Xinfang: Alternative Legal System in China

Delve into the intricate Xinfang system, an alternative legal institution deeply rooted in Chinese society since ancient times. Understand its role in resolving disputes, filing complaints, and seeking justice outside traditional legal frameworks.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Alternative Legal Institutions, Xinfang and Finance Jiafu An, Jo Danbolt, Wenxuan Hou, and Ross Levine The University of Edinburgh; UC Berkeley

Motivation: Literature Legal institutions Development of financial market (La Porta et al., 1997; 1998; 1999; 2000 and Beck, Demirg -Kunt & Levine, 2001; 2003) Financial markets Economic growth (Levine, 1993;1997) Legal Institutions Economic growth (Acemoglu, Johnson, Robinson, 2000; 2001; Nunn, 2008)

Motivation: Challenge Legal institutions are defined by western standards. Challenge: Law-finance nexus may not apply to eastern countries such as China. (Allen, Qian and Qian, 2005; Clarke, Murrell, Whiting, 2008) Market Cap. of Listed Domestic Companies in 2014 30000 25000 20000 Billions US$ 15000 10000 5000 0 United States China Japan Source: World Bank Canada France Germany

Motivation: Big Questions Does legal system promote finance in eastern countries, such as China? Why it does or does not? Why, despite their weak legal institutions, some eastern countries still grow their financial markets at an enormous rate?

Institutional Background: Definition Xinfang: an alternative legal system deeply embedded in Chinese society since the first dynasty Xia (2070-1046 B.C.) The xinfang system is broadly defined as a mechanism for citizens to resolve disputes, file complaints, government and its associations on higher administrative level. and seek resolutions from

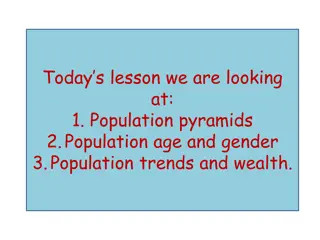

Institutional Background: Application Number of Legal and Xinfang Cases 14,000,000 12,000,000 10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 Legal Cases Xinfang Cases

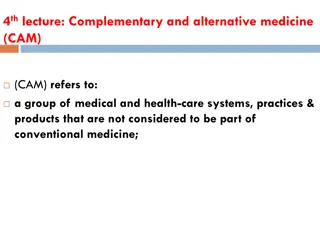

Institutional Background: Distinction Xinfang Legal Consult laws, but sometimes disregard it based on current circumstance and state policy law, state policies, social norms, fair and justice required by the Constitutions of the Party. law Completely base on the legal rules

Institutional Background: Distinction The formal legal system (German civil law origin) was established by the end of the Qing dynasty (1912) The xinfang system has always been there since 2000 years BC. So attention should also be paid to the alternative legal systems.

Hypotheses Xinfang system Development of financial market Property rights Xinfang Finance Private contract Checks on government

Data: Xinfang We hand-collect xinfang regulations of each province during 1993- 2014. (because, and the process involves) A xinfang regulation is a document describing the operation of xinfang in a province. In total, we obtain 60 regulations covering 27 provinces in 1993-2014 (An, Hou, and Levine, 2016).

Data: Coding We take individual policies of provincial xinfang systems and construct measures of the functioning of each xinfang system in each year in four areas: (1) the efficiency with which the xinfang system resolves cases (efficiency of dispute resolution) (2) the degree to which the xinfang system has explicit checks on conflicts of interest on cases and formal oversight and review procedures of xinfang workers (dispute resolution mechanisms)

Data: Coding (3) the degree to which the xinfang system formally requires particular responses by xinfang workers to people filing a case ( xinfangers ) and does not constrain xinfangers from pursuing their cases (access support and restraints) (4) the degree to which the xinfang system requires rewarding xinfangers for bringing socially beneficial cases and punishing xinfang workers who do not perform their jobs effectively and lawfully (punishment and reward). In particular, we focus on 69 particular policies . (An, Hou, and Levine, 2016).

Data: Financial Development No. of IPOs the value of provincial equity market as a share of GDP Rajan and Zingales, 1998; Allen, Qian, and Qian, 2005; LLSV, 1997 Total the number of IPOs per million population in each province Rajan and Zingales, 1998; LLSV, 1997 capitalization Circulating cap. the value of total loans of banks as a share of GDP Allen, Qian, and Qian, 2005 Total loans the value of floating shares in provincial equity market as a share of GDP Trading volume the value of total trading volume of the provincial capital market as a share of GDP Allen, Qian, and Qian, 2005 Other loans the value of medium and long term loans of banks as a share of GDP No. of listed firms the number of listed firms per million population in each province Rajan and Zingales, 1998; LLSV, 1997 Short loans the value of short-term loans of banks as a share of GDP

Findings Xinfang system Development of financial market Xinfang-finance > in provinces with better formal legal institutions, less corruption and larger private economy. Xinfang-finance > in industries with larger size of non-current assets; and more dependence on external finance Xinfang-finance > in non-SOEs (more long term debt and investments)

Contributions We contribute to the law-finance-growth (La Porta et al., 1997; 1998; 1999; 2000 and Beck, Demirg -Kunt & Levine, 2001; 2003) by providing a novel dataset of legal system that is based on eastern standards. This paper relates to the research on China (Allen, Qian and Qian, 2005; Clarke, Murrell, Whiting, 2008). We show that after considering the alternative legal system, the law-finance nexus does apply to China, which contradicts the evidence provided by previous research that ignores the alternative legal system.

Contributions We also provides an explanation of a long-standing puzzle that despite their weak legal institutions, some eastern countries can still grow their financial markets at an enormous rate. We show that alternative legal institutions that previously been ignored have a positive impact on financial market development.