Strategic Webinars for Distributor Teams and Buying Groups

Explore a series of webinars tailored for distributor management teams, trade professionals, and buying groups. Topics include embracing new thinking paradigms, analyzing Amazon business effects, mastering net-profit analytics, and migrating to new selling models. Delve into specific plays for enhancing profitability, managing change, and adapting to emerging trends in the industry. Discover actionable strategies to optimize performance and drive success in a data-driven culture.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

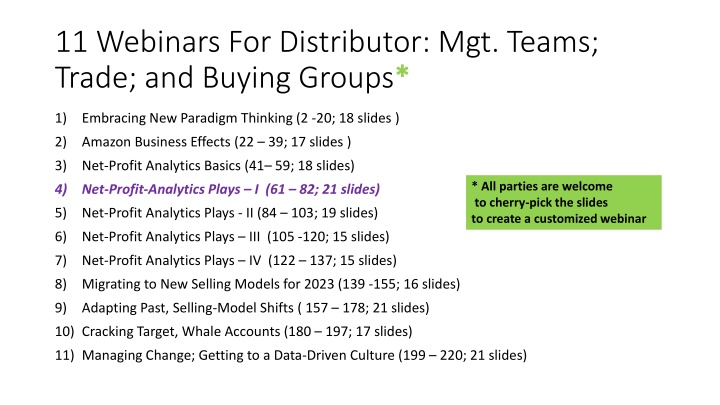

11 Webinars For Distributor: Mgt. Teams; Trade; and Buying Groups* * 1) Embracing New Paradigm Thinking (2 -20; 18 slides ) 2) Amazon Business Effects (22 39; 17 slides ) 3) Net-Profit Analytics Basics (41 59; 18 slides) * All parties are welcome to cherry-pick the slides to create a customized webinar 4) Net-Profit-Analytics Plays I (61 82; 21 slides) 5) Net-Profit Analytics Plays - II (84 103; 19 slides) 6) Net-Profit Analytics Plays III (105 -120; 15 slides) 7) Net-Profit Analytics Plays IV (122 137; 15 slides) 8) Migrating to New Selling Models for 2023 (139 -155; 16 slides) 9) Adapting Past, Selling-Model Shifts ( 157 178; 21 slides) 10) Cracking Target, Whale Accounts (180 197; 17 slides) 11) Managing Change; Getting to a Data-Driven Culture (199 220; 21 slides)

Specific Net-Profit Analytical Plays in Webinars 4-7 Webinar #4: 1. How GM$s/FTEE is a 4-win metric 2. CEO takes #1 account to next level 3. Fixing 3 types of losing customers 4. Beef best SKUs; Fix Losing Ones 5. Big Rebate Suppliers: New Angles Webinar #5: 6. High Credit Activity Expense Customers 7. Customer-Niche, Service Excellence Innovation/Domination 8. Better, High-Yield Quoting Niches and Generally Webinar #6: 9.Reducing Repetitive Inter-Branch SKU Activity 10 a-c: Solving (Branch) Counter Sales Unprofitability Webinar #7: 11-a. Biggest Loser Analysis/Solution 11-b. Worst, small loser: analysis/solution 11-c. JIT Delivery of Paper Clips: Solution

(#4) Net (#4) Net- -Profit Analytics Plays Profit Analytics Plays I I Uses? 5 Specific Plays 1. How GM$s/FTEE is a 4-win metric 2. CEO takes #1 account to next level 3. Fixing 3 types of losing customers 4. Beef best SKUs; Fix Losing Ones 5. Big Rebate Suppliers: New Angles D. Bruce Merrifield, Jr. www.merrifieldact2.com bruce@merrifield.com Connect at LinkedIn For copy of slide deck

Many Opportunities, Much Fear 1. Twin Challenges: Core customer renewal, Fixing Small-pick/order customers (all sizes) Creating new (business and channel e-selling) models for cloud Ecommerce 2. Elephants against change: Data-free, Received Wisdom (39+ objections/answers*) All incented on GM$s will resist (webinars 8-10) Why? What s In It for (Me) We? All 4-stakeholder groups can win! 3. Psychological-savvy roadmap** starts with: More comp? Freeze headcount. Grow GM$s/FTEE Get Bright Spot winsfor courage to nibble at fixing losing customers Image result for elephant cartoon angry clipart-library * Answers to 39+ objections: http://merrifieldact2.com/e-book/chapter-five/1-39-objections/ ** Download my Core Customer Renewal Roadmap at www.merrifieldact2.com

Opportunities v Fear (2) 4. Innovation Department x Easiest Wins (Rent an intrapreneur*?) Easiest plays (Bright Spot or Affirmative Inquiry management) #1. Freeze headcount. Focus on GM$s/ FTEE . Downsize? Grow order size. #2. Take Best Account(s) to Next Level #3. Then: Too Busy! Baby steps with easiest, big-losers #4. SKU Whale Curve tactics: beef winners, blend of fixes for losers # 5. What about biggest rebate suppliers? But, first big picture upside of a Core Customer Renewal * Best Net-Profit-Analytics intrapreneur I ve worked with: McKinnon Shisko (mshisko@ircg.com)

Customer Whale Curve Sub-Categories Web Sales Division P&L 2) 13K Reg- Minnows 1) PDA s 3) HEA s 3 1 2

Lollapalooza* Lollapalooza * Melt-Down Model Stinks. Change to make losers (Web Division) Profitable Shift costs to all other accounts More customers, orders, sales, GM$s - are good (regardless of CTS) Need new accounts to replace dying and defecting ( portfolio ) Acorns grow into Oak trees (4% do. Rest self-employed) Sales Force won t like this. (100% worst scenarios) Other distributors don t believe/do this. (First-innovators win!) What are the blind spots in these data-free beliefs? What is the opportunity cost for partnering best, big guys? Charlie Munger term: when a batch of cognitive biases reinforce groupthink so irrational behavior can take over.

Proactive Web-Selling v. Web Apps for Existing Base Don t have AMZ overall fulfillment costs. More is a loser But: 1. Custom-replenishment, web-order-entry for key accounts 2. Web Order Entry discount structure for existing small accounts 1. Optiquote (jet.com) incentives to order ever-more per order 2. New Web Div. Manager: re-orients; sets up order page; max SKUs to buy Distributors with Reps need to better sell: Total-Procurement-Cost, replenishment-systems to top 20% (esp gazelles). AMZ can t!

Core Renewal Upside Faith Case 5) 5X in 2yrs Bonuses for All* 1 2: many small losers 6) Eventual Goal: 100% of Customers (how quickly?) Profitable . No tail to the whale. 3 Tail = Op Profit 1) 10% customers 500% Profits 3) 1% of customers eat 40% of profits *In 24 months: GP$s/FTEE 2X. Profits/FTEE 1500 to 40K. Gainsharing for all.

Play #1 Play #1: GM$/FTEE; a 4-Way-Win Strategy 1. Service-value innovation for best customers and win-win consolidation solutions yields: 2. Rising GM$s per: pick; order; customer; FTEE 3. Leveraged increase in Profit$s/FTEE. + Sales/Rebates. 4. Gainsharing from Premium Profits in bank. 4-Way-Win Dynamic Trend Lines 5 4.5 4 3.5 Constant: FTEEs; picks; orders; deliveries; calls; crank turns 3 2.5 2 Declining percent of losing - picks, orders, customers from: order consolidation solutions; New Minnow-Division Service Model 1.5 1 0.5 0

Play # 2 Play # 2: CEO audits #1 Account (Bright Spot) #1 account yields 25% of profit Went unannounced without Rep into the back door Easier to ask forgiveness than get permission Ended with impromptu audience with VP Supply Chain who: Sees no reps, but sees honchos. Protocol effect We ll fix 15 things for free. Give you credit. (Asked for more!) Sales doubled; order size up 25%; profits up 150% Y-O-Y Frozen FTEEs busy! Courage to now fix which losers first. Blog #110: Know and Partner Your Top 2% Customers. #79: Join the 4% Gazelle Club.

Play #3 Play #3: First Losers to Fix? 3 options: A. Biggest, minnow losers. 5 to 10 cases per branch. Baby Steps! Cherry-pickers? (Whale: loyal elsewhere) Buys only odd SKU shorts Counter customers with daily returns from yesterday. (Allow team to exempt their pets; start with 5 worst as experiment) Courage, Skills, terms come quickly. Minnow Division program. 85% stay, become profitable. Then fade. Harvest? Opportunity costs? B. Rethink Web-Selling Don t have AMZ s low-costs or monetized Clickstream cross-subsidies Install order-size incentives, suggestions and calculator. OptiQuote C. Big-Losing, Super-Friendlies With Obvious Win-Win fix(es)

Worst Losing Minnows (abstraction to concrete) Sales GP$s GP% GP$s/inv CTS$s NBC $s # INV s 1. Management didn t know any of these accounts. (Big, but cherry-picking?) 2. 15+ lens tools. Visits? Brainstorm? Pet exemptions? Inside Sales (heat!) 3. Courage to dictate profitable new service and terms, because: a. They don t fit company s locations and service model. b.Too busy from wins with bright spot customers (and frozen FTEEs) c. Do baby-steps (with personal account exceptions) for no fear.

5 x 5 Account Focus Focus Thinking About 5 Accounts in each of the following categories 5 most net-profitable. Best defense, next level value innovation 5 most un-profitable. Friendlies: turn lose-lose habits to win-win. Gain slack, more share Cherry-Pickers. Dictate profitable terms. Gain slack to feed growing Best 5 Most Up accounts. Why? Gazelle? Forward invest in partnering? 5 Most Down Accounts. Why? Too late to salvage? Lessons? Next Time! 5 Most Likely TargetWhales to Crack with Full-Team, 3PL approach 5x5 Report in Waypoint for every level More 5x5 thinking: merrifieldact2.com; exhibit 44

Play #4 Play #4: (SKU Whale Curve) Beef Best, Fix CRaP ? 5K 277% 200 166% 200 (111%) PBIT Profits/Losses = Symptoms. Root Causes? 5-Whys. Insights. Plays! Big GM$/line leverage with small innovative tweaks at the extremes

Top 6 Most Profitable SKUs: Water Heaters; Pure Margin Fees for Freight Characteristics: Popular: Avg. number of customers: 1500 Commodity Rebuys: Avg. 5 buys/yr/customer Average pick $500 (worth price checking) at ( low ) 20% GM GP$s/pick average $115+ (with $66/pick CTS in model) = profitable Shop AMZ to spot buy. Small dollar stuff from distributor! Why?

Tail of Whale, Popular, Small-dollar Pick SKUs Sales/pick GP$/pick Characteristics (bottom 5 of hundreds of small losers): Popular: 2000+ customers buying 3 picks/year Average GP$s/pick about $8 v Average CTS $s/pick of $8 to $33. GM%? Fastenal s 57% v. Wholesale-List (less) contract price discounts. AMZ: bundles, raises prices (+) Add-on . Return hassle v.Trading Stuff at the counter TWIG problem: Customers get: wholetail convenience at wholesale-less terms

Inventory v. Fill-Rate Wisdom (?) http://i.stack.imgur.com/wVMjE.png 1. Don t double all SKUs, Just top 1%+. 2. Financial-Lens, Blind-spot Ideas: TURNS X EARN & GMROI 3. Dollar size of both the pick/order and cost-to-serve matters too! Choose: 100 Picks @ $100/pick @ 20%; or, 100 Picks @ $1/pick @ 65% (and Cost-per-pick is $8). 4. And, service-value and productivity of 100% filled lines, orders v. back-orders and/or inter-branch shipments.

Re-Buy Frequency x Fill-rates & Excess Stock Blind-Spots: WMT s Efficiencies from: 1. Cross-docking of even cases 2. Paperless replenishment 3. Truckload2store deliveries Positive Tradeoff of: Extra, Best-SKU inventory (con) Fill-rate, service value (pro) Fulfillment productivity (pro) No lost orders on best SKUs Wal-Mart (+) textile manufacturing discovery (1984) 52X 12X 4X + 40% Months out 12 weeks - 40% 1 week YT 1: 18 Deviation from actual demand

Quick Research To Dos: Search top 10- 100, profitable, warehouse SKUs at AMZ Resellers? Dynamic price-variance game (47th Street Photo of yore?) Or, 20-50% above list price!? Odd SKU model? Like used-books; charge for uniqueness. Any Perfect+ Clones (yet!) with great reviews? Cream SKU vulnerability questions/trends: AMZ owns Millennial B2B buyers. Webroomed on Cream SKUs? AMZ warehouses 9.0: 4-5 stories; 3 sections; bulk delivery partners Smart Home standard: Connected Home over IP (CHIP). Water heaters; home furnaces and central air conditioners? What to do right now?

Action Steps: BEEF BEST SKUS, BEST BRAND* 2X Safety stock of best few items Sales Up 30% v 5% for line Substitutes down 15% 10% Net? Loyalists switched 2X entire line? No, just the best High-Leverage only at Whale- Curve extremes FIXES FOR SMALL-$, HI-PICKS 1. Bundle 2-12 2. Add-on Item (for free?) 3. Raise prices X% (least benefit) 4. Customer-centric spice-rack Biggest losing vendor; Biggest losing SKU Customers buying the SKU: WOW! Change all SKUs X turns * Exhibit 61 at www.merrifieldact2.com

Play #5: SKU Whale Curves for Big-Rebate Supplier at 2 of Its Distributors ski QUESTIONS: 1. What are common, best/worst SKUs? 2. 5-whys for the root causes? 3. Win-win solutions supplier could offer? 4. Co-op funds for shared data that leads to new solutions? 5. Increase rebates as a by-product of: customer-centric, service-value innovations! 6. Buying Group initiative!?

2017: Big Suppliers Overall P&L OBSERVATIONS: 1. Big Sales and rebates; but, low net profits 2. Rebates v Freight, Extra Upcharges - wash 3. Big Directs profitable: no change; more? 4. Small Directs unprofitable. Sell direct; re-intermedate distributors? 5. Warehouse: popular, small-pick SKUs. Re-bundle + New suggested pricing? 6. Channel Captain for: Easy fixes? Vertical Marketplace?

Plays- Part One Summary 5-Why analysis and experiments at whale curve extremes Focus first on Bright Spots with Freeze on headcount (GM$s/FTEE) 5 Best accounts: total team + ex-budget solutions wins. ( Heroic Acts ; weekly Praising Statement publication. Webinar #11) Then, baby-step courage/skills for easy-type, losing customers GM% on SKUs/Vendor lines is blind to order-size and fill-rate math Beef Best Supplier SKUs, Tweak big-losing SKUs multiple way Cream SKUs will be web-roomed. How to afford matching prices(?) Rebates as profits? All go up with customer-value innovation. Lots more plays in future webinars.