Military Financial Readiness Guide - Pre-Deployment Essentials

Explore key aspects of financial planning, insurance, special pays, taxes, and more to prepare for deployment. Learn about setting financial goals, creating a spending plan, understanding entitlements, and managing insurance needs. Stay informed on combat zone tax exclusions and legal document requirements for a smooth pre-deployment process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

TC 12A Pre-Deployment Internal

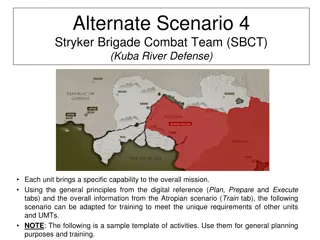

Agenda Financial planning Insurance and legal documents Saving and investing Managing debt and credit Pre-Deployment Checklist Available Internal

Financial Planning Internal

Setting Financial Goals If necessary, set new or additional goals to establish SMART Goals Specific Measurable Achievable Realistic Time-bound Write down your financial goals Prioritize your goals Determine how much to save Internal

Spending Plan Create and update your spending plan Set up automatic bill pay Account for changes to income, taxes and expenses Increased Income Reduced Expenses Living expenses Sea Pay Family Separation Allowance (FSA) Combat Zone Tax Exclusion (CZTE) Hostile Fire / Imminent Danger Pay (HFP / IDP) Income tax Lower debt payments Spending Plan Worksheet Handout Available Internal

Special Pay and Entitlements Special Pays Monthly $250 Family Separation Allowance Hardship Duty Pay (HDP) $50 $150 Hostile Fire Pay/Imminent Danger Pay (HFP/IDP) $225 Varies Per Diem Source: dcms.uscg.mil Internal

Taxes Combat Zone Tax Exclusion (CZTE) Exempts all or a portion of earnings from federal income taxes while deployed to a designated combat zone Unlimited for enlisted Service members Officers pay is limited to the maximum rate for enlisted Service members plus imminent danger or hostile fire pay ($9,069.30 in 2020) Tax filing considerations and residency issues Resources irs.gov/pub/irs-pdf/p3.pdf Ref. pg.15 CZTE Handout Available Internal

Insurance and Legal Documents Internal

LIFE Insurance Needs Liabilities (debts and obligations) Income (amount X numbers of years needed) + Final expenses Education and other goals + + Subtract current coverage and assets Your Total Need Internal

Insurance Overview Life Insurance SGLI Private Policy (Term/Permanent) Coverage Beneficiaries War clause and other restrictions TRICARE Auto, Homeowners, Renters, Dental Review and update your current insurance policies TRICARE Overview Handout Available Internal

Legal Documents Safeguard information and documents while deployed Review and update important documents Will Power of attorney Living will Medical directives Record of Emergency Data Religious preference Home of record considerations Estate Planning Handout Available Internal

Survivor Benefits Servicemembers Group Life Insurance (SGLI) Casualty Assistance Office Dependency and Indemnification Compensation (DIC) Dependents Educational Assistance (DEA) Survivor Benefit Plan (SBP) Death Gratuity Social Security Survivors Benefits VA Burial Survivor Benefits Overview Handout Available Internal

Saving and Investing Internal

Emergency Funds Start with saving up to $1,000 Strive to save and maintain 3 to 6 months of living expenses Automate savings Keep funds accessible Internal

Savings Deposit Program (SDP) Deployed to designated combat zone Deposit up to $10,000 Earnings are taxable Earn 10% annually Withdrawals Emergency Automatic direct deposit after 120 days dcms.uscg.mil/ppc/news/Article/1119913/ savings-deposit-plan-sdp Internal

Calculate Your Earnings Savings Deposit Program (SDP) Estimate your earnings Multiply the average quarterly balance by .025 (10% 4) Example If your average quarterly balance is $3,000 $3,000 x .025 = $75 You earned $75 that quarter Internal

Thrift Savings Plan (TSP) Combat Zone Tax Exclusion Reserve must coordinate contributions Example on how to maximize your retirement savings while deployed (2021) TSP Elective Deferrals (Roth) $19,500 TSP Contributions Limits (Traditional) + any match + $38,500 TSP Total $58,000 + $6,000 $64,000 Roth or Traditional IRA Total Retirement Savings Internal Thrift Savings Plan Handout Available

Managing Debt and Credit Internal

Financial Warning Signs Living paycheck to paycheck Unable to pay bills Bounced checks Expensive purchases Spouse lost job Divorce/separation No savings Preoccupied and being distant Internal Financial Warning Signs Handout Available

Mission Readiness Military values Duty to warn Consequences of financial problems Non-judicial punishment Administrative discharge Revoke security clearance Lose promotion or duty assignment Leader s responsibility Confidentiality Be direct, but understanding Refer for assistance Internal

Military Consumer Protections Active Duty alert and security freeze Review credit report Speak to a Personal Financial Manager for credit questions Visit annualcreditreport.com Service members may request credit monitoring from each of the reporting agencies at no charge Know your rights Servicemembers Civil Relief Act (SCRA) Military Lending Act (MLA) Student loans Legal office Understanding Credit, Paying off Student Loans, Military Consumer Protection, Servicemembers Civil Relief Act, and Sources of Help for Military Consumers Handouts Available Internal

Identity Theft Secure your information Follow Personally Identifiable Information regulations and procedures Opt out and do not call While deployed Active Duty alert or credit freeze Additional information identitytheft.gov consumer.gov Internal Military Consumer Protection Handout Available

Misleading Consumer Practices Recognize scams Multilevel marketing/pyramid scheme Get rich quick Too good to be true Protect yourself Research Comparison shop Sleep on it Report a complaint Internal Sources of Help for Military Consumers Handout Available

Summary and Resources Internal

Summary Best wishes for a safe and financially successful deployment! Let s wrap up all the topics we discussed: Financial planning Insurance and legal documents Saving and investing Managing debt and credit Internal

Resources Checklist and Handouts Financial Education and Support Command Financial Specialists (CFS) Personal Financial Managers (PFM) Health, Safety and Work-Life (HSWL) Regional Practice CG SUPRT Coast Guard Mutual Assistance (CGMA) Financial Literacy Mobile Apps Coast Guard Work-Life mobile app DoD FINRED Sen$e mobile app Internal

Thank You! The appearance of U.S. Department of Homeland Security (DHS) visual information does not imply or constitute DHS endorsement. Internal