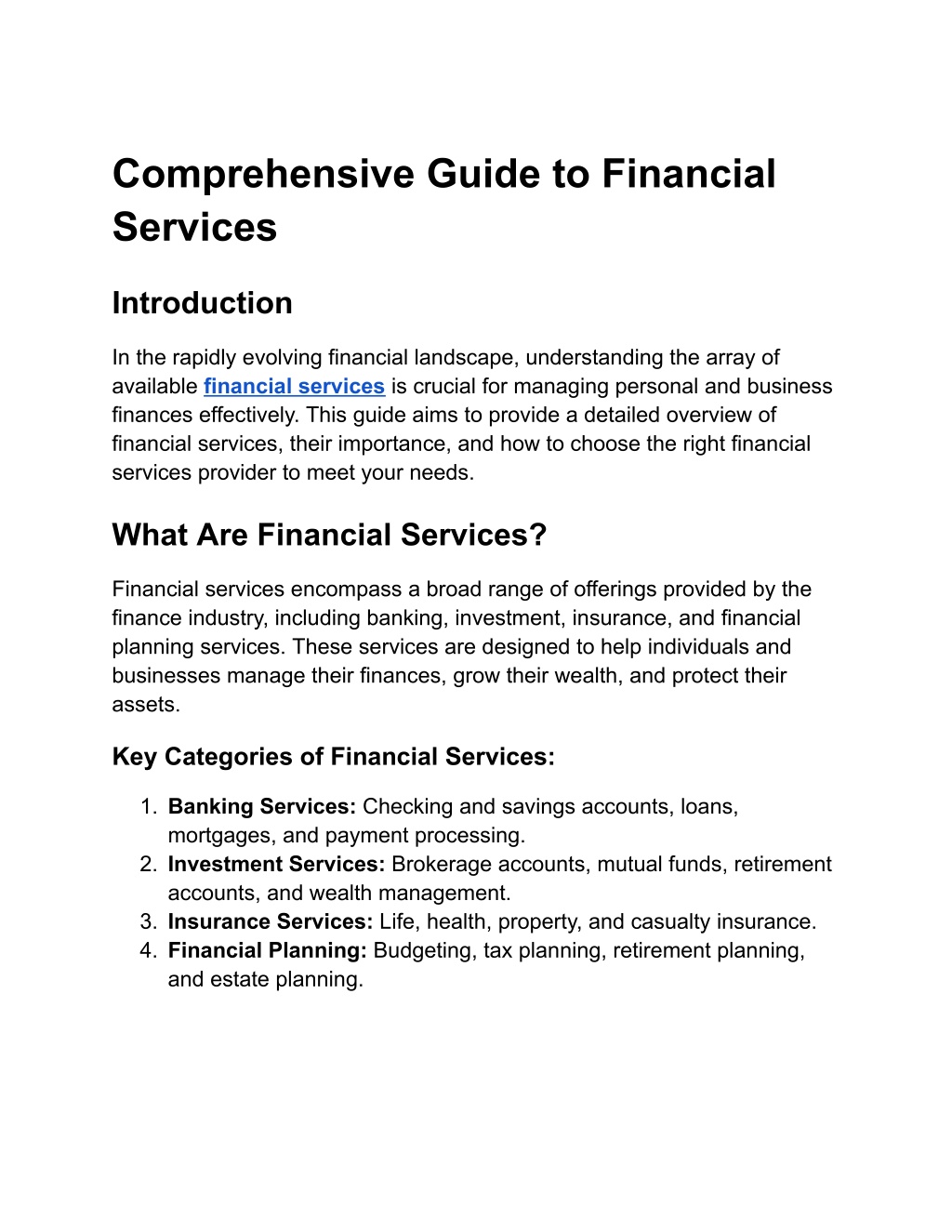

Comprehensive Guide to Financial Services

In the rapidly evolving financial landscape, understanding the array of available financial services is crucial for managing personal and business finances effectively. This guide aims to provide a detailed overview of financial services, their importance, and how to choose the right financial services provider to meet your needs.

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

Presentation Transcript

Comprehensive Guide to Financial Services Introduction In the rapidly evolving financial landscape, understanding the array of available financial services is crucial for managing personal and business finances effectively. This guide aims to provide a detailed overview of financial services, their importance, and how to choose the right financial services provider to meet your needs. What Are Financial Services? Financial services encompass a broad range of offerings provided by the finance industry, including banking, investment, insurance, and financial planning services. These services are designed to help individuals and businesses manage their finances, grow their wealth, and protect their assets. Key Categories of Financial Services: 1. Banking Services: Checking and savings accounts, loans, mortgages, and payment processing. 2. Investment Services: Brokerage accounts, mutual funds, retirement accounts, and wealth management. 3. Insurance Services: Life, health, property, and casualty insurance. 4. Financial Planning: Budgeting, tax planning, retirement planning, and estate planning.

Importance of Financial Services Financial services play a vital role in the economy by facilitating transactions, providing credit, enabling investments, and protecting against risks. They help individuals and businesses achieve financial stability, security, and growth. Benefits of Financial Services: Accessibility: Financial services provide access to credit, enabling individuals and businesses to invest and grow. Security: Insurance services protect against unforeseen events, providing financial security and peace of mind. Growth: Investment services help grow wealth through strategic investments and portfolio management. Efficiency: Banking and payment services streamline transactions, making financial management more efficient. Banking Services Checking and Savings Accounts These are fundamental banking services that provide safe places to deposit money. Checking accounts offer easy access to funds for everyday transactions, while savings accounts typically earn interest and are used for longer-term savings. Loans and Mortgages Banks offer various types of loans, including personal loans, auto loans, and mortgages. These services provide the necessary capital for significant purchases, such as homes and cars, and help manage cash flow for businesses.

Payment Processing Banks facilitate payment processing services, including credit and debit card transactions, wire transfers, and electronic payments. These services are essential for both consumers and businesses to conduct financial transactions smoothly. Investment Services Brokerage Accounts Brokerage accounts allow individuals to buy and sell securities, such as stocks, bonds, and mutual funds. These accounts are managed by brokerage firms that provide investment advice and facilitate trading. Mutual Funds Mutual funds pool money from multiple investors to purchase a diversified portfolio of securities. These funds are managed by professional fund managers and offer an accessible way to invest in a broad range of assets. Retirement Accounts Retirement accounts, such as 401(k) plans and Individual Retirement Accounts (IRAs), provide tax-advantaged ways to save for retirement. These accounts offer various investment options and are critical for long-term financial planning. Wealth Management Wealth management services offer personalized investment strategies and financial planning to high-net-worth individuals. These services include portfolio management, tax planning, estate planning, and more.

Insurance Services Life Insurance Life insurance provides financial protection to beneficiaries in the event of the policyholder's death. It helps cover expenses such as funeral costs, debts, and living expenses for dependents. Health Insurance Health insurance covers medical expenses, including doctor visits, hospital stays, surgeries, and prescription drugs. It is essential for managing healthcare costs and ensuring access to necessary medical services. Property and Casualty Insurance This type of insurance protects against loss or damage to property, such as homes and vehicles, and covers liability for accidents or injuries that occur on the property. Financial Planning Budgeting Budgeting services help individuals and businesses create and manage budgets, ensuring that income is allocated effectively to meet expenses and savings goals. Tax Planning Tax planning services provide strategies to minimize tax liabilities and ensure compliance with tax laws. These services include tax preparation, filing, and advice on tax-efficient investments.

Retirement Planning Retirement planning services help individuals plan for a financially secure retirement by creating savings strategies, selecting appropriate retirement accounts, and managing retirement income. Estate Planning Estate planning services assist in creating wills, trusts, and other legal documents to manage and distribute assets upon death. These services ensure that assets are passed on according to the individual's wishes and can minimize estate taxes. Choosing the Right Financial Services Provider Assess Your Needs Start by identifying your financial needs and goals. Consider whether you need banking services, investment advice, insurance coverage, or comprehensive financial planning. Research Providers Conduct thorough research on potential financial services providers. Look for firms with a strong reputation, good customer reviews, and a track record of reliability and performance. Evaluate Services and Fees Compare the services offered by different providers and evaluate their fee structures. Ensure that the services align with your needs and that the fees are transparent and reasonable.

Check Credentials Verify the credentials and qualifications of financial advisors and professionals. Look for certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Assess Customer Service Good customer service is essential for a positive experience with financial services providers. Choose a provider known for responsive and helpful customer support. Conclusion Understanding and utilizing the right financial services is crucial for achieving financial stability, growth, and security. By assessing your needs, researching providers, and evaluating services and fees, you can select the best financial services provider to help you meet your financial goals.

![Financial hardship and the economic burden of health [cancer] care](/thumb/779/financial-hardship-and-the-economic-burden-of-health-cancer-care.jpg)