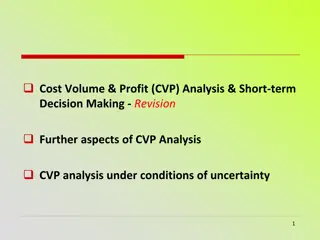

Understanding Cost-Volume-Profit Analysis in Financial Modeling

Explore the fundamentals of Cost-Volume-Profit (CVP) analysis, also known as financial modeling, which demonstrates the relationship between costs, volume, and profits. Learn to calculate break-even points, margins of safety, and target sales. Discover how to create Excel spreadsheets for CVP analysis, conduct What-If scenarios, and make informed business decisions based on accurate financial modeling.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Cost-Volume-Profit Analysis (aka Financial Modeling)

Upon completion of this online session, participants will be able to: 1. Grasp the relationship between costs, volume (production and sale) and profits 2. Calculate Break-Even (BE) point, Margin-of-Safety (MOS) and target sales and production

Upon completion of this Module in-class, participants will also be able to: 1. Create a functional Excel spreadsheet to facilitate cost- volume-profit (CVP) analysis with and without taxes 2. Conduct CVP analysis for single or multiple products 3. Conduct a What-If analysis under multiple scenarios

Definition of Financial Models Relationships between costs, revenues, & income. Accurate, reliable simulations of relationships among relevant costs, benefits, value and risk that is useful for supporting business decisions. Pro forma financial statements. Relationships between current investments and value.

Objectives of Financial Modeling Useful for decision making Accurate and reliable simulation of relevant factors and relationships Flexible and responsive analyses

Now that we know how to calculate Operating Income (in Module 3), the next step is to understand how inputs into the calculations affect the final numbers. These inputs are fixed costs, variable costs, volume of sales, selling price and taxes. This analysis is known as Cost-Volume-Profit (CVP) Analysis

Basic Cost-Volume-Profit (CVP) Model Revenue = Variable Costs + Fixed Costs + Income Assumptions: Revenue can be estimated as: sales price (P) units sold (Q). Total variable costs can be estimated as: variable cost per unit (V) units sold (Q). Total fixed costs (F) will remain constant over the relevant range.

Basic CVP Model and the Break-Even Point Revenue = Variable Costs + Fixed Costs + Income PQ = VQ + F + I At the break-even point income = 0 PQ = VQ + F Combining terms and solving for Q, the number of units that must be sold to break even: Q = F (P V) Let s see some numbers! (P V) is the unit contribution margin

Basic CVP Model and the Break-Even Point The break-even point is the point in the volume of activity where the organization s revenues and expenses are equal. Sales Less: variable expenses Contribution margin Less: fixed expenses Net income 200,000 $ 120,000 80,000 80,000 $ -

Basic CVP Model and the Break-Even Point Consider the following information developed by the accountant at Curl, Inc.: Total 250,000 $ 150,000 100,000 $ 80,000 20,000 $ Per Unit $ $ Percent 100% 60% 40% Sales (500 surf boards) Less: variable expenses Contribution margin Less: fixed expenses Net income 500 300 200

Basic CVP Model and the Break-Even Point For each additional surf board sold, Curl generates $200 in contribution margin. Total 250,000 $ 150,000 100,000 $ 80,000 20,000 $ Per Unit $ $ Percent 100% 60% 40% Sales (500 surf boards) Less: variable expenses Contribution margin Less: fixed expenses Net income 500 300 200

Basic CVP Model and the Break-Even Point Fixed expenses Unit contribution margin Break-even point (in units) = Total 250,000 $ 150,000 100,000 $ 80,000 20,000 $ Per Unit $ $ Percent 100% 60% 40% Sales (500 surf boards) Less: variable expenses Contribution margin Less: fixed expenses Net income 500 300 200 $80,000 $200 = 400 surf boards

Basic CVP Model and the Break-Even Point Here is the proof! Total 200,000 $ 120,000 80,000 $ 80,000 $ Per Unit $ $ Percent 100% 60% 40% Sales (400 surf boards) Less: variable expenses Contribution margin Less: fixed expenses Net income 500 300 200 - 400 $500 = $200,000 400 $300 = $120,000

Basic CVP Model and the Break-Even Point Calculate the break-even point in sales dollars rather than units by using the contribution margin ratio. Contribution margin Sales = CM Ratio Fixed expense CM Ratio Break-even point (in sales dollars) =

Basic CVP Model and the Break-Even Point Total 200,000 $ 120,000 80,000 $ 80,000 $ Per Unit $ $ Percent 100% 60% 40% Sales (400 surf boards) Less: variable expenses Contribution margin Less: fixed expenses Net income 500 300 200 - $80,000 40% $200,000 sales =

Basic CVP Model in Graphical Format Viewing CVP relationships in a graph gives managers a perspective that can be obtained in no other way. Consider the following information for Curl, Inc.: 300 units 150,000 $ 90,000 60,000 $ 80,000 (20,000) $ 400 units 200,000 $ 120,000 80,000 $ 80,000 $ 500 units 250,000 $ 150,000 100,000 $ 80,000 20,000 $ Sales Less: variable expenses Contribution margin Less: fixed expenses Net income (loss) - 12-16

Basic CVP Model in Graphical Format 450,000 Total sales Break-even point 400,000 350,000 300,000 Total expenses 250,000 200,000 Fixed expenses 150,000 100,000 50,000 - - 100 200 300 400 500 600 700 800 Units Sold

Profit-Volume Graph Some managers like the profit-volume graph because it focuses on profits and volume. $100,000 $80,000 $60,000 $40,000 $20,000 $- $- $50 $100 $150 $200 $250 $300 $350 $400 $(20,000) $(40,000) Break-even point $(60,000) $(80,000) $(100,000) 1 2 3 4 5 6 7 8 Units sold (00s)

CVP and Target Income We can determine the number of surfboards that Curl must sell to earn a profit of $100,000 using the contribution margin approach. Fixed expenses + Target income Unit contribution margin Units sold to earn the target income = $80,000 + $100,000 $200 per surf board = 900 surf boards

CVP and Target Income We can also use the equation approach to get the same result. Revenue = Variable costs + Fixed costs + Income ($500 Q) ($300 Q) + $80,000 + $100,000 = $200Q = $180,000 Q = 900 surf boards

Modeling Taxes We can adjust the basic CVP model to incorporate income taxes. Using the following notation: A = Income after tax B = Income before tax T = Tax rate A = B BT A = B (1 T) or solving for B: B = A (1 T)

Modeling Multiple Products When a company sells multiple products, modeling requires: 1. An estimate of the relative proportion of each product in the sales mix . 2. A computation of the Weighted Average Unit Contribution Margin.

Modeling Multiple Products For a company with more than one product, sales mix is the relative combination in which a company s products are sold. Different products have different selling prices, cost structures, and contribution margins. Let s assume Curl sells surf boards and sail boards and see how we deal with break-even analysis.

Modeling Multiple Products Curl provides us with the following information: Unit Variable Cost $ Unit Number of Boards Selling Price $ Contribution Margin $ Description Surfboards Sailboards Total sold 500 300 450 200 550 500 300 800 1,000 Number of Boards % of Total 62.5% (500 800) 37.5% (300 800) 100.0% Description Surfboards Sailboards Total sold 500 300 800 Sales mix computation

Modeling Multiple Products Weighted-average unit contribution margin Contribution Margin $ Weighted Contribution 125.00 $ 206.25 331.25 $ Description Surfboards Sailboards Weighted-average contribution margin % of Total 62.5% 37.5% 200 550 $200 62.5%

Modeling Multiple Products Break-even point Break-even point Fixed expenses = Weighted-average unit contribution margin Fixed costs increased from $80,000 due to expansion needed to sell multiple products. Break-even point $170,000 $331.25 = Break-even point 514 combined units =

Modeling Multiple Products Breakeven is 514 combined units. We can use the sales mix to find the number of units of each product that must be sold to breakeven. Combined Breakeven Sales 514 % of Total 62.5% 37.5% Individual Sales Product Surfboards Sailboards Total units 321 193 514 The break-even point of 514 units is valid only for the sales mix of 62.5% and 37.5%.

Sensitivity Analysis An examination of the changes in outcomes caused by changes in each of a model s parameters. For example, we can examine the impact on profit (outcome) if the parameters of selling price, quantity sold, unit variable cost, and or fixed costs change. Because of the number of computations involved, computerized models are used for sensitivity analysis.

Sensitivity Analysis Estimate the likely range of each parameter. Change one parameter to upper and lower end of range, keeping other parameters at the most likely values. Estimate the most likely value of each parameter. Record profit for each change and repeat process for all parameters. Because of the number of computations involved, computerized models are used for sensitivity analysis.

Sensitivity Analysis Model elasticity The ratio of percentage change in outcome (profit) to percentage change in a parameter. If greater than 1.0, change in parameter has a large effect on profit. If less than 1.0, change in parameter has a small effect on profit. Because of the number of computations involved, computerized models are used for sensitivity analysis.

Scenario Analysis Realistic combinations of changed parameters Best case scenario Realistic combination of highest prices and quantities, along with the lowest costs. Worst case scenario Realistic combination of lowest prices and quantities, along with the highest costs. Most likely case scenario Realistic combination of most likely prices and quantities, along with the most likely costs.