SPLIT - -DOLLAR 101

Private premium funding involves techniques such as private premium financing loans and collateral assignment split-dollar arrangements. These techniques offer alternatives to direct funding through gifting or institutional lending, providing various economic advantages and strategies for estate planning.

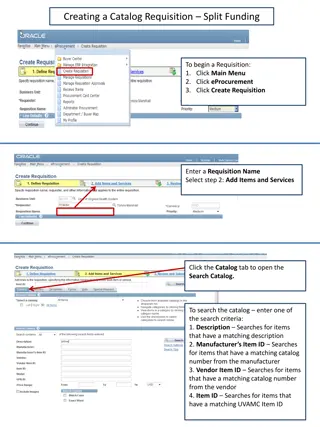

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

SPLIT SPLIT- -DOLLAR 101 DOLLAR 101 DENVER OFFICE CLE August 12, 2020 LAWRENCE BRODY, ESQ. STEPHANIE MOLL, ESQ. BRYAN CAVE LEIGHTON PAISNER LLP ST. LOUIS, MISSOURI 1 1

I. Private Premium Funding of Life Insurance Policy Premiums A. Private premium funding involves the use of one of two insurance trust funding techniques: 1. Private premium financing loans to the trust, by the insured, with interest either paid currently or accrued, in either case at the AFR or, in some limited circumstances, imputed under Section 7872. 2. Private, non-equity, collateral assignment split-dollar arrangements between the insured and the trust. 2

I. Private Premium Funding of Life Insurance Policy Premiums B. These are alternatives to both the insured/donor directly funding the premiums by making gifts or third-party institutional lending. 1. Direct gifting uses annual exclusions, gift exemptions and GST exemptions, all of which could be used on other transfers, and all of which may have been used by the donor elsewhere. 2. Institutional financing takes two forms direct loans to the ILIT or a loan to the donor, who uses the loan proceeds to advance or loan to the ILIT. 3. Institutional lending uses up the donor s credit line, is short term (3 to 5 years or even annually renewable), with no guarantee of renewability, requires a pledge of the policy plus a pledge of acceptable collateral for the shortfall between the amount loaned and the loan value of the cash value, and has a floating interest rate. 3

I. Private Premium Funding of Life Insurance Policy Premiums C. As discussed in detail below, these are similar transactions economically, but with a different measure of the gift to the trust for transfer tax purposes (both gift and generation- skipping). 1. These techniques can be viewed a variation of the familiar freezes and squeezes transactions used in sophisticated estate planning. 2. Private premium financing with interest paid currently at the AFR, non-interest bearing demand loans, and private split-dollar could all be viewed as discount transactions. 3. Private premium financing with interest accrued at the AFR could be viewed as a freeze technique, since there is no gift for transfer tax purposes. 4

II. Premium Financing Techniques A. General. 1. Alternatives. 2. Economics. 3. Exit strategies. 5

II. Premium Financing Techniques B. Premium financing formats. 1. Private premium financing interest-bearing loans to an irrevocable life insurance trust by the insured, interest at the AFR, paid or accrued, principal paid at death. 2. The same transaction with the insured s employer or controlled entity (such as an FLP) as the lender. 3. Loans by an employer to an employee, to allow the employee to acquire a policy on his or her life, and to pay policy premiums. 6

III. Split-Dollar Arrangements A. There have always been two tax issues in economic benefit split-dollar arrangements. 1. The measure of the economic benefit. 2. The treatment of policy equity (cash values in excess of what is owed the premium provider for the premium advances). 7

III. Split-Dollar Arrangements B. The final regulations and to some extent Notice 2002- 8 fixed the equity issue, but left open the economic benefit measurement issue. 8

III. Split-Dollar Arrangements C. Measure of the economic benefit in economic benefit split-dollar arrangements. 1. The economic benefit is premium insensitive, both as to the level of the premium and whether a premium was paid in a given year. 2. Traditionally, the economic benefit was measured by the lower of the carrier s qualifying term rates or the IRS table rates, under Rev. Rul. 66-110. 3. Validity of alternative term rates. 9

III. Split-Dollar Arrangements D. The taxation of policy equity in pre-Final Regulation arrangements. 1. Importantly, Notice 2002-8 continues to govern the tax treatment of pre-final regulation arrangements, even after the adoption of the Final Regulations. 2. Taxation under the further guidance of Notice 2002- 8 for pre-Final Regulation arrangements taxed under Section 83. 10

III. Split-Dollar Arrangements E. Taxation of policy equity under the final regulations. 1. With one exception, these rules apply to arrangements entered into after adoption of the final regulations that is, they are, with that one exception, prospective. 2. The one exception is for pre-final regulation arrangements, which are materially modified after the final regulations were adopted September 18, 2003 (with an exception to the exception for arrangements converted under a safe harbor under Notice 2002-8 thereafter). 3. Under the regulations, split-dollar arrangements are intentionally broadly defined. 4. Under the regulations, generally, which regime economic benefit or loan will apply to post-final regulation split-dollar arrangements will depend exclusively on policy ownership. 11

III. Split-Dollar Arrangements E. Taxation of policy equity under the final regulations. 5. Section 61 (not, as under Notice 2002-8, Section 83) will govern endorsement method arrangements, entered into or materially modified after the regulations are adopted. 6. With one important exception discussed below, Section 7872 will govern post-final regulation collateral assignment arrangements. 7. As noted above, there is one major exception to the general rule that policy ownership is the sole determinant of the tax regime required to be used under the regulations. 8. Again, these rules are effective for arrangements entered into (a newly defined term in the regulations) after September 17, 2003 or prior arrangements materially modified thereafter. 12