Transition of LIBOR Rates

LIBOR, the London Interbank Offered Rate, plays a key role in financial markets but faced misconduct allegations, leading to its transition. Learn about its history, replacement rates like SOFR and SONIA, and regulatory changes impacting the financial industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

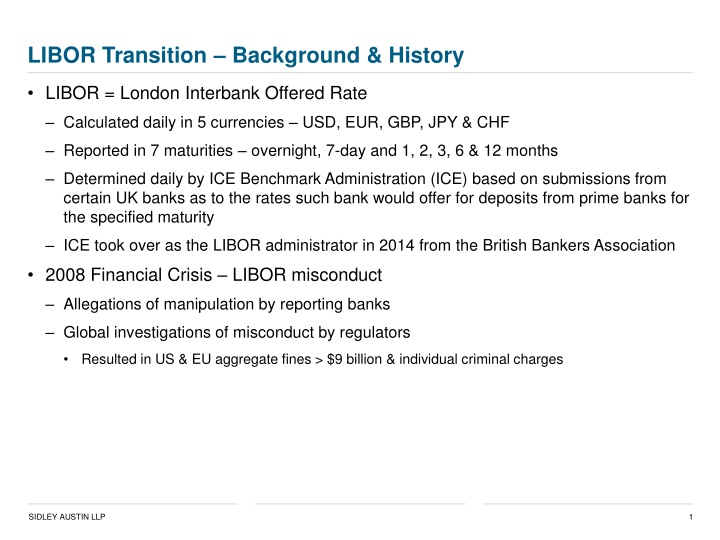

LIBOR Transition Background & History LIBOR = London Interbank Offered Rate Calculated daily in 5 currencies USD, EUR, GBP, JPY & CHF Reported in 7 maturities overnight, 7-day and 1, 2, 3, 6 & 12 months Determined daily by ICE Benchmark Administration (ICE) based on submissions from certain UK banks as to the rates such bank would offer for deposits from prime banks for the specified maturity ICE took over as the LIBOR administrator in 2014 from the British Bankers Association 2008 Financial Crisis LIBOR misconduct Allegations of manipulation by reporting banks Global investigations of misconduct by regulators Resulted in US & EU aggregate fines > $9 billion & individual criminal charges 1 SIDLEY AUSTIN LLP

LIBOR Transition Background & History 2013 LIBOR became regulated by the Financial Conduct Authority (FCA) in UK and the International Organization of Securities Commissions (IOSCO) published Principles for Financial Benchmarks 2014 Federal Reserve Bank of New York convened the Alternative Reference Rates Committee (ARRC) to identify best practices for U.S. alternative reference rates June 2016 EU Benchmarks Regulation (BMR) creates Standards for Benchmarks In Use In The EU which becomes effective as of January 1, 2020 July 2017 Andrew Bailey (Chief Executive of the FCA) announced that the FCA would no longer compel or persuade banks to submit quotes for LIBOR beyond 2021 January 2018 new EU Benchmark Regulation (BMR) took effect, replacing the prior FCA regulations adopted in 2013 to regulate LIBOR. The new BMR applies to a broader range of benchmarks and requires registration and regulation of benchmark administrators 2 SIDLEY AUSTIN LLP

Replacement Reference/Risk Free Rates NEW RATE OLD RATE Key Characteristics: All are overnight rights SOFR USD LIBOR All are based on actual transaction data GBP LIBOR SONIA ESTER EUR LIBOR Transaction data comes from markets that generally have high volumes and liquidity TONA JPY LIBOR CHF LIBOR SARON 3 SIDLEY AUSTIN LLP

Replacement Reference/Risk Free Rates STER = Euro Short Term Rate Based on unsecured lending transactions reported by banks SARON = Swiss Average Rate Overnight Based on transactions in the interbank overnight repo market SOFR = Secured Overnight Financing Rate Based on overnight repo transactions SONIA = Sterling Overnight Index Average Based on unsecured overnight transactions negotiated bilaterally and arranged with brokers TONAR = Tokyo Overnight Average Rate Based on transactions executed in the unsecured overnight call rate market 4 SIDLEY AUSTIN LLP

SOFR Specifics SOFR Calculated and published by the Federal Reserve Bank of New York: Published daily at 8AM New York time each business day BUT, can be republished at 2:30PM New York time if there were errors in the initial calculation of the rate published earlier that day Calculated based on a volume-weighted median of transaction-level tri-party repurchase (repo) agreement data collected from three components: Rates for bilateral Treasury repo transactions cleared through the delivery- versus-payment system offered by the Fixed Income Clearing Corporation Rates on overnight Treasury general collateral repo transactions Rates for overnight, specific-counterparty tri-party general collateral repo transactions secured by Treasury securities. SOFR is substantially different from LIBOR & fluctuates based on different factors than LIBOR 5 SIDLEY AUSTIN LLP

SOFR Specifics SOFR is a risk-free rate so there is no credit quality that is factored into the rate At present, SOFR is calculated based solely on overnight rates, so the rate does not have any term duration options it is solely a 1 day, overnight rate LIBOR SOFR Unsecured Secured Reflects bank cost of funds Risk-free rate Widens to reflect COF in periods of stress Will not widen in periods of stress Term structure Overnight (for now) Established and well-understood New and not well understood Not liquid, deep or transparent Will be liquid and deep Easily manipulated Will not be easily manipulated In millions of long-dated contracts Just beginning to appear in contacts. Chart content from the Loan Syndications & Trading Association 6 SIDLEY AUSTIN LLP

LIBOR Transition Affected Asset Classes LIBOR is used/referenced in a wide range of different financial products ($370 trillion+ of IBOR- based contracts ~ $200 trillion are denominated in USD): LIBOR IS REFERENCED IN: Swaps & Derivatives Credit & Financing Agreements Corporate Notes & Bonds Securitization Notes & Certificates Adjustable Rate Mortgages Student Loans 7 SIDLEY AUSTIN LLP

Fixing the Fallbacks Different financial products contemplate different fallback methodologies if LIBOR becomes unavailable most of which were crafted to only address a temporary disruption in the publication of LIBOR COMMON FALLBACKS: Reference Banks rate ISDA Definitions Alternate Base Rate or Prime Credit/Financing Agreements Corporate Notes & Bonds Last published LIBOR rate Different products may fallback to different rates creating unexpected basis risk e.g. credit agreement falls back to the prime rate, but related interest rate swap falls back to SOFR 8 SIDLEY AUSTIN LLP

Fixing the Fallbacks In September 2018 ISDA published the 20018 Benchmark Supplement to strengthen the triggers and fallbacks in the existing ISDA definitions In September 2018 the ARRC published consultation papers with recommended fallback contract language for new originations of syndicated business loans and floating rate notes In December 2018 the ARRC published consultation papers with recommended fallback contract language for new originations of bilateral business loans and securitizations (including CLOs) In January 2020 ISDA is expected to publish its IBOR Fallback Protocol which addresses fallbacks for the IBORS covering USD, GBP, EUR, CHF & YEN ISDA Protocol will address the fallback issues for the derivatives market legacy trades, however the solution for the cash markets is not so simple 9 SIDLEY AUSTIN LLP

When to Trigger the Fallbacks? Temporary disruptions of a benchmark Usually triggered due to a local force majeure or technical issue Permanent cessation of a benchmark Effective date of cessation as detailed in a public announcement from an identified source i.e. benchmark administrator or regulatory authority Pre-cessation of a benchmark early opt-in? Specified date prior to the announced effective date of cessation The loan market prefers pre-cessation/early opt-in, however the derivatives market is moving towards triggering on the effective date of the permanent cessation 10 SIDLEY AUSTIN LLP

Equalizing LIBOR to SOFR Because LIBOR and SOFR are fundamentally different rates, triggering a fallback from LIBOR to SOFR will result in a transfer of value between the parties to LIBOR referencing contracts In an effort to minimize this value transfer, markets are developing adjustments to SOFR that will address: Credit differences Term/duration differences The credit differences will likely be addressed via a fixed spread or margin added to SOFR The term/duration differences are being addressed in potentially different manners: The derivatives market is moving towards compounding the daily SOFR rate in arrears for the relevant period The loan market is moving towards compounding the daily SOFR rate in arrears for the immediate prior period The NY Fed has indicated that it may begin to publish Term SOFR rates as it develops the data to do so 11 SIDLEY AUSTIN LLP

LIBOR Transition Additional Risks and Considerations Divergence between proposed fallback provisions for loans and derivatives Different triggers for replacement of LIBOR Difference between compounding periods between loan and derivatives market Creates basis risk Creation of basis risk may result in regulatory issues many CFTC exemptions are predicated on swaps only being entered into for bona fide hedging purposes if basis risk is created, the swaps may no longer qualify as bona fide hedging In credit/financing agreements that require interest rate hedging, the ISDA fallback to SOFR may not satisfy the hedging requirements in the credit/financing documentation unless it is similarly amended LIBOR transition may result in financial valuation issues which could adversely impact financial statements and result in tax issues which are expected to be addressed in new rules issued by the U.S. Treasury 12 SIDLEY AUSTIN LLP