Digitalization, Personalization, Affordability Shaping the Future of Home Loans Market

The home loan industry stands as a critical pillar of the global economy, enabling individuals and families to achieve the dream of homeownership. This dynamic sector, fueled by rising urbanization and increasing disposable incomes, is witnessing exciting growth prospects across the globe. In this b

1 views • 3 slides

Digitalization, Personalization, Affordability Shaping the Future of Home Loans Market

The home loan industry stands as a critical pillar of the global economy, enabling individuals and families to achieve the dream of homeownership. This dynamic sector, fueled by rising urbanization and increasing disposable incomes, is witnessing exciting growth prospects across the globe. In this b

5 views • 3 slides

Global Home Loan Boom Market Worth 37.7 Trillion Poised for Growth at 4.4 CAGR

The home loan industry plays a critical role in facilitating homeownership and driving the housing market. This dynamic sector, estimated to be worth USD 37.7 trillion globally in 2023, is constantly evolving, and shaped by various economic, demographic, and regulatory factors.

3 views • 3 slides

Innovative Collaborations: Expanding Mortgage Lending Options with Fannie Mae

Leveraging partnerships to enhance mortgage lending options, Fannie Mae works to support homeownership by facilitating access to affordable financing in diverse markets, including Tribal Trust Lands and Native American communities. Through its Duty to Serve commitment, Fannie Mae actively engages wi

0 views • 32 slides

Smooth Homeownership with a Home Mortgage Broker in Raleigh, NC

Purchasing a home is one of the most significant financial decisions you'll make in your lifetime. To ensure a smooth and successful journey, enlisting the help of a knowledgeable Home Mortgage Broker In Raleigh, NC, Blackwell Mortgage offers expert guidance and personalized services to help you nav

11 views • 5 slides

Best Home Loans in Brunswick

Are you looking for the Best Home Loans in Brunswick? Then contact Domenic LaRocca Mortgage Broker. They offer personalised advice, access to diverse home and business loan options, and help navigate the complex world of mortgages. Save time, money, and stress as they negotiate the best deals on you

0 views • 6 slides

Denver Home Financing Solutions | thehomeloanarranger.com

Unlock your dream home in Denver with Thehomeloanarranger.com. Our personalized financing solutions will make your homeownership journey stress-free.\n\n\/\/thehomeloanarranger.com\/

3 views • 1 slides

Understanding Home Ownership and Mortgages

Exploring the fundamental concepts of buying a house, the cost of living, renting vs. buying, mortgages, and reasons why not everyone owns a home. The content covers essential financial aspects and practical considerations involved in homeownership, making it insightful for individuals navigating th

1 views • 20 slides

Understanding the Housing Choice Voucher (HCV) Homeownership Program

The Housing Choice Voucher (HCV) Homeownership Program helps low-income, first-time homebuyers by providing monthly housing assistance payments. This presentation covers key aspects such as program overview, steps to develop the program, operations, counseling, eligible housing, inspections, financi

0 views • 71 slides

Understanding Redlining and Its Impact on Communities

Redlining, a historical practice of denying services or goods based on discriminatory reasons, particularly affects property values and homeownership. This systematic denial led to neighborhoods falling into decline due to lack of access to loans. Discriminatory practices isolated minority communiti

7 views • 13 slides

Understanding the Costs of Buying a Home

When purchasing a home, it's crucial to consider all the costs involved beyond the mortgage payment. These additional expenses include property taxes, homeowners insurance, maintenance fees, and more. One-time costs like down payments, realtor fees, and title fees must also be factored in. This cont

0 views • 10 slides

Addressing Systemic Housing Inequities: A Call to Action

The U.S. Poverty Domestic Housing Policy Forum held on March 17, 2022, shed light on the deep-rooted oppression and discrimination impacting housing policies. The forum emphasized the importance of combating racism, classism, and other oppressions to effectively address poverty. It highlighted the d

0 views • 30 slides

Innovative ESOP Program for Disabled Citizens in Restaurant Management

Disabled citizens in Michigan are offered training in culinary arts and management through programs run by institutions like the Michigan Disability Commission and community colleges. Jack in the Box is hiring disabled citizens and veterans to manage restaurants under a unique ESOP program. The ESOP

0 views • 6 slides

A Roof Over Your Head: Consumer Education on Renting and Homeownership

This educational module provides valuable insights into the costs and considerations associated with renting and buying a home. Covering topics such as rental agreements, landlord and tenant rights, insurance, and more, it equips individuals with essential information to make informed decisions rega

1 views • 40 slides

Impact of Habitat for Humanity Homeownership on Quality of Life

A study by Wilder Research on Habitat for Humanity homeowners in Minnesota reveals positive impacts on safety, health, education, social connectedness, family interaction, personal well-being, and economic situation. Results show improved quality of life, with high levels of satisfaction and safety

0 views • 13 slides

Guide to Filling Out Parent's Financial Statement Section 4: Assets and Liabilities

Learn how to accurately complete Section 4 - Assets and Liabilities of the Parent's Financial Statement. This section covers details on rental payments, homeownership information, bank accounts, investments, retirement savings, and education funds. Follow the instructions provided to showcase the fa

0 views • 8 slides

Wilmington Homeownership Pool: Empowering First-Time Buyers

The City of Wilmington offers the Home Ownership Pool (HOP) program to assist low-to-moderate income first-time homebuyers. Through partnerships with local banks, HOP provides fixed-rate loans, down payment assistance, and free home inspections. Income limits and loan options cater to various househ

0 views • 14 slides

Federal Lending Update and Housing Finance Reform Overview

The VA 2019 Lenders Conference provided insights on the positive economic environment, unique features of the VA Home Loan Program, and the President's plan to reform the housing finance system. Encouraging demographic trends and the goals of the reform were discussed, emphasizing reduced taxpayer r

0 views • 21 slides

Navigating Home Mortgages in San Diego: Your Path to Homeownership

Discover the detailed DSCR loan requirements essential for real estate investors to secure financing and maximize returns in San Diego's competitive market.

1 views • 2 slides

Post-WWII America: Progress, Politics, and the Election of 1948

Lakewood, California's post-WWII boom symbolized the era's prosperity and status symbol of homeownership. Truman's Fair Deal faced Republican opposition, leading to postwar political shifts, including the 22nd Amendment and Taft-Hartley Act. The Election of 1948 saw Truman navigating Democratic fact

0 views • 20 slides

Understanding the Truth about Districts and Homeownership Risks

Debunking common misconceptions about districts, this discussion sheds light on the limited obligations and protections for homeowners. It explains how districts provide financial viability and transparency, showcasing the intelligence of homeowners in evaluating their choices.

0 views • 11 slides

Understanding Perceived Barriers to Homeownership in Ontario

Survey in Ontario explores renters' awareness and willingness to access non-traditional mechanisms for entering the housing market like rent-to-own and shared equity models. Results indicate increasing challenges for young Canadians to own homes. Government promoting alternative approaches. The stud

0 views • 21 slides

Local Innovative Fast Tract (LIFT) and Rural Definition Engagement Session

Welcome to the LIFT and Rural Definition Engagement Session focusing on the LIFT Program, rental and homeownership discussions, and rural definition dialogue. Explore how the OHCS Local Innovation and Fast Track Program is utilizing funding for housing initiatives in Oregon. Share your insights and

0 views • 20 slides

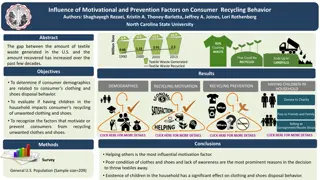

Impact of Motivational and Prevention Factors on Consumer Recycling Behavior

The study explores how motivational and prevention factors influence consumer recycling behavior, particularly regarding clothing and shoes disposal. Findings suggest that helping others is a significant motivation, while poor condition of textiles and lack of awareness lead to disposal. Demographic

0 views • 5 slides

Mississippi Home Corporation - CHDO Program Overview

Mississippi Home Corporation (MHC) is a State Housing Finance Authority dedicated to promoting homeownership and affordable housing in Mississippi. The Community Housing Development Organization (CHDO) program under the HOME Investment Partnerships Program provides funding for local development acti

0 views • 26 slides

Affordable Housing Needs in Northeast Florida

The data presented highlights the challenges faced in Northeast Florida regarding affordable housing, showcasing a shift towards renting over homeownership, disparities between rents and wages, and the prevalence of cost burden among low-income households. The statistics reveal the impact on various

0 views • 20 slides

Guide to Home Buying Essentials

This comprehensive guide covers essential topics for prospective homebuyers, including course objectives, financial considerations, advantages and disadvantages of homeownership, the home buying process, household finances, saving strategies, and budgeting basics. From understanding your rights to p

0 views • 28 slides

Employee Housing Solutions Implemented by Mammoth Community Water District

Mammoth Community Water District (MCWD) faced housing cost challenges affecting workforce recruitment and retention. To address this, they initiated strategies like an Employee Housing Program, Employee Home Loan Assistance Program, and a Van Pool Employee Transportation Association. These programs

0 views • 6 slides

Understanding the Impact of Mortgage Interest Deduction on the Housing Market

The Mortgage Interest Deduction (MID) is a significant tax expenditure in the U.S., often associated with promoting homeownership. However, research suggests that its impact on increasing affordability and homeownership is limited, particularly for high-income households. The regressive nature of th

0 views • 6 slides

Homeownership with the HEART Loan Program in San Mateo County

Explore the Homeownership with the HEART Loan Program in San Mateo County, offering down payment assistance and second mortgages to help buyers afford homes up to $781,875. Learn about program details, underwriting criteria, advantages, and the current real estate market challenges.

0 views • 22 slides

Home Loans Made Simple Buy Your Home with Confidence

Learn about your loan alternatives at Moresellerfinancing.com and find the home of your dreams. Start constructing your future today and feel the thrill of homeownership.

3 views • 1 slides

Updates and Reauthorizations in Tribal Housing Programs

Anthony Walters appointed as Executive Director for SWTHA in October 2021. NAHASDA commemorates its 25th Anniversary with special events. Reauthorization efforts for NAHASDA through bills like S.2264 and H.R. 5195 are underway. Congressional members are working on NAHASDA reauthorizations to be incl

0 views • 15 slides