Understanding Overseas Joint Venture Agreements with Eyemax Group Holdings

Eyemax Group Holdings is exploring the possibility of creating a private equity fund to acquire solar lenses and partnering with utility companies for expertise in energy distribution. Joint venture structures and types are discussed, emphasizing the benefits of pooling resources for specific tasks. Key considerations for engaging with partners in overseas joint ventures are highlighted.

- Overseas Joint Venture

- Eyemax Group Holdings

- Business Arrangements

- Private Equity Fund

- Utility Companies

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

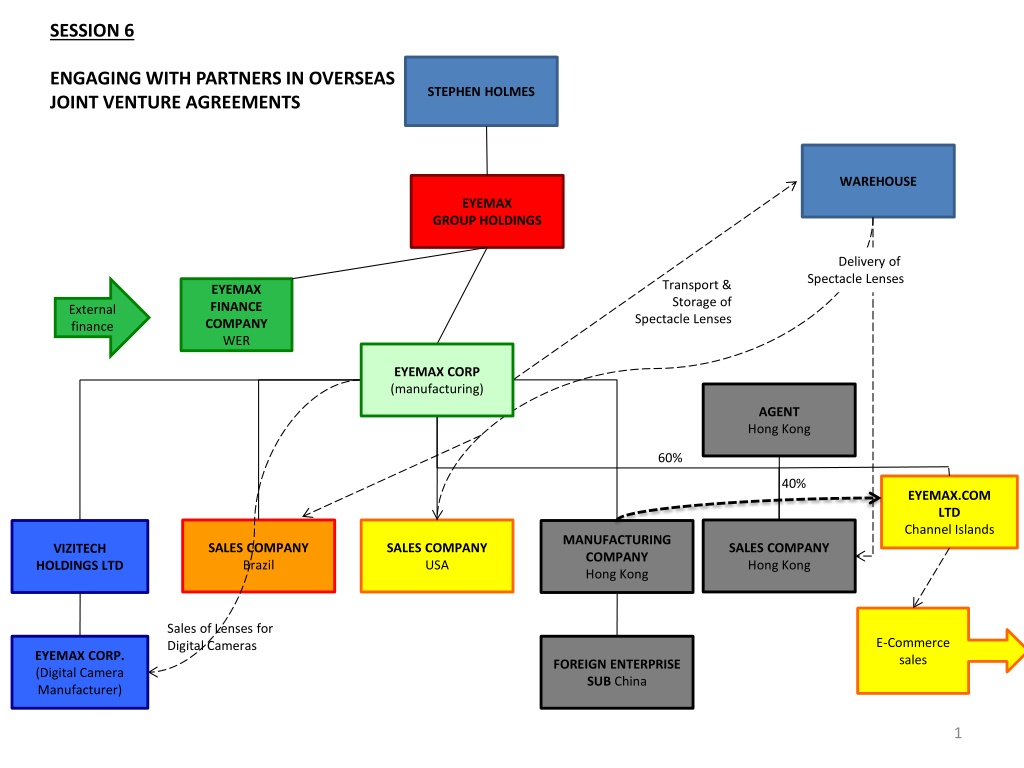

SESSION 6 ENGAGING WITH PARTNERS IN OVERSEAS JOINT VENTURE AGREEMENTS STEPHEN HOLMES WAREHOUSE EYEMAX GROUP HOLDINGS Delivery of Spectacle Lenses Transport & Storage of Spectacle Lenses EYEMAX FINANCE COMPANY WER External finance EYEMAX CORP (manufacturing) AGENT Hong Kong 60% 40% EYEMAX.COM LTD Channel Islands MANUFACTURING COMPANY Hong Kong SALES COMPANY Brazil SALES COMPANY USA SALES COMPANY Hong Kong VIZITECH HOLDINGS LTD Sales of Lenses for Digital Cameras E-Commerce sales EYEMAX CORP. (Digital Camera Manufacturer) FOREIGN ENTERPRISE SUB China 1

ENGAGING WITH PARTNERS IN OVERSEAS JOINT VENTURE AGREEMENTS By Anthony Hunt and Annick Bredero 18 November 2016

Overview 1. Current structure of Eyemax 2. Structuring 3. Contractual arrangements 4. Practicalities www.howardkennedy.com

It has been suggested that Eyemax creates a private equity fund established as a Cayman Islands entity which would attract the finance required to acquire the solar bowls in sites made available to the Fund by relevant regional authorities, as well as to maintain them once in situ to maximum efficient. The private equity fund would establish its own corporate organisation which would have contracts with the Eyemax Group for the manufacture and supply of the solar lens bowls. A management team would need to be employed which would have experience in renewable energy, and who would take over the initial contacts with regional energy authorities so that predetermined sales can be effected in advance of manufacture of the solar lens bowls. Rather than dilute the management expertise currently employed in the principal Eyemax business, the directors are considering joint venture arrangements with large utility companies whose expertise in energy distribution would be crucial to the success of the new operation. Eyemax key personnel are encouraged to discuss the potential for the solar bowls on a confidential basis with prospective partners. www.howardkennedy.com

Current structure of Eyemax www.howardkennedy.com

Structuring What is a joint venture? A business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task. This task can be a new project or any other business activity. Why do people enter into joint ventures? Combine expertise Spread risk Finance purposes www.howardkennedy.com

Structuring Basic types of joint ventures limited liability company limited liability partnership (LLP) partnership contractual joint venture arrangement www.howardkennedy.com

Structuring Key impact elements Taxation Funding Choice of Law Commercial/contractor/counterparty What are the drivers for the Eyemax Group? www.howardkennedy.com

Structuring Bankability mechanism enabling the parties to grant security over the corporate interests in the JV structure waterfall provisions that provide for the priority repayment of third party debt (in advance of distributions to the parties) cater for what happens if a party becomes insolvent evidence of compliance with applicable law and regulation. www.howardkennedy.com

Structuring Compliance with applicable law and regulation scope and application of merger regulations collective investment scheme/alternative investment fund if a party is listed on a major stock exchange choice of law Cross border/commercial/counterparty influences www.howardkennedy.com

Contractual arrangements Documents Joint Venture Shareholders Agreement (JVSA) Articles of Association (Articles) Ancillary documents www.howardkennedy.com

Contractual arrangements Main forms of JVSA 50/50 (two parties with equal number of shares) majority/minority (one party holds the majority of the shares) Key consideration for a 50/50 JVSA - deadlock Key consideration for majority/minority JVSA - minority protection rights www.howardkennedy.com

Contractual arrangements Matters generally covered Subscription for shares (if coming in to the JVC) Business of the JVC Management of the JVC Reserved matters (minority shareholder protection) Finance Distribution Deadlock and resolution Share transfer provisions Termination Warranties and indemnities www.howardkennedy.com

Contractual arrangements Articles of Association Constitutional document of a company Sets out management and administrative structure of the company and regulates its internal affairs Contract between the company and each of its members in their capacity as members Public document open to inspection at Companies House Can be bespoke or in the statutory prescribed form www.howardkennedy.com

Contractual arrangements Issues are generally covered in Articles Dividends Liquidation/Exit preference Anti-dilution rights Pre-emptions rights Compulsory and permitted transfers of shares Drag and tag along Composition of board and requirements for board meeting; Conduct of general meetings Variations of rights Permitted transfers www.howardkennedy.com

Contractual arrangements Ancillary documents Services agreements Management / employment agreements Agency and distribution agreements Licensing and IP-related agreements Other intra-group transfer agreements www.howardkennedy.com

Practicalities Pre-contractual phase/ Heads of Terms Cultural differences Jurisdictional differences Language barrier Negotiations conduct, participants and style Use and engagement of other advisers/experts Managing expectations Other factors/shared experiences in engaging with partners in cross border JV arrangements www.howardkennedy.com