Unveiling Small Business Success in the UK Chemical Distribution Industry

Delve into the complexities of success in the UK chemical distribution sector, where challenges in defining SMEs, measuring success, and identifying critical factors abound. With a focus on supplier management and the unique characteristics of the industry, this research sheds light on the need for tailored studies to uncover key success factors. Despite the industry's significant turnover and workforce, a lack of consensus on definitions and limited research pose hurdles for businesses seeking to thrive in this competitive landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

An insight into small business success: the UK chemical distribution industry Dr Evri Lampadarios Business Manager WSB PT Lecturer LBU

Contents The research problem The chosen industry My research Supplier management Challenges

The research problem No universally accepted definition for SMEs with significant variations in different countries (Smallbone et al., 2010; Unger et al., 2011) No single agreed-upon definition of success (Rogoff et al., 2004) No universally accepted model to incorporate all aspects of small business success (Chawla et al., 2010; Lampadarios et al., n.d.) Knowledge more fragmented than cumulative (Dobbs and Hamilton, 2007) High failure rates and poor performance levels (Gray, et al., 2012; Ropega, 2011) CSFs vary with the business environment (industry and country) (Krasniqi et al., 2008; Simpson et al., 2012). creates need for more empirical studies to investigate the critical success factors in each individual industry and in a specific country setting.

UK chemical distribution industry 4.42bn turnover 10% of the total European market 6,800 employees Forecasted for growth Strong consolidation trends Regulatory requirements High fragmentation Strong presence of SMEs To make it worse . No research on success/ failure and modus operandi No universally agreed definition of a chemical distributor (Chemagility, 2008). No official statistical and/or financial data Confusion with other types of trading in the industry Wide variety of functions

Chemical distribution Rationale Chemical distribution originates in the gap between producers who wish to sell large lots without regulatory or logistical complications and customers demanding small volumes and who have very specific needs on technical, regulatory and logistical level (Mortelmans and Reniers, 2012) Chemical distributors allow their principals to profitably reach smaller customers in many industries and countries (Chemagility, 2008) However genuine chemical distributors add value through an extensive range of services to both customers and suppliers (Hornke, 2013)

Definitions No universally agreed definition .wide variety of functions and confusion with other types of trading in the industry Not logistics Not traders Not agents A company that takes title to bulk and/or non-bulk chemicals from a chemical manufacturer or supplier and re-sells the chemicals to an end-user (NACD, 2005)

Classification By products Commodities Specialities Full range By geography / market coverage Regional / national multinational

Services Customers: broad product portfolio with complementary products access to reputable suppliers competitive (and stable) pricing stock management and Just In Time (JIT) deliveries competent and knowledgeable sales team technical support and problem solving skills product expertise for formulation purposes value-added services, for instance, custom blending, repackaging) sample management financing and credit in line with local terms safety training and hazardous waste removal Sources: BCG, 2013; Burns, 2010; Chemagility, 2008; Chemanager, 2013; Districonsult, 2012; FECC, 2013; Mortelmans and Reniers, 2012).

Services Suppliers: market share and penetration logistics services including storage and packaging in-depth market intelligence assist with the implementation of marketing strategies demand forecasting and planning market development capabilities new product approvals conforming to local regulations and language repackaging and relabelling arrangement of import authorizations trainable staff with good technical knowledge modern IT infrastructure allowing automated information exchange Sources: BCG, 2013; Burns, 2010; Chemagility, 2008; Chemanager, 2013; Districonsult, 2012; FECC, 2013; Mortelmans and Reniers, 2012).

In a nutshell Quality Speed Flexibility Dependability Cost

Finding a chemical distributor how hard can it be??? Complex market Varied requirements and strategies Managing expectations Cultural differences

Important but still academically understudied

My research Aim: Identify CSFs for SMEs in the UK Chemical distribution industry Target group: SMEs as defined by the European Union; located in the UK; not part of a another organization or belonging to a larger corporation; no manufacturing activity and capability Population: 180 Key informants: Owners and Senior managers (CEOs, MD, Directors)

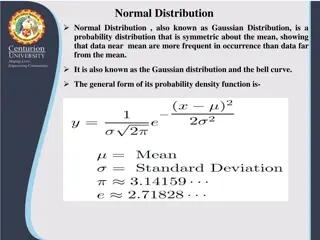

My research Twenty two (22) factors critical to small business success identified and their impact is investigated. Categorised in: entrepreneurial (relating to the personal characteristics of the owner/manager) enterprise (relating to the firm) business environment (external) factors Positivistic philosophy, deductive approach, concurrent embedded mixed methodology, survey strategy, self- administered questionnaires. Response rate 65.5%.

Success factors Enterprise Factors Entrepreneurial Factors Business Environment Age and size of company Business Networks Customer Relations Management Financial resources Internationalisation Human Capital Market and Product Development Marketing Strategic Planning Age Education Level Entrepreneurial Orientation Gender Personality Prior Work Experience and Management Skills Political Economic Socio-cultural Technological Legal and Regulatory Ecological and Environmental

Critical Success Factors (CSFs) Enterprise factors: Customer relations management (MR: 2028) Market and product development (MR: 1938) Human capital (MR: 1800) Strategic planning (MR: 1643) Entrepreneurial factors: Business Environment: SMEs Success Entrepreneurial orientation (MR: 2036) Regulatory compliance UK chemical distribution (MR: 2047) Prior work experience and management skills Economic (MR: 1651) (MR: 1812)

CSFs explained Entrepreneurial factors Entrepreneurial Orientation Prior Work Experience and Management skills Enterprise factors Customer Relations Management Market and Product development Human Capital Strategic Planning Business Environment factors Regulatory compliance Economic environment

Main findings Success is a multidimensional phenomenon, where both firm-internal and firm-external factors need to be optimal simultaneously. Flexibility and adaptability required

Main findings II SMEs are not a homogeneous group - different strategies are needed for different sized businesses. Variations in all enterprise and business environment CSFs i.e. customer focus, formal vs informal strategy, sources of finances, HR management, market orientation, regulatory strategy

Main findings III Strong interrelations Business networks / owners/managers prior experience. Age, education, skills, financial and social capital accumulated / prior working experience Economic environment / financial resources Personality / entrepreneurial orientation. EO / elements of the political and socio-cultural environment Marketing / regulatory compliance, customer relations management, market and product development and strategic planning. Internationalisation / market and product development.

Supplier Management Where does it fit in?

Supplier Management remember distributors do not manufacture products Significant part of CRM and MPD and HR Integral part of strategic planning Suppliers / Principals key to success Suppliers need to be treated as best customers Input in NPD and R&D Providing resources: technical expertise, training, product knowledge, applications etc. Opportunities for integration

Where is the focus then? Need for extra services Integration Outsourcing Strong supplier relationships Focus on operations management

Integration Way to survive and solve issues? Customer Manufacturer Distributor Manufacturer Raw materials supplier Warehousing / Logistics Distributor Final customer Distributor

Outsourcing Way to survive and solve issues? Main functions to outsource: Logistics Warehousing Sampling Accounting

Location Where would you base your offices / warehousing? Criteria: Infrastructure Access Customer base Suppliers

Challenges in real life Suppliers Selection Single or multiple sourcing? / Exclusivity or not? Global sourcing / internet Market based or relationship supply relationships? Customers Expectations / Do they know what they really want? Internal issues Manufacturing delays Shutdowns: planned and unplanned / FM Inventory / Warehousing Logistics / Transportation Changes in demand? Seasonality / environment / trends?

Future / Current research CSFs for SMEs European chemical distribution Collaboration with FECC SMEs - Food storage and distribution Collaboration with Food Storage & Distribution Federation (FSDF) SMEs PR Consultancies Collaboration with PR Consultants Association (PRCA) Call for new collaborations

References Boston Consulting Group (2013) The Growing Opportunity for Chemical Distributors: Reducing complexity for producers through tailored service offerings, [online], Available at: https://www.bcgperspectives.com/content/articles/process_industries_supply_chain_management_growing_opportunity_che mical_distributors/#chapter1, [Accessed 20 February 2014]. Burns, N. A. (2010) Chemical Distributors, [online], Available at http://www.neilaburns.com/2010/11/chemical-distributors, [accessed 15 December 2010]. Chawla, S. K., Khanna, D. and Chen J. (2010) Are Small Business Critical Success Factors Same in Different Countries?, SIES Journal of Management, Vol. 7, Iss. 1, pp. 1-12. Chemagility (2008) UK Chemical Distributor Market Report 008: Information, Insight and analysis of the UK Chemical distribution industry, Surrey: Chemagility. Chemanager (2013) Distribution & Logistics for the Chemical and Life Sciences Industries, [online], Available at: http://www.chemanager-online.com/sites/chemanager- online.com/files/printausgabe/epapers/SDL/SDL0113/blaetterkatalog/index.html, [Accessed 14 February 2014]. DistriConsult (2012) Chemical Distribution in 2012: What s next on the horizon? 6th Brazilian Congress of Chemicals and Petrochemical Distributors (EBDQUIM), Praia do Forte (Bahia), 16th March 2012, [online], Available at: http://www.associquim.org.br/ebdquim2012/palestras/Ebdquim2012_G%C3%BCentherEberhard.pdf [Accessed 10th May 2013] Dobbs M. and Hamilton R. T. (2007) Small business growth: recent evidence and new directions, International Journal of Entrepreneurial Behaviour and Research, Vol. 13, No. 5, pp. 296 322. FECC (2013) The Chemical distribution Sector in Europe [online] Fecc.org., Available at: http://www.fecc.org/fecc/about-fecc/the- chemical-distribution-sector-in-europe, [Accessed 9 March 2015].

References Gray, D., Saunders, M. and Goregaokar, H. (2012) Success in challenging times: Key lessons for UK SMEs, University of Surrey. Honrke, M. (2013) The future of chemical distribution in Europe: Customer relations as key value lever, Journal of business Chemistry, Vol. 9, Iss. 2, pp. 65-66. Krasniqi, B. A., Shiroka-Pula, J. and Kutllovci, E. (2008) The determinants of entrepreneurship and small business growth in Kosova: evidence from new and established firms, International Journal of Entrepreneurship and Innovation Management, Vol. 8, No. 3, pp. 320 342. Mortelmans, S. and Reniers, G. (2012) Chemical distribution in Belgium from 2007 to 2010: An empirical study, Journal of Business Chemistry, Vol. 9, Iss. 2, pp. 105-113. National Association of Chemical Distributors (NACD) (2005) The Chemical Distribution Industry & Its Focus on Security, [online], Available at: http://www.chemserv.com/pdf/NACD%20ChemicalSecurity.pdf, [Accessed 15 February 2015]. Rogoff, E. G., Lee, M. S. and Suh, D. C. (2004) Who Done It? Attributions by Entrepreneurs and Experts of the Factors that Cause and Impede Small Business Success, Journal of Small Business Management, Vol. 42, Iss. 4, pp. 364 376. Ropega, J. (2011) The Reasons and Symptoms of Failure in SME, International Advanced Economic Research, Vol.17, pp. 476-483. Simpson, M., Padmore, J. and Newman, N. (2012) Towards a new model of success and performance in SMEs, International Journal of Entrepreneurial Behaviour and Research, Vol. 18, Iss. 3, pp. 264-285. Smallbone, D., Welter, F., Voytovich, A. and Egorov, I. (2010) Government and entrepreneurship in transition economies: the case of small firms in business services in Ukraine, Service Industries Journal, Vol. 30, No. 5, pp. 655-670 Unger, J.M., Rauch, A., Frese, M. and Rosenbusch, N. (2011) Human capital and entrepreneurial success: A meta-analytical review, Journal of Business Venturing, Vol. 26, pp. 341-358.

Thank you! Any questions?