Understanding Audit and Assurance_ Crucial Approaches, Optimal

For economic reporting to be clear, compliant, and trusted in the ever-changing economic landscape of today, audit and assurance skills are necessary. Understanding the subtleties of audit and assurance can have a big impact on how successful e

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

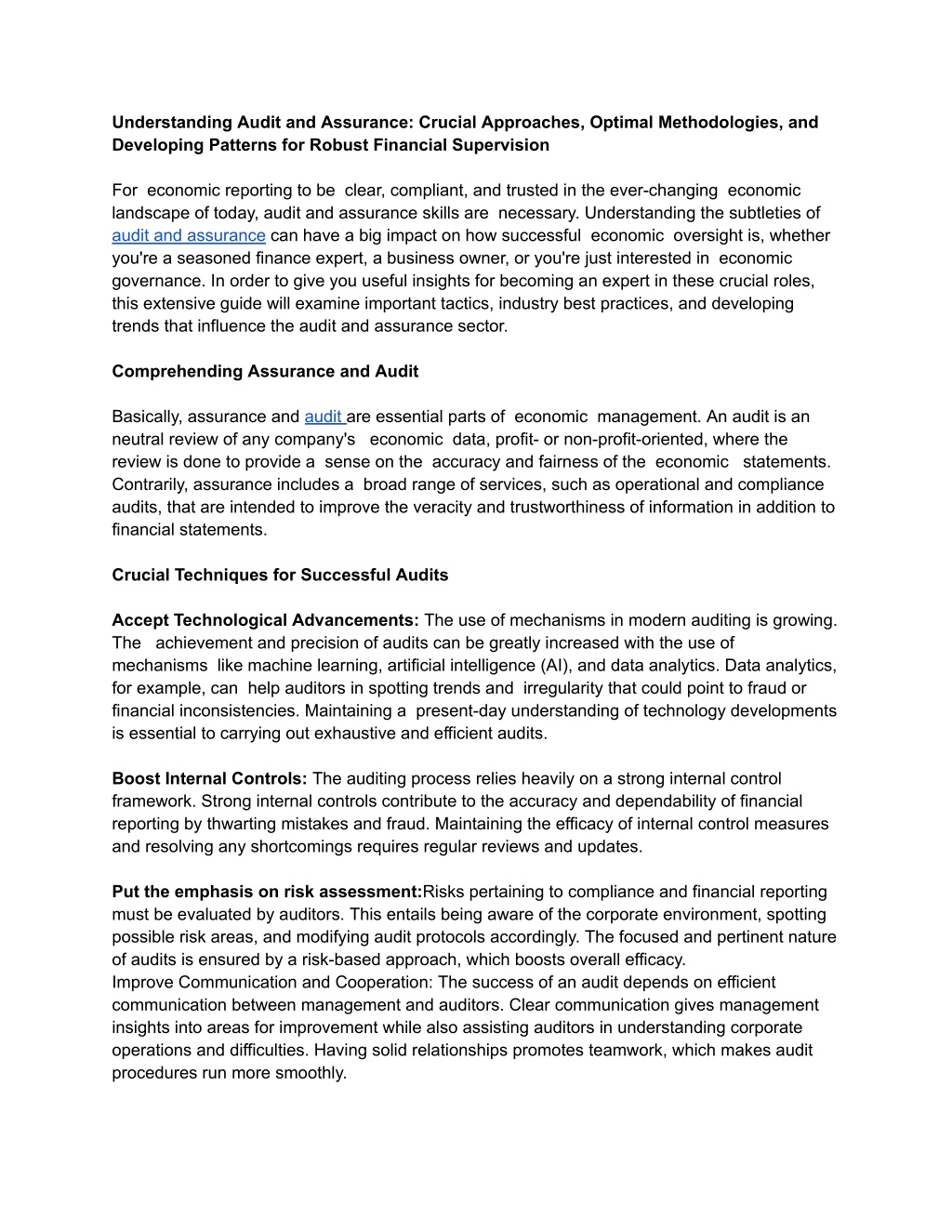

Understanding Audit and Assurance: Crucial Approaches, Optimal Methodologies, and Developing Patterns for Robust Financial Supervision For economic reporting to be clear, compliant, and trusted in the ever-changing economic landscape of today, audit and assurance skills are necessary. Understanding the subtleties of audit and assurance can have a big impact on how successful economic oversight is, whether you're a seasoned finance expert, a business owner, or you're just interested in economic governance. In order to give you useful insights for becoming an expert in these crucial roles, this extensive guide will examine important tactics, industry best practices, and developing trends that influence the audit and assurance sector. Comprehending Assurance and Audit Basically, assurance and audit are essential parts of economic management. An audit is an neutral review of any company's economic data, profit- or non-profit-oriented, where the review is done to provide a sense on the accuracy and fairness of the economic statements. Contrarily, assurance includes a broad range of services, such as operational and compliance audits, that are intended to improve the veracity and trustworthiness of information in addition to financial statements. Crucial Techniques for Successful Audits Accept Technological Advancements: The use of mechanisms in modern auditing is growing. The achievement and precision of audits can be greatly increased with the use of mechanisms like machine learning, artificial intelligence (AI), and data analytics. Data analytics, for example, can help auditors in spotting trends and irregularity that could point to fraud or financial inconsistencies. Maintaining a present-day understanding of technology developments is essential to carrying out exhaustive and efficient audits. Boost Internal Controls: The auditing process relies heavily on a strong internal control framework. Strong internal controls contribute to the accuracy and dependability of financial reporting by thwarting mistakes and fraud. Maintaining the efficacy of internal control measures and resolving any shortcomings requires regular reviews and updates. Put the emphasis on risk assessment:Risks pertaining to compliance and financial reporting must be evaluated by auditors. This entails being aware of the corporate environment, spotting possible risk areas, and modifying audit protocols accordingly. The focused and pertinent nature of audits is ensured by a risk-based approach, which boosts overall efficacy. Improve Communication and Cooperation: The success of an audit depends on efficient communication between management and auditors. Clear communication gives management insights into areas for improvement while also assisting auditors in understanding corporate operations and difficulties. Having solid relationships promotes teamwork, which makes audit procedures run more smoothly.

Optimal Methodologies for Assurance Services Establish a Comprehensive Framework for Assurance: Consistency and effectiveness in the delivery of assurance services are enhanced by a clearly defined assurance framework. To direct the assurance process and guarantee conformity with stakeholder expectations, this framework should have explicit objectives, procedures, and reporting requirements. Assure Independence and Objectivity: In the field of assurance services, independence and objectivity are essential concepts. In order to produce trustworthy and dependable evaluations, assurance providers need to keep an objective viewpoint and stay away from conflicts of interest. Respecting these guidelines improves the assurance results' credibility. Keep Up with Regulatory Changes: The audit and assurance regulatory landscape is always changing. It is imperative to remain up to date on modifications to legislation and standards in order to maintain compliance and guarantee that assurance services fulfill existing requirements. Professionals may stay ahead of the curve in a field that is evolving all the time with regular training and upgrades. Employ Quality Control procedures: To ensure that assurance services continue to meet high standards, it is imperative to use strong quality control procedures. To guarantee the precision and dependability of assurance outcomes, this entails conducting routine reviews, according to defined procedures, and implementing continuous improvement techniques. New Developments in Assurance and Audit Digital Transformation: The use of digital technologies is transforming assurance and audit procedures. Digital tools are improving the audit and assurance services' scope, accuracy, and efficiency. Examples of these instrument include blockchain technology and advanced data analytics. In order to fulfill changing customer assumption and remain competitive, it is imperative to embrace digital transformation. Grow Prioritization of Environmental, Social, and Governance (ESG) Considerations: The field of audit and guarantee is seeing a rise in the significance of ESG factors. Regarding the effects on the nature, social authority, and governance method, stakeholders are calling for increased accountability and transparency. In order to address these new issues and offer insights into ESG performance, assurance services are changing. Improved Data Privacy and Protection: As worries about data privacy develop, assurance providers and auditors are becoming more aware of data protection procedures. Safeguarding

sensitive data and ensuring compliance with data privacy laws are increasingly essential components of audit and assurance engagements. In conclusion Understanding core tactics, industry best practices, and new developments in-depth is necessary to become an expert in audit and assurance. The efficiency of audits and assurance services can be improved by experts by adopting technology improvements, fortifying internal controls, concentrating on risk assessment, and abiding by best practices. You may put yourself in a successful position in the changing financial supervision landscape by keeping up with legislative changes, implementing thorough frameworks, and tackling new trends like digital transformation and ESG factors. This guide provides insightful information to assist you in achieving excellence in financial management, regardless of your goals for enhancing your audit procedures or offering strong assurance services.