Understanding the Impact of Horizontal Shareholding on Our Economy

Horizontal shareholding, where leading shareholders of horizontal competitors overlap, dampens competition and leads to higher prices. Economic proofs demonstrate how this harms the economy, affecting executive compensation, investment, and inequality. Antitrust laws are crucial for addressing this issue to safeguard market competitiveness and consumer welfare.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

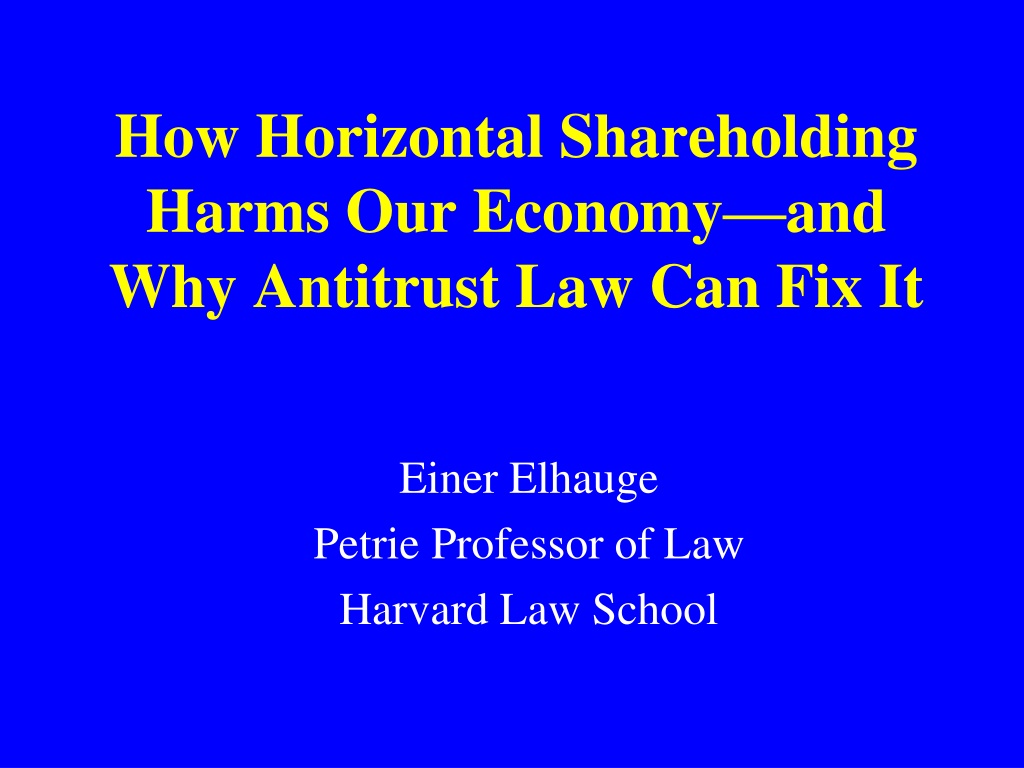

How Horizontal Shareholding Harms Our Economy and Why Antitrust Law Can Fix It Einer Elhauge Petrie Professor of Law Harvard Law School

Horizontal Shareholding When the leading shareholders of horizontal competitors overlap. Decreases incentives to compete: equivalent to increased marginal cost because taking sales from rival costs shareholders profits in other firms. Industry studies confirm horizontal shareholding raises airline & banking prices significantly Results replicated unless redone using invalid methods: Use proxies for HS that are negatively correlated with HS Assume longer flights have lower costs Ignore fund family combinations of stock Set shared voting rights equal to zero Correcting for valid critiques increased price effects

Economic Proofs If managers maximize (1) expected vote share or (2) probability of re-election, they will maximize weighted average of their shareholders profits from all their stockholdings. If (1), weight by voting shares, so increased horizontal shareholding proportionally increase prices If (2), weight by odds particular shareholder s vote will be pivotal, so extra weight to the largest shareholders Proof accounts for shareholder heterogeneity & provides theoretical basis for MHHI/GHHI measures Communication unnecessary, but can increase weight of communicating shareholders

Effect on Executive Compensation Puzzle: Efficient for incentive-based compensation to be based only on firm performance, but much instead reflects industry performance. Economic proof: with horizontal shareholding, maximize shareholder interests by increasing weight of industry performance. (With full horizontal shareholding, equal weight on rival and firm performance.) Empirical evidence: markets with higher horizontal shareholding do just that. 99% statistical confidence. Requires no coordination or communication. Provides direct incentive to lessen competition.

Effects on Investment & Inequality From 1999 to 2014, probability that two large competing firms have a large horizontal shareholder increased from 16% to 90%. Over same period gap between corporate investment and profits increased by the largest extent since World War II. Greatest decline in labor share of income since World War II. Regression analysis: investment-profit gap driven by level of horizontal shareholding in concentrated industries within those industries, by the firms with high horizontal shareholding levels. Suggests gap not driven by automation, declining productivity or innovation, tax or regulatory policies, etc.

2 New Industry Studies in Pharma Increased horizontal shareholding between incumbent branded drug & entering generic increases By 5% the odds of a reverse payment settlement that delays entry The size of entry delay Increased common ownership between drug manufacturers and potential generic entrants reduces the odds of generic entry by 9-13%

Anticompetitive Effects Not Prevented by Fiduciary duties to nonhorizontal shareholders Models assume do consider nonhorizontal interests Business judgment rule Lack of net injury to nonhorizontal shareholders Argument would apply equally to mergers Vertical shareholding Horizontal shareholders not equally invested vertically: S&P 500 firms include all 4 major airlines but pay 5% of airfares When are equally invested vertically, horizontal shareholding at multiple levels worsens problem by creating successive markups Can have its own adverse vertical effects Index fund incentives (next)

Do Index Funds Lack Incentives? BCH: Implausible b/c increased corporate performance cannot help compete for investment flow with other index funds, so exert effort only if ? ? > ? + ??, but 1. The Incremental Costs of Facilitating Lessened Competition Are Generally Zero or Negative. BCH admit C = 0 for decisions about how to vote or positions to take when talking to managers. Have legal duty to engage in informed voting & it costs the same to vote either way. C and IC probably negative for shareholder influence on competitive behavior because Competing vigorously is hard work for managers Managers benefit from executive compensation that rewards them for industry performance

Do Index Funds Lack Incentives? 2. Even When Costs Are Positive, They Are Small Relative to the Anticompetitive Gains. can spread C across many corporate investments & long time horizon Average index fund fee is 0.12% pre year, so present value of increased corporate valuation makes ? more like 1.2% ? massive: back of envelope 60% or more of stock in markets with high HHI and MHHI anticompetitive effects in such markets make corporate profit margins double or more BlackRock manages $3.3 trillion in stock So ? ? = (1.2%)($3.3 trillion)(60%)(50%) = $12 billion

Do Index Funds Lack Incentives? 3. Index Funds Do Have Incentives to Compete with Other Funds for Investment Flow Compete with active funds and personal investments for investments flow in 2015 was $575 billion Given different holdings, increased performance of index funds can increase returns relative to active funds Even if same raw return, means higher net performance for index funds given lower fees (0.12% to 0.79%) Collective action problem minimized because index fund market concentrated: BlackRock 39%, Vanguard 33%, State Street 23% If increased performance affects half the total flow & flow tracks index market shares, that means increased present value of fees of $13.4 billion at BlackRock, $11.4 billion at Vanguard, and $7.9 billion at State Street

Do Index Funds Lack Incentives? 4. Index Funds Are Not the Main Horizontal Shareholders and Are Voted by Fund Families That Also Have Active Funds. Index funds accounted for only 29% of all institutional investor funds Index fund families have hundreds of billions in active funds Given higher fees on active funds, BlackRock earns about as much in fees on active funds as passive ones Active funds do not lose any of their incentives to exert effort to increase corporate value by being in the same fund family as index funds Just increases incentives for effort because fund family has additional voting power by voting the index fund shares as well

Do Index Funds Lack Incentives? 5. What Matters Is Relative Shareholder Influence, Not Whether Shareholder Effort Is Fully Optimal BCH assume proper benchmark is sole 100% owner who exerts effort whenever ? > ? Not the right baseline for optimal effort Total cost of $1 million to increase value by $1 million, no welfare gain Want to maximize difference between value enhancement & total cost Effort only if marginal increase in value > marginal increase in cost At initial effort levels, index funds have ample incentives to exrt effort For anticompetitive effects, what matters is influence of index funds and other horizontal shareholders relative to other shareholders. High because Index funds vote far more often Cannot exit Larger stockholding gives higher odds of affecting corporate behavior Have fiduciary duties to vote knowledgeably Can spread costs of effort on common governance issues (like executive compensation methods) across many more corporations

Do Index Funds Lack Incentives? 6. Empirical Evidence Shows That Index Fund Families Do Exert Effort and Influence. 63% of institutional investors talk with corporate managers. One admitted high on agenda was urging price increases over competing for market share. 53% tried to influence managers by voting against them. BlackRock: 1500 private engagements with firms & CEO says we are imposing more of what we think is correct and We can tell a company to fire 5,000 employees tomorrow. Index fund ownership has statistically significant correlation with anti-management votes,share of directors who are independent, poison pill removals, reduced dual class shareholding, and increased rate of return. Horizontal shareholding by institutional investors affects executive comp, corporate investment & product prices

Clayton Act 7 Remedy Stock acquisitions likely to have anticompetitive effects violate Clayton Act 7, even if no control or influence. Passive investor exception no obstacle because applies only if solely for investment = don t vote or otherwise influence and does not actually have likely anticompetitive effects Should investigate if HHI > 2500 & MHHI > 200 & condemn if likely anticompetitive effects are found

Sherman Act 1 Remedy Any contract, combination in the form of trust or otherwise, or conspiracy that imposes a net restraint on competition is illegal. Horizontal shareholding involves formal contracts whose voting & financial rights create the anticompetitive effects. Antitrust law aimed to prohibit trusts that were horizontal shareholders. So also a combination . Effect of multiple contracts aggregated: e.g., exclusive dealing and vertical price-fixing Given possible efficiencies, rule of reason, so need to show anticompetitive effects.

Extension to EU Merger Law EU merger control regulation more narrow than Clayton Act because need control But could cover stock acquisitions that potentially give horizontal shareholders collective decisive influence Would require changing enforcement practice to not require contractual or direct links among shareholders. Similar to Gencor change that extended old merger regulation to mergers creating collective dominance. But would still fail to address full problem since collective decisive influence not necessary for anticompetitive effects

Extension to TFEU 101 Prohibits agreements or concerted practices between undertakings that have the effect of restricting competition. At least as broad as Sherman Act Philip Morris held applies to minority stock acquisitions if they have effect of influencing the competitive behaviour , which is what the effect of horizontal shareholding is. Concerted practices extends beyond agreements to cover any indirect contact that has the effect of influencing conduct of competitor. Suiker Unie. Horizontal shareholding is such an indirect contact.

Extension to TFEU 102 Bans abusing collective dominance, including through excessive pricing. Good reasons not to enforce excessive pricing provision against Monopoly pricing, because such pricing is a desirable reward for investment Oligopoly pricing, because it is unavoidable But horizontal shareholding that raises prices Does not reflect desirable reward for investment Is not unavoidable Does create a collective dominance based on contractual & structural links that results in excessive pricing This legal claim eliminates need to show ongoing agreement This interpretation also solves puzzle of how to give some sensible meaning to the excessive pricing provision.