GST Jurisdiction and Enforcement Procedures Explained

This content covers various situations involving GST enforcement, such as denial of tax payment options, cancellation of registrations, rejection of applications, and more. It also discusses show cause notices under different sections, the role of proper officers, and jurisdiction aspects in the context of the Goods and Services Tax (GST) system in India.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

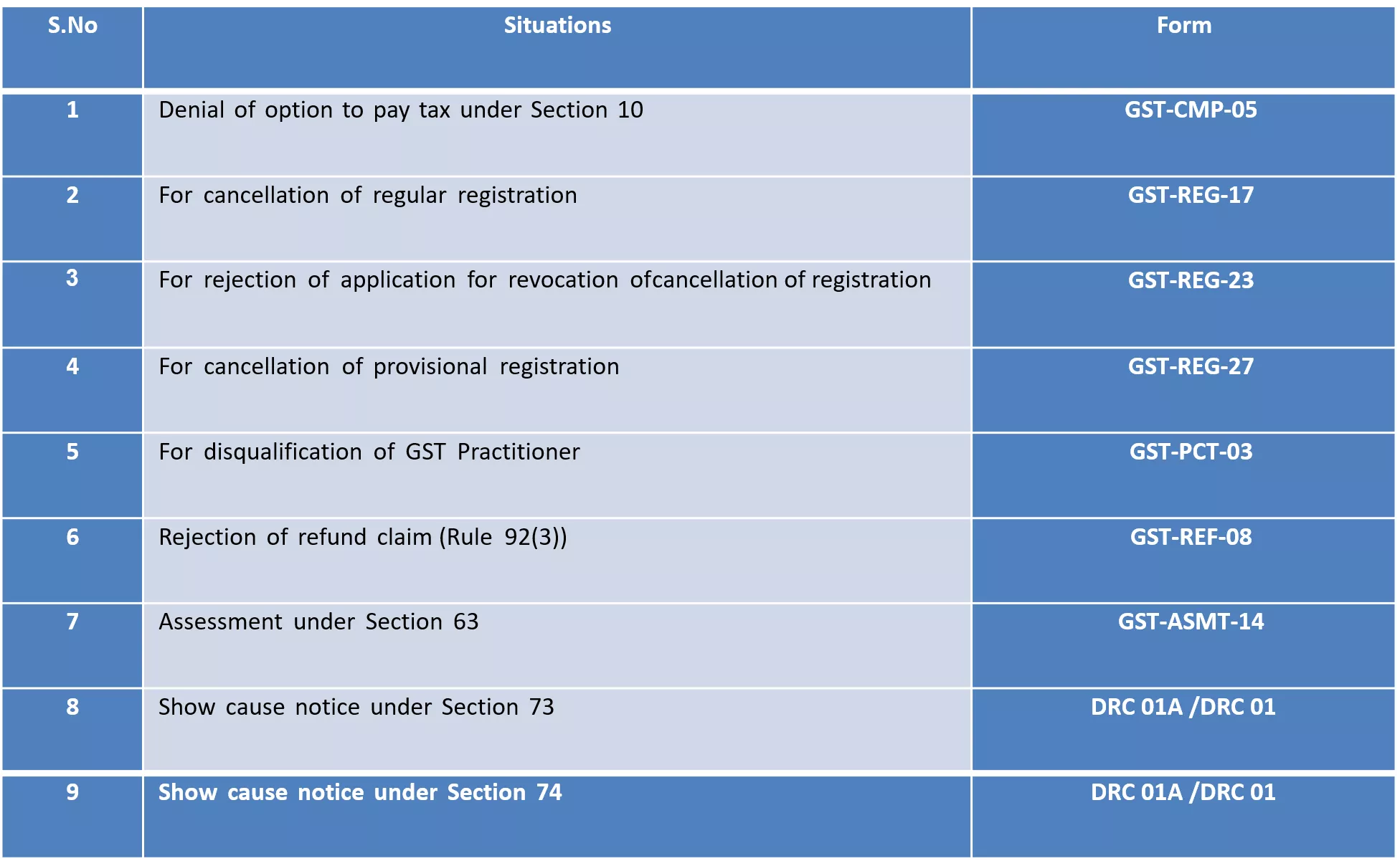

Situation of SCN S.No Situations Form 1 Denial of option to pay tax under Section 10 GST-CMP-05 2 For cancellation of regular registration GST-REG-17 3 For rejection of application for revocation ofcancellation of registration GST-REG-23 4 For cancellation of provisional registration GST-REG-27 5 For disqualification of GST Practitioner GST-PCT-03 6 Rejection of refund claim (Rule 92(3)) GST-REF-08 7 Assessment under Section 63 GST-ASMT-14 8 Show cause notice under Section 73 DRC 01A /DRC 01 9 Show cause notice under Section 74 DRC 01A /DRC 01

10 Show cause notice under Section 76 DRC 01A /DRC 01 11 Section 107 (11) by Appellate Authority DRC 01A /DRC 01 12 Section 122 Penalty for certain offences. DRC 01A /DRC 01 13 Section 123 Penalty for failure to furnish information return. DRC 01A /DRC 01 14 Section 124 - Fine for failure to furnish statistics. DRC 01A /DRC 01 15 Section 125- General penalty.Power to impose penalty in certain cases. DRC 01A /DRC 01 16 Section 127 Power to impose penalty in certain cases. DRC 01A /DRC 01 17 Section 129 Detention, seizure and release of goods and conveyances in transit MOV 07 18 Section 130 Confiscation of goods or conveyances and levy of penalty. MOV-10

Show Cause Notice under Section 73 73. (1) Where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised for any reason, other than the reason of fraud or any wilful-misstatement or suppression of facts to evade tax, he shall serve notice on the person chargeable with tax which has not been so paid or which has been so short paid or to whom the refund has erroneously been made, or who has wrongly availed or utilised input tax credit, requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under section 50 and a penalty leviable under the provisions of this Act or the rules made thereunder.

Proper Officer who is Being section 5 to carry out this function under the law. Section 6(1) (CGST / SGST PO) Circular 3/3/2017 GST Circular 31/05/2018-GST applicable to SGST Also?) Circular 169/01/2022-GST DGGSTI have jurisdiction the territory of India (Noti. 14/2017 CT) State Enforcement Jurisdiction (Noti. 06.02.2018) one authorized under (Is it throughout have Whole state

Cross Empowerment 6. (1) Without prejudice to the provisions of this Act, the officers appointed under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act are authorised to be the proper officers for the purposes of this Act, subject to such Government shall, recommendations notification, specify. conditions as the the by on Council, of the

Clarifications / Instructions / Orders - GST F.No. CBEC-20/10/07/2019-GST 3.1 The issue has been examined in the light of relevant legal provisions under the CGST Act, 2017. It is observed that Section 6 of the CGST Act provides for cross empowerment of State Tax officers and Central Tax officers and reads as: 6. (1) Without prejudice to the provisions of this Act, the officers appointed under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act are authorised officers for the purposes- of this Act, Subject to such conditions as the Government shall, on the recommendations of the Council, by Notification specify. to be the proper

3.2. 6 of the CGST Act and sub-section (1) of section 6 of the respective State GST Acts respective State Tax officers and the Central Tax officers respectively are authorised to be the proper officers for the purposes of respective Acts and no separate notification is required for exercising the said powers in this case by the Central Tax Officers under the provisions of the State GST Act. It is noteworthy in this context that the registered person in GST are registered under both the CGST Act SGST/UTGST Act. Thus in terms of sub-section (1) of section and the respective

Trigger Point when a person has (a) not paid or (b) short paid or (c) erroneously received refund, or (d) wrongly availed or utilised input tax credit for any reason, other than the reason of fraud or any wilful-misstatement suppression of facts to evade tax, or Additionally, a summary of the total demand in Form DRC-01 also will be issued along with the show cause notice Rule 142(1)(a)

Rule 142(1A) 1A) service of notice to the person chargeable with tax, interest and penalty, under sub-section (1) of Section 73 or sub- section (1) of Section 74, as the case may be, tax, interest and penalty as ascertained by the said officer, in Part A of FORM GST DRC-01A.] W.e.f. 15.10.2020 substituted with word Shall The proper officer may*, before 9[communicate] the details of any The Word may is

DRC 01A up to 15.10.2020 provision, amendment 15.10.2020, employed. ANDHRA M/S. New Morning Star Travels Versus The Deputy Commissioner (St) Versus The Assistant Commissioner (St) , The Deputy Commissioner (St) , The State Of Andhra Pradesh, The Union Of India which with the stood effect word before from shall is PRADESH HIGH COURT

REPLY TO DRC 01A IS mandatory? IN THE HIGH COURT OF ORISSA AT CUTTACK Shri D. Murali Mohan Patanaik-Secretary to Government of Department and others Odisha, Finance

Rule 142. Notice and order for demand of amounts payable under the Act.- (1) The proper officer shall serve, along with the (a) notice issued under section 52 or section 73 or section 74 or section 76 or section 122 or section 123 or section 124 or section 125 or section 127 or section 129 or section 130, a summary thereof electronically in FORM GST DRC-01, (b) statement under sub-section (3) of section 73 or sub-section (3) of section 74, a summary thereof electronically in FORM GST DRC-02, specifying therein the details of the amount payable.

Power to impose penalty in certain cases. 127. Where the proper officer is of the view that a person is liable to a penalty and the same is not covered under any section 62 or section 63 or section 64 or section 73 or section 74 or section 129 or section 130, he may issue an order levying such penalty after giving a reasonable opportunity of being heard to such person. proceedings under Section 122?

Time Limit Section 73(2) when read with Section 73(10), spells out the time limit for passing the adjudication with the time limit for issuance of show cause notice. It adjudication order needs to be passed within three years from the due date for furnishing of annual financial year to which the tax relates to or within three years from the date of erroneous refund. order along says that, the return for the

It prescribes that the show cause notice shall be months before the due date of passing of adjudication orders. issued at least 3

Tax Period Due Date for filling Annual Return SCN u/s 73 to be passed before Order u/s 73 to be passed before 2017-18 05.02.2020 (For Chandigarh, Delhi, Gujarat, Haryana, Jammu& Kashmir, Ladakh, Punjab, Rajasthan, Tamilnadu and Uttarakhand) 07.02.2020 (For all other states) 30.06.2023 30.09.2023 30.09.2023 31.12.2023 2018-19 31.12.2020 30.09.2023 31.12.2023 31.12.2023 31.03.2024 2019-20 31.03.2021 31.12.2023 31.03.2024 31.03.2024 30.06.2024

Notification. 35/2020-Central Tax, Notification No. 14/2021 Central Tax Notification No. 13/2022-Central Tax Notification No. 09/2023- Central Tax

CBIC vide Notification No. 09/2023 Central Tax dated March 31, 2023 [Power of Government to extend time limit in special circumstances 168A. (1) Notwithstanding anything contained in this Act, the Government may, on the recommendations of the Council, by notification, extend the time limit specified in, or prescribed or notified under, this Act in respect of actions which cannot be completed of complied with due to force majeure. (2) The power to issue notification under sub-section (1) shall include the power to give notification from a date not commencement of this Act. Explanation.- For the purposes of this section, the expression force majeure means a case of war, epidemic, flood, drought, fire, cyclone, earthquake or any other calamity caused by nature or otherwise affecting the implementation of any of the provisions of this Act.] retrospective earlier effect to date such than the of