the LIBOR Transition: Key Points and Implications

Explore the LIBOR transition, including its background, replacement benchmarks, cessation timeline, and the differences between IBORs and RFRs. Learn about the LIBOR scandal, reforms, and the shift to alternative rates. Understand the LIBOR fallback methodology and its impact on financial markets.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

LIBOR Transition Qinjun Su, Xiaocheng Liang, Zhengxi Yan

Introduction of LIBOR Transition

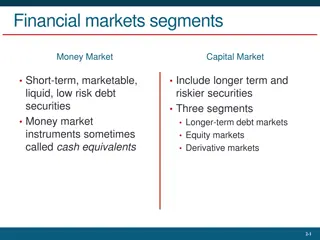

Background IBORs were the most widely used benchmark rates for a wide range of financial products LIBOR Scandal in 2012 Recommendations to reform and use near risk-free rates (RFR) in 2014 by the Financial Stability Board

Replacement Benchmarks Currency Current Rate Alternate Rate USD USD LIBOR Secured Overnight Financing Rate (SOFR) EURO EURIBOR, EUR LIBOR and EONIA Euro Short-Term Rate ( STR) GBP GBP LIBOR Sterling Overnight Index Average (SONIA) CAD Canadian Dollar Offered Rate (CDOR) Canadian Overnight Repo Rate Average (CORRA) (with CDOR co-existing)

Replacement Benchmarks Currency Current Rate Alternate Rate CHF CHF LIBOR Swiss Average Rate Overnight (SARON) HKD HIBOR Hong Kong Overnight Index Average (HONIA) (with HIBOR co-existing) SGD SIBOR Singapore Overnight Rate Average (SORA) JPY JPY LIBOR and TIBOR TONA (Tokyo Overnight Average Rate)

Libor Cessation Timeline Currency IBOR Settings Permanent Cessation Date USD LIBOR (Overnight, 1- month, 3- month, 6- month, 12-month) June 30, 2023 GBP LIBOR (All Settings) December 31, 2021 CHF CHF LIBOR (All Settings) December 31, 2021 EUR EUR LIBOR (All Settings) December 31, 2021 JPY JPY LIBOR (All Settings) December 31, 2021

Difference Between IBORs and RFRs RFRs are based on short-term wholesale transactions for unsecured RFRs and repo transactions for secured RFRs. Therefore, RFRs do not require a credit spread IBORs are forward-looking term rates while RFRs are backward-looking overnight rates

Fallback Methodology Background The methodology used in the calculation of the IBOR fallbacks was determined through a series of market-wide consultations conducted by ISDA. Bloomberg constructed the rules that detail how to implement the calculations by the methodology. The selected methodology is fixed and cannot be altered without ISDA conducting further consultations.

Two Parts of Fallback Rate Adjusted Reference Rate: Compounded in arrears over a period corresponding to the tenor to get the adjusted reference rate. Spread Adjustment: Used to adjust for the different nature of rates. They are all published for each weekday.

Right Part of ARR Standard compounding Performs the compounding of the reference rate over an accrual period denoted by the term AP.

Middle Part of ARR Annualization Factor part This is the number of times the accrual period goes into a year under count convention of the reference rate.

Left Part of ARR Adjusted Day count convention Upper: IBOR day count Lower: Reference Rate day count

Spread Adjustment Used to adjust for the different nature of rates. It s Median spread between IBOR and adjusted reference rate over a five-year historical period.(before cessation) Become fixed value when the IBOR cessation is triggered.

Spread Adjustment Median spread between the IBOR and ARR over 5-year period.(MP period) When the cessation is triggered:

In Arrears VS In Advance In Advance In Arrears reference a value determined before the beginning of the interest period. reference a value determined at the end of the interest period.

Basis created by different convention Depend on: Whether interest rates happen to be trending up or down over a given period? The lender will face a comparable sort of basis relative to in arrears if rates rise during the interest period. How frequently payments are made? Typically, less payment frequency leads to more basis.

In Arrears Plain Arrears: under a pure in arrears structure, the SOFR rate for each given day in the interest period would be applied to calculate interest for that business day, and interest would be paid on the first day of the next interest period

In Arrears Payment Delay: Interest is calculated in the same way as in a plain arrears framework, with the SOFR rate for each given day in the interest period applied to calculate interest for that business day, but interest is paid k days after the start of the next period.

In Arrears Lockout or Suspension Period: the SOFR rate applied for the last k days of the interest period is frozen at the rate observed k days before the period ends.

In Arrears Lookback: For each day in the interest period, the SOFR rate from k business days earlier is used to accrue interest.

In Arrears Lookback without observation shift: The date that the SOFR rate is pulled from (the observation date) is k business days before the date that interest is applied (the interest date) and is applied for the number of calendar days until the next business day following the interest date.

In Arrears Lookback with observation shift: The date that the SOFR rate is pulled from (the observation date) is k business days before the date that interest is applied (the interest date) and is applied for the number of calendar days until the next business day following the observation date.

In Advance An in advance payment structure based on an overnight rate would reference an average of the overnight rates observed before the current interest period began. Last Reset: Last Recent: Use the averaged SOFR over the last interest reset period as rate for current interest period. Use the averaged SOFR from a shorter recent period as rate for current interest period. (Similar to a lookback model and will more closely match the structure of an OIS, though the payment structure will be lagged.) (Likely to have less basis relative to the in arrears average interest rate over the current interest period. )

ISDA RFR Conventions https://www.isda.org/a/bdigE/RFR-Conventions-and-IBOR-Fallbacks- Product-Table-October-2021.pdf

Introduction CME Term SOFR: A daily set of forward-looking interest rate estimates, calculated and published for 1-month, 3-month, 6-month and 12-month tenors. Publication: Each day the New York Federal Reserve calculates and publishes SOFR. Publication will occur at 5:00 am CT.

ARRCs recommendation on the usage of Term SOFR The ARRC continues to recommend overnight SOFR and SOFR averages for all products, particularly in markets where we have seen that there can be successful adoption of these rates such as floating rate notes, consumer products including adjustable rate mortgages and student loans, and most securitizations. The ARRC also supports the use of the SOFR Term Rate in areas where use of overnight and averages of SOFR has proven to be difficult, such as multi-lender facilities, middle market loans, and trade finance loans. The ARRC does not support the use of the SOFR Term Rate for the vast majority of the derivatives markets, because these markets already reference SOFR compounded in arrears and transitioning derivatives markets to the more robust overnight risk-free rates (RFRs) is essential to ensure financial stability.

ARRCs recommendation on the usage of Term SOFR The ARRC recommends that any use of SOFR Term Rate derivatives be limited to end-user facing derivatives intended to hedge cash products that reference the SOFR Term Rate. The ARRC considers an end-user to be: A direct party or guarantor, either a lender or borrower who have entered into a SOFR Term Rate business loan A dealer counterparty would not be considered an end-user under these recommendations

ARRCs recommendation on the usage of Term SOFR The ARRC does not recommend the trading of SOFR Term Rate derivatives in the interdealer market because such activity could undermine trading activity in the underlying overnight SOFR derivatives that are needed to construct the SOFR term rate itself and could, thereby, compromise the robustness of the rate and its corresponding utility to market participants.

Input Data selection Input Data: One-month SOFR Futures (SR1): 13 (thirteen) consecutive months contracts To calculate the final settlement of a one-month SOFR Future: The simple arithmetic average of the daily SOFR rates of the calendar month is calculated. Three-month SOFR Futures (SR3): 5 (five) consecutive months contracts To calculate the final settlement of a three-month SOFR Future: Simple interest is accrued to all non-Business Days based on the daily SOFR benchmark from the preceding Business Day. Compounded interest is accrued to all Bussiness Days based on the daily SOFR benchmark.

Input Data selection Sampling Market Prices: CME Term SOFR Reference Rates use executed transactions and executable bids and offers in SOFR Futures, traded on the CME Designated Contract Market (DCM). Selected Prices derived from: Volume Weighted Average Prices (VWAP) Midpoint of the bid/ask that are calculated based on a snapshot of executable bid/ask prices at a random moment

Calculation Methodology Assumption: The overnight SOFR rates follow a piecewise constant step function and can only jump up or down the day after FOMC Policy Rate announcement dates and remains at those levels across all dates in between the FOMC Policy Rate announcement dates. CME One-month SOFR Futures7 (SR1) and CME Three-month SOFR Futures8 (SR3) contracts provide estimates of values of overnight SOFR on average over the specific contract reference periods; CME SOFR Futures do not directly provide estimates of individual overnight SOFR rates.

Calculation Methodology The overnight SOFR rate for date t can be computed as: ??: the date of the k th FOMC policy rate announcement date that occurs on or after ?? ??: the initial overnight SOFR rate as of date ?0 ??: the jump size in overnight SOFR rate occurs on the day after the k-th FOMC policy rate announcement date. A positive ??means the overnight SOFR rate jumps up after the k-th FOMC policy rate announcement date ??; a negative means the overnight SOFR rate jumps down after the k-th FOMC policy rate announcement date ?? ??;?: the overnight SOFR rate as of date ?, where ? = (??, , ??) and ? is the index of the last relevant FOMC policy rate announcement date ?{ }: binary function returning 1 if the statement in the parenthesis is true and 0 otherwise

Calculation Methodology Optimization: ?m1and ?q3: the observed blended prices of SR1 and SR3 contract with reference month ? and reference quarter ?, respectively ?m1( ) and ?q3( ): the implied value of SR1 and SR3 contract with reference month ? and reference quarter ?, respectively ?m1and ?q3: weighting parameters for pricing errors of SR1 and SR3 with reference month ? and reference quarter ?, respectively ?: weighting parameter for penalty function.

Calculation Methodology For SR1 contracts, whose reference month is not the current month (? > 0), the implied value only depends on projected overnight SOFR rates: T?1: set of calendar days for the ?-th month N?1: total number of calendar days in ?-th month.

Calculation Methodology For the SR1 contract, whose reference month is the current month (? = 0), the implied value can be calculated using published SOFR fixings and projected overnight SOFR rates: ?01+= { ? ? ?01| ? ?0} ?01-= { ? ? ?01| ? < ?0} ??: published SOFR fixing for date ?

Calculation Methodology For SR3 contracts, whose reference quarter is not the current quarter (? > 0), the implied value only depends on projected overnight SOFR rates: ??3: set of Business Days for the ? -th quarter; ??3: total number of calendar days in ?-th quarter ??: the number of calendar days from date ? to its next Business Day following the SIFMA US Holiday Schedule

Calculation Methodology For the SR3 contract, whose reference quarter is the current quarter (? = 0), the implied value can be calculated using published SOFR fixings and projected overnight SOFR rates: ?q3+= { ? ? ?q3| ? ?0} ?q3-= { ? ? ?q3| ? < ?0} ??: published SOFR fixing for date ?

Computing Term Rates Term Rates are derived by compounding the overnight SOFR rates over one, three, six and twelve months: ? (? ): the set of Business Days from the term start date to date ? days in the future. The term rate will span the corresponding tenor (e.g., 1-month, 3-month, 6-month, 12-month which is represented by ? days in the formula) ? : a Business Day in set ? (? ) ??: the number of calendar days from date ? to its next Business Day following the SIFMA US Holiday Schedule. ? (?, ): the overnight SOFR rate as of date ?