Quarterly Survey of Transactions with Foreign Persons Webinar

Explore the BE-125 survey focusing on transactions in selected services and intellectual property with foreign persons. Understand the purpose, participants, and reporting guidelines for this survey conducted by the BEA. Learn about key economic indicators and how the data is utilized in shaping U.S. international economic policy.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

BEA Webinar Series BE-125 Quarterly Survey of Transactions in Selected Services and Intellectual Property with Foreign Persons Presenter: Damon Battaglia Webinar Time: TBD April 25, 2014 www.bea.gov

Introductions and Agenda Presenter: Damon Battaglia Facilitators: Faith Brannam, Steve Muno How the BE-125 survey data are used Understanding reportable and non-reportable transactions with foreign persons An explanation of affiliation types and reporting relationships An overview of BEA s eFile system General Q&A bea.gov

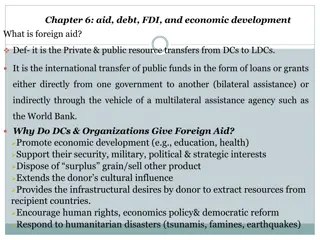

Purpose of the BE-125 Survey Obtain up-to-date data on the size and economic significance of services and intellectual property transactions between U.S. and foreign persons Support U.S. international economic policy Compile key economic indicators U.S. trade balance U.S. international transactions accounts, including the current account balance Gross Domestic Product (GDP) bea.gov

Transactions with Foreign Persons http://ncgmp.usgs.gov/images/usa_map.jpg A U.S. person means any person resident in the United States or subject to the jurisdiction of the United States. The word person used in this tutorial is a legal term that means any individual, branch, partnership, associated group, association, estate, trust, corporation, or other organization and any government. U.S. A Foreign person means any person resident outside the United States or subject to the jurisdiction of a country other than the United States. Payments Foreign Countries Receipts bea.gov

Transactions with Foreign Persons Exports of advertising services bea.gov

Work Performed by Foreign Affiliates for Other Foreign Persons bea.gov

Subcontracting with Foreign Affiliates Imports of advertising services Exports of advertising services bea.gov

Accrual Basis Transactions should be reported on an accrual basis Exception- Telecom services should be reported on a settlement basis For guidance on adjustments, send an email to be125help@bea.gov, or call (202) 606-5588. bea.gov

Goods are Not Reportable Goods are not reportable However, there is an exception bea.gov

Other Items Not Reportable Payments or receipts for financial instruments, including stocks, bonds, financial derivatives, loans, mutual fund shares, and negotiable CDs. Exceptions: payments for securities brokerage services should be reported under transaction code 17, financial services Income on financial instruments (report on BE-185 survey) Compensation paid to, or received by, employees. Exceptions: Commissions paid to foreign sales agents are reportable under transaction code 25, trade-related services other than merchanting services. Penalties, fines, gifts or grants. bea.gov

Relationships with Foreign Persons Foreign affiliates - an entity domiciled in a foreign country that is owned at least ten percent, directly or indirectly, by the U.S. reporter. Foreign parent(s) and foreign affiliates of foreign parent(s) A foreign parent is the foreign entity, or the first entity outside the United States in a foreign chain of ownership, which owns at least ten percent, directly or indirectly, of the U.S. reporter. Foreign affiliates of foreign parents would be those companies located abroad that are owned at least ten percent, directly or indirectly, by the foreign parent, but less than ten percent, directly or indirectly, by the U.S. reporter. Unaffiliated foreign persons - an entity domiciled abroad that is owned less than ten percent, directly or indirectly, by the U.S. reporter or the U.S. reporter s foreign parent. bea.gov

Examples of the Ten Percent Ownership Rule Company A 5%, unaffiliated 80%, affiliated Company B Company C 8%, unaffiliated 10%, affiliated Company D bea.gov

Alternate Filing Options Survey forms in PDF or Excel spreadsheet format are available at: http://www.bea.gov/ surveys/iussurv.htm Receive survey form by sending a blank email to: be125@bea.gov bea.gov

How to File the Survey bea.gov

Reporting Thresholds Is the $6m threshold per type per country or just per type of service? Reporting threshold for schedules A and/or C Receipts: Receipts from foreign persons in any one of the covered types of services and intellectual property that exceeded $6 million in the previous fiscal year or that are expected to exceed that amount in the current fiscal year. Reporting threshold for schedule B Payments: Payments to foreign persons in any one of the covered types of services and intellectual property that exceeded $4 million in the previous fiscal year or that are expected to exceed that amount in the current fiscal year. bea.gov