Evaluation of Economic Crisis Causes in 1929-1933: Republican Policies and Factors

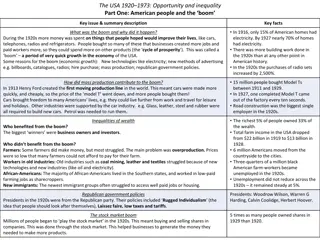

The economic crisis of 1929-1933 in the USA was influenced by various factors, including Republican government policies favoring laissez-faire capitalism, overproduction of goods, weaknesses in the banking system, international economic issues, and the Wall Street Crash. The prosperity of the 1920s, driven by consumerism and credit, set the stage for the subsequent downturn. Republican administrations under Presidents Harding, Coolidge, and Hoover implemented tax reductions benefiting the wealthy and big businesses, contributing to a pre-crash economic imbalance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

USA 1918- 1968 Evaluation of the Reasons for the Economic Crisis of 1929-1933

Factors 1. Republican Government Policies in the 1920s 2. Overproduction of goods and underconsumption 3. Weaknesses of the U.S banking system 4. International Economic Problems 5. Wall Street Crash

Context 1920s boomtime America Between 1921 and 1929, Americans enjoyed a level of prosperity, which had been previously unknown, either in the USA or anywhere else in the world. Average wage levels steadily rose and, for the first time, Americans were able to purchase an unprecedented range of consumer goods manufactured by the new techniques of mass production This obsession with new consumer goods, and the fact that most people eventually bought them on credit, led an American humorist, Will Rogers to say of the economic crisis that America was The nation that drove to the poorhouse in an automobile

Republican Government Policies in the 1920s- Knowledge (BG) After WW1, America was the richest nation on earth. The Republicans in power wanted to ensure they remained this way. (K1) Laissez Faire- Attitudes of Presidents (K1) President Harding shared the values of the business elite, and so did the colleagues who he appointed. (K1) He and Coolidge both chose Cabinets mostly composed of millionaires who could be expected to sympathise with any difficulties facing businessmen (K1) Coolidge The chief business of the American people is business (K1) Policies revolved around the principle that businesses should be allowed to operate as far as possible unrestricted by regulation. (K1) The Wall Street Journal, a financial newspaper, approvingly declared: Never before, here or anywhere else, has a Government been so completely fused with business. (K1) Under Coolidge, the Republicans became frankly the businessmen s party. (K1) Hoover believed in the virtues of rugged individualism . He was a self-made millionaire and did not see why Americans should be helped out of their difficulties. He believed that people should learn to stand on their own two feet, rather than expect the government to bail them out every time they faced problems. (K1) More than any of their predecessors, these Republican Presidents identified the fortune of America with the fortunes of business. When they spoke of business, Republicans meant privately operated business.

Republican Government Policies in the 1920s- Knowledge (K2) Tax Reductions (K2) Taxes on high incomes and company profits that had been imposed during the war effort were drastically reduced (K2) The Government reduced Federal Tax significantly in 1924, 1926 and 1928. (K2) This benefitted business and those who earned the highest salaries not the poor. (K2) Large-scale industrialists benefited from tax rebates, deferments (putting off payment) on loans and extended credit totalling $3.5 billion. (K2) Low capital gains tax encouraged share speculation (K2) This meant there had to be a cut in government spending from $6.4b to $2.9b in 7 years e.g. taking funding away from schools etc. (K2) Meant businesses had more money to expand, and consumers had more expendable income to spend on goods. (K2) The government believed that money would trickle down through all levels of society and raise standards of American life

Republican Government Policies in the 1920s- Knowledge (K3) Tariff Barriers (K3) The Fordney-McCumber Act 1922 created strict tariff barriers imposed on foreign imports (K3) It reduced the number of foreign goods being sold in America (K3) This is known as protectionism . (K3) The idea behind this was to led to an increase in American made goods being bought at the expensive of foreign goods

Republican Government Policies in the 1920s- Knowledge (K4) No help for farmers (K4) During the First World War, farmers had been encouraged to grow as much food as they could. (K4) Thanks to new technologies, machines and techniques, farm production increased dramatically. (K4) This resulted in lower prices for their goods. (K4) At the same time, after the war, agricultural output in Europe recovered and the demand for American exports fell steeply. (K4) Farmers would not willingly cut production. They couldn t trust that their neighbours would do the same. The farmers wanted the Government to guarantee prices. They would not do it. (K4) As prices dropped, many farmers lived in unhygienic conditions in tin shacks, without electricity or running water. (K4) In 1929, when the average monthly income of a skilled manufacturing worker might be $140, farm labourers were earning only $49 a month. (K4) Farmers generally had heavy debt payments for land, for equipment and supplies. More and more farmers were forced to sell. There were 1,000,000 less farms in 1930 than there had been in 1920. (K4) Between 1920 and 1932, one in four farms was sold to meet financial obligations .So, not everybody was able to participate fully in the emergent consumer economy in American. (K4) This impacts on America

Republican Government Policies in the 1920s- Analysis (A1) Instead: the rich got richer. The poor could not buy the mass goods being produced, which leads to an oversaturation of the market (underconsumption). Made worse by unregulated businesses setting wages at a low standard. (A1) By 1929 5% of the population received 1/3 of the income. 71% of the population received incomes of less than $2,500 a year the minimum generally thought necessary for decent comfort. (A1) Wages rose on average by 40% but in 1929 36,000 of the wealthiest families received as much income as the 12 million poorest (A2) Six million families 42% of the total had an income of less than $1,000 a year and certainly could not afford the new cars and gadgets rolling off the production lines (A2) Plus, the rich bought an increasing number of shares in an unpredictable market (A2) Increased share speculation led to risky investments, which later leads to Wall Street Crash

Republican Government Policies in the 1920s- Analysis (A3) However this back fired and the Europeans did the same putting a high tariff on Americans goods (A3) Therefore the US economy could not expand into foreign markets as rapidly as they could produce resulting in over-production/under-consumption (A3) It was virtually impossible for the USA to increase exports overseas, leading to further falls in production and increased unemployment. (A4) To survive, many farmers planted more crops instead of less, only worsening the problem of overproduction and falling prices. (A4) Lack of demand from Europe = American farmers' incomes were drastically reduced and they fell into debt (couldn t participate in spending on products)

Republican Government Policies in the 1920s- Analysis Plus (A+4) The situation was made worse by the policy of the US government. The Fordney-McCumber tariffs meant foreign exports to the USA were very expensive. If Americans did not buy foreign goods, foreigners would earn less and therefore have less money to spend on US foodstuffs. The result was a severe agricultural depression. During the 1920s more than 600,000 farmers went bankrupt.

Republican Government Policies in the 1920s- Evaluation (EV 1+2) Peter Clements: These policies and lack of government regulation created a dynamism within the age that encouraged risk and adventure (EV) Hugh Brogan: This was an era of irresponsibility (EV 2) Howard Zinn: Economic growth, rather than diminishing the gap between the rich and poor, increased it.

Overproduction of Goods and Underconsumption- Knowledge (BG) The American economy was changing during the 1920s and output increased by a staggering 50%. (K1) The New Era used mass-production methods (moving assembly line) to produce huge amounts of goods could be made at a fraction of the cost because they were made by unskilled labour & costs were cut through bulk buying (K1) This meant many good for the first time were accessible to the whole nation not only the wealthy. (K1) The production of automobiles rose from 1.9 million in 1920 to 4.5 million in 1929. Henry Ford s reliable Model T ( tin Lizzie ) appeared in 1908 & by 1929 more than 23 million were produced. The car industry stimulated other industries as well such as steel, rubber and petrol. It also resulted in the expansion of roads creating jobs 10,000 miles worth per year. (K1) Other goods such as hand cameras, wristwatches, cigarette lighters, vacuum cleaners, refrigerators and washing machines were other examples of mass-produced goods which flooded the market. (K1) By 1923 there were over 500 stations and 3 million radios in action (K1) Many Americans thought they had entered a new era of prosperity due to the availability of work that they accepted new offers of CREDIT in order to buy what they could not afford out of their pocket

Overproduction of Goods and Underconsumption- Knowledge (K2) Lack of Income (K2) However, workers income in the 1920s did not rise with the increased productivity. (K2) The purchasing power of farmers had also declined. Between 1920 and 1932 the total income of farmers dropped by approximately 70%. Many small farmers lived in appalling conditions and many lost their farms due to outstanding debts. (K2) 71% of the population were earning less than a decent comfort wage of $2,500 annually - the minimum thought necessary for decent comfort but definitely not enough to be buying the latest models (K2) Unequal distribution of wealth (K2) As we know, business had benefited from low tax policies. These cuts had no impact on the poor as they weren't earning enough to be paying tax in the first place. (K2) The result of this was that the bottom 40% of the population received only 12.5% of the nation s wealth. (K2) In contrast, the top 5% of the population owned 33% of the nation s wealth. Only a wealthy minority of the US population could afford the new consumer goods that rolled off factory production lines but as mentioned, there were only so many of these goods that people really NEEDED. When they reached this, they stopped buying.

Overproduction of Goods and Underconsumption- Analysis (A1) By 1929 those people who had the money to buy consumer goods even on credit, had already bought them (there are only so many Hoovers rich families could own). (A1) The poor, many of whom who were not earning enough to buy item out right and had bought the items on credit, were unwilling to take out more of a loan to buy goods they didn t really need . (A1) This meant the market was SATURATED there was no need for the mass of goods still being (A1/2) The USA was experiencing the serious problem of over production. Goods were piling up in warehouses across the country - businesses went bust as people were not buying their goods. (A2) The enormous output of goods required a corresponding increase of consumer buying power, for example, higher wages however, this did not happen (A2) This meant there was a surplus of goods which led to a fall in prices and a fall in companies profits. (A2) Companies had to cut costs and did this by letting workers go which resulted in huge unemployment.

Overproduction of Goods and Underconsumption- Analysis Plus (A+1) Therefore, domestic demand never kept up with production. (A+1) By the end of the 1920s the market for the new consumer goods was saturated. (A+ 1) By 1929 automobile factories had to lay off thousands of workers because of reduced demand (A+2) As a large percentage of the population could not afford the goods that were being produced throughout the 1920s, and the wealthy had stopped buying, there was a fall of prices and a fall in company profits. (A+2) To cut costs, companies let workers go resulting in high unemployment and later the Great Depression in the 1930s

Overproduction of Goods and Underconsumption- Evaluation (EV) Howard Zinn: One-tenth of 1% of the families at the top received as much as 42% of families at the bottom (KU1/2/EV) (EV) John Kenneth Galbraith: No one was responsible for the Wall Street Crash. No one engineered the speculation that preceded it. Both were the product of free choice and decisions of thousands of individuals they were impelled to it by the seminal lunacy which has always seized people who are in turn seized with the notion that they can become very rich (KU1/2/EV)

Weaknesses of the U.S Banking System Knowledge (BG) The U.S. banking system was underregulated and so promoted their own interests rather than the interests of the nation = banks doing well from suffering of others (background) (K1) Lack of banking regulation (K1) The US banking system was made up of hundreds of small, state-based banks. This is because the government didn t allow BRANCHING e.g. one large bank that has many branches in different locations. (K1) In hundreds of small communities local people put their money into the banks for safe keeping and a small amount of interest. Banks then used that money to make investments that made some money for the banks. As the economic boom grew, banks invested savers money in stocks and shares in the hope of making a large profit (K1) The banking system allowed the banks to regulate themselves without the Government interfering. (K1) They allowed 75% of the purchase price of shares to be obtained on credit. By 1927 there was an average of 5 million transactions per day. (K1) People had blind faith in the market fluctuation between 1928-9 had always been fixed (so didn t change) . Brokers used persuasive rags to riches tales to encourage people to invest in shares (K1) There was little consistency in measures to discourage speculation . For example Charles Mitchell (a businessman) pumped $25m of his own money into the broker industry even though the Federal Reserve Board were trying to discourage speculation. (K1) Further, in 1927 the Federal Reserve Board also lowered interest by 0.5% (K1) Plus, members of the FRB were bankers themselves, so they only gave half-hearted efforts to reform/prevent speculation. Plus, they didn t want regulation because of a widespread support in laissez-faire

Weaknesses of the U.S Banking System Knowledge (K2) Easy Credit (K2) The Credit System (K2) Credit was the easiest way for banks to make money. Bankers encouraged people to take out loans to buy new consumer goods and to speculate on the stock market. As with all loans, people would make regular payments to the bank (plus interest) over a set period until the loan was repaid. (K2) In 1921 there were 30,000 independent banks - set up in response to the demand for hire purchase credit (like we currently have, particularly for cars) to buy all the new mass-produced goods (K2) For example 75% of cars on the road and 50% of household goods were bought on credit and by 1929 $7 billion of goods were sold on credit. (K2) It was assumed everyone s credit was good. Almost everyone was in debt but no one seemed concerned. Banks and loan companies would lend money with very few questions asked. (K2) It was estimated that men earning $35 a week were paying out the same amount per month for their family car. Companies sometimes used credit facilities to finance operations.

Weaknesses of the U.S Banking System Analysis (A1) However as these banks were very small they were unable to withstand major setbacks - say due to a crop failure. If they collapsed their investors would lose virtually all their savings (A1) The banks were loaning large amounts of their investor s money and were expecting to make large profits which did not happen especially following the Wall Street Crash when loans could not be repaid (A1) They gave out loans too easily to unreliable clients (A1) As a result there was a crisis in confidence in the banks and people began to withdraw their savings as they were afraid of losing their money. This was called a run on banks (A1) The banks could not pay back the money and as a result went bankrupt and collapsed. Overall impact : (A1) In 1929, 659 banks closed losing a total of $200 million and in 1931, 2,294 banks closed losing a total of $1.7 billion (A1) By the end of 1932, twenty per cent of the banks that had been operating in 1929 had closed down. The normal banking system almost ceased to exist and without an efficient banking system, the economy could not function.

Weaknesses of the U.S Banking System Analysis (A2) This was all fine as long as people remained employed and had reasonably high wages. (A2) The banks happily loaned out huge amounts of their investors' cash, expecting to make big profits on interests to the loans as well as in the stock market themselves. However as these banks were very small they were unable to withstand major setbacks (A2) Between 1921-28 5,000 went bust due to being unable to cope with setbacks. This then happened on a much larger scale from 1929 as people began to lose their jobs and receive lower wages

Weaknesses of the U.S Banking System Analysis Plus (A+1) However: the weak banking system was caused by the Republicans laissez- faire approach to politics and their failure to impose adequate banking regulations (A+1) The U.S. banking system was underregulated and so promoted their own interests rather than the interests of the nation = banks doing well from suffering of others (A+2) However, this was only done because of the new consumer market (overproduction). and (A+2) Because banks weren t government regulated, they could continue to practice irresponsible lending (loaning to people they shouldn t have loaned money to as it was unlikely they would be able to repay the loans, or they were using the money for investment in unpredictable stocks). (A+2) Increased unemployment in the late 1920s also meant that these loans became even more risky

Weaknesses of the U.S Banking System Evaluation/ Analysis Plus (EV 1) Crafts and Fearon: Particularly important in contributing to the severity of the Great Depression, [was] the US unit banking system (EV 1) Eugene Nelson White: Increased branching would have substantially strengthened the banking system and probably have prevented the wave of bank failures in the 1930s (EV 2) John A. Garraty: The trouble came to a head mainly because of the easy credit policies of the Federal Reserve Board, which favoured the rich.

International Economic Problems- Knowledge (K1) Post WW1 (K1) The post war boom in America created over confidence in American economy. People thought it would always be a strong economy, so made riskier investments. To try and continue this boom, the Republicans followed a policy of protectionism. (K1)To do this, they placed high tariffs on international goods. The Fordney- McCumber Tariff of 1922 continued the Emergency Tariff of 1921. (K1) Its protection on many items was extremely high, ranging from 60 to 100 percent of the price of the item (if it cost $2 in Germany, it would cost up to $4 in America)

International Economic Problems- Knowledge (K2) The US had lent over $10 billion to the allies during WWI which they had to repay. Germany owed 6.6b reparations to Britain and France they planned to use this to pay America. (K2) Germany then borrowed from US to rebuild industries and currency (K2) In this way, the Dawes and Young Plans which gave Germany money on loan from America effectively allowed Germany, France and Britain to pay America back using American money.

International Economic Problems- Analysis (A1) US tariff barriers meant that other countries found it difficult to pay back loans. Furthermore, in retaliation, foreign countries (except Britain) put high tariffs on American goods coming into their countries making it harder for American companies to sell their goods around the world. This did not help them sell the surplus goods that American consumers were not buying. (A1) The Republican policy of protectionism ultimately failed to help America s economy. It may have initially helped the US domestic market by making foreign goods more expensive meaning consumers would buy cheaper American made goods which stimulated America s economy.

International Economic Problems- Analysis (A2) One historian said America had taken money out of one Treasury building and put it in another (A2) The system worked well as long as there was an outflow of American capital, but this did not continue. (A2) This was probably at the heart of the economic problem. The Americans wanted the European nations to repay the loans that they had taken out through the war but some countries had problems making the payments.. (A2) This meant the USA had to accept reduced payments and when the crash came there was no country in a position to help the USA. The international nature of finance meant that other countries slipped into depression too.

International Economic Problems- Analysis Plus (A+1) However, America could only do well for so long on its own there needed to be a prospering WORLD economy to continue the boom protectionism stopped this. (A+2) However: this was made worse by high tariffs implemented by Republicans which reduced overseas demand for US goods contributed to overproduction and underconsumption

International Economic Problems- Evaluation (EV1)Eric Rauchway: war also changed America, rendering the once peripheral New World central to the planet s concerns (EV2)Peter Clements: International debt after WWI was at the heart of the American economic problems after 1929.

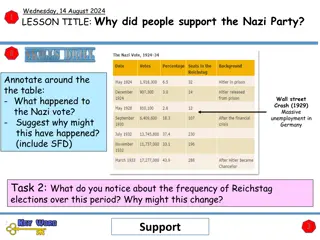

The Wall Street Crash- Knowledge (BG) Wall Street Crash = when stock prices dramatically dropped in a short space of time on October 24th 1929 (BG) The boom of the 1920s had been consistently strong, and false confidence made people invest in risky ways, such as on credit. However, this boom wouldn t last, and the Wall Street Crash had disastrous consequences. (K1) Speculative Buying (K1) The stock market contained the seeds of its own collapse. America had gone Wall Street Crazy and went on a spending spree in the Roaring Twenties . Many overextended themselves thinking they could not lose and financed their investments in the stock market by taking out loans (credit buying on margin) With prices rising constantly throughout 1929, everyone was confident that ever-rising share values would continue. Few paused to consider what would happen if prices fell. People chose to ignore the golden rule of business: that the share price could collapse as well as soar. (K1) As the share prices went up, the demand for shares increased further as people saw the chance to make easy money. (K1) The higher a share cost, the more it looked like the business was doing well. This is turn made it look like the American economy was doing well. People would borrow money so that they could buy shares, this was called buying on the margin (K1) Then when the stock prices were high enough they would sell them, pay money back to the bank and keep the small fortune they had made (K1) This created a get rich quick culture which meant that investors were forcing up share prices with money they did not really have (You can see some of this get rich quick culture in action when you study The Great Gatsby in English)

The Wall Street Crash- Knowledge (K1) When times were good, investors would buy stock valued at $100. (K1) They would get a loan to pay a 20% deposit of the share value so $20. This means there was an outstanding balance of $80 to be paid later. (K1) However, as times were good, the stock s value would rise. The investor would then sell the stock when it reached $160 they would pay off the balance on the account ($80), pay back the loan for the deposit ($20), and make $60 profit. (K1) BUT: if instead of rising, the stock price falls before the investor has time to sell, they face problems. (K1) For example, if this $100 stock dropped to only being worth $50, then they still owe $50 to the stockbroker they bought it from originally. (K1) They can sell the stock for $50, and put that towards paying back their $20 loan, and the $80 balance but will still need to find another $30 to pay the broker. (K1) During the late 1920s, the economic boom started to slow down. There was an atmosphere of uncertainty in October 1929 and some shareholders began to sell their shares, believing that prices were at their peak.

The Wall Street Crash- Knowledge (K2) Nearly everyone in America had invested in shares and the stock market was huge. However in October 1929 things started to go wrong (K2) A few of the smarter people and companies began selling their shares in fear of them going bust. This was when everyone else began to panic and started selling - this led to the run on the banks trying desperately to retain some of their finances (K2) This was known As Black Tuesday and $14 million were wiped off the value of shares. Their shares were now worthless and many people had lost all their money. They could not repay bank loans as they had lost everything (K2) Banks were forced to shut as they had no money and even people who had had nothing to do with the stock market but had put their money in banks to save up and keep safe lost it all as the banks could not give it back as they d lent it to other people, or had gambled with people s savings in the hope of achieving a big return and making substantial profits (K2) Jobs, homes, and possessions were all lost because of the Wall Street Crash. People even took their own lives because the pressure was too much for them. (K2) The stock market crash did play a role in the depression but its significance was more as a trigger. The Wall Street Crash led to a collapse of credit, and of confidence. (K2) Between 1929-32, 100,000 businesses collapsed and 15 million became unemployed; millions lost their savings and pensions as banks went out of business

The Wall Street Crash- Analysis (A1) Impacts of Speculative Buying (A1) It can be argued that the speculative buying in the 1920s led to the Depression of the 1930s (A1) The soaring prices of shares did not reflect their true value - this showed the lack of understanding existed AND that a crash was inevitable (A1) The get rich quick scheme would only work if the market continued to rise (A2) Some historians argue that the Wall Street Crash was a symptom, not the disease and that it was a symbol of how unstable the economy had become during the boom period of the 1920s (A2) The crash is important in causing the banks to collapse which massively damaged the economy. By itself however it was not a sufficient cause of the depression as it could not have done so much damage if the banks were not in such poor health due to lack of regulation under Republican policies

The Wall Street Crash- Evaluation (EV1) Piers Brendon: Wall Street inspired visions of boundless wealth. (EV1/2) Milton Friedman (Economist): The Federal Reserve Bank didn t respond to the crisis quickly enough should have introduced more money into circulation after the crash. This failure of action caused the Depression. (EV1/2) Hall and Fergusson: Due to a combination of economic ignorance, confusion, and incompetence, U.S. policy makers pursued policies that were highly contractionary. They deepened and transformed the recession into a Great Depression. (EV2) Joseph Schumpeter (Economist): The crash was just another event in history at the end of the economic cycle. (EV2) Robert Sobel: The Wall Street Crash did not lead to bank failures they didn t fail until 1931/32. Instead, it was President Hoover s inactivity after the crash which led to collapse (links to Republican policy)