Small Business Assistance Amid COVID-19 Crisis

Stay informed about the federal response to COVID-19 impacting small businesses. Learn about programs like Economic Injury Disaster Loan (EIDL) and Emergency EIDL Grant, vital for businesses during this challenging time. Explore eligibility criteria and how to apply for financial assistance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

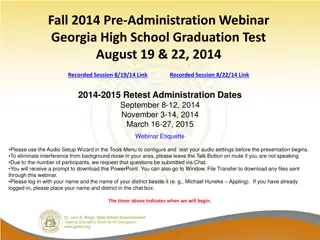

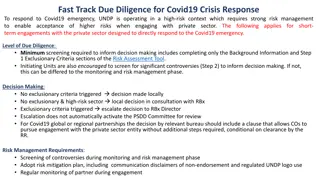

COVID-19 and Small Businesses April 8, 2020

While the information provided in this presentation is intended to be accurate, it should not be considered legal advice. NFIB and the NFIB Small Business Legal Center cannot be held responsible for any errors or omissions.

PHASE 1 (enacted March 6, 2020) Small Business Administration, Economic Injury Disaster Loan PHASE 2 (enacted March 18, 2020) Emergency Paid Sick Leave 10 days paid leave Refundable Tax Credits credits against payroll taxes Hardship Exemption, less than 50 employees Expanded FMLA 12 weeks paid FMLA PHASE 3 (enacted March 27, 2020) Paycheck Protections Program/Loans o 8 weeks forgivable o $10,000 up-front forgivable o 6 month payment deferment o no-prepay penalty o max interest rate 4% Delayed Payroll Tax Payments

1. Economic Injury Disaster Loan (EIDL) 2. Emergency EIDL Grant 3. Paycheck Protection Program Loan (PPPL)

Economic Injury Disaster Loan (EIDL) program Economic Injury Disaster Loan (EIDL) program Apply through the SBA, the SBA facilitates these loans Provides small businesses with working capital loans of up to $2 million. 3.75 percent interest rate (non-profits 2.75% interest rate). Loans smaller than $200,000 can be approved without a personal guarantee. No early payment penalties. 30-year loan

EIDL eligible EIDL eligible expenses expenses Payroll costs, including benefits, Fixed debts (mortgage, rent, lease), Accounts payable, Other bills.

Emergency EIDL Grant Emergency EIDL Grant All those applying for an EIDL loan will be eligible for up to a $10,000 emergency advance. The up to $10,000 emergency advance is entirely forgivable.

Who qualifies for a PPPL? Who qualifies for a PPPL? Businesses with less than 500 employees Independently owned franchises with less than 500 employees Accommodation and Food Services, if each location has less than 500 employees Sole proprietors, independent contractors, self-employed individuals 501(c)(3) nonprofits AND Been in business since 2/15/2020 and paid taxes on your employees or independent contractors.

Golf Courses Golf Courses Golf Courses and Country Club Small Business Size Standards: $16,500,000 annual revenue

How much can I borrow? How much can I borrow? 2.5x average monthly payroll for previous year, up to $10 million For seasonal employers, the average total employees is calculated for the period between 2/15/19 and 6/30/19.

Affiliation Test 50% equity ownership Common management by CEO, Board or similar Identify of interest between close relatives Stock options, convertible securities, and agreements to merge

The Application Process Basic business identification information; A list of owners of the applicant with 20% or greater ownership stake; A list of any businesses under common ownership or management with the applicant; Details on any EIDLs received by the business between January 1, 202 and April 3, 2020; Information about individual applicant s and 20% - plus owners criminal history; and Good faith certification by a business representative. Applicants must also submit payroll documentation. It appears that lenders will use payroll documentation from calendar year 2019 to make loan amount calculations, even though the rules reference the last 12 months as the look-back period.

What are the terms of the loan? What are the terms of the loan? Loan payments (including interest) will be deferred for 6 months starting at the origination of the loan. Interest rate 1% Loan maturity is 2 years. SBA guarantees 100% of the loan. No collateral or personal guarantee is required. There is no prepayment penalty.

What can I use the loan on? What can I use the loan on? At least 75% of funds have to be used for payroll expenses and 25% can be use for other qualifying expenses including rents, utility payments, and mortgage interest. The loan can only be used for expenses incurred between 2/15/2020 and 6/30/2020.

What expenses are covered by loan What expenses are covered by loan forgiveness? forgiveness? The covered period during which expenses can be forgiven extends 8- weeks from date of loan origination. Payroll costs Mortgage interest Rent Utilities ***Keep all paperwork on qualifying expenses***

Where can I apply for the loan? Where can I apply for the loan? Any lending institution that is participating in the loan program. Please check first with your bank to see if they are participating or are planning to participate.

Employee Retention Tax Credit The credit, available through 2020, is equal to 50% of wages (including qualified health plan expenses) of up to $10,000 per worker. (So, the maximum credit per employee is $5,000 this year.) The credit can be claimed against quarterly payroll taxes. The Treasury can make advance payments of the tax credit and waive penalties for employers who don t pay applicable payroll taxes in anticipation of receiving the credit.

SBA Express Bridge Loans This program allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000.00. These loan funds can be used to help overcome the temporary loss of revenue a business owner is experience. These loans can be term loans or serve as bridge financing while a business waits for a decision and/or disbursement of an Economic Injury Disaster Loan. Find an Express Bridge Loan Lender by connecting with your local SBA District Office.

Additional Information PPPL and EIDL loan programs side-by-side (updated as we receive new information) https://www.nfib.com/assets/Small-Business- Loans-Side-by-Side.pdf SBA Loan Program Guide (Small Business Administration) https://www.sba.gov/funding- programs/loans/coronavirus-relief-options PPPL Fact Sheet (Treasury Department) https://home.treasury.gov/system/files/136/P PP--Fact-Sheet.pdf Paid Leave Mandates (Department of Labor) https://www.dol.gov/agencies/whd/pandemic Unemployment Insurance information (Department of Labor) https://www.dol.gov/general/topic/unemploy ment-insurance State Unemployment Insurance Agency finder https://www.careeronestop.org/LocalHelp/Un employmentBenefits/find-unemployment- benefits.aspx