Understanding Transaction Processing Systems (TPS)

Transaction Processing Systems (TPS) are vital components in capturing, storing, and processing data generated from various business transactions. They ensure efficient handling of high volumes of data while maintaining accuracy, security, and privacy. TPS operate through automated data entry, batch processing, and online processing (OLTP) to record transactions in real-time. Avoiding errors is crucial as TPS data directly impact organizational databases.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

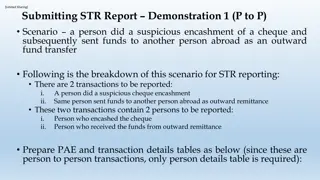

TRANSACTION PROCESSING SYSTEM

TRANSACTION Is any business event that generates data worthy of being captured and stored in a database. Examples of transactions are a product manufactured, a service sold, a person hired and a payroll check generated. When you check out at SM, every time one of your purchases is swiped over the bar code reader, that is one transaction.

TRANSACTION PROCESSING SYSTEM monitor, collect, store, and process data generated from all business transactions. These data are inputs to the organization s database. TPSs have to handle both high volume and large variations in volume (for example, during peak times) efficiently.

In addition, they must avoid errors and downtime, record results accurately and securely, and maintain privacy and security. Avoiding errors is particularly critical, because data from the TPSs are input into the organization s database and must be correct.

Actual process First, data are collected by people or sensors and are entered into the computer via any input device. Generally speaking, organizations try to automate the TPS data entry as much as possible because of the large volume involved, a process called source data automation.

Next, the system processes data in one of two basic ways: batch processing or online processing. In batch processing, the firm collects data from transactions as they occur, placing them in groups or batches. The system then prepares and processes the batches periodically (say, every night).

In online transaction processing (OLTP), business transactions are processed online as soon as they occur. For example, when you pay for an item at a store, the system records the sale by reducing the inventory on hand by a unit, increasing the store s cash position by the amount you paid, and increasing sales figures for the item by one unit by means of online technologies and in real time.

FUNCTIONAL AREA INFORMATION SYSTEM provide information primarily to lower- and middle-level managers in the various functional areas. Lower-level managers handle the day-to-day operations of the organization, making routine decisions such as assigning tasks to employees and placing purchase orders. Middle managers make tactical decisions, which deal with activities such as short-term planning, organizing, and control.

Managers use this information to help plan, organize, and control operations. The information is provided in a variety of reports. Traditionally, information systems were designed within each functional area. Their purpose was to support the area by increasing its internal effectiveness and efficiency.

Typical function-specific systems are accounting and finance, marketing, production/operations (POM), and human resources management.

Information Systems for Accounting and Finance A primary mission of the accounting and finance functional areas is to manage money flows into, within, and out of organizations. This mission is very broad because money is involved in all functions of an organization. We focus on certain selected activities of the accounting/finance functional area.

Financial Planning and Budgeting Appropriate management of financial assets is a major task in financial planning and budgeting. Managers must plan for both the acquisition of resources and their use. Financial and Economic Forecasting. Knowledge about the availability and cost of money is a key ingredient for successful financial planning. Cash flow projections are particularly important, because they tell organizations what funds they need and when, and how they will acquire them.

Funds for operating organizations come from multiple sources, including stockholders investments, bond sales, bank loans, sales of products and services, and income from investments. In addition, numerous software packages for conducting economic and financial forecasting are available. Many of these packages can be downloaded from the Internet, some of them for free.

Budgeting An essential part of the accounting/finance function is the annual budget, which allocates the organization s financial resources among participants and activities. The budget allows management to distribute resources in the way that best supports the organization s mission and goals.

Several software packages are available to support budget preparation and control and to facilitate communication among participants in the budget process. These packages can reduce the time involved in the budget process. Managing Financial Transactions. Many accounting/finance software packages are integrated with other functional areas. For example, Peachtree by Sage (www.peachtree.com) offers a sales ledger, purchase ledger, cash book, sales order processing, invoicing, stock control, fixed assets register, and more.

Investment Management. Organizations invest large amounts of money in stocks, bonds, real estate, and other assets. Managing these investments is a complex task for several reasons. First, there are literally thousands of investment alternatives, and they are dispersed throughout the world. In addition, these investments are subject to complex regulations and tax laws, which vary from one location to another.

Investment decisions require managers to evaluate financial and economic reports provided by diverse institutions, including federal and state agencies, universities, research institutions, and financial services firms. In addition, thousands of Web sites provide financial data, many of them for free.

Control and Auditing. One major reason that organizations go out of business is their inability to forecast and/or secure a sufficient cash flow. overspending, engaging in fraud, and mismanaging financial statements can lead to disaster. Underestimating expenses

Information Systems for Marketing It is impossible to overestimate the importance of customers to any organization. Therefore, any successful organization must understand its customers needs and wants, and then develop its marketing and advertising strategies around them. Information systems provide numerous types of support to the marketing function.

Information Systems for Production/Operations Management The production and operations management (POM) function in an organization is responsible for the processes that transform inputs into useful outputs and for the operation of the business. The POM function is also responsible for managing the organization s supply chain. Because supply chain management is vital to the success of modern organizations.

In-House Logistics and Materials Management. Logistics management deals with ordering, purchasing, inbound logistics (receiving), and outbound logistics (shipping) activities. Related activities include inventory management and quality control. Inventory Management. Inventory management determines how much inventory to keep. Overstocking can be expensive, due to storage costs and the costs of spoilage and obsolescence. However, keeping insufficient inventory is also expensive (due to last-minute orders and lost sales).

Operations personnel make two basic decisions: when to order and how much to order. Inventory models, such as the economic order quantity (EOQ) model, support these decisions. A large number of commercial inventory software packages are available that automate the application of these inventory models. Many large companies allow their suppliers to monitor their inventory levels and ship products as they are needed. This strategy, called vendor-managed inventory (VMI).

Quality Control. Quality-control systems used by manufacturing units provide information about the quality of incoming material and parts, as well as the quality of in- process semifinished products and final finished products. These systems also generate periodic reports containing information about quality (e.g., percentage of defects, percentage of rework needed).