Understanding the Role of Collecting Bankers in Cheque Collection Process

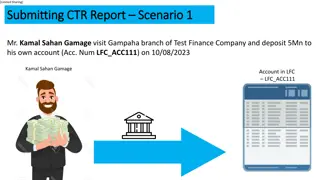

Collecting bankers play a crucial role in collecting cheques and bills on behalf of customers. They act as agents, scrutinize instruments, check endorsements, present instruments on time, and collect proceeds in the payee's account. They also handle notice of dishonor and return instruments if needed. Through images and explanations, this content covers the responsibilities and functions of collecting bankers, including conversion aspects and dealing with non-acceptance scenarios, emphasizing the importance of presenting cheques promptly, serving notice of dishonor, and addressing various situations that may arise during the cheque collection process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

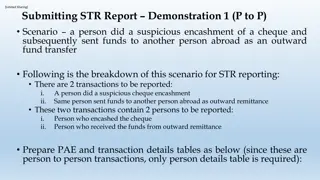

Collecting the cheques and bills on behalf of the customers. In other words, every crossed cheque is necessarily to be collected through any bank is known as collecting Collecting banker who banker means the banker banker collects bank, which banker. collecting banker

1. Acting as Agent 2. Scrutinisingg the instruments 3. Checking the Endorsement 4. Presenting the Instrument in Due time 5. Collecting the proceeds in the payee s account 6. Notice of dishonor and returning the instruments

A) Holder for Value : A) Holder for Value : 1 Bankers as a holder for value 2. Banker as an agent B) Conversion of the collecting Banker r: 1.Conversion is applicable to tangible property and not to debts. 2. Conversion of Negotiable Instruments.

1. Presenting the Cheques for Payment within Reasonable Time. 2. To serve notice of dishonor. 3. Position in case the collecting and paying bank is the same

Non acceptance: Non acceptance:- - 1.Uncrossed Cheques 2. Collection on behalf of a customer 3. Ad hoc account holder 4. Irregularity of Endorsement 5. Doubtful cases

1.CreditingCustmors Account before Realization. 2.Right of the customer to the cheque. 3. Precautions regarding endorsements.