Technology Sector Overview and Trends

The technology sector is experiencing slight bearishness with some concerns over the fiscal cliff. It includes IT consulting, semiconductor products, computers, telecommunication services, and more. Recent developments show weak demand with iPhone 5 order cuts and Netflix facing challenges. Despite volatility, the sector remains less impacted during recession. Key drivers include consumer sentiment and economic conditions. Innovation and R&D are crucial for staying competitive, along with government regulations for protecting intellectual property.

Uploaded on Sep 15, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Taylor Woodruff Kyle Temple Austin Frazier Brady Parsons Thomas Laskowski

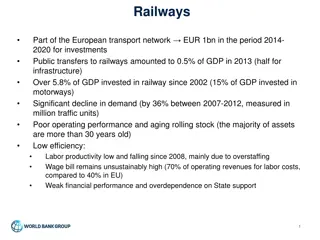

Current State: slightly bearish Some hesitation on fiscal cliff Consists of: information technology consulting, semiconductor products, computers and computer peripherals, telecommunication services and wireless telecommunication services

Weak demand, cut IPhone 5 orders RIM, Blackberry 10 this week Google cofounder, Google glasses Netflix- 37% price increase over growth expectations

The technology sector is volatile. extremely sensitive to consumer estimates Demand is shifting from hardware to software and high end services. Not as heavily impacted during recession In business cycle, XLK is in expansion near peak. Jan-March are consistently XLK strongest months.

Apple: 14.42% Intl Business Machine Corp: 7.59% Microsoft: 7.36% Google: 6.99% AT&T: 6.73%

No Changes Snapdragon 800 Chip

Product Innovation/ Research and Development Billions of dollars spent each year Must be cutting edge or could become obsolete Government Regulation Need protection of patents and trademarks to protect new ideas

Key Drivers Consumer Sentiment For Tech firms to thrive there must be a substantial amount of consumer spending. Economy The performance of the sector tends to be very volatile, dependent upon current state of the economy.

PEG P/E divided by the growth rate of a company s earnings. Many companies in growth stage. Lower = more undervalued. P/E Current share price compared to per share earnings. Important to what each company is trading at in relation to their earnings.

P/CF compares the stock's market price to the amount of cash flow the company generates. Many smaller firms are acquired by corporate giants. Strong indicator of having sufficient cash for future endeavors.

Apple Intel Dell F5 Networks Ebay AT&T Verizon Oracle Qualcomm Texas Instruments Microsoft Crown Castle International IBM Centurylink Salesforce.com

Recommended buy on 12/6 CIF Decision: Bought @ $63.94 Review Performance: +.75% Continued growth in 4G networks Lagged by Apple Announce on Jan. 30th

Recommended no buy on 12/3 Review Performance: +13.20% Announced Q4 sneak peak Restructured wireless segment New products demo at CES

Recommended buy on 11/15 CIF: NO BUY Review Performance: +1.60% Weak holiday computer sells Surface tablet sales, Surface Pro Windows 8 phone, cloud network Intel Buyout

Recommended buy on 12/7 CIF: NO BUY Review Performance: +5.5% Reached agreements with Sprint and Clearwire Acquisition of shared wireless towers

Recommended buy on 11/13 CIF: NO BUY Review Performance: +3.7% Recently beat wall street estimates Revenue continues to slowly decline Supercomputer and cloud computing

Recommended buy on 11/8 CIF: NO BUY Review Performance: +1.9% Combines network sales & operations Announced $.725 dividend Earnings Feb. 13th

Recommended no buy on 10/16 Review Performance: +9.3% Recently beat wall street estimates Facing increased competition 4-1 split announced

Recommendation: YES Dropped 20.97% since purchased on 10/18 Analysts wonder whether the tech giant has lost its steam Missed earnings on January 24th Iphone is no longer the best selling phone What s next to come? will determine their future

Recommendation: NO Lost 1.57% since recommended on 10/23 Told analysts that they would be spending $13 billion to build and develop manufacturing technology, up $2 billion from 2012 Wall Street doesn t see the value, they see PC s becoming more obsolete by the year

Recommendation: NO Has gained 12.14% since it was recommended on 10/25 Earnings beat estimates, unexpected Holiday spending online was up Outlook is somewhat mixed, as some analysts see Amazon bullying for market share

Recommendation: YES Lost 3.07% since it was recommended on October 25th Executives blamed Hurricane Sandy for lost revenue in the quarter Added 80,000 subscribers above what analysts estimated, providing for some optimisim in 2013.

Recommendation: YES F5 networks has exploded since recommended on 10/30, up 17.31% The stock dropped 20% the week prior to its recommendation due to lower revenues and several analyst downgrades. Their new products have been entering the market and are receiving positive affirmation, pushing the stock towards their all-time highs.

Recommendation: NO The stock has fallen 5.7% since recommended on 11/1 Talks about the outright buyout of Vodaphone have worried investors. VZ already owns 55% of Vodaphone, yet analysts don t the acquisition as the best source of cash for the shareholders.

Recommendation: YES Oracle was purchased on 10/18 and posted an 8% gain before it was sold in December. Overall, it has gained 12.82%, sold a bit too early! Their announcement to pay three early dividends in 2012 inclined investors to jump on board, as they were all scared about capital gains taxes going into 2013.

Recommendation: NO Dell has posted gains of 34.73% since it was recommended on 11/6. Dell has been in talks about going private Currently 4 major banks lined up to help with financing, as well as Microsoft Microsoft could monopolize the PC market (possibly) by buying Dell outright, yet its unexpected Dell has lost a lot of market share and has no competition in the tablet generation

With XLKs 15% stake in Apple, we definitely see the value of an underweight ETF proportion Bullish on IT computing, cloud computing, and telecommunication services Bearish on semiconductors and computers sales