Risk Analysis for GST Enforcement

Delve into the cutting-edge approach of ANVESHAN for risk analysis in GST enforcement, focusing on early identification of risky taxpayers, anomalies in digital information, and actionable intelligence to combat fraud. This presentation highlights the utilization of registration documents, E-way bills, and Fastag data to enhance the efficacy of risk management and enforcement measures in the GST framework.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Risk Analysis for GST Enforcement Presentation by the Directorate General of Analytics & Risk Management National Conference of Enforcement Chiefs of State & Central GST 04.03.2024 1

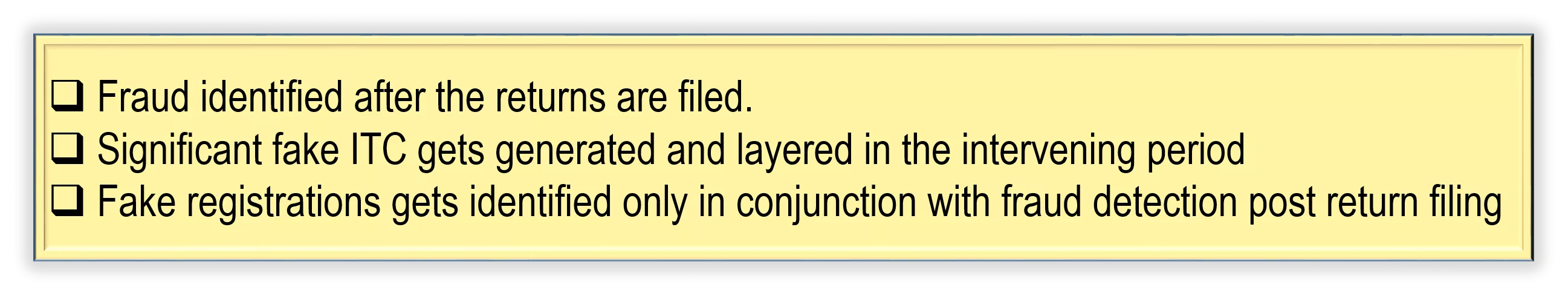

Risk Analysis : Beginnings Analysis based on Return Filing Cycle (GSTR-1/3B) Initiated Identification of List of risky taxpayers shared for verification Mismatch in 2A-3B, 1-3B, etc. e-way bill New Registration Taken . . Risky Taxpayers GST returns data Fraud identified after the returns are filed. Significant fake ITC gets generated and layered in the intervening period Fake registrations gets identified only in conjunction with fraud detection post return filing 2 CONFIDENTIAL

New approach to Risk Analysis : ANVESHAN New approach to Risk Analysis : ANVESHAN Registration documents, E-way bills, VAHAN / Fastag data ANALYSIS on the data prior to the Return Filing Stage List of risky taxpayers shared for verification Identification of New Registration Taken Risky Taxpayers In addition to existing risk management approach, new approach is to advance the risk analysis before return cycle and to make it pinpointed and actionable. 3 CONFIDENTIAL

ANVESHAN ANVESHAN- - Actionable Intelligence Actionable Intelligence Single point identification of entire risky supply chain networks Removing constraints of Jurisdiction/Human resources for speedy and efficient enforcement Detecting anomalous behaviour of new registrants Analysis of EWB linked with FASTag data Targeting fake and fraudulent ITC Zeroing in on ultimate beneficiary 4

ANVESHAN : Anomalies in Digital Information ANVESHAN : Anomalies in Digital Information Exercise to weed out fake registration Analysis of registration documents in the time window between registration and kicking in of returns cycle PAN: CAAPV0024M Illustration-I 24CAAPV0024MIZT Vaghela Akash Harsukhbhai Vaghela Traders 36CAAPV0024MIZO Vaghela Akash Harsukhbhai Ever Star Enterprise 33CAAPV0024MIZU Vaghela Akash Harsukhbhai V K Enterprise 27CAAPV0024MIZN Vaghela Akash Harsukhbhai V A Enterprise 24CAAPV0024M2ZS Vaghela Akash Harsukhbhai Tradillion & Store 5

Illustration-II PAN : GKRPS4027N GSTIN: 33GKRPS4027N1ZE : SV Jasvantbhai Shah Enterprise PAN: LHEPS1418N GSTIN 09LHEPS1418N1ZN Solanki Mukesh : Kushwaha Ent. PAN : DOPPG3692A GSTIN: 27BOPPG3692A1ZU MP Gaekwad Tirupati Enterprise PAN:GAOPP7529B GSTIN 14GAOPP7529B1ZH PV Karshanbhai, Mayadevi Ent. Outcomes: No of GSTINs found fake/non-existent 259 Registration Months GSTINs shared No. of GSTINs Verified Percentage Oct/Nov 2023 438 286 90% 6

ANVESHAN ANVESHAN Early Warning Series Early Warning Series Exercise to identify New Registrants with propensity to generate fake ITC Analysis of EWB/FASTag data in the time window between registration and kicking in of returns cycle Actionable input shared with Field on 28.02.2024 PoC undertaken for New Registrations obtained in February 2024 Analysis conducted in third week of Feb 7

Illustration Gajanand Steel Traders 1. Mewara Traders 0.1 2. Regn: 7.2.2024 3. Outward supply : 1.9 cr. in 15 days 4. Inward supply : 0.2 cr. Mewad Scrap 0.2 Ayodhya Alloys Mewara Traders Nil inward 0.2 cr. 0.28 Vinayak Enterprises 0.65 0.64 Rishikesh Iron Steel 5. Verification: Non existent Patel Techno Outcome: No. of GSTINs Verified No of GSTINs found fake/Non-existent GSTINs shared Percentage Centre 19 16 16 100% State 13 1 1 100% Total 32 17 17 100% 8

Moving Ahead Inputs to the field have yielded encouraging results Suggestions from field formations will help in refining the risk analysis. The directorate is working to automate and scale up the process of generation of these reports. This will ensure more detections and faster dissemination of inputs to field formations. 9