Tobacco Industry: Big Tobacco vs Juul

The tobacco industry has seen a shift in trends with the emergence of Juul threatening Big Tobacco's market share. Market dynamics, alternatives, and reactions of major players like Altria are analyzed in light of changing consumer preferences and regulations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Tobacco Industry: Big Tobacco vs Juul Amanda Rushton Jesse Prent Jonathan Faerman Winnie Hu JMSB Consulting

Industry The Disruption Analysis Alternatives Recommendation Three primary product categories in tobacco industry Traditional Cigarettes Vaping Products Hybrid Products Tobacco has developed substitute products to appeal to smokers looking to switch/quit

Industry The Disruption Analysis Alternatives Recommendation Tobacco Industry has faced a change in trends for the past 40 years R&D on hybrid products: IQOS Mesh in development Health Phillip Morris Consciousness British American Tobacco Perception Second movers: Released hybrid and vapes Tobacco Industry reaction: Fast Followers: Hybrid products & Vape in the US Convenience Japan Tobacco Traditional companies have reacted slowly and waited for market signals

Industry The Disruption Analysis Alternatives Recommendation Market and regulations are changing rapidly Marketing Society Consumers Direct communication with customers is no longer possible Tobacco is becoming against new lifestyles and smoking is no longer free Health conscious consumers are looking for alternatives Traditional companies have not adapted to the new environment

Industry The Disruption Analysis Alternatives Recommendation JUUL s success threatens Big Tobacco s ability to compete in vaping market Juul: 80% of market share Technology Marketing Nicotine salt formulation Social Media Style Others Discrete Size Not as much regulation Flavors Clean Meme culture Inconclusive medical studies Juul 80% Declining tobacco sales means long-term success in vaping or further diversification is necessary

Industry The Disruption Analysis Alternatives Recommendation How Big Tobacco has reacted to JUUL Marketing Acquisition R&D Leveraging marketing budget and distribution capabilities convenience and awareness Altria purchased 30% stake in JUUL Product innovations that can compete with JUUL Altria investing in cannabis industry

Industry Analysis The Disruption Alternatives Recommendation Tobacco companies must adapt to changing perceptions of tobacco and vaping Approach Strategic Phillip Morris (+ Altria) Managerial British American Tobacco Japan Tobacco Inc. Compliance Risky Red Zone Defensive Issue Maturity (in public realm) Emerging Consolidating Latent Institutionalized Focus on

Industry Analysis The Disruption Alternatives Recommendation Tobacco companies must adapt to changing perceptions of tobacco and vaping Approach Strategic Phillip Morris (+ Altria) Managerial British American Tobacco Japan Tobacco Inc. Compliance Risky Red Zone Defensive Issue Maturity (in public realm) Emerging Consolidating Latent Institutionalized

Industry Analysis The Disruption Alternatives Recommendation Tobacco companies must adapt to changing perceptions of tobacco and vaping Approach Strategic Phillip Morris (+ Altria) Managerial British American Tobacco Japan Tobacco Inc. Compliance Risky Red Zone Defensive Issue Maturity (in public realm) Emerging Consolidating Latent Institutionalized Focus on developing ethical leadership that can sustain organization beyond tobacco

Industry Analysis The Disruption Alternatives Recommendation Why Tobacco companies should care? Because there is a lot of money involved Size of the market: Tobacco Smoker 1 in 10 adults smoke 2M Yearly Spend LTV (40 Years) Margin (30%) $5,000 $200K $260K (Between 1 and 2 packages daily) $120Bn Adults are rapidly switching to Vape and is already penetrated on younger population

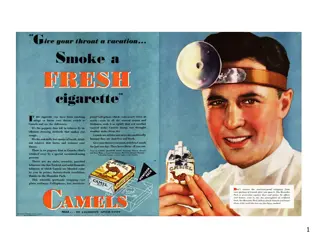

Industry Analysis The Disruption Alternatives Recommendation How Big Tobacco initially reacted to the disruption Product Innovation Slow product innovation Increased R&D spend, acquisitions Imperfect products pushed to market Regulatory Environment Exploited lack of regulations No ethical use lobbying power Lifestyle marketing Unsubstantiated health claims Marketing

Industry Alternatives The Disruption Analysis Recommendation Tobacco alternatives meeting the market demands of present and future consumers Innovation Boring product Lack of innovation in tobacco industry has stayed the same for centuries Product Adaptation Strategic Focus Long history of success for tobacco without need for change Market Market Next generation of consumers looking for exciting and healthier product Tobacco industry needs to reinvent itself

Industry Alternatives The Disruption Analysis Recommendation Invest in product development Enter New Industry Innovate Product Ethical Leadership Criteria Feasibility Profitability Sustainable Growth

Industry Alternatives The Disruption Analysis Recommendation Risks can be mitigated! Risks Contingency Mitigation Public backlash for hypocrisy Invest marketing and rebranding campaign Spin off Develop additional products Regulatory limitations Invest in lobbying Expensive to innovate product Invest in more R&D Acquire smaller player

Industry The Disruption Analysis Alternatives Recommendation Big Tobacco should have taken an ethical leadership approach Product Innovation Technology to improve safety: app-based age verification Partnerships with independent labs for health studies Medical applications: aerosol administration of medicine Regulatory Environment Work with governments to shape regulations Collaborate with other regulating bodies to explore medical applications No lifestyle marketing Use substantiated claims only Increase transparency to improve public relations Marketing