Responsibilities of Board of Directors in Enhancing Corporate Reporting

Corporate reporting encompasses the communication of companies' performance and activities to stakeholders through various mechanisms like financial reporting, corporate governance, CSR, and more. Directors play a crucial role in ensuring quality reporting and compliance with regulatory requirements, ultimately impacting the organization's transparency and accountability.

Uploaded on Sep 17, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Enhancing Quality in Corporate Reporting: Responsibilities of Board of Directors Wednesday 27 August 2014 1 1

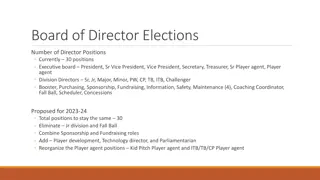

Areas to be covered What is corporate reporting and why do we need it? Regulatory requirements Companies Act 2001 Financial Reporting Act 2004 and the Code of Corporate Governance for Mauritius Roles and responsibilities of directors in Corporate Reporting Evolving Corporate Reporting trends Where are we going? Wednesday 27 August 2014 3 3 3

What is Corporate Reporting and why do we need it? 4

What is corporate reporting? Corporate reporting = all the mechanisms by which companies communicate their performance and activities to their stakeholders Presentation & disclosure aspects of: - Financial reporting - Corporate governance - Executive remuneration - Corporate social responsibility - Narrative reporting - Integrated reporting Wednesday 27 August 2014 5 5

Describes performance Corporate Reporting For a specific audience Involves measurement Is a recurring process Wednesday 27 August 2014 6 6

The Corporate Reporting supply chain 9/17/2024Wednesday 27 August 2014 7

Why companies produce a corporate report Wednesday 27 August 2014 8 8

Annual report Regulatory Requirements Statutory disclosures Companies Act Sec 221: Contents of an Annual Report Financial Reporting Act Section 75: Corporate Governance S75(2) Every public interest entity shall, adopt corporate governance in accordance with the National Code of Corporate Governance. S75(3) Every public interest entity under subsection (2) shall submit to the Council a statement of compliance with the Code of Corporate Governance and where there is no compliance, the statement shall specify the reasons for non-compliance. Guidelines on Compliance with the Code of Corporate Governance by PIEs Wednesday 27 August 2014 9

Annual report Regulatory Requirements (Continued) Financial Statements CA Sec 210: obligation of Board to prepare Financial Statements & signed on behalf of Board by 2 directors CA Sec 211(3): Financial Statements to comply with IFRS (public & private companies) Auditor s report CA Sec 205(1): The auditor of a company shall make a report to the shareholders on the Financial Statements which have been audited 10

Annual report Regulatory Requirements (Continued) Auditor s report - FRA 2004 Sec 39(2): No licensed auditor shall, in his report, express an opinion unless he has complied with the auditing standards. - FRA 2004 Sec 39(3):The licensed auditor shall report on the extent of compliance with the Code of Corporate Governance disclosed in the annual report of the public interest entity and on whether the disclosure is consistent with the requirements of the Code. Guidelines issued by FRC Voluntary reporting: Chairman report, CEO report, Sustainability report

Contents of annual report - S221 Nature of business Signed company FS + Group FS (where relevant) Auditor s report Particulars of entries in interests register during accounting period: o Term of director s service contract with its date of expiry o Any notice period for termination of contract o Particulars of provisions for predetermined compensation on termination exceeding one year s salary & any benefits including benefits in kind Total remuneration & benefits received / due & receivable from the company & related corporation (separately for executives & NEDs) Total amount of donations Names of persons holding office & ceased to hold office as directors Audit fees & fees for other services separate Wednesday 27 August 2014 12 12

Corporate reports main concerns Weakness in the corporate reporting model Inadequate disclosures; Lack of trustworthiness; No integration of essential information; Lack of leading indicators of future performance; Environment, Social, governance (ESG) issues at infancy stage; Backward looking; Irrelevance of information; and Compliance mindset. Source: Tomorrow s Corporate Reporting : A Critical System at Risk CIMA Wednesday 27 August 2014 13 13

Stakeholders expectations The company has not made profits at the expense of the environment, human rights, or society; There are adequate controls in place to monitor and manage material risks and opportunities; Remuneration is linked to overall performance which includes social, environmental and financial aspects; There is an interactive communication with the stakeholders who are strategic to the company s business; and The company is conducting a sustainable business. Wednesday 27 August 2014 14 14

The importance of Corporate Reporting Influences decisions management An essential element of corporate governance Influences decisions shareholders and other stakeholders Affects resource allocation (financial, natural and human resources) in society Critical for investor confidence Influences perceptions of the company s customers, vendors, and employees Shapes how a company sees itself in the future Wednesday 27 August 2014 and actions of and actions of 15 15

What is the main source of information you use to assess company performance? Re-assessing the value of corporate reporting, January 2012, ACCOUNTANCY FUTURES, ACCA Wednesday 27 August 2014 16 16

Role of Board of Directors: Attributes needed Understand financial reporting- boards should help all of their members to develop financial literacy, not just those who sit on the audit committee Strong willingness to both question issues and to speak out in meetings Understand the business of the company and the risks involved Understand the company s business model Wednesday 27 August 2014 17 17

A Good set of Report and Accounts How the money is made What worries the Board A single story Consistency Cut the Clutter Clarity Explain change Summarise True and fair Wednesday 27 August 2014 18 18

Benefits of producing a good set of corporate report More long term investors Improved access to new capital & lower cost of capital Higher share prices Increased management credibility Wednesday 27 August 2014 19 19

Corporate Governance 20

Corporate Governance Wednesday 27 August 2014 21

Evolution of Corporate Reporting Where are we going? 22

The evolution of corporate reporting 1960 1980 2000 2020 Financial Statements Financial Statements Management Commentary Environmental Reporting Governance and Remuneration Financial Statements Management Commentary Sustainability Reporting Governance and Remuneration Financial Statements Management Commentary Sustainability Reporting Governance and Remuneration Integrated Reporting Wednesday 27 August 2014 23 23

Integrated Reporting Governance Strategy Financial Statements Prospects Performance Demonstrates Stewardship and Creates Value Opportunities Risks Sustainability report Wednesday 27 August 2014 24 24

Integrated Reporting is... Wednesday 27 August 2014 25 25 25

A growing momentum for change Wednesday 27 August 2014 26 26

IFRS disclosures - What is the disclosure problem? Source: IASB, FEEDBACK STATEMENT: FINANCIAL REPORTING DISCLOSURE, MAY 2013 Wednesday 27 August 2014 27 27

Next steps Disclosure initiative Long-term steps Short-term steps Research Materiality Review new project IAS Review of assessment EDs Amendments existing 1, IAS 7 and to IAS 1 of existing disclosure IAS 8 FSP Standards guidance requirements project Wednesday 27 August 2014 28 28

If I pick up an annual report and I cant understand a footnote, I probably won t no, I won t invest in that company because I know that they don t want me to understand it. Warren Buffet 29

THANK YOU Financial Reporting Council www.frc.mu Wednesday 27 August 2014 30 30