Understanding Cohort Default Rates in Federal Student Loans

This document discusses the importance of protecting the cohort default rate in educational institutions for financial well-being of students and safeguarding federal funding. It explains the cohort default rate equation and provides insights into the cohort year 2013 data. The visuals and information aim to emphasize the significance of responsible borrowing and its impact on financial aid programs, focusing on federal loan defaults and financial aid statistics in fiscal year 2014.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Protecting our Cohort Default Rate

Goals 1. Protect financial well-being and ensure they borrow responsibly. <School Name> s students 2. Protect <School Name> s reputation. 3. Protect <School Name> s Cohort Default Rate and ultimately our Title IV funding that provides much-needed financial aid for an increasing proportion of students. federal 2

UNDERSTANDING COHORT DEFAULT RATES 3

CDR Equation Borrowers in the cohort who default within cohort default 3 year period (Numerator) X 100 = CDR Cohort of federal student loan borrowers who enter repayment during cohort fiscal year (Denominator) 4

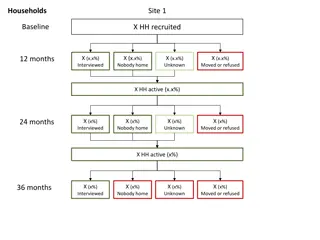

Cohort Year 2013 September 30, 2013 October 1, 2012 September 30, 2015 September 30, 2014 Enter Repayment Track Default Status 5

PROTECT <SCHOOL NAME> S STUDENTS FINANCIAL WELL-BEING AND ENSURE THEY BORROW RESPONSIBLY 6

In fiscal year 2014, students borrowed approximately $100 billion through federal loan programs. Summary of Federal Loan Defaults as of FY 2014 Q3 Average Amount in Default per Borrower Federal Loan Program Outstanding Loans ($ billions) Recipients (millions) Direct Loans $37.4 2.6 $14,385 Federal Family Education Loans $60.7 4.4 $13,795 TOTAL $98.1 7.0 $14,014 Source: U.S. Department of Education 8

Financial Aid at <<COLLEGE NAME>> Undergraduate Student Financial Aid, 2013-2014 (All Undergraduate Students) Total amount of aid received Average amount of aid received Number receiving aid Percent receiving aid Type of Aid Grant or scholarship aid Pell grants Federal student loans 6,536 53% $45,386,811 $6,944 3,672 30% $14,317,792 $3,899 7,335 60% $53,383,030 $7,278 !!!Update chart with your school s numbers; can be accessed from the College Navigator website!!! 9

COHORT DEFAULT RATE IS A NEW MEASURE OF REPUTATION AND SUCCESS 10

Students experience garnished wages and tax refunds Schools lose eligibility for major federal student aid programs Schools become less appealing to prospective students Taxpayers are responsible for 97-100% of defaulted loans 11

Impact of your CDR The Shopping Sheet 1. Graduation Rate 2. Cohort Default Rate 3. Average Indebtedness 13

Comparative CDR <<INSERT PEER COMPARISON INFORMATION USING THE COMPARISON CHART FROM WWW.INCEPTIA.ORG/TOOLKIT>> 14

PROTECT <SCHOOL NAME> S COHORT DEFAULT RATE AND ULTIMATELY OUR TITLE IV FUNDING 15

Snapshot of our CDR SCHOOL NAME 2012 2011 Default rate 9.7% 5.0% Number in default 144 90 Number in repayment 1,471 1,794 !!!Update chart with your school s numbers; can be accessed from the College Navigator website!!! 16

U.S. Department of Education Default Prevention Plan Requirements An effective default prevention and management plan (required or not) can ensure our students have the financial tools required for successful student loan repayment. Create Default Prevention and Management Plan Default Prevention Taskforce Department of Education Approval Measureable Objectives 18

DEFAULT PREVENTION STRATEGY 19

Default Prevention Strategy Current strategies in place (list existing strategies/processes that your Financial Aid Office and/or other departments currently does to promote default prevention) 20

Default Prevention Strategy <<INSERT SCHOOL S COHORT ACTIVITY REPORT. ACCESSIBLE VIA WWW.INCEPTIA.ORG/TOOLKIT. YOU WILL NEED TO LOAD YOUR SCHOOL PORTFOLIO REPORT.>> 21

Default Prevention Strategy <<INSERT CDR TOOL CHART . ACCESSIBLE VIA WWW.INCEPTIA.ORG/TOOLKIT.>> 22

Costs Developing & Implementing a Successful Default Management Program Default Management Program Development Program Operational Costs Overhead Computer workstations Software Phone lines Training (initial and ongoing) Personnel Paper Postage Media publications Counseling materials Recording services Skip-tracing Systems to report Telephone services Long distance charges Equipment maintenance 23

Recommendation Engage in additional activities across the entire student lifecycle, including additional training and counseling for borrowers. In-school period: keep in-house Grace period: partner with a third-party vendor Repayment period: partner with a third- party vendor 24

Value of Working with a Third Party Vendor Increased operational efficiencies and cost savings. Reduced overhead costs. Compliance with all laws and regulations related to contacting students and protecting their data. Ongoing training with counselors on latest repayment plans and options. 25

The Clock is Ticking! Every day passed without an enhanced default prevention strategy is one less day to make an impact on our CDR. Update numbers. Information is available via your Cohort Activity Report. XX .XX% Percentage one borrower impacts our CDR Number of borrowers that must be saved to reduce our rate by one percent 26