Understanding Internal Control Evaluation Methods in Auditing

Auditors need to evaluate internal control systems by familiarizing themselves with the flow of transactions and control procedures. They must develop techniques like narratives, checklists, and questionnaires for testing, assess the impact of errors, report weaknesses, and determine reliance on the system. Internal audit and control play crucial roles in safeguarding assets, ensuring data accuracy, and achieving organizational objectives.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

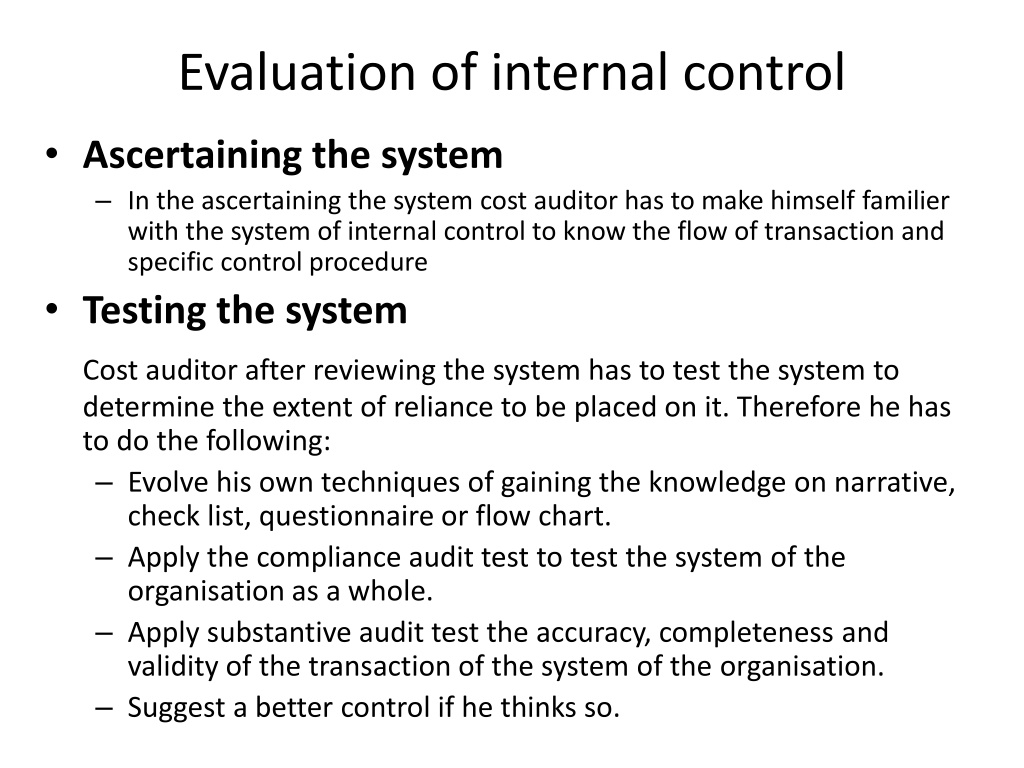

Evaluation of internal control Ascertaining the system In the ascertaining the system cost auditor has to make himself familier with the system of internal control to know the flow of transaction and specific control procedure Testing the system Cost auditor after reviewing the system has to test the system to determine the extent of reliance to be placed on it. Therefore he has to do the following: Evolve his own techniques of gaining the knowledge on narrative, check list, questionnaire or flow chart. Apply the compliance audit test to test the system of the organisation as a whole. Apply substantive audit test the accuracy, completeness and validity of the transaction of the system of the organisation. Suggest a better control if he thinks so.

Contd Evaluation of the system Cost auditor after reviewing and testing the system has to evaluate it so as to ascertain whether a system is capable of detecting the materials errors and irregularities in the system to place reliance on it. Cost auditor therefore has to find out the following: Ascertain the impact of the material errors and irregularities in the transaction on the related transactions. Report on the weakness of the internal control system to the management of the company.

Internal Audit Internal Control Internal assigned audit staff within an organisation with the objective of determining whether the other internal control are properly designed and operated. audit is undertaken by specially Internal control is the plan of the organisation to safe guard its assets check the accuracy and reliability of the accounting data and efficiency in order to achieve managerial objective. promote operational Internal audit is a part of the internal control system which is required to evaluate the adequacy of the internal control system. Internal control is the wide term which is set up by the management for the whole system of the organisation. An internal audit is a check that is conducted at specific times. Internal control is responsible for checks that are on- going to make sure operational efficiency and effectiveness are achieved through the control of risks. Internal control includes administrative controls e.g. safeguarding of assets, periodic physical verification etc. Internal audit is only a primary part of the internal control system which is set up by the management to evaluate and report on the accounting and other controls in operation. Internal audit is a control device whose function is to examine and evaluate the adequacy of other controls. Internal control is a control device who provides reasonable assurance about the achievement of an entity s objectives with regard to reliability of accounting data, effectiveness and efficiency of operations etc.

Internal Audit Internal Check Internal audit is an independent review of the operations and organisation by specially auditing staff. Internal check is a dependent system whereby the work of one person is automatically checked by another person. records of the by appointed Separate internal auditors are appointed to carry out the functions of the internal audit. Internal check is an in build part of the system and no separate staffs are engaged to carry out internal check. The objective of internal audit is to discover the errors and frauds in the organisation. Internal audit is mainly a detective function. The objective of internal check is to minimize the errors and frauds in the various activities that are conducted in an organisation. It is mainly a preventive function. In internal audit the work of the employee is checked after it is completed. In internal check the checking is done while carrying out the work. Its nature of check is subjective. Implementation of checking is done by internal auditor. Its nature of check is objective. Implementation continuous. of check is automatic and There is a scope for suggestions. There is no scope for suggestions.

Inventory Control Objectives Avoidance of out of stock danger Service to consumers Economy in purchasing Information about the inventory

Evaluation of inventory control He should check whether the inventory is properly stored and protected from getting deteriorated. Auditor should check whether material has been issued from stores only on valid requisition. He should also confirm the authorized person to sign the requisition. Auditor should check the records maintained at stores location. He should check whether continuous stock records have been maintained for raw materials, consumable stores, finished goods and stocks held on behalf of third parties. Auditor has to check whether records are maintained as per quantity, or as per value or both in quantity and value. Auditor should check whether separate records are maintained for each category of raw materials. He should confirm that the cost accounting system is fully integrated with financial records.

Budgetory Control Budgetary control was defined can be defined as the establishment of budgets relating to the responsibilities of the executives to the requirements of a policy and a continuous comparison of the actual result s with the budgeted result so as to provide a basis of revision of the activities.

Objectives of Budgetory Control To plan To coordinate To communicate To control

Evaluation of Budgetory Control Whether the budgetary control system is serving any useful purpose. Whether the standards are set in consultation with those who are responsible for their fulfillment. Whether the budgetary control systems is used for the purpose of price quotation or is only used as an internal control device. Whether flexibility is provided in the budgets. Whether the budgets proposals are periodically reviewed. Whether the budgeted figures are compared with actual in order to ascertain the variance. Whether variances reports are timely prepared and corrective action are taken by the management in order to improve the planned result to avoid the negative variance in the future. Whether the purpose of the budgetary control system is clear to all the levels management. Whether budgets are prepared by taking the previous years budgets as a base year or zero base.

Management Information System (MIS) MIS is a comprehensive and co-ordinated system of providing right information to the right person at a right time and in a right format to the various levels of management in the organisation for providing support to the decision making activities.

Evaluation of Management Information System Content and source of information A cost auditor should check whether the information collected is relevant to decision making or requires any improvement in the decision making process. He should check whether the reporting of MIS is regular and uniform for financial and non-financial information. Auditor should check the reliability of source of information and should see that unwanted information has been deleted.

Evaluation of Management Information System Flow of information A cost auditor has to check the system of organisation of information whether it is centralized or decentralized, flow of information from various units to control section, estimating the volume of data, transaction time and cost involved. He should check the methods used in data collection and management. He should confirm that the data is classified properly and matched with decision making process.

Evaluation of Management Information System Correlation of MIS with decision areas Cost auditor should examine whether input-output analysis is attempted. He should also check whether the MIS is helpful in reducing the effects of uncertainity.

Capacity Utilisation Capacity can be defined as rate of output at which there is no incentive to alter the size of the plant if that rate of output is expected to the permanent the cost. Capacity planning and production planning and control are the pre-requisites to capacity utilisation control mechanism for capacity planning

Evaluation of Capacity Utilisation Method of measuring base machine capacity. Clear guidelines should be available regarding the assessment of capacity. In some industries a capacity is influenced by a number of factors and determining a single base figure requires adjustment of various variables. Whether the system provides for a comparative study of the rated output, actual output and normal output. Determined whether a capacity utilisation report is been prepared by the person other than the person who is responsible for the production activity. Check whether the capacity measurement is based on capital output ratio or an any other factor.

Statistical sampling Statistical sampling involves the random selection of a number of items for inspection and is endorsed by the accountancy bodies. statistical sampling is that it removes the need for the use of the professional judgement. uses statistical methods to determine the sample size and to select and evaluate audit samples it is the responsibility of the auditor to consider and specify in advance factors such as, the expected error rate or amount, standard deviation and population size, before the sample size can be determined. Types of sampling are Random, Systematic, Stratified etc

Judgemental Sampling It involves a subjective selection of items for testing and a subjective evaluation of the results. Judgemental sampling is accepted by the accounting professions as a means of gathering evidence concerning the truth and fairness of the financial statements. It could be criticized on the grounds that it is not scientific and may be rendered inconsistent and unreliable because of: Differences in individual auditor s ability, knowledge, experience and prejudices. Auditor s state of physical and mental health. It relies on intuition and non-quantitative methods in the evaluation process. It has also been criticized on the basis that the extent of audit testing is not consistent between auditors or across audits.

Assessment of the adequacy of the Internal Audit Function Review of the accounting system and the related internal control Examination of financial and operating information for the management Compliance with established policies and procedures Safeguarding of assets