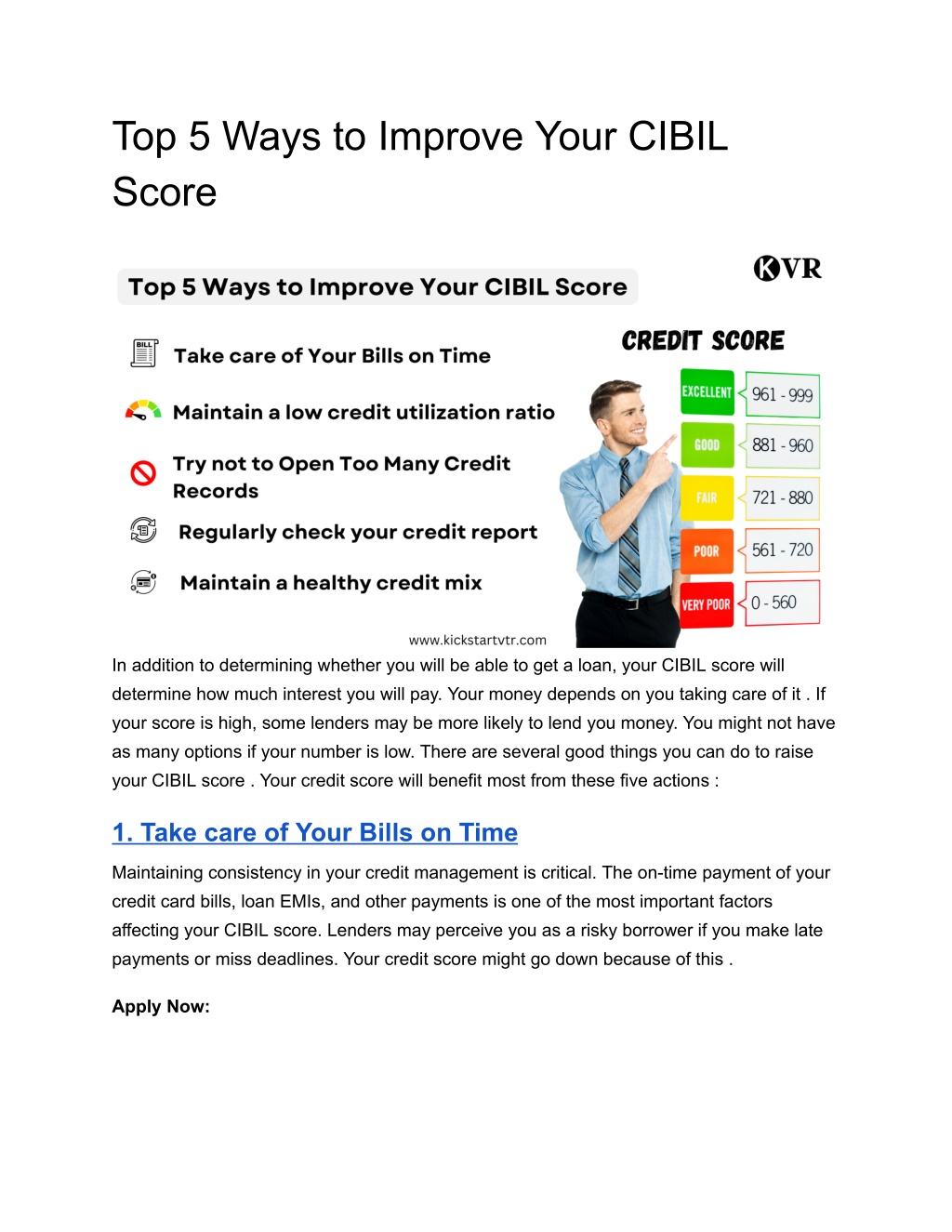

Top 5 Ways to Improve Your CIBIL Score

In addition to determining whether you will be able to get a loan, your CIBIL score will determine how much interest you will pay. Your money depends on you taking care of it . If your score is high, some lenders may be more likely to lend you money.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Top 5 Ways to Improve Your CIBIL Score In addition to determining whether you will be able to get a loan, your CIBIL score will determine how much interest you will pay. Your money depends on you taking care of it . If your score is high, some lenders may be more likely to lend you money. You might not have as many options if your number is low. There are several good things you can do to raise your CIBIL score . Your credit score will benefit most from these five actions : 1. Take care of Your Bills on Time Maintaining consistency in your credit management is critical. The on-time payment of your credit card bills, loan EMIs, and other payments is one of the most important factors affecting your CIBIL score. Lenders may perceive you as a risky borrower if you make late payments or miss deadlines. Your credit score might go down because of this . Apply Now:

Tip: Set up normal installments or cautions to guarantee that you never disregard an installment or due date. A solitary late installment can hurt your FICO rating for quite a while . 2. Maintain a low credit utilization ratio Your credit utilization ratio the amount of your credit limit that you're actually using has a big effect on your CIBIL score. At all times, this amount should be less than 30%. For example, in the event that your Visa limit is 100,000 , attempt to keep an equilibrium of something like 30,000. Apply Now: Tip: On the off chance that you find it hard to keep your use low, consider mentioning a credit limit increment or taking care of your Visa adjusts all the more regularly. 3. Try not to Open Too Many Credit Records Your credit score may go down briefly every time you ask for a new loan or credit card. This is called a "hard inquiry." Furthermore , the management of multiple credit accounts can be difficult and may result in higher utilization rates. Apply Now: Tip : Concentrate on the responsible maintenance and management of your current credit accounts rather than the frequent launching of new ones . You should only ask for more cash when you really need it . 4. Regularly check your credit report Errors and inaccuracies on your credit report can adversely affect your CIBIL score. Regularly reviewing your credit report allows you to identify and dispute any incorrect information that could be dragging down your score. Apply Now: Tip: Each year, CIBIL will provide you with one free credit report. Use this opportunity to review your report for any discrepancies and get them corrected promptly. 5 . Maintain a healthy credit mix

The CIBIL score can be improved by having a credit account with protected and unsecured loans, for example, personal loans, credit cards, and auto loans. This shows that you can safely handle different types of credit . Apply Now : Tip: If you only have one type of credit account, you might want to think about adding more credit in a way that you can handle. However, taking on more debt should be done in a responsible manner, so be careful. Note: Using Rupicard helped us get a higher cibil score. Apply Now Conclusion Consistent effort and prudent financial management are required to raise your CIBIL score . You can improve your creditworthiness and get better financial chances by paying your bills on time, keeping an eye on how much credit you use, avoiding applying for too much credit, checking your credit report often, and keeping a healthy credit mix. Start using these tips right away, and over time you'll see your credit score go up .