Corporate Failures in Ghana: Roles of Auditors and Accountants

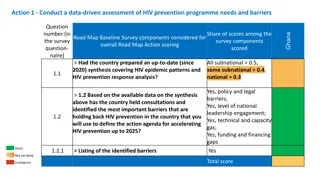

This study conducted at Kwame Nkrumah University of Science & Technology, Kumasi, Ghana, explores the causes of corporate crises in Ghana and the roles played by auditors and accountants. The research aims to identify common business areas contributing to corporate crises and internal factors leading to such failures. Additionally, the study delves into predicting the success of small businesses in Ghana using a model that considers factors like start-up capital, record-keeping, and industry experience.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Kwame Nkrumah University of Science & Technology, Kumasi, Ghana CORPORATE FAILURES IN GHANA: THE ROLES OF AUDITORS AND ACCOUNTANTS? Name: K.O.Appiah, PhD, FCCA, ICA, MSc Department: Accounting and Finance Faculty & College: School of Business/Humanities & Social Sciences 10/1/2024 1

ICAG PUBLIC FORUM CORPORATE FAILURES IN GHANA: THE ROLES OF AUDITORS AND ACCOUNTANTS? www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 2

WHAT ARE THE COMMON BUSINESS AREAS THAT CAUSE A CORPORATE CRISIS OR CONTRIBUTE SIGNIFICANTLY TO IT? 10/1/2024 koappiah.ksb@knust.edu.gh 3

WHAT ARE THE COMMON BUSINESS AREAS THAT CAUSE A CORPORATE CRISIS OR CONTRIBUTE SIGNIFICANTLY TO IT? www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 4

www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 5

WHAT ARE THE MOST INTERNAL CAUSES FOR A CORPORATE CRISIS THAT YOU HAVE EXPERIENCED? 10/1/2024 koappiah.ksb@knust.edu.gh 6

www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 7

www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 8

CAN WE PREDICT THE SUCCESS OF SMALL BUSINESSES IN GHANA? 10/1/2024 koappiah.ksb@knust.edu.gh 9

Ghana Model for predicting of small business success, N=208 Sig. 0.000 0.056 0.869 0.945 0.329 0.432 0.638 0.797 0.997 0.014 0.709 0.537 0.263 0.161 0.000 -0.977 1. Start-up Capital 2. Record keeping of financial transactions 3. No. of years of Industry experience by CEO 4. No. of years of Management experience of CEO 5. Startup Plan 6. Professional Advise 7. Education level of CEO 8. level of difficulty in recruitment and retaining Staff 9. Stage of product/services at start-up 10. Stage of Economy at Start-up 11. Age of CEO at Start-up 12. Firm started by Owner or more than one Owner 13.CEO s parents own their own business 14. Minority or Majority CEO 15. Level of Marketing skills at start-up Constant -0.942 0.138 0.022 0.011 0.124 -0.074 -0.079 0.027 0.001 -0.208 0.019 0.301 -0.567 0.997 0.514 Model Test Results-N 101 Failed and 107 Success Model Significance 0.000 10/1/2024 10 Classification Results-overall 86.5, Success 88%, Failure 85% koappiah.ksb@knust.edu.gh

WHAT IS THE ROLE OF AUDITORS AND ACCOUNTANTS IN CORPORATE FAILURES IN GHANA? 10/1/2024 koappiah.ksb@knust.edu.gh 11

Argenti (1976) 10/1/2024 koappiah.ksb@knust.edu.gh 12

DEFECTS MANAGEMENT ACCOUNTING SYSTEMS REPONSE TO CHANGE 10/1/2024 koappiah.ksb@knust.edu.gh 13

MANAGEMENT DEFECTS Management: autocratic chief executive chief executive is also chairman unbalanced skill &knowledge on the board passive board weak finance director lack of professional managers below the board 8 4 2 2 2 1 10/1/2024 koappiah.ksb@knust.edu.gh 14

MANAGEMENT DEFECTS Management: unbalanced skill &knowledge on the board passive board weak finance director lack of professional managers below the board 2 2 2 1 10/1/2024 koappiah.ksb@knust.edu.gh 15

Re Management Defects Re Management Defects: : UT and CAPITAL BANK Collapse UT and CAPITAL BANK Collapse Let me be upfront and say that though the failure of the two banks was due to significant capital deficiencies, the underlying reason was poor corporate governance practices within these institutions. Dr Ernest Addison, Governor December, 2, 2017 10/1/2024 koappiah.ksb@knust.edu.gh 16

Re Weak Finance Director: UT and CAPITAL BANK Collapse The dominant role of shareholders who exerted The dominant role of shareholders who exerted undue influence on management of the banks, undue influence on management of the banks, leading to leading to poor lending practices. poor lending practices. This was also reinforced by This was also reinforced by weak risk management systems systems and and poor oversight responsibility by the poor oversight responsibility by the boards of directors boards of directors. weak risk management . Dr Ernest Addison, Governor December, 2, 2017 10/1/2024 koappiah.ksb@knust.edu.gh 17

Re: UT and CAPITAL BANK Collapse Non-executive directors of the banks compromised their independence and fiduciary duties to serve as checks on executive directors. This was because rewards such as business class air tickets were being granted to them class air tickets were being granted to them annually annually. business Dr Ernest Addison, Governor December, 2, 2017 10/1/2024 koappiah.ksb@knust.edu.gh 18

Re Passive Board: UT and CAPITAL BANK Collapse Interference by non-executive directors in the day-to-day administration of the banks weakened the management oversight function of executive directors. Some non-executive directors were also acting as consultants to the same banks with no clear mandate, which gave rise to conflict of interest situations of interest situations. Dr Ernest Addison, Governor December, 2, 2017 rise to conflict 10/1/2024 koappiah.ksb@knust.edu.gh 19

Re Passive Board: UT and CAPITAL BANK Collapse Irregular board meeting also accounted for the weaknesses in the board oversight. 10/1/2024 koappiah.ksb@knust.edu.gh 20

DEFECTS IN ACCOUNTING SYSTEMS Budgetary control Cash flow plans Costing systems 3 3 3 10/1/2024 koappiah.ksb@knust.edu.gh 21

Re Accounting Systems Defects: UT and CAPITAL BANK Collapse The The poor lending practices poor lending practices was also reinforced by by weak risk management systems weak risk management systems and oversight responsibility by the boards of directors oversight responsibility by the boards of directors was also reinforced and poor poor Addison (December 2, 2017) 10/1/2024 koappiah.ksb@knust.edu.gh 22

Re: UT and CAPITAL BANK Collapse Also, very high executive compensation schemes were being operated by the affected banks which were not commensurate with their operations. The risk and earnings profile of the banks could not support the compensation schemes 10/1/2024 koappiah.ksb@knust.edu.gh 23

Re: UT and CAPITAL BANK Collapse Non-adherence to credit management principles and procedures as the banks were heavily exposed to insiders and related parties. There was also no evidence of interest payments on these investments. The investments were, therefore, impaired, but some members of the board at the time accepted the responsibility to pay off the said amount through a board resolution. 10/1/2024 koappiah.ksb@knust.edu.gh 24

DEFECTS IN REPONSE TO CHANGE Products, Processes, Markets, Employee Practice, etc. 15 Total possible(Danger mark = 10) 10/1/2024 43 koappiah.ksb@knust.edu.gh 25

Re Response to change: UT and CAPITAL BANK Collapse The banks could not delineate themselves from their past practices as finance houses. They followed the same practice of borrowing from high net worth persons at very high costs, without any plans to bring themselves without any plans to bring themselves in line with the industry norm in line with the industry norm. Addison (December 2, 2017) 10/1/2024 koappiah.ksb@knust.edu.gh 26

Re Practices: UT and CAPITAL BANK Collapse Diversion of funds to holding companies and their related parties was widespread. In the case of one bank, placements could not be traced to the bank s records though some customers showed proof of their investments with the bank. Addison (December 2, 2017) 10/1/2024 koappiah.ksb@knust.edu.gh 27

Argenti (1976) 10/1/2024 koappiah.ksb@knust.edu.gh 28

MISTAKES Overtrading: expanding faster than cash funding Gearing: bank overdrafts (loans) imprudently high Big project: project failure jeopardising company 15 15 15 Total possible(Danger mark = 15) 45 10/1/2024 koappiah.ksb@knust.edu.gh 29

Indicators of Overtrading (see Addo 286) Overtrading may lead to a lower than expected: Overtrading may lead to a higher than expected: Average settlement period for trade payables Current ratio Acid test ratio Sales to capital employed ratio Average inventories turnover period Average settlement period for trade receivables 10/1/2024 koappiah.ksb@knust.edu.gh 30

Indicators of overtrading Gearing Ratio- Debt/equity UT UT UNIB UNIB YEAR ACID TEST UT UNI SG-S UNI-BA INTEREST/CE UT UT SG-SS SG-SS 2011 2011 0.10 0.10 0.16 0.16 0.18 0.18 34.24 34.24 137.3 137.3 41.06 18.81 18.81 76.59 76.59 0 0 0.20 105.9 105.9 19.66 70.93 70.93 0 0 2012 2012 0.11 0.11 0.13 0.13 0.20 87.3 87.3 35.69 19.66 0.14 126.8 126.8 117.10 726.4 726.4 0 0 2013 2013 0.10 0.10 0.11 0.11 0.14 67.3 67.3 84.59 117.10 0.12 126.8 126.8 147.3 157.44 98.23 98.23 0 0 2014 2014 0.10 0.10 0.06 0.06 0.12 147.3 111.50 157.44 0.06 92.56 92.56 +10.0 +138.63 +21.6 +21.6 0 0 0.00 0.00 - -0.10 0.10 - -0.06 +10.0 +70.44+138.63 10/1/2024 koappiah.ksb@knust.edu.gh 31

Gearing ratios -how risky a business is perceived? -what are the implications of high gearing? -what are the limitations of gearing? 10/1/2024 koappiah.ksb@knust.edu.gh 32

Re: UT and CAPITAL BANK Collapse Examples of recklessness that led to the failure of the two banks include: Co-mingling of the banks activities with their related holding companies. For instance, one bank was paying royalties for the brand name, even at the time that the bank s financial performance was abysmal and could not pay dividends. Interestingly, the royalties were approved by four out of seven members of the board without the consent of the other significant minority shareholders, including an International Financial Institution. Dr Ernest Addison, Governor December, 2, 2017 10/1/2024 koappiah.ksb@knust.edu.gh 33

Big project: project failure jeopardising company who is responsible for project appraisal? www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 34

UT BANK BIG PROJECT 2011 Borrowed $10M and $5m from IFC to finance SMEs Raised GHS 46m from equity placement in order to meet the minimum capital requirement. 2012 The bank purchase mobile breast cancer screening van costing $65000 and screened 8000 people As part of the chairman's Christmas Day, UT distributed 2000 pieces of food to the needy. 2013 Sponsored Amidaus Professional Football Club at Tema Established UT care foundation. Continuous sponsoring for breast awareness campaign. 2014 koappiah.ksb@knust.edu.gh 35 10/1/2024

UNIBANK BIG PROJECT 2011 Agreed to open more branches across the country The Head Office was relocated to World trade Centre (WTC). Commission Kasoa, Koforidua, Central and Eastern region. 2012 Renovate GIMPA branch and open an agency office in Brong Ahafo. Purchased properties in Madina and Kejetia 2013 Completed the construction of Tamale and Techiman branches 10/1/2024 koappiah.ksb@knust.edu.gh 36

Re Big project:-UNIBANK 8 branches were opened. 3 in Kumasi, 4 in Accra and 1 in Tema 2014 Plus 4 others to be completed with the same year Meter card was also operationalised Sponsored Black Stars for 2014 Brazil world cup Lunch a promotion called 'Dash for 200K' Completed the disaster recovery site at Tema 10/1/2024 koappiah.ksb@knust.edu.gh 37

SYMPTOMS SYMPTOMS Financial: deteriorating ratios Creative accounting: signs of window dressing Non-financial signs: declining quality, morale, market share, etc. Terminal signs: writs, rumours, resignations 4 4 3 1 Total possible Total overall possible score(Danger mark = 25) 12 100 10/1/2024 koappiah.ksb@knust.edu.gh 38

Re Symptoms: UT and CAPITAL BANK Collapse Co-mingling of the banks activities with their related holding companies. .. As a result, the international institution placed a notice on its website abrogating all relationships with the bank, and this led to most of the foreign lenders cutting off their credit lines to the bank and recalling their credits; thereby creating serious liquidity squeeze to the bank. 10/1/2024 koappiah.ksb@knust.edu.gh 39

TAKE HOME One of the more significant earlier works was by Ross and Kami (1973); they gave Ten Commandments which, if broken, could lead to failure: 10/1/2024 koappiah.ksb@knust.edu.gh 40

Ross and Kami (1973) 1. You must have a strategy. You must have a strategy. 2. 2. You must have controls. You must have controls. 3. 3. The Board must participate. The Board must participate. 4. 4. You must avoid one You must avoid one- -man man- -rule. rule. 10/1/2024 koappiah.ksb@knust.edu.gh 41

Ross and Kami (1973) 5. There must be management in depth. 5. There must be management in depth. 6. Keep informed of, and react to, change. 6. Keep informed of, and react to, change. 7. The customer is king. 7. The customer is king. 10/1/2024 koappiah.ksb@knust.edu.gh 42

Ross and Kami (1973) 8. Do not . Do not misuse computers misuse computers. . 9. 9.Do not manipulate your accounts. Do not manipulate your accounts. 10. 10. Organize to meet employees needs Organize to meet employees needs. . 10/1/2024 koappiah.ksb@knust.edu.gh 43

Conclusion The fact is that UT Bank, CAPITAL Bank, Nobel Dream, Ghana Airways have collapse. We can for example point out the Ghana Airways in 2004, which is (maybe) accidently very similar to UT Bank and Capital Bank cases. But why we have the old pattern here again? www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 44

Conclusion cont. My personal opinion is that the reason is in the weak corporate governance arrangements in the company and in the fact that corporate governance principles are not under the root of law. In the UT and Capital weak corporate governance arrangements allowed officers to find the way how to accumulate unearned profit and specifically increase their personal wealth. www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 45

Conclusion cont In my opinion, there is no problem in the context of BoG BoG corporate governance directives (Act 930) corporate governance directives (Act 930) since they arch over all problems discussed in this presentation. www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 46

The BOG Directives on corporate governance The BOG Directives on corporate governance ACT 930 specifically say that the corporate governance framework specifically say that the corporate governance framework should ensure: should ensure: s23. The board of directors shall have s23. The board of directors shall have overall responsibility for the regulated financial institution responsibility for the regulated financial institution, , including approving and overseeing the including approving and overseeing the implementation of the implementation of the institution s strategic objectives, risk strategy, corporate governance and objectives, risk strategy, corporate governance and corporate values corporate values. . overall institution s strategic 10/1/2024 koappiah.ksb@knust.edu.gh 47

The BOG Directives on corporate governance The BOG Directives on corporate governance ACT 930 S S24 24. . Board Board Nomination Nomination Committee Committee S S20 20 Board Board Audit Audit Committee Committee S S63 S S71 63 Board Board Risk Risk Committee Committee 71: : Remuneration Remuneration committee committee S S82 82: : Internal Internal and and External External Audit Audit Functions Functions 10/1/2024 koappiah.ksb@knust.edu.gh 48

Will these committees reduce the Bank failures? 10/1/2024 koappiah.ksb@knust.edu.gh 49

Empirical studies in the UK Appiah et al (2015) "Remuneration committee and corporate failure", Corporate Governance, Vol. 15 Issue: 5, pp.623-640, Appiah et al (2016) "The impact of board quality and nomination committee on corporate bankruptcy." Advances in Accounting 35 (2016): 75-81. Appiah et al (2016) Audit Committee and Corporate Insolvency, Journal of Applied Accounting Research,18 (3), 298-316 www.knust.edu.gh www.knust.edu.gh www.knust.edu.gh 10/1/2024 koappiah.ksb@knust.edu.gh 50