non-resident assessee. It follows that for a resident assessee, the total income include all income that accrue, arise, earned or received in India (except those income which accrues or arises outside India) However various chapters and sections of the Income tax Act further lays down which income would not form part of total income, computation to be made, Clubbing of Income, set off or carry forward of loss and deductions to be made in computing total income.

Continue Total income or taxable total income- As per section 14, all income shall, for purposes of Income-tax and computation of total income, be classified under the following heads of income: 1. Salary 2. Income from house property 3. Profits and gains of business and profession 4. Capital gains and 5. Income from other sources

Continue The computation of total income of an Assessee is made by deducting from the gross total income. Means total income = grass total income [ (A)+ (B) + (C) + (D) + (E) and head wise deduction ] deduction available under chapter VIA (sec. 80C to 80U)

The steps to determine the Total Income The steps in which the Total Income, for any assessment year, is determined are as follows: A. Determine the residential status of the Assessee to find out which income is to be included in the computation of his Total Income. B.Classify the income under each of the following five heads. Compute the income under each head after allowing the deductions prescribed for each head of income. C. subtracting all deductions permissible under Chapter VIA of the Income-tax Act i.e., deductions under sections 80C to 80U.