Insights into Post-Incorporation Compliance Requirements under various forums

Post-incorporation compliance ensures a company's legal status and operational integrity by meeting reporting obligations, adhering to tax laws, and obtaining necessary registrations like GSTIN, EPFO, ESIC, and others through AGILE-PRO-S (INC-35). Th

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

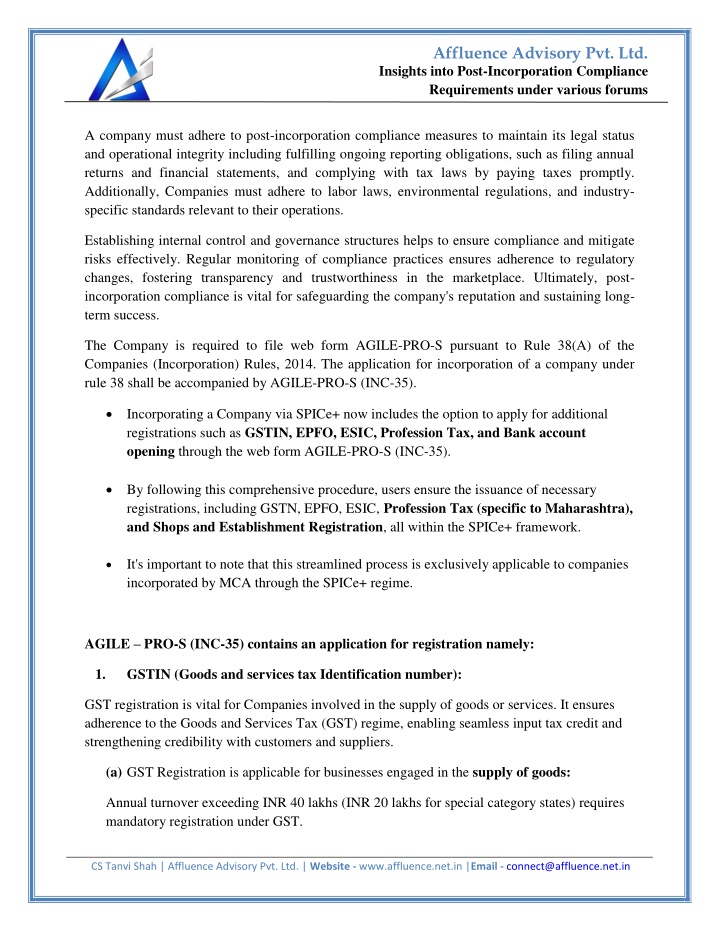

Affluence Advisory Pvt. Ltd. Insights into Post-Incorporation Compliance Requirements under various forums A company must adhere to post-incorporation compliance measures to maintain its legal status and operational integrity including fulfilling ongoing reporting obligations, such as filing annual returns and financial statements, and complying with tax laws by paying taxes promptly. Additionally, Companies must adhere to labor laws, environmental regulations, and industry- specific standards relevant to their operations. Establishing internal control and governance structures helps to ensure compliance and mitigate risks effectively. Regular monitoring of compliance practices ensures adherence to regulatory changes, fostering transparency and trustworthiness in the marketplace. Ultimately, post- incorporation compliance is vital for safeguarding the company's reputation and sustaining long- term success. The Company is required to file web form AGILE-PRO-S pursuant to Rule 38(A) of the Companies (Incorporation) Rules, 2014. The application for incorporation of a company under rule 38 shall be accompanied by AGILE-PRO-S (INC-35). Incorporating a Company via SPICe+ now includes the option to apply for additional registrations such as GSTIN, EPFO, ESIC, Profession Tax, and Bank account opening through the web form AGILE-PRO-S (INC-35). By following this comprehensive procedure, users ensure the issuance of necessary registrations, including GSTN, EPFO, ESIC, Profession Tax (specific to Maharashtra), and Shops and Establishment Registration, all within the SPICe+ framework. It's important to note that this streamlined process is exclusively applicable to companies incorporated by MCA through the SPICe+ regime. AGILE PRO-S (INC-35) contains an application for registration namely: 1. GSTIN (Goods and services tax Identification number): GST registration is vital for Companies involved in the supply of goods or services. It ensures adherence to the Goods and Services Tax (GST) regime, enabling seamless input tax credit and strengthening credibility with customers and suppliers. (a)GST Registration is applicable for businesses engaged in the supply of goods: Annual turnover exceeding INR 40 lakhs (INR 20 lakhs for special category states) requires mandatory registration under GST. CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Insights into Post-Incorporation Compliance Requirements under various forums (b)For businesses providing services: Annual turnover exceeding INR 20 lakhs (INR 10 lakhs for special category states) requires mandatory registration under GST. (c)Additionally, voluntary registration is an option for businesses below the threshold, offering access to benefits and simplified compliance procedures. (d)By providing details as required in e-form AGILE-PRO-S (INC-35) the Company can obtain registration. 2. EPFO (Employees Provident Fund Organization Registration): EPFO registration is a crucial step for businesses operating in India and employing a certain number of employees. It ensures compliance with the Employees' Provident Fund and Miscellaneous Provisions Act, which mandates employers to contribute towards their employees' retirement savings. This registration facilitates the creation of individual provident fund accounts for employees, helping them build a financial cushion for their post-retirement years. Failure to register with EPFO can result in legal repercussions and prevent businesses from fulfilling their obligations towards employee welfare and retirement benefits. 3. ESIC (Employees State Insurance Corporation Registration): ESIC registration is a vital requirement for applicable establishments as provided below in table. It ensures compliance with the Employees' State Insurance Act, providing healthcare benefits and financial support to employees in case of sickness, maternity, disablement, or death due to employment-related injuries. Failure to obtain ESIC registration can lead to legal consequences and hinder the company's ability to fulfill its obligations towards employee welfare and safety. Hence it has been made mandatory for all Companies doing registration. Applicability OF ESIC & EPFO Registration: Particulars EPFO ESIC Employee Threshold 20 or More 10 or More CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Insights into Post-Incorporation Compliance Requirements under various forums Mandatory after 20 or more employees. However, the company can opt for voluntary coverage. Mandatory after 10 or more employees. No voluntary coverage. Coverage Mandatory after registration in both ESIC and EPFO. Mandatory after registration in both ESIC and EPFO. Return Filing Circular link:- No. P-11/14/19/Misc/02/2022-Rev.II Detailed article on circular:- https://affluence.net.in/online-registration-of-units-through- mca-portal-for-esi-registration-and-inspection-of-units-in- this-regard/ Employee State Insurance Corporation Circular dated 22nd December, 2022 for newly incorporated companies 4. Profession Tax Registration: Professional Tax Registration is a compulsory compliance requirement for businesses that employ professionals or skilled workers in certain states across India. This registration must be obtained within 30 days of company incorporation. Essentially, PT Registration facilitates the payment of Professional Tax, a state-level levy imposed on individuals earning income from various professions, trades, or employment. Failure to adhere to this obligation may result in penalties, fines, and legal consequences enforced by state tax authorities. Additionally, overlooking Professional Tax Registration could classify the company as non-compliant with tax regulations, jeopardizing its legal standing and inviting further scrutiny from regulatory authorities. 5. Opening of Bank Account: Establishing a bank account emerges as a critical post-incorporation obligation for companies, serving as the linchpin for financial transactions and operational efficacy. Typically, businesses are mandated to initiate this process within a reasonable timeframe after incorporation, often spanning a few weeks to a month. This account acts as the nucleus for company funds, facilitating crucial transactions such as receiving payments, managing expenses, and handling payroll. Failure to meet this requirement can significantly impede the company's financial activities, diminishing operational efficiency and potentially causing missed business opportunities. Furthermore, the absence of a bank account can pose challenges in financial management and tax compliance, exposing the company to financial risks and regulatory sanctions. CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Insights into Post-Incorporation Compliance Requirements under various forums 6. Shops and Establishment Registration: Securing Shops and Establishment Registration stands as a pivotal step in post-incorporation labor law compliance for businesses with physical operations. Mandated by state governments, obtaining this registration within 30 days of incorporation is imperative. Its primary function is to regulate working conditions, safeguard employee rights, and enforce safety standards within commercial premises. Failure to comply can lead to severe penalties, including fines, closure orders, or legal action. Moreover, neglecting this registration jeopardizes the company's legal legitimacy, tarnishes its reputation, and hampers its growth trajectory. Please find additional post-incorporation compliance requirements in the following link: https://affluence.net.in/checklist-for-post-incorporation-activities-of-company/ CONCLUSION: In summary, post-incorporation compliance is essential for maintaining a company's legal status and operational integrity. Meeting reporting obligations like filing annual returns and financial statements, along with prompt tax payments, ensures transparency and trustworthiness. Through AGILE-PRO-S (INC-35), companies can efficiently obtain registrations like GSTIN, EPFO, ESIC, Profession Tax, and Shops and Establishment, streamlining their compliance process. These registrations are crucial for regulatory adherence and credibility. Neglecting compliance can result in legal penalties and damage to the company's reputation. Therefore, prioritizing post- incorporation compliance is vital for sustained success and positive contributions to the business environment. Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in