Potential and Opportunities in Polish Commerce Sector

An overview of the potentials and opportunities in the Polish commerce sector, including modernization models, national market potential, food position, exports growth, key players in wholesale, and retail FMCG insights. The sector shows positive dynamics with growth in domestic and export markets, leading to increased interest from producers and retailers.

Uploaded on Sep 27, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Polish Commerce Sector An overview of potentials and opportunities Maria Andrzej Fali ski (Ph.D.) Ljubljana 2014

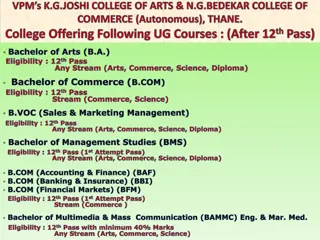

Commerce Modernization Models in Poland M-1 imported growth M-2 domestic Low capital projects High capital projects Mass Privatization take- overs, modernization of socialism remnants investments, new advantages d i s c o u n t hi pe r su pe r C & C SMEs, horeca Multiformats based on wholesale Other concepts: Purchasing groups, partnerships, etc Producer s chains of retailing

National National Market Market Potential Potential Retail: 700 B PLN (ca.170 B Euro) but food takes 34% Wholesale: 980 B PLN (ca.245 B Euro) food takes 15% Commerce and repairs give ca. 19% of GDP The economy depends on domestic market (stability): 56% of PKB comes from inside but high level of competition offers good price for exports, too Total numer of stores: retail: 350.000 ( more than 40 sqm 140 ths) wholesale: 4.000 (more than 500 sqm) Main proportions (sales shares): - Traditional commerce (incl.chained ones) 43% - Modern distribution - 57%

Food Food P Position osition Retail food sales: ca 270 B PLN (65 B Euro) - 34% of total retail Wholesale food sales: ca 150 B PLN (ca. 38 B Euro) 15%of total wholesale food FMCG 130 B PLN (ca. 33 B Euro) Food exports: ca 20 B Euro/13% total exports /35% of national production Food market is supplied by domestic products in 83% - largest % in the EU Food SKU indice number: ca 250.000 HoReCa: ca. 26 B PLN (ca.8,5 B E)/ca.95 ths gastro-points - 3% of total consumption spendings a perspective - fastest growth outside restaurants Additional potential in seasonal stores and points (ca. 110 ths)

Food Exports Food Exports fast growth fast growth 1995 2013: average sales growth. DYNAMICS! - domestic 6,7% a year - exports 14,1% a year Despite Russian ebargoes and EU-markets congestion - exports grow (est. 6 -8% in 2014) Producers in search of markets promotion funds and strategies Interesting circumstances: SMEs of good technological standard look for partners to stand to challenge Transnational retailers look for new offers in PL for the West

Wholesale Wholesale main players main players Company Market share Sale Eurocash 22% -25% est 17 B Makro C&C ca 7% 7 B Selgros ca 3,5% 3,5 B Ba Pol, Specja , Kolporter ca 2% each 2 B each Others 4000 ca 60% 70 B

Retail FMCG Retail FMCG top 10 (modern top 10 (modern distribution distribution) ) Company Market share Sale Biedronka (JMP) 14% 32 B Auchan/Real 5,0% 10 B Tesco 4,9% 9,5 B Lidl 4,7% 9,3 B Carrefour 4,6% 9,2 B Grupa Specja 3,7% 7,4 B Kaufland 3,2% 6,4 B GH Plus PL (P&P, Polomarket, SPAR, Topaz) 2,2% 5,4 B Leclerc 1,2% 2,1 B Netto 1,2% 2,1 B

Retail Retail formats formats number (market (market share number of stores of stores share) ) Modern chains contain ca. 8000 stores larger than 400 sqm: 570 hypermarkets (12%) 2300 - supermarkets (incl. 300mkw ca. 2900) (17%) 3500 dicounts (post discounts no hard discount in) (21%) 460 shopping centers of varied concepts 1500 - others (salons, exposition halls, semi-wholesale, etc) ca. 35.000 franchised traditional stores (av. 200 sqm) (7%) Plus traditional stores: hanged on wholesale (43%)

Phenomena Phenomena of of success success (1) (1) Lack of hard discount stores : the better they work the less are discounts 5 main players ca. 3600 stores - Biedronka: 2.550 - Lidl: 550 - Netto: 400 - Aldi: 80 - Czerwona Torebka: 40 Discounts are not the cheapest stores (compete with quality, PL, replicable and must have gama) This format shows competition referrence for franchisers and supermarket.

Phenomena of success (2) Phenomena of success (2) Two formulas of delicatessen stores - traditional (Krakowski Kredens, adverbials , colonial stores) some of franchise participants - supermarket concept (Piotr i Pawe , Alma) Pivotal role of PL at premium level Complementary mission to discounters and hypermarkets (to some extent) Vintage discounting vs vintage-prestige ofering

Phenomena of success(3) Phenomena of success (3) Poland has retained and modernized a huge numer of traditional stores The wholesale performes as a main integrator Pricing differences among formats does not excede 15% - including stores below 300 sqm There is ca. 950 franchise systems in the market to integrate: - ca. 60.000 stores among which 2/3 sell food taking 7% of food market - average area of franchise-store is ca. 130 sqm - there is ca 8.000 HoReCa businesses in franchise Integrating proces is deepened by part-franchise, franchising offered by producers, purchasing groups, partenrships, etc. These double the numer of integrated entities.

Traditional Stores: sources of streghts Traditional Stores: sources of streghts Number and strategies of integration Flexibility and access to scale effect Flat prices by format Niches and localizations Internet local markets Consumers bias to traditional shopping Bonds with local producers Strong local wholesales

Structures Foster Flexibility in cooperation Structures Foster Flexibility in cooperation Medium size companies (mainly meat and dairy) need to: - to surmount internal competition by attracting external partners and expanding onto their markets - to balance over-investments (benefit from full potentials) - to expectably look for compensatory payments (mutual sales of each-other-imported goods) Eligibility of ca. 200 companies

Main suggestion: have a partner Main suggestion: have a partner Choose appropriate format and scale of selling Cosider PL but be wary Know conditions of entering retail system (quality, flexiblity rules, delivery pace) Apply quality marks (example: meat suppliers apply PQS, QMP, QAMP: talk with them in a case) Identify financial rules and costs in a chain (net/net vs slotting fees) Selling is never for free Conditions of products removal (take-outs)

In Search of Mutualities In Search of Mutualities Do ut des I give that you give: mutual markets openning - commercial partenrs - producers Legal formula does not matter: clusters are fashionable but old ventures aren t bad, either Good Cicerone: organizations OK but more personalized consulting and jungle guiding helps faster Offers complemetarization, suplementing assortments, attract by news,

E E- -Commerce Commerce Two main concepts: - Specialized stores (Frisco, Amazon, Allegro, ) - Auxiliary channel of selling (from the shelf or from the storage): chains and traditional stores Local markets open to E-Commerce. -34% e-transactions come from settlements below 5.000 dwellers) New formulas: i.e. pick&collect; smartphone systems, etc Food: relatively weak ca. 1 B PLN but growth ca. 20% yearly. Market value in sales: 29 B in retail, but 65 70 B in B2B Advantages perceived: price, comfort, access to premium Challenges:packaging, logistics, flexibility, marketing, claiming

Exports via chains Exports via chains Sales value 7 B PLN, expected even 10 B in 2014 There are two leaders: Tesco and Lidl Counts Europe West and Region CEE PL dominates: advantages and necessities Common brands: vertical and horizontal Umbrellas: double fostered promotion Candid numer and role: brands abroad.

Stores Stores need need products (1) products (1) Meat Meat and and dairy dairy Meat - high potential and high level of technology. EU integration upgraded entire sector and opened deep markets. Plethora of assortments in fresh meat and its products (pork, poultry, beef). Poultry is a hit. Counts ca. 450 companies; 3,0 B Euro from exports Dairy: similiar situation cheese and milk gourmets (cream, milkbased cookies, snacks, yoghurts etc) are the hit. Also simple product: i.e. milk powder. Counts ca. 150 companies; 1,8 B Euro from exports

Stoores need products(2) Stoores need products (2) Sweets (candies, cookies, chocolate, gelees ) Sweets (candies, cookies, chocolate, gelees ) Prices of raw-materials and competition in the ntl. market open companies to exports: - preferable is: import/processing/export Reinforcement: export-cargo often cheaper than storing Consolidation in progres: need of potential partners New products to be offered: - icecream - sweet snacks (backed, long duration) - functional snacks (health-friendly certificates)