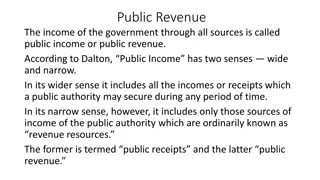

County Government Revenue Sources and Allocation in Kenya

The county government revenue in Kenya is sourced from various avenues such as property rates, entertainment taxes, and service charges. Equitable share forms a significant part of this revenue, allocated based on a formula developed by the Commission on Revenue Allocation. The funds given through the equitable share can be used by counties without restrictions. Understanding the sources and allocation of county government revenue is vital for effective governance and resource management in Kenya.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Interactive Session Entity Funding Kenya School Government Kabete 6thDecember 2018 CPA Robinson Kweyu

THE SOURCES OF COUNTY GOVERNMENT REVENUE IN KENYA LOCAL REVENUE EQUITABLE SHARE CONDITIONAL GRANTS LOANS DONOR FUNDING

LOCAL REVENUE Article 209 (3) of the Constitution empowers the county governments to impose two types of taxes and charges. These sources of county government revenue in Kenya are property rates and entertainment taxes. The county governments can also impose charges for any services they provide in accordance with the stipulated laws. Some types of these local revenue sources include rates, single business permits, parking fees, building permits, and fees from billboards and advertisements. All these sources of county government revenue in Kenya constitute the local revenue. The county governments impose the rates and taxes through the Finance Act.

EQUITABLE SHARE The equitable share is the money parliament shares vertically between the national and the county governments. The money comes from the ordinary revenue the national government raises nationally. The Senate then allocates the equitable share for the counties from the vertical share horizontally among the 47 counties. The equitable share is the biggest of the sources of county government revenue in Kenya. The equitable share for the counties should not be less than fifteen per cent of all the revenue raised by the national government. The most recent audited revenues by parliament should form the base for this threshold of 15 per cent.

EQUITABLE SHARE The Senate uses a revenue sharing formula developed by the Commission on Revenue Allocation (CRA) to divide the equitable share among the counties. The equitable share allocated to the counties is unconditional. That is, the county governments can spend the money without any restrictions from the national government. FUNDS GIVEN THROUGH THE EQUITABLE SHARE CAN BE USED IN ANY LEGAL WAY THAT THE COUNTIES WOULD LIKE; THERE ARE NO STRINGS ATTACHED (DR JASON LAKIN, INTERNATIONAL BUDGET (DR JASON LAKIN, INTERNATIONAL BUDGET PARTNERSHIP). PARTNERSHIP).

Revenue Allocation Formula CAi= 0.45PNi+ 0.26ESi+ 0.18PIi+ 0.08LAi+ 0.02FEi+ 0.01DFi Where: CA=Revenue allocated to county i= County: 1,,2 47. PNi=Revenue allocated to a county on the basis of Population Factor. ESi= Revenue allocated to a county on the basis of Equal Share factor. This is shared equally among the 47 counties. PIi= Revenue allocated to a county on the basis of Poverty Factor. LAi= Revenue allocated to a county on the basis of Land Area Factor. FEi= Revenue allocated to a given county on the basis of Fiscal Effort. DFi= Revenue allocated to a given county on the basis of Development Factor.

Revenue Allocation Formula - Population The weight of this parameter is 45% and is a proxy used to identify the expenditure needs of a county

Revenue Allocation Formula - Poverty The weight of this parameter is 45% and is a proxy used to identify the expenditure needs of a county

CONDITIONAL GRANTS The county governments can receive additional allocations from the national government s equitable share of revenue (from the vertical sharing). These additional allocations are known as conditional allocations or conditional grants. They are conditional when the national government imposes restrictions on how county governments will spend them. They are unconditional when the national government does not impose any restrictions concerning their expenditure. Most of these additional allocations are conditional allocations or grants. The county governments should spend them on specific items in the budget. They cannot divert them for other purposes. For example, if a county receives a conditional grant for level five hospitals, it should not divert the money for other purposes other than these hospitals.

CONDITIONAL GRANTS The conditional grants include the Equalization Fund (Article 204 of the Constitution) that benefits certain areas that CRA recognizes and categorizes as marginalized. Other examples are money for: Level Five hospitals, Compensation for user fees forgone (reimbursements for services county hospitals render) and Fuel Levy Fund (for maintaining county roads). Universal health care DANIDA Free maternal healthcare (a Jubilee Government flagship project. The grant is no longer given to county governments from the financial year 2017/18 after Treasury moved it to NHIF). Leasing of medical equipment (set up to facilitate the purchase of modern specialized healthcare equipment in at least two health facilities in each county).

CONDITIONAL GRANTS For example, a conditional grant may require that a county also put in matching funds. For instance, a county may receive a grant for 75 per cent of the cost of some service, such as a hospital, and be expected to put in 25 per cent on its own. If it refuses, it may not receive the grant. It is also important to note that not all counties receive some conditional grants. For example, only the counties with level five hospitals receive the regional grant for level five hospitals. In addition, only those areas recognized as marginalized using CRA s criteria receive the Equalization Fund.

LOANS Loans as sources of county government revenue in Kenya may come from external sources or private lenders. The external sources include foreign lenders such as multinational corporations (IMF, World Bank, etc.). The private lenders include commercial banks and other financial institutions. o The County Governments can borrow or access loans, which they repay with interest. o However, the counties must meet two conditions in order to access the loans. First, they can only access a loan if the national government guarantees the loan. That is, the national government should be willing to repay the loan if the county government is unable to repay. Second, the county assembly must approve any loans that the county government intends to borrow. o The Kenyan Constitution mandates Parliament to come up with legislation to prescribe how the national government should guarantee loans. o The county governments should not borrow beyond the limits set by the County Assembly. o

DONOR FUNDING Donor funding as one of the sources of county government revenue in Kenya involves aid from international donors. The international donors provide the aid in form of loans and grants. As with the national government, the international donors can also request counties to put in matching funds to receive a grant. Such international donors include: United States Agency for International Development (USAID); Denmark s development cooperation (DANIDA); and United Kingdom s Department for International Development (DFID). The donors can send the money directly to the counties as conditional grants or through the national government ministries, departments and agencies (MDAs). Apart from matching the funds, the donors may also require the counties to increase accountability mechanisms or improve the capacity of county staff in monitoring and expenditure of donor aid.

undefined

undefined